Travis Texas Clauses Relating to Capital Withdrawals, Interest on Capital — A Comprehensive Overview In the realm of business partnerships or limited liability partnerships (Laps), it is essential to establish clear guidelines regarding capital withdrawals and the calculation of interest on capital investments. Travis Texas Clauses provide a legal framework to address these crucial aspects of a partnership agreement. The following description will delve into the details of Travis Texas Clauses, highlighting their significance and outlining different types when applicable. Travis Texas Clauses Relating to Capital Withdrawals: 1. Withdrawal Provisions: These clauses outline the conditions and procedures for partners to withdraw their contributed capital from the partnership. They typically specify a notice period and require the consent of other partners or predetermined approval thresholds. 2. Capital Accounts: Travis Texas Clauses often include provisions concerning capital accounts. These stipulations determine the manner in which capital contributions, withdrawals, and profit/loss allocations are recorded for each partner. They ensure transparency and accuracy in the accounting of individual partners' investments. 3. Restrictions on Withdrawals: Certain Travis Texas Clauses may impose limitations on capital withdrawals to protect the partnership's stability and prevent financial strain. Such restrictions can be established based on specific circumstances, timeframes, or predefined events such as retirement, death, or dissolution of the partnership. Travis Texas Clauses Relating to Interest on Capital: 1. Calculation of Interest: These clauses define how interest on capital investments is calculated. The terms often specify whether interest is accrued annually, monthly, or at another interval, and outline the applicable interest rate or method of calculation. 2. Interest Payment Timeline: Travis Texas Clauses may detail the timeline and frequency for interest payments. They can specify whether interest should be distributed periodically or upon certain events, such as partnership profit distributions or at the end of each financial year. 3. Deemed Interest: In some cases, partnerships may agree to impute or deem interest on capital investments, even if no explicit interest rate or payment terms are established. These clauses can ensure that partners are rewarded for their invested capital and align their interest-related expectations. The specific types of Travis Texas Clauses relating to capital withdrawals and interest on capital may vary depending on the partnership agreement's unique provisions and the partners' preferences. It is crucial to consult with legal professionals to draft comprehensive clauses tailored to the partnership's specific needs and objectives. Keywords: Travis Texas Clauses, Capital Withdrawals, Interest on Capital, Withdrawal Provisions, Capital Accounts, Restrictions on Withdrawals, Calculation of Interest, Interest Payment Timeline, Deemed Interest, Partnership Agreement, Limited Liability Partnership (LLP), Partnership Dissolution, Partnership Profit Distribution.

Travis Texas Clauses Relating to Capital Withdrawals, Interest on Capital

Description

How to fill out Travis Texas Clauses Relating To Capital Withdrawals, Interest On Capital?

Drafting papers for the business or individual needs is always a big responsibility. When drawing up an agreement, a public service request, or a power of attorney, it's important to take into account all federal and state laws of the specific region. Nevertheless, small counties and even cities also have legislative provisions that you need to consider. All these aspects make it tense and time-consuming to create Travis Clauses Relating to Capital Withdrawals, Interest on Capital without professional help.

It's easy to avoid wasting money on lawyers drafting your documentation and create a legally valid Travis Clauses Relating to Capital Withdrawals, Interest on Capital on your own, using the US Legal Forms web library. It is the largest online collection of state-specific legal templates that are professionally cheched, so you can be sure of their validity when picking a sample for your county. Earlier subscribed users only need to log in to their accounts to save the needed document.

If you still don't have a subscription, follow the step-by-step guideline below to obtain the Travis Clauses Relating to Capital Withdrawals, Interest on Capital:

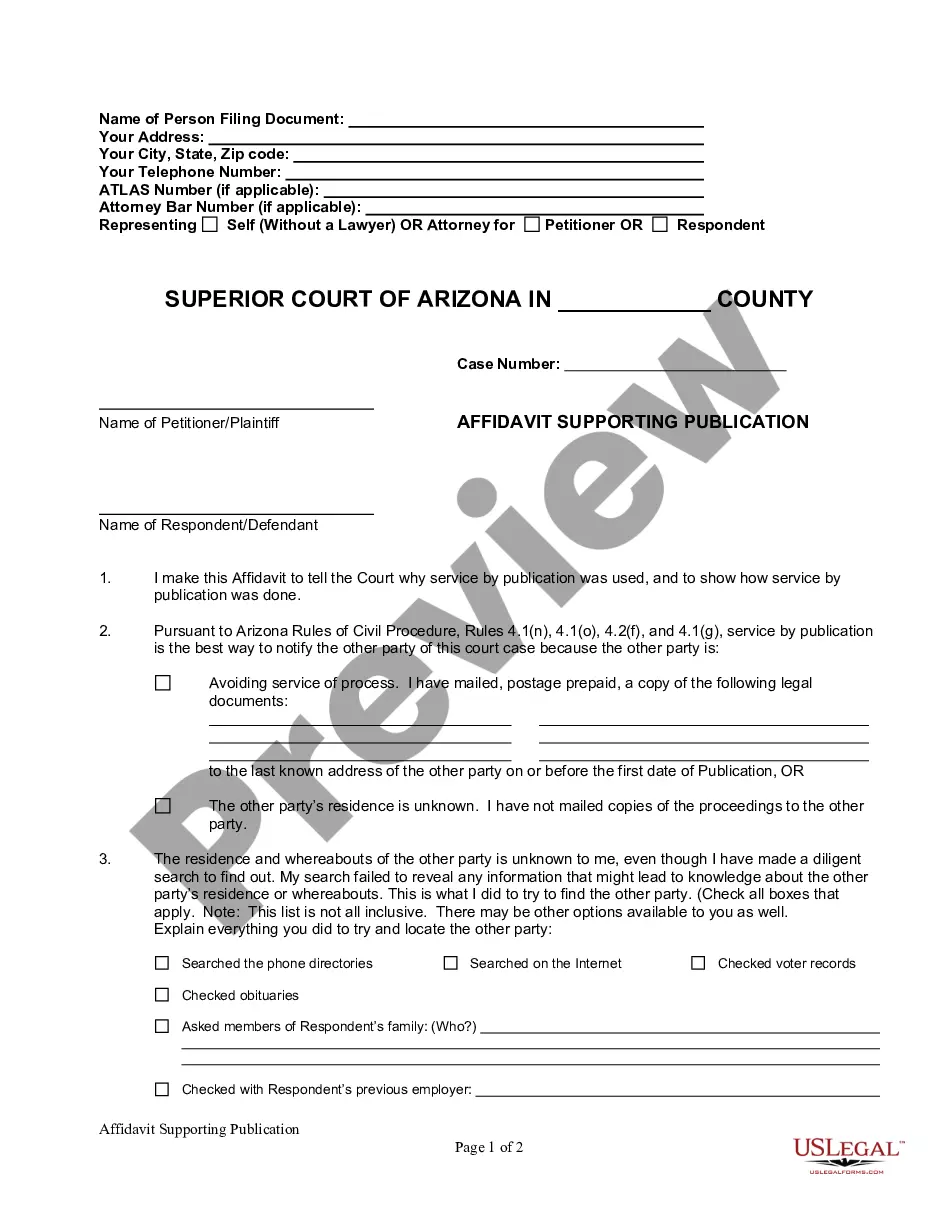

- Examine the page you've opened and verify if it has the sample you need.

- To achieve this, use the form description and preview if these options are presented.

- To locate the one that satisfies your requirements, use the search tab in the page header.

- Recheck that the sample complies with juridical standards and click Buy Now.

- Opt for the subscription plan, then sign in or register for an account with the US Legal Forms.

- Utilize your credit card or PayPal account to pay for your subscription.

- Download the chosen document in the preferred format, print it, or fill it out electronically.

The great thing about the US Legal Forms library is that all the documentation you've ever obtained never gets lost - you can access it in your profile within the My Forms tab at any moment. Join the platform and easily get verified legal templates for any use case with just a couple of clicks!