Cook Illinois is a prominent term in the legal and finance industry, specifically referring to a type of clause relating to capital calls. A Cook Illinois clause outlines the obligations and procedures for capital contributions by limited partners in a partnership or fund structure. It ensures that limited partners are bound to invest additional capital when needed to maintain the operations and growth of the partnership or fund. There are two primary types of Cook Illinois Clauses Relating to Capital Calls, namely the "Uniform Cook Illinois Clause" and the "Tailored Cook Illinois Clause." 1. Uniform Cook Illinois Clause: The Uniform Cook Illinois Clause is a standard provision found in many partnership or fund agreements. It establishes the conditions for capital calls, including the timing, amount, and notice requirements to limited partners. It typically states that limited partners are obligated to contribute additional capital in proportion to their ownership stakes when a capital call is made by the general partner. This type of clause aims to maintain fairness and uniformity among all limited partners in funding the partnership. 2. Tailored Cook Illinois Clause: A Tailored Cook Illinois Clause is a modified provision that varies from the standard uniform clause mentioned above. It is customized to suit the specific needs and requirements of a particular partnership or fund. This type of clause enables the general partner or fund manager to design the capital call process according to their specific investment strategy, industry conditions, and investor preferences. Tailored Cook Illinois Clauses may have unique capital call schedules, specific thresholds triggering capital contributions, or different notice periods compared to the uniform clause. Overall, Cook Illinois Clauses Relating to Capital Calls are crucial for maintaining the stability and growth of partnership or fund structures. By establishing obligations and procedures for capital contributions, these clauses ensure that limited partners fulfill their financial commitments as needed, allowing the partnership or fund to seize investment opportunities and effectively manage ongoing operations.

Cook Illinois Clauses Relating to Capital Calls

Description

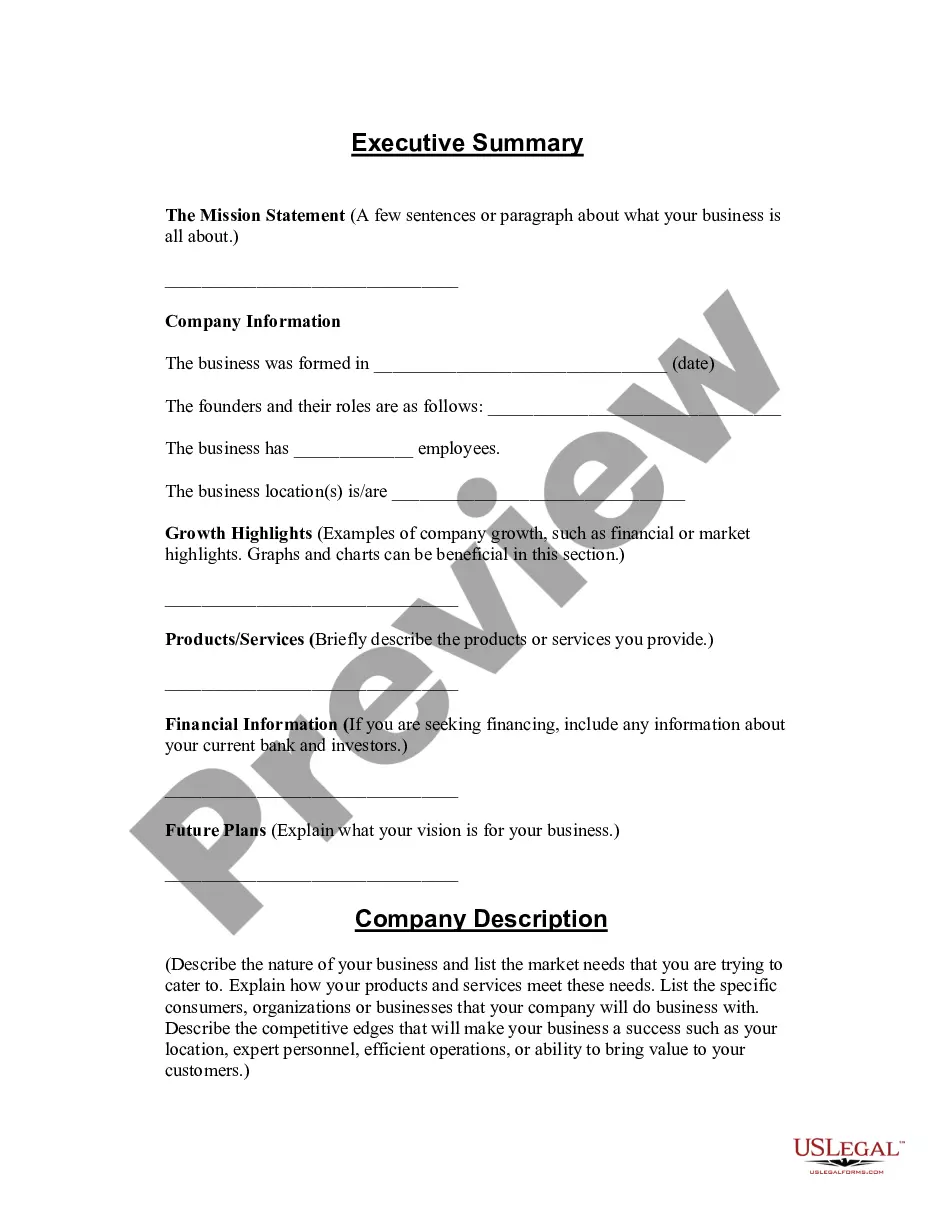

How to fill out Cook Illinois Clauses Relating To Capital Calls?

Draftwing forms, like Cook Clauses Relating to Capital Calls, to manage your legal matters is a tough and time-consumming task. A lot of circumstances require an attorney’s involvement, which also makes this task not really affordable. Nevertheless, you can take your legal matters into your own hands and manage them yourself. US Legal Forms is here to the rescue. Our website comes with more than 85,000 legal documents intended for various cases and life circumstances. We ensure each form is in adherence with the laws of each state, so you don’t have to be concerned about potential legal problems compliance-wise.

If you're already aware of our services and have a subscription with US, you know how easy it is to get the Cook Clauses Relating to Capital Calls template. Simply log in to your account, download the template, and customize it to your requirements. Have you lost your form? No worries. You can find it in the My Forms folder in your account - on desktop or mobile.

The onboarding flow of new customers is fairly simple! Here’s what you need to do before getting Cook Clauses Relating to Capital Calls:

- Make sure that your form is specific to your state/county since the rules for writing legal papers may differ from one state another.

- Learn more about the form by previewing it or going through a quick description. If the Cook Clauses Relating to Capital Calls isn’t something you were hoping to find, then take advantage of the search bar in the header to find another one.

- Log in or register an account to start using our website and get the document.

- Everything looks good on your side? Hit the Buy now button and select the subscription plan.

- Pick the payment gateway and type in your payment details.

- Your template is all set. You can try and download it.

It’s easy to locate and buy the needed document with US Legal Forms. Thousands of organizations and individuals are already benefiting from our rich collection. Sign up for it now if you want to check what other benefits you can get with US Legal Forms!