Title: Understanding Harris Texas Clauses Relating to Initial Capital Contributions Introduction: Harris Texas Clauses Relating to Initial Capital Contributions are legal provisions that outline the requirements and obligations related to the initial capital contributions of partners in a business entity operating in Harris County, Texas. These clauses play a crucial role in defining the financial obligations, responsibilities, and rights of each partner, ensuring a fair and transparent business structure. This detailed description aims to explore the different types of Harris Texas Clauses Relating to Initial Capital Contributions, highlighting essential keywords to provide a comprehensive understanding. 1. Capital Contribution Definitions: Harris Texas Clauses Relating to Initial Capital Contributions begin by meticulously defining the term "capital contribution." These definitions establish the monetary or non-monetary assets that each partner must contribute to the partnership during its formation, expansion, or recalibration. 2. Mandatory Initial Capital Contribution: One of the most common types of clauses in Harris Texas partnerships is the "Mandatory Initial Capital Contribution" clause. This clause specifies the exact amount or percentage of the initial capital that each partner must contribute at the beginning of the partnership. The clause ensures that partners share the financial burden equitably and adhere to the agreed-upon investment structure. 3. Timeframe for Capital Contribution: Partnerships also include clauses that entail a specific timeframe within which partners must make their initial capital contributions. These clauses serve to prevent any delay or ambiguity in fulfilling financial obligations, maintaining transparency and accountability. 4. Adjustments in Capital Contribution: In certain situations, partners may need to increase or decrease their initial capital contribution. This type of clause outlines the procedures and requirements for such adjustments, laying out the factors that can trigger changes, such as business expansion, loss, or admission of new partners. 5. Method of Capital Payment: Partnerships may have clauses addressing the preferred methods of capital payment. These clauses specify whether the contribution must be in the form of cash, property, or services. They also outline requirements for valuation methodologies, if applicable. 6. Consequences of Non-Compliance: To ensure compliance, Harris Texas Clauses Relating to Initial Capital Contributions generally include provisions stipulating the consequences of non-compliance. These consequences may involve penalties, interest charges, or restrictive measures that can be enforced against non-compliant partners. 7. Suspension or Termination of Partnership Rights: Partnerships may contain clauses empowering the management to suspend or terminate a partner's rights and shares if they fail to fulfill their initial capital contribution obligations within a specified time frame. These clauses protect the partnership's interests and ensure commitment from all partners involved. Conclusion: Harris Texas Clauses Relating to Initial Capital Contributions establish the fundamental financial obligations partners must fulfill for equitable business operations. The various types of clauses mentioned above provide clarity and legal framework for capital contributions in Harris County, Texas. Understanding these clauses is essential for both existing and prospective partners, ensuring transparency, accountability, and a strong foundation for successful partnerships.

Harris Texas Clauses Relating to Initial Capital contributions

Description

How to fill out Harris Texas Clauses Relating To Initial Capital Contributions?

Drafting paperwork for the business or personal demands is always a big responsibility. When creating a contract, a public service request, or a power of attorney, it's important to take into account all federal and state regulations of the specific area. However, small counties and even cities also have legislative provisions that you need to consider. All these aspects make it burdensome and time-consuming to create Harris Clauses Relating to Initial Capital contributions without expert help.

It's possible to avoid wasting money on lawyers drafting your paperwork and create a legally valid Harris Clauses Relating to Initial Capital contributions by yourself, using the US Legal Forms online library. It is the most extensive online catalog of state-specific legal templates that are professionally verified, so you can be certain of their validity when choosing a sample for your county. Earlier subscribed users only need to log in to their accounts to save the needed document.

If you still don't have a subscription, adhere to the step-by-step guide below to obtain the Harris Clauses Relating to Initial Capital contributions:

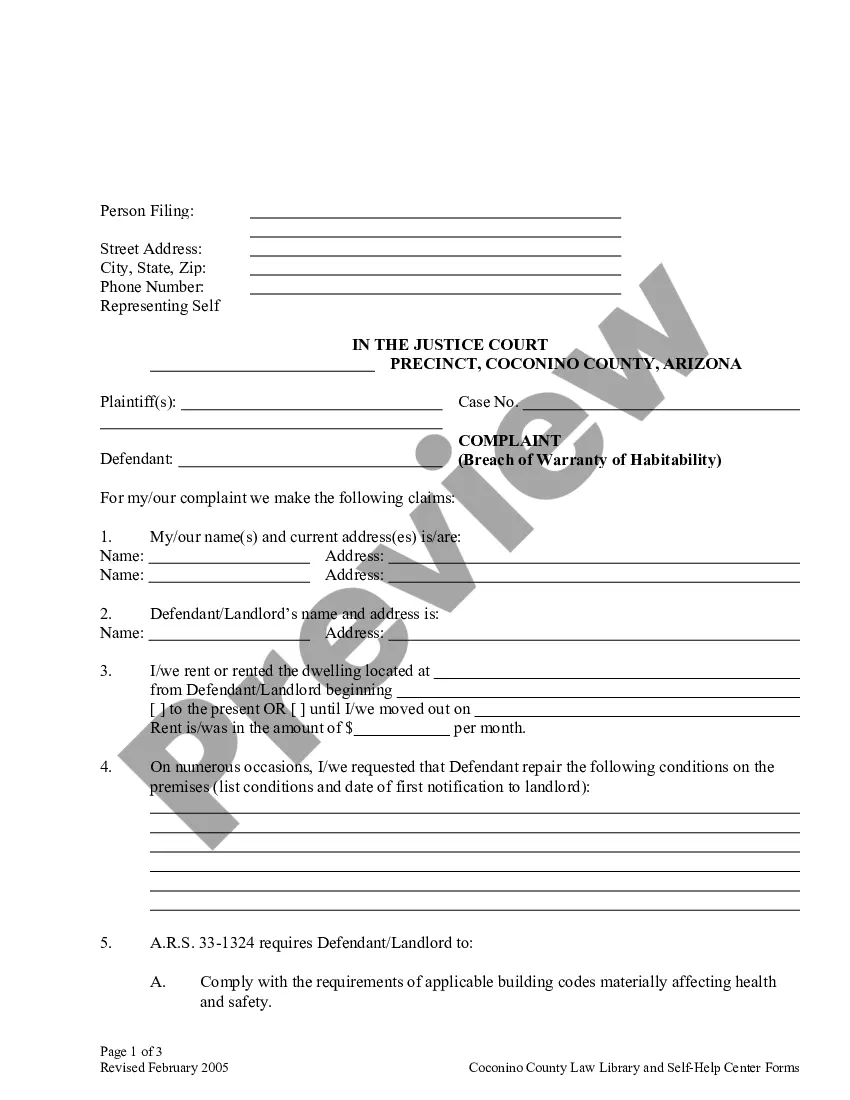

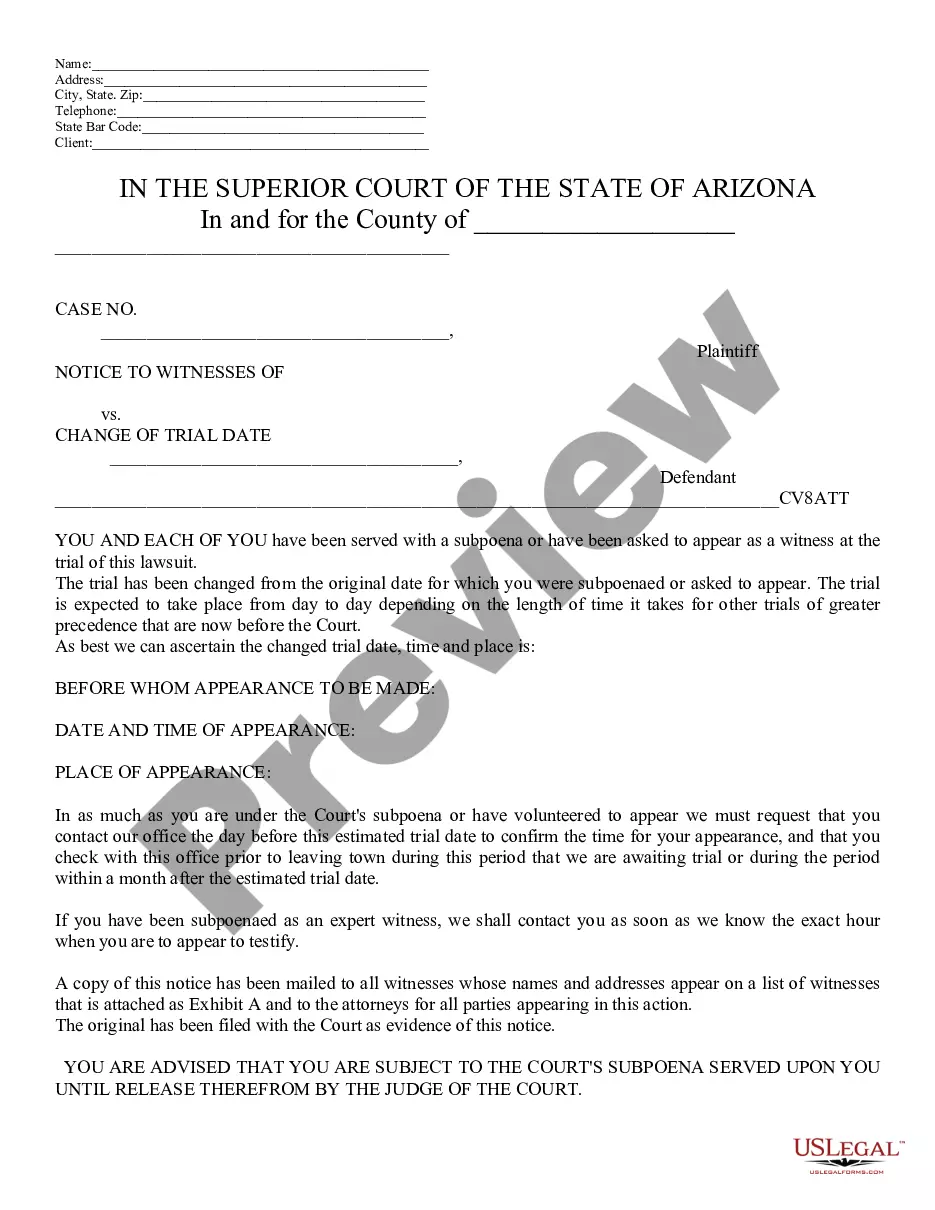

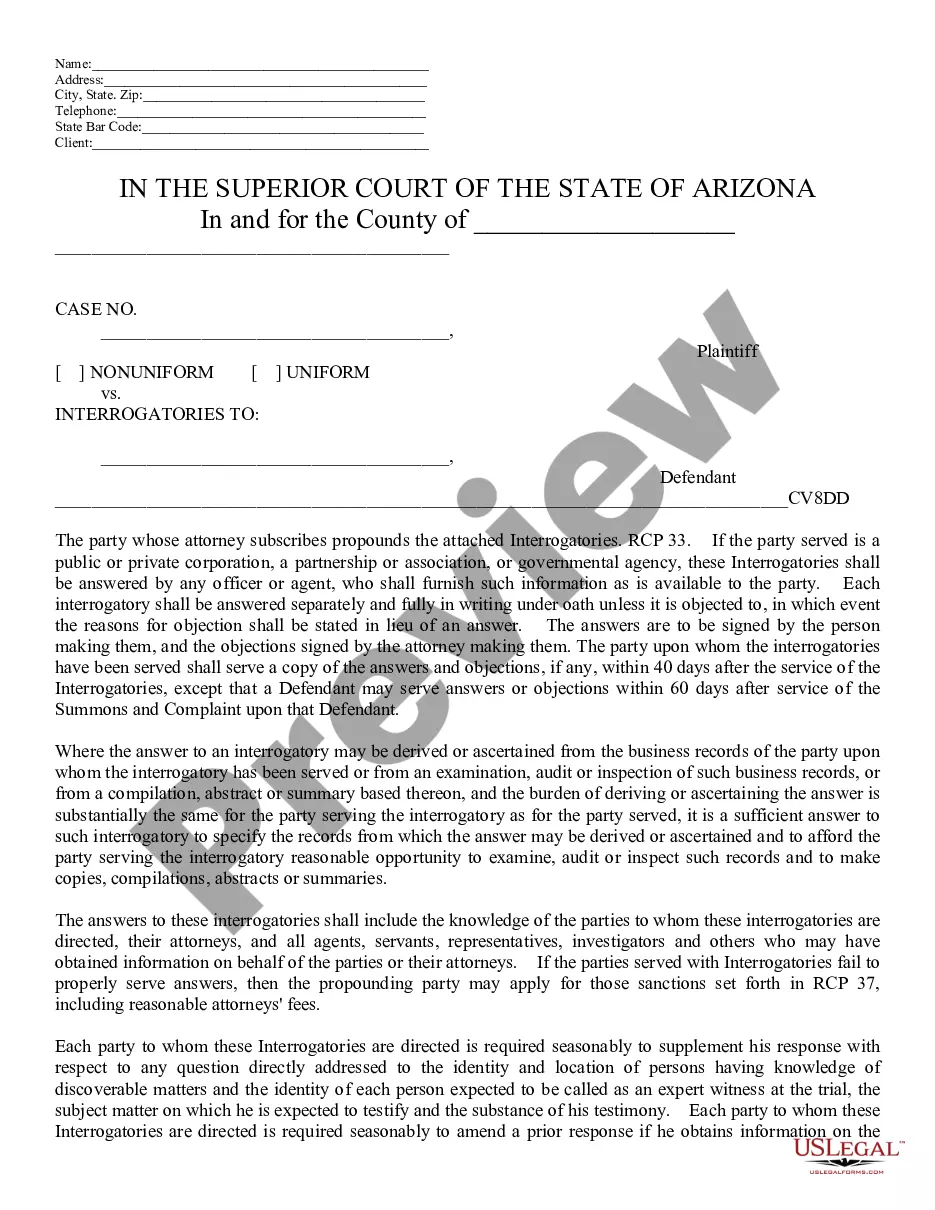

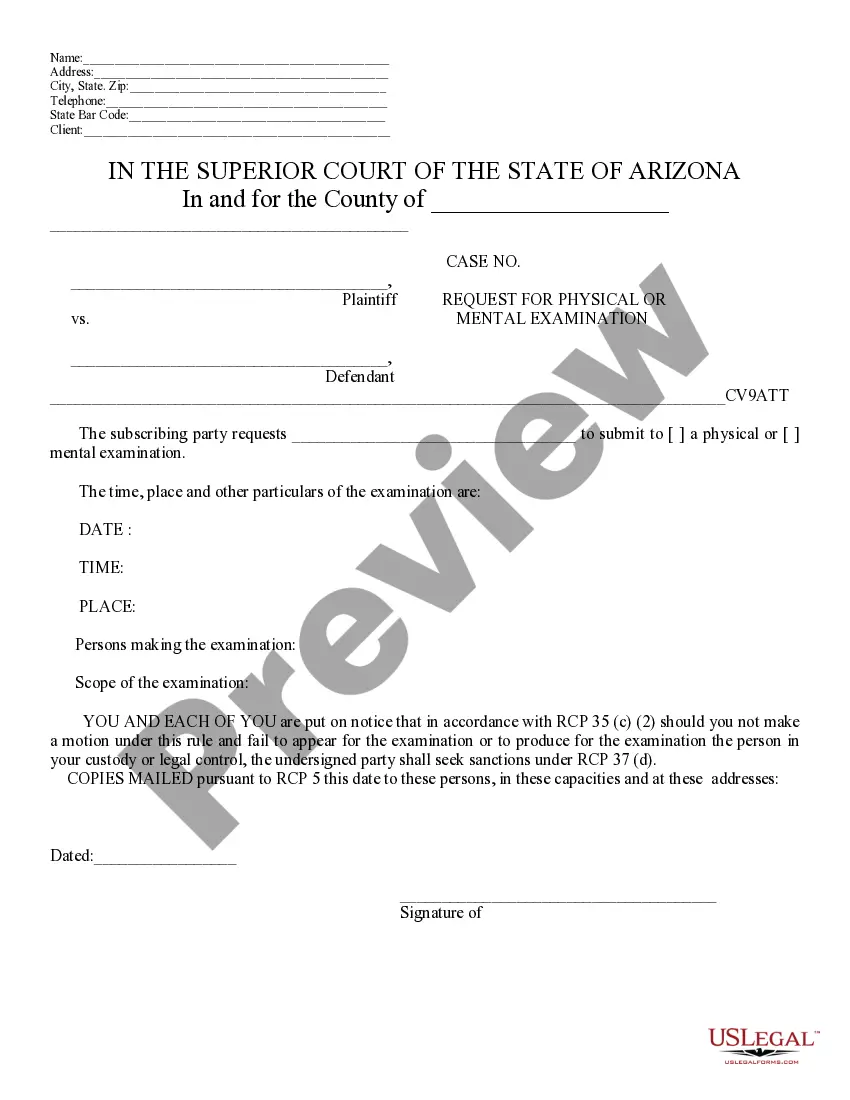

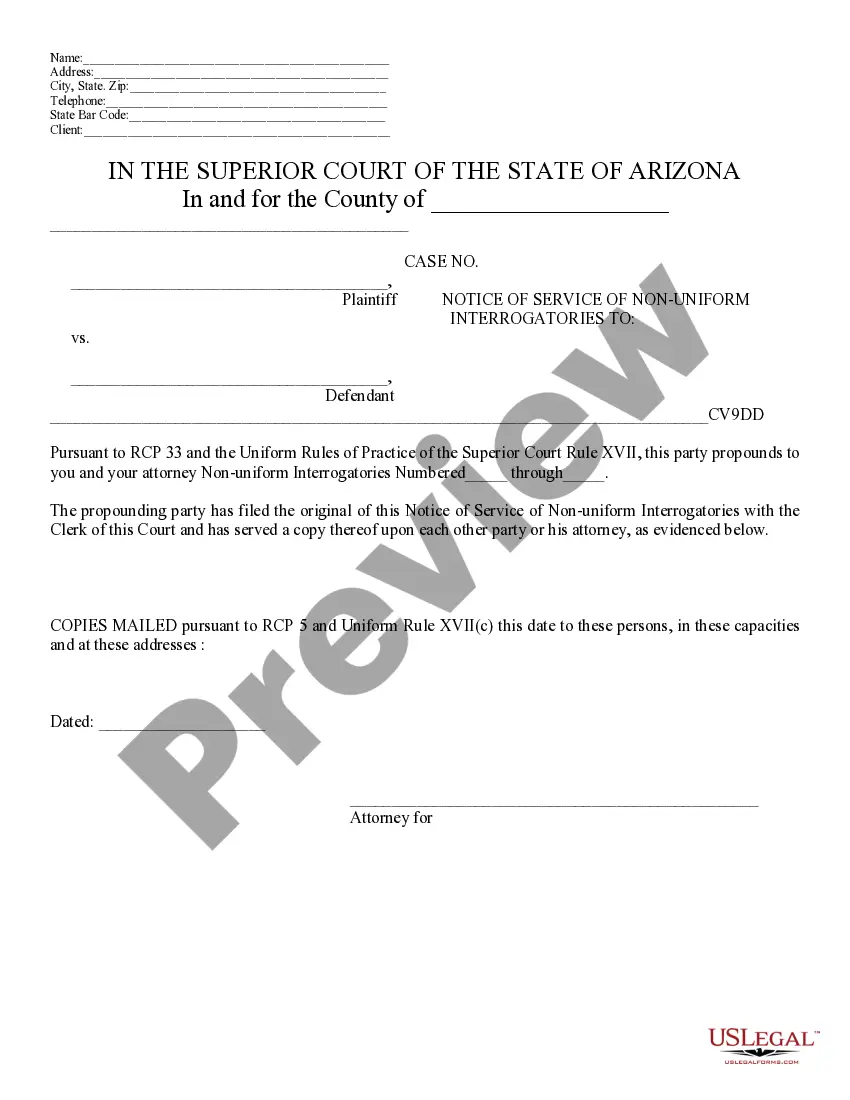

- Look through the page you've opened and check if it has the sample you need.

- To achieve this, use the form description and preview if these options are available.

- To find the one that meets your needs, utilize the search tab in the page header.

- Recheck that the template complies with juridical standards and click Buy Now.

- Choose the subscription plan, then sign in or register for an account with the US Legal Forms.

- Utilize your credit card or PayPal account to pay for your subscription.

- Download the chosen document in the preferred format, print it, or fill it out electronically.

The exceptional thing about the US Legal Forms library is that all the paperwork you've ever purchased never gets lost - you can get it in your profile within the My Forms tab at any moment. Join the platform and quickly obtain verified legal forms for any scenario with just a few clicks!