Kings New York Clauses Relating to Initial Capital Contributions are provisions within the company's operating agreement or articles of incorporation that outline the terms, conditions, and requirements for partners or shareholders to contribute initial capital to the business. These clauses play a crucial role in establishing the financial structure of the company and ensuring all parties fulfill their financial obligations. There are several types of Kings New York Clauses Relating to Initial Capital Contributions, which include: 1. Mandatory Capital Contribution Clause: This clause states that each partner or shareholder is obligated to make a specific financial contribution as outlined in the operating agreement. It establishes a minimum capital requirement for the formation of the company. 2. Timing of Contributions Clause: This clause specifies the deadlines or schedule for making the initial capital contributions. It ensures that all partners or shareholders contribute their respective share of capital within a specified timeframe. 3. Revocability of Contributions Clause: This clause determines whether the initial capital contributions are revocable or irrevocable once made. If the clause allows revocability, partners or shareholders may withdraw their contributed capital under certain circumstances. 4. Form of Contributions Clause: This clause defines the acceptable forms of contributions, such as cash, property, or services. It ensures that all contributions are made in accordance with the agreement and valuations are properly determined. 5. Additional Contributions Clause: This clause outlines the terms and conditions for making additional capital contributions beyond the initial requirement. It addresses situations when the company requires additional funding for business growth or to meet financial obligations. 6. Consequences of Nonpayment Clause: This clause states the consequences for partners or shareholders who fail to make the required initial capital contributions within the specified timeframe. It may entail penalties, loss of ownership rights, or forced buyouts. 7. Rights and Interests Clause: This clause determines the rights and interests of partners or shareholders based on their respective capital contributions. It establishes the proportionate ownership rights, profit distributions, voting power, and decision-making authority. 8. Transferability of Contributions Clause: This clause determines whether partners or shareholders can transfer their capital contributions to other parties. It addresses situations where partners or shareholders want to sell or transfer their ownership interests to third parties. 9. Forfeiture of Contributions Clause: This clause specifies the conditions under which partners or shareholders may forfeit their capital contributions. It may include events like termination of partnership, dissolution of the company, or violation of the operating agreement. In conclusion, Kings New York Clauses Relating to Initial Capital Contributions are essential provisions that define the financial obligations, responsibilities, and rights of partners or shareholders within a company. These clauses ensure proper capitalization, financial stability, and equity distribution among the stakeholders.

Kings New York Clauses Relating to Initial Capital contributions

Description

How to fill out Kings New York Clauses Relating To Initial Capital Contributions?

Preparing papers for the business or personal needs is always a big responsibility. When creating an agreement, a public service request, or a power of attorney, it's essential to consider all federal and state regulations of the particular region. Nevertheless, small counties and even cities also have legislative procedures that you need to consider. All these details make it tense and time-consuming to draft Kings Clauses Relating to Initial Capital contributions without professional help.

It's possible to avoid wasting money on attorneys drafting your paperwork and create a legally valid Kings Clauses Relating to Initial Capital contributions by yourself, using the US Legal Forms online library. It is the biggest online collection of state-specific legal templates that are professionally cheched, so you can be sure of their validity when selecting a sample for your county. Previously subscribed users only need to log in to their accounts to download the needed form.

In case you still don't have a subscription, follow the step-by-step instruction below to get the Kings Clauses Relating to Initial Capital contributions:

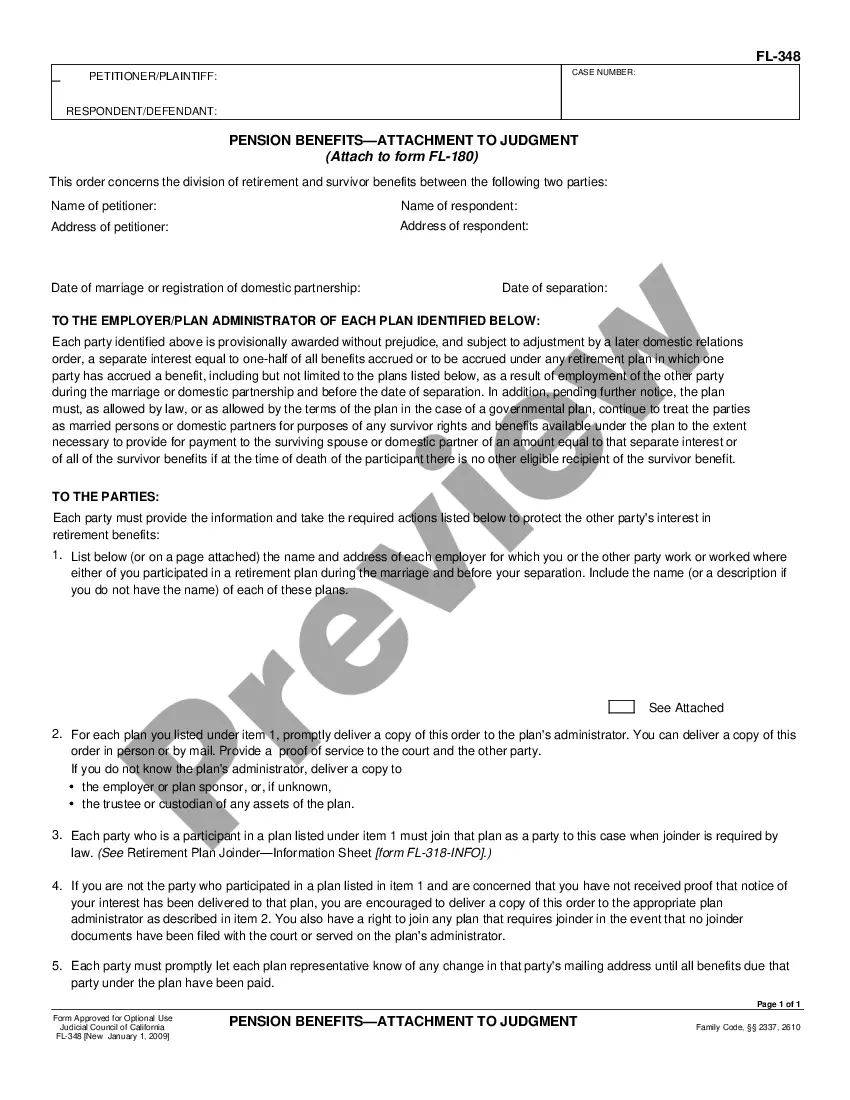

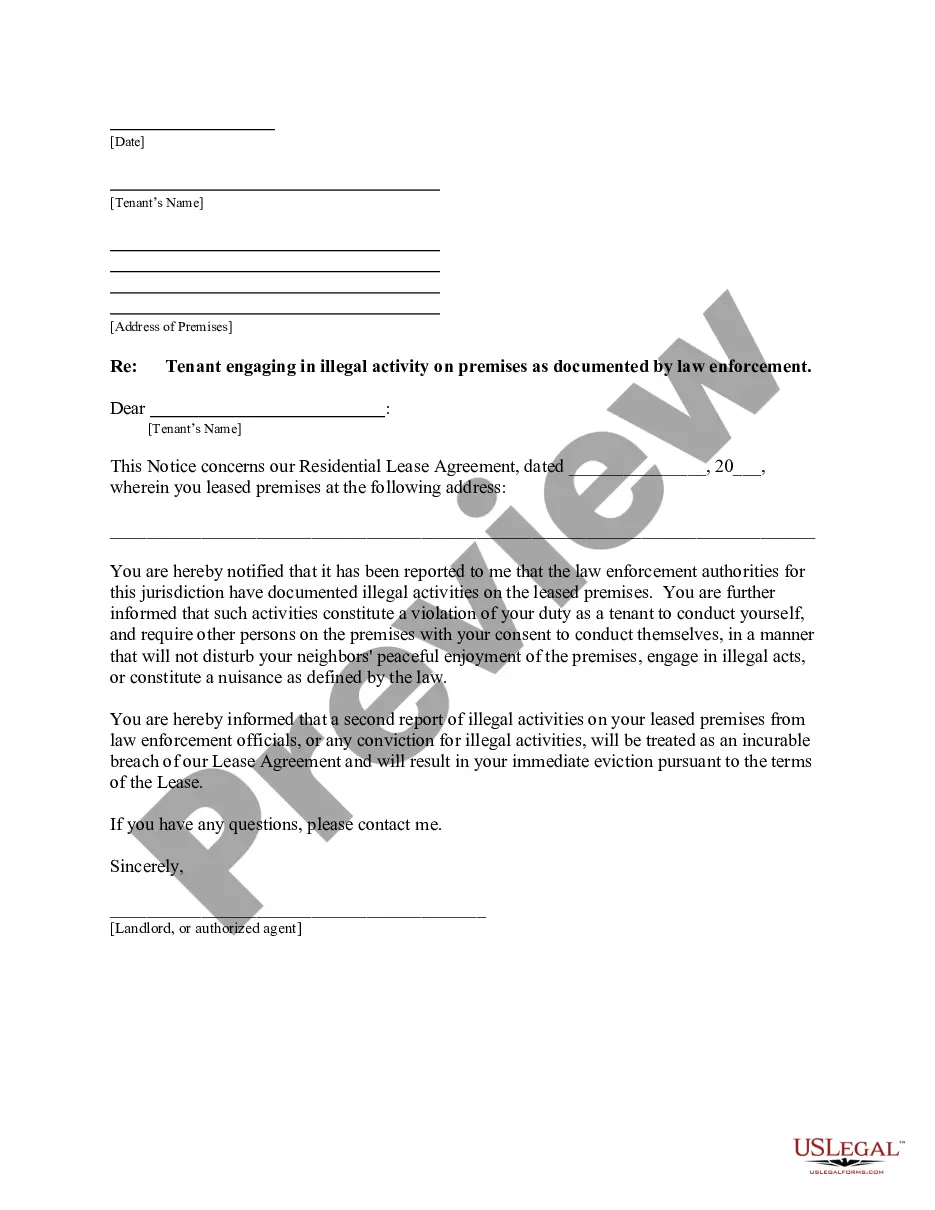

- Look through the page you've opened and verify if it has the sample you require.

- To achieve this, use the form description and preview if these options are available.

- To locate the one that fits your needs, use the search tab in the page header.

- Double-check that the template complies with juridical criteria and click Buy Now.

- Choose the subscription plan, then log in or register for an account with the US Legal Forms.

- Utilize your credit card or PayPal account to pay for your subscription.

- Download the chosen file in the preferred format, print it, or complete it electronically.

The great thing about the US Legal Forms library is that all the paperwork you've ever acquired never gets lost - you can access it in your profile within the My Forms tab at any moment. Join the platform and easily get verified legal templates for any use case with just a couple of clicks!