Kings New York Clauses Relating to Capital Withdrawals and Interest on Capital are essential aspects of financial agreements and contracts. These clauses outline the terms and conditions pertaining to the withdrawal of capital and the interest that is earned on the invested capital. Here, we will provide a detailed description of these clauses, highlighting their significance and potential variations. 1. Capital Withdrawals Clause: The Capital Withdrawals' clause in the Kings New York agreement defines the rules and procedures for withdrawing the capital invested in a specific venture or investment. It clarifies how and when the capital can be redeemed and the potential penalties or restrictions associated with withdrawal. There are several types of Capital Withdrawal Clauses, including: a) Partial Withdrawal Clause: This clause allows the investor to withdraw only a portion of the invested capital while leaving the remaining amount intact. It typically stipulates a maximum withdrawal limit or a predetermined percentage of the total investment that can be withdrawn. b) Full Withdrawal Clause: This clause permits the complete withdrawal of the invested capital. However, there might be specific conditions and formalities that must be fulfilled before the withdrawal can take place, such as providing prior notice or meeting certain performance criteria. 2. Interest on Capital Clause: The Interest on Capital clause outlines the terms and conditions regarding the interest earned on the invested capital. It specifies the interest rate, compounding frequency, and the computation method, which may vary depending on the specific agreement or investment. Different types of Interest on Capital Clauses include: a) Fixed Interest Rate Clause: This clause establishes a predetermined interest rate that remains constant throughout the investment period. The interest is calculated based on the initial capital amount and paid at regular intervals, such as quarterly, semi-annually, or annually. b) Floating Interest Rate Clause: In contrast to the fixed interest rate clause, this clause allows the interest rate to fluctuate based on a benchmark rate, such as LIBOR (London Interbank Offered Rate). The interest payment is adjusted periodically according to the changes in the benchmark rate, providing potential benefits or risks to the investor. c) Compound Interest Clause: This clause determines whether the interest is compounded or simple. Compound interest means that the interest is calculated not only based on the initial capital but also on the accumulated interest from previous periods. Simple interest, on the other hand, is calculated only on the initial capital amount. In summary, Kings New York Clauses Relating to Capital Withdrawals and Interest on Capital play a crucial role in defining the terms and conditions of financial agreements. The specific types of Clauses may vary, allowing for customization and flexibility based on the requirements and preferences of the parties involved.

Kings New York Clauses Relating to Capital Withdrawals, Interest on Capital

Description

How to fill out Kings New York Clauses Relating To Capital Withdrawals, Interest On Capital?

How much time does it normally take you to draw up a legal document? Considering that every state has its laws and regulations for every life situation, finding a Kings Clauses Relating to Capital Withdrawals, Interest on Capital suiting all regional requirements can be stressful, and ordering it from a professional attorney is often costly. Many web services offer the most common state-specific documents for download, but using the US Legal Forms library is most advantegeous.

US Legal Forms is the most extensive web collection of templates, grouped by states and areas of use. Aside from the Kings Clauses Relating to Capital Withdrawals, Interest on Capital, here you can find any specific document to run your business or personal deeds, complying with your regional requirements. Specialists verify all samples for their actuality, so you can be certain to prepare your paperwork correctly.

Using the service is fairly easy. If you already have an account on the platform and your subscription is valid, you only need to log in, opt for the needed sample, and download it. You can pick the document in your profile anytime later on. Otherwise, if you are new to the website, there will be a few more actions to complete before you obtain your Kings Clauses Relating to Capital Withdrawals, Interest on Capital:

- Examine the content of the page you’re on.

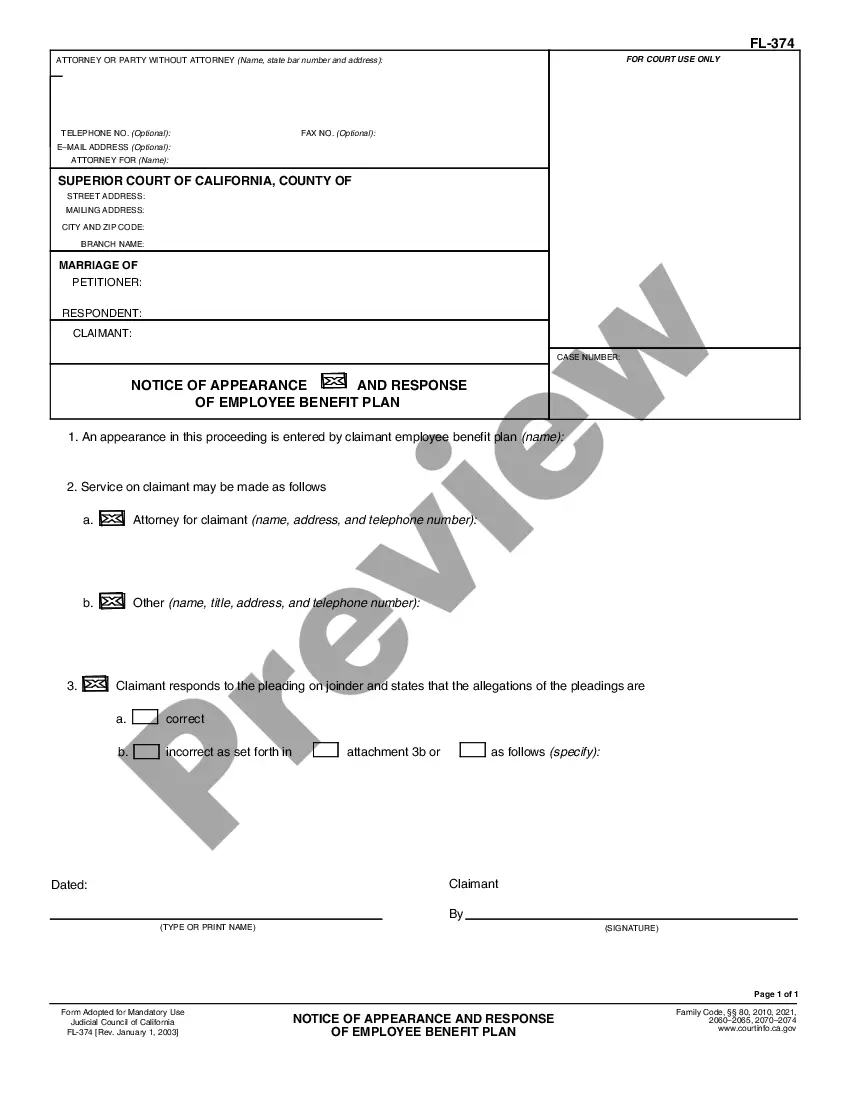

- Read the description of the sample or Preview it (if available).

- Search for another document using the corresponding option in the header.

- Click Buy Now once you’re certain in the selected document.

- Decide on the subscription plan that suits you most.

- Create an account on the platform or log in to proceed to payment options.

- Make a payment via PalPal or with your credit card.

- Switch the file format if necessary.

- Click Download to save the Kings Clauses Relating to Capital Withdrawals, Interest on Capital.

- Print the sample or use any preferred online editor to complete it electronically.

No matter how many times you need to use the purchased template, you can find all the files you’ve ever saved in your profile by opening the My Forms tab. Try it out!