Maricopa, Arizona, is a vibrant city located in Pinal County, known for its unique charm and breathtaking scenic beauty. When it comes to legal matters within businesses, one important aspect to consider is the Maricopa Arizona Clauses Relating to Initial Capital contributions. These clauses outline the terms and conditions related to the initial capital investments made by partners or members in an entity or corporation. There are several types of Maricopa Arizona Clauses Relating to Initial Capital contributions which can vary depending on the legal structure of the business. Commonly found clauses include: 1. Initial Capital Contribution Amount: This clause specifies the amount of money or assets each partner/member is required to contribute towards the initial capital of the business. It outlines the share of ownership that will be allocated to each contributor. 2. Mode and Timing of Contribution: This clause describes the methods and timeline within which the initial capital contributions must be made. It may indicate specific deadlines or allow for flexible payment schedules, such as lump-sum payments or installment plans. 3. Nature of Contribution: This clause defines the permissible forms of initial capital contributions, which can include cash, property, equipment, inventory, or any other tangible or intangible assets. It may also specify the valuation methods to determine the worth of non-cash contributions. 4. Consequences of Failure to Contribute: This clause addresses the ramifications if a partner/member fails to fulfill their initial capital contribution obligations. It outlines potential consequences such as reducing ownership stake, forfeiting voting rights, or other predetermined penalties. 5. Additional Capital Contributions: Sometimes, clauses also mention potential future capital injections. These provisions outline the process, conditions, and benefits associated with any potential additional contributions that may be required to support the ongoing operations or expansion of the business. It is essential for business owners and stakeholders to thoroughly understand and adhere to these Maricopa Arizona Clauses Relating to Initial Capital contributions. Legal professionals with expertise in business laws and corporate governance can provide guidance and help draft these clauses to ensure compliance with applicable regulations and protect the rights and interests of all parties involved. In summary, the Maricopa Arizona Clauses Relating to Initial Capital contributions are crucial legal provisions that define the terms regarding the initial financial investments made by partners or members in a business. By clearly outlining the contribution amounts, modes and timing, nature of contributions, consequences of non-compliance, and potential for future investments, these clauses help ensure transparency, fairness, and the smooth functioning of the business.

Maricopa Arizona Clauses Relating to Initial Capital contributions

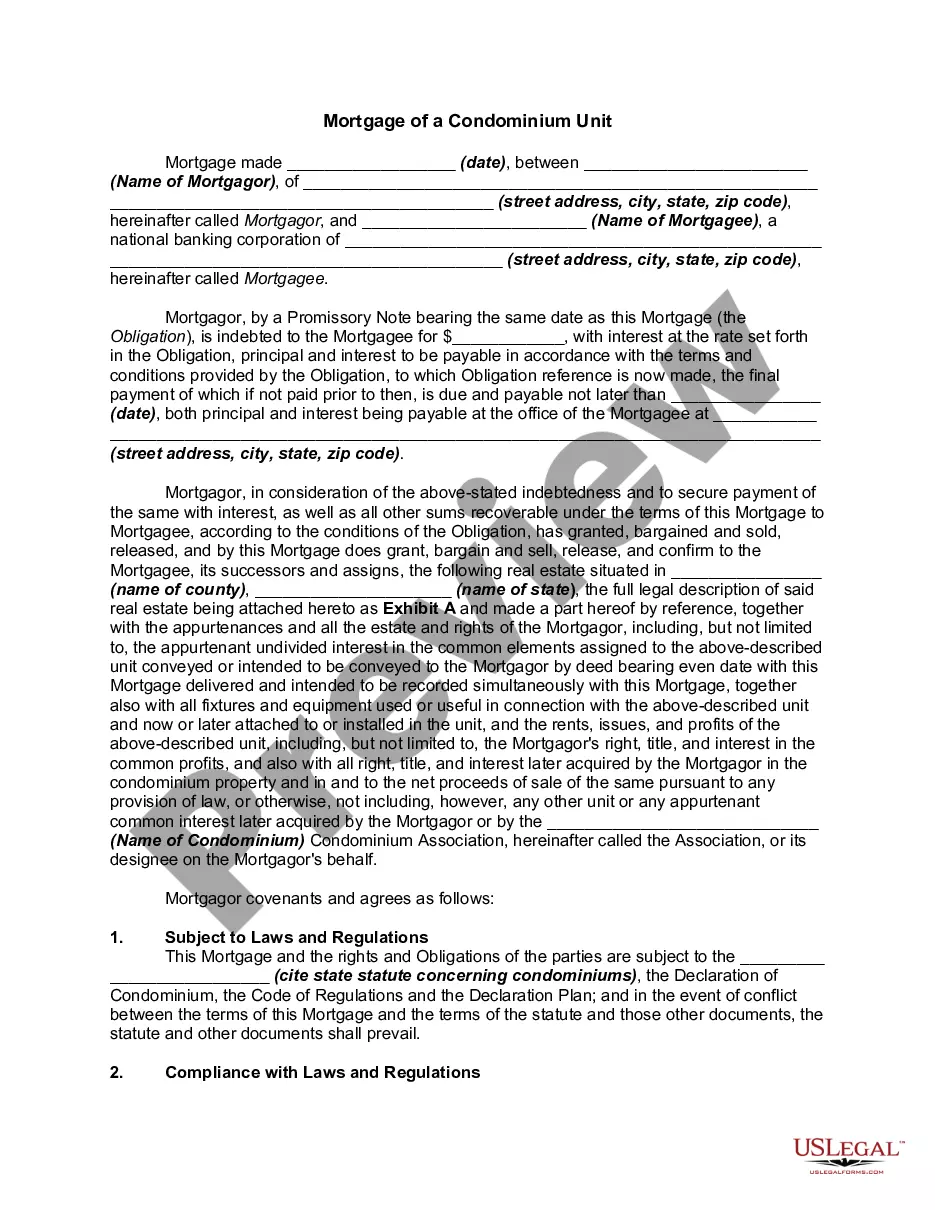

Description

How to fill out Maricopa Arizona Clauses Relating To Initial Capital Contributions?

How much time does it usually take you to draft a legal document? Since every state has its laws and regulations for every life sphere, locating a Maricopa Clauses Relating to Initial Capital contributions meeting all local requirements can be stressful, and ordering it from a professional lawyer is often expensive. Many web services offer the most common state-specific documents for download, but using the US Legal Forms library is most advantegeous.

US Legal Forms is the most extensive web collection of templates, gathered by states and areas of use. Aside from the Maricopa Clauses Relating to Initial Capital contributions, here you can get any specific document to run your business or personal deeds, complying with your county requirements. Specialists verify all samples for their actuality, so you can be certain to prepare your documentation correctly.

Using the service is pretty easy. If you already have an account on the platform and your subscription is valid, you only need to log in, select the required sample, and download it. You can retain the file in your profile at any time in the future. Otherwise, if you are new to the platform, there will be some extra actions to complete before you obtain your Maricopa Clauses Relating to Initial Capital contributions:

- Check the content of the page you’re on.

- Read the description of the template or Preview it (if available).

- Look for another document utilizing the corresponding option in the header.

- Click Buy Now when you’re certain in the chosen file.

- Decide on the subscription plan that suits you most.

- Register for an account on the platform or log in to proceed to payment options.

- Make a payment via PalPal or with your credit card.

- Change the file format if necessary.

- Click Download to save the Maricopa Clauses Relating to Initial Capital contributions.

- Print the sample or use any preferred online editor to fill it out electronically.

No matter how many times you need to use the acquired document, you can locate all the files you’ve ever downloaded in your profile by opening the My Forms tab. Give it a try!