Franklin Ohio Clauses Relating to Dividends and Distributions In the state of Ohio, Franklin County has specific clauses that come into play when it comes to dividends and distributions in various legal matters. These clauses, also known as Franklin Ohio Clauses Relating to Dividends and Distributions, outline the rules and regulations surrounding the payment and allocation of profits or assets to shareholders. There are several types of Franklin Ohio Clauses Relating to Dividends and Distributions which include: 1. Dividend Payment Clauses: These clauses specify the terms and conditions under which a company can distribute dividends to its shareholders. They outline the frequency, amount, and process for dividend payments. Franklin County's specific clauses ensure that dividend payments are made in compliance with state laws and protect the rights of shareholders. 2. Accumulated Dividend Clauses: These clauses address the accumulation of unpaid dividends. If a company cannot pay dividends in a particular year, these clauses determine whether the accumulated dividends will be paid in subsequent years or if the company has the discretion to forgo the payment altogether. The Franklin Ohio Clauses Relating to Dividends and Distributions safeguard the interests of shareholders and provide guidance on how accumulated dividends should be handled. 3. Liquidation Preference Clauses: In the event of liquidation or dissolution of a company, these clauses determine the order in which shareholders and other stakeholders receive distributions from the remaining assets. They outline the priority and preference given to certain classes of shareholders, such as preferred shareholders, over common shareholders. The Franklin Ohio Clauses Relating to Dividends and Distributions ensure fairness and transparency in the distribution of assets during liquidation proceedings. 4. Stockholder Rights Clauses: These clauses protect the rights of shareholders related to dividends and distributions. They may include provisions that allow shareholders to participate in the decision-making process regarding dividend payments, ensuring their voices are heard. The Franklin Ohio Clauses Relating to Dividends and Distributions emphasize the importance of shareholder rights and seek to balance the interests of all stakeholders involved. 5. Dividend Reinvestment Clauses: These clauses provide guidance on reinvesting dividends back into the company's stock instead of distributing them as cash payments. They may outline the conditions under which shareholders can opt for dividend reinvestment programs and the benefits associated with such programs. The Franklin Ohio Clauses Relating to Dividends and Distributions ensure that companies comply with applicable laws when implementing dividend reinvestment options. In conclusion, the Franklin Ohio Clauses Relating to Dividends and Distributions encompass various provisions that govern dividend payments, accumulated dividends, liquidation preferences, stockholder rights, and dividend reinvestment. These clauses aim to protect the interests of shareholders and ensure fairness in the allocation of profits and assets in Franklin County, Ohio.

Franklin Ohio Clauses Relating to Dividends, Distributions

Description

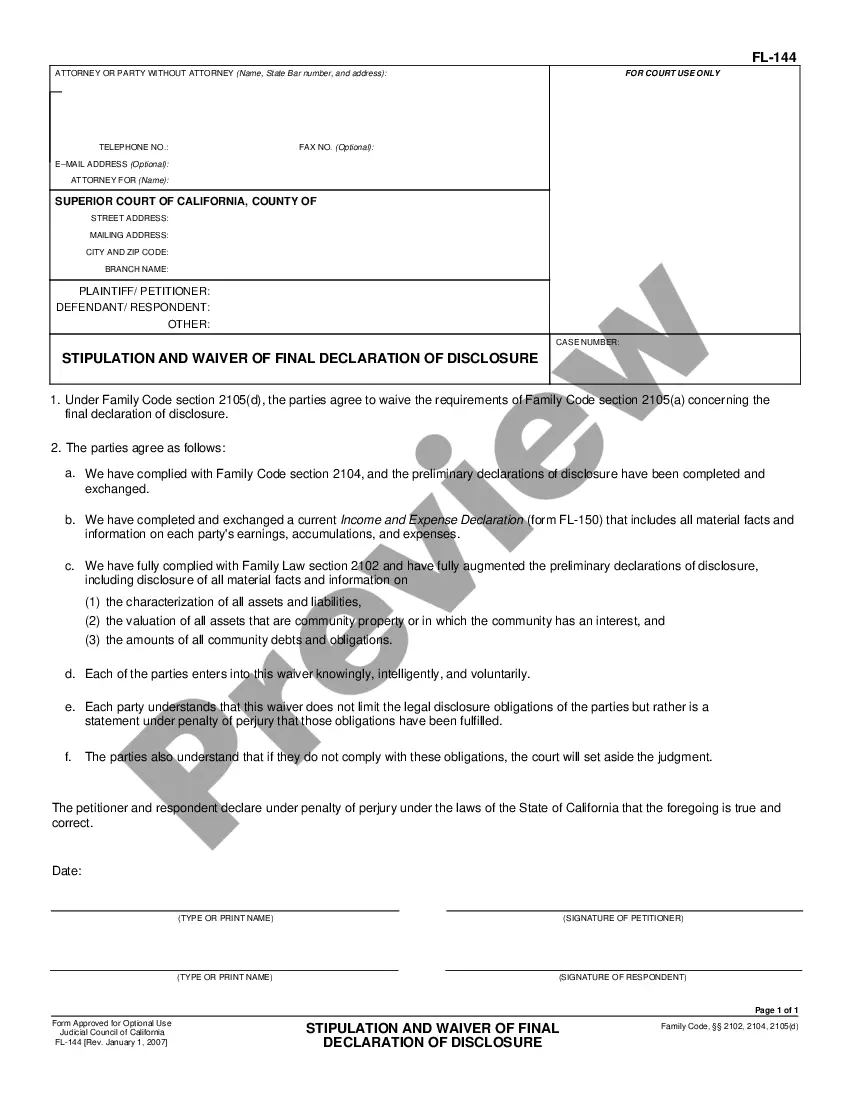

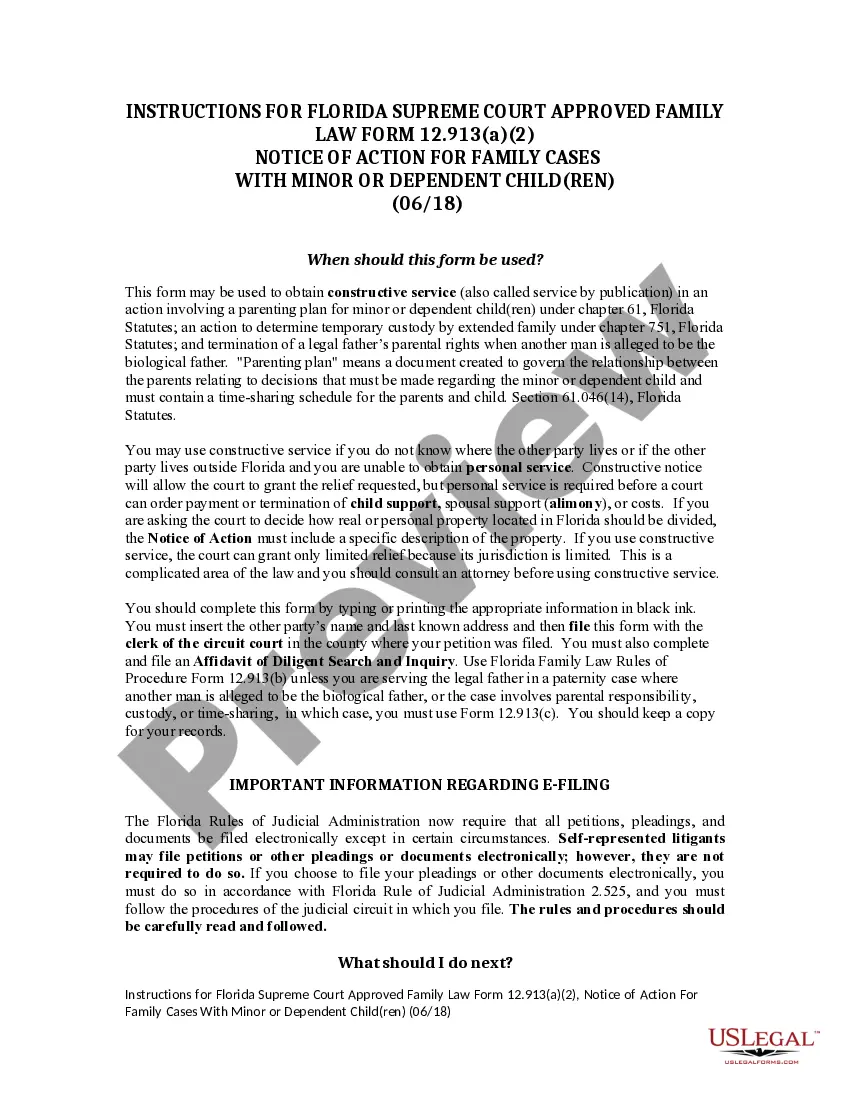

How to fill out Franklin Ohio Clauses Relating To Dividends, Distributions?

Draftwing paperwork, like Franklin Clauses Relating to Dividends, Distributions, to manage your legal matters is a difficult and time-consumming task. Many circumstances require an attorney’s participation, which also makes this task expensive. Nevertheless, you can get your legal affairs into your own hands and deal with them yourself. US Legal Forms is here to the rescue. Our website features more than 85,000 legal forms crafted for various scenarios and life circumstances. We ensure each form is in adherence with the laws of each state, so you don’t have to be concerned about potential legal pitfalls associated with compliance.

If you're already aware of our services and have a subscription with US, you know how easy it is to get the Franklin Clauses Relating to Dividends, Distributions form. Go ahead and log in to your account, download the form, and personalize it to your needs. Have you lost your form? Don’t worry. You can find it in the My Forms folder in your account - on desktop or mobile.

The onboarding flow of new customers is just as easy! Here’s what you need to do before downloading Franklin Clauses Relating to Dividends, Distributions:

- Ensure that your form is compliant with your state/county since the rules for creating legal documents may vary from one state another.

- Learn more about the form by previewing it or reading a quick intro. If the Franklin Clauses Relating to Dividends, Distributions isn’t something you were hoping to find, then use the header to find another one.

- Log in or register an account to start using our website and get the document.

- Everything looks great on your end? Click the Buy now button and select the subscription plan.

- Pick the payment gateway and type in your payment details.

- Your form is good to go. You can try and download it.

It’s an easy task to find and buy the appropriate document with US Legal Forms. Thousands of businesses and individuals are already benefiting from our rich library. Sign up for it now if you want to check what other perks you can get with US Legal Forms!

Form popularity

FAQ

The taxation of short sales is treated the same as traditional stock sales: Stocks held for a year and one day are taxed at long-term rates, currently 15%. Stocks held for less than one year are taxed as ordinary income subject to the investor's current tax rate.

Short Stocks and Dividend Payments Investors short a stock are never entitled to its dividends, and that includes those short a stock on its dividend record date. Rather, short-sellers owe any declared dividend payments to the shares' lenders.

You can deduct these payments only if you hold the short sale open at least 46 days (more than 1 year in the case of an extraordinary dividend, as defined later) and you itemize your deductions. You deduct these payments as investment interest on Schedule A (Form 1040 or 1040-SR).

You can deduct these payments only if you hold the short sale open at least 46 days (more than 1 year in the case of an extraordinary dividend, as defined later) and you itemize your deductions. You deduct these payments as investment interest on Schedule A (Form 1040 or 1040-SR).

You are responsible for reporting short sale on taxes. You must report the sale on Form 8949. This transfers to a Schedule D for the year of sale if: You received a 1099-S or other substitute form.

If you receive over $1,500 of taxable ordinary dividends, you must report these dividends on Schedule B (Form 1040), Interest and Ordinary Dividends. If you receive dividends in significant amounts, you may be subject to the Net Investment Income Tax (NIIT) and may have to pay estimated tax to avoid a penalty.

How do I report this Form 1099-DIV I received from my mutual fund? Enter the ordinary dividends from box 1a on Form 1099-DIV, Dividends and Distributions on line 3b of Form 1040, U.S. Individual Income Tax Return, Form 1040-SR, U.S. Tax Return for Seniors or Form 1040-NR, U.S. Nonresident Alien Income Tax Return.

Other 1099-G boxes Boxes 4, 10a, 10b and 11 report information about the federal, state and local income taxes withheld from any government payments you received. Box 5 reports certain trade adjustments. Box 6 shows any taxable grants you receive from government agencies.

Enter your total capital gains (Box 2a) from all your taxable investments on line 6 of Form 1040 and check the box on that line. Box 5 shows the portion of the amount in Box 1a that may be eligible for the 20% qualified business income deduction under Section 199A.

Substitute payments, such as dividends on securities that you have loaned to others, are reported in Box 8 on Form 1099-MISC.