Hillsborough County, located in Florida, is not directly associated with specific clauses relating to dividends or distributions. However, to provide relevancy to the keywords, let's discuss general clauses related to dividends and distributions that may be found in business contracts or corporate governance documents applicable in Hillsborough County or any other jurisdiction in Florida. 1. Dividend Distribution Clause: This clause outlines the provisions for distributing dividends, which are the payments made by a corporation to its shareholders. It may specify the frequency of dividend payments, the calculation methodology, any restrictions or conditions, and the source of funds for dividend distribution. 2. Preferential Dividend Clause: Some corporations may offer preferential dividends to specific shareholders, usually referred to as preferred shareholders. This clause outlines the conditions, rates, and priority of dividend payments to preferred shareholders before common shareholders receive their share. 3. Dividend Reinvestment Clause: This clause pertains to the reinvestment of dividends back into the corporation instead of distributing them to shareholders as cash payments. It defines the terms and procedures for shareholders to participate in dividend reinvestment plans (Drips) and the allocation of reinvested dividends. 4. Cumulative Dividend Clause: Corporations may include a cumulative dividend clause to ensure that if dividends cannot be paid in a particular year, they accumulate and must be paid in future years before common shareholders receive any dividends. This clause protects preferred shareholders' right to receive their missed dividend payments. 5. Liquidation Preference Clause: Although not directly related to dividends, the liquidation preference clause may impact future distributions. It outlines the order in which shareholders receive payments if the corporation goes bankrupt or liquidates, which could impact the returns obtained from dividend payments in such instances. 6. Dividend Yield Clause: This clause may not specifically be named as a "Hillsborough Florida" clause, but it refers to the representation of dividend payments in relation to a corporation's stock price. It outlines the formula for calculating the dividend yield and may impact the investment decisions of prospective shareholders. It is crucial to note that the specific requirements or terms within these clauses may vary depending on the company's bylaws, shareholder agreements, or applicable laws in Florida and Hillsborough County. Therefore, individuals and businesses should consult legal professionals or review the respective documents in their jurisdiction for accurate and comprehensive information.

Hillsborough Florida Clauses Relating to Dividends, Distributions

Description

How to fill out Hillsborough Florida Clauses Relating To Dividends, Distributions?

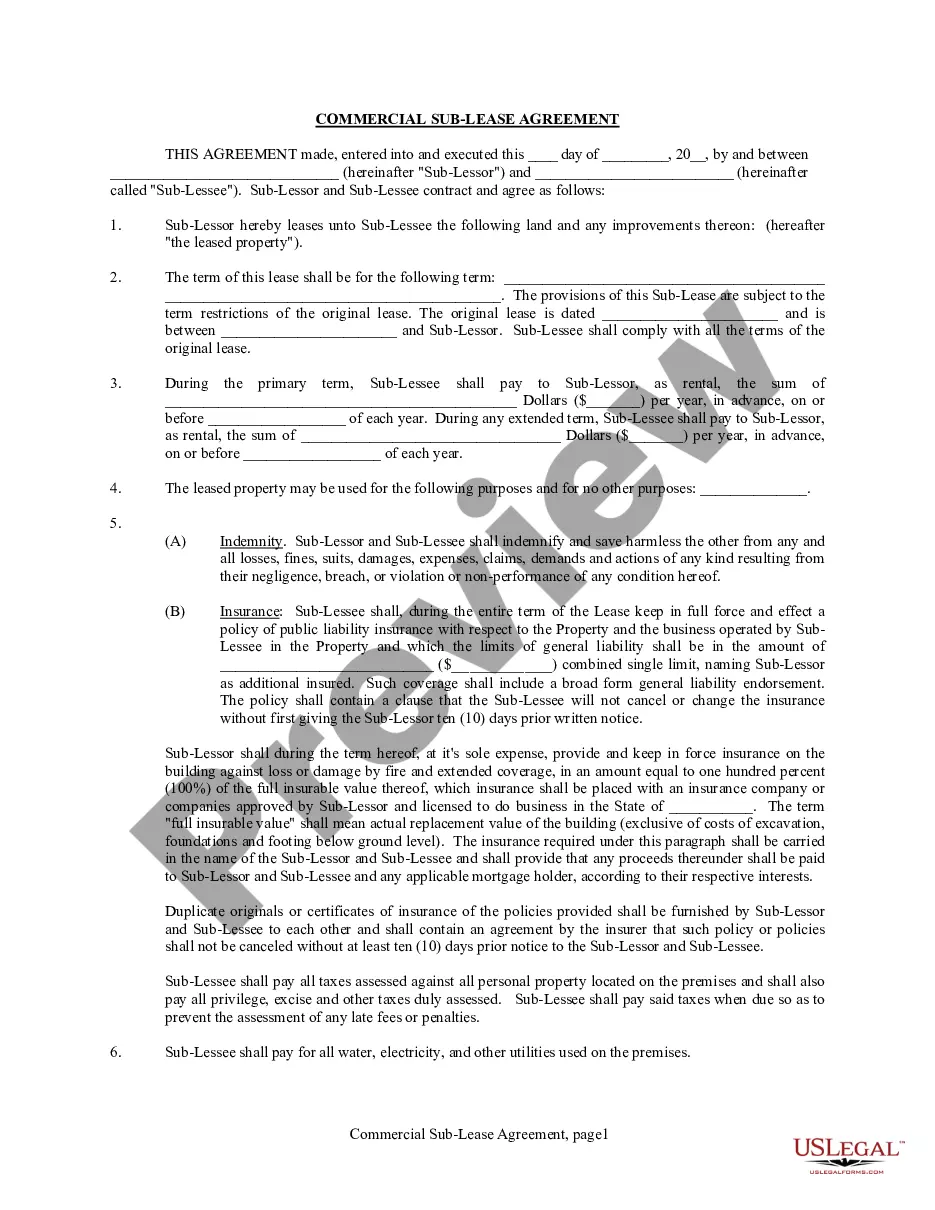

Are you looking to quickly draft a legally-binding Hillsborough Clauses Relating to Dividends, Distributions or maybe any other form to handle your personal or corporate affairs? You can select one of the two options: contact a legal advisor to draft a legal document for you or draft it entirely on your own. The good news is, there's another solution - US Legal Forms. It will help you receive neatly written legal documents without having to pay sky-high prices for legal services.

US Legal Forms offers a huge collection of more than 85,000 state-compliant form templates, including Hillsborough Clauses Relating to Dividends, Distributions and form packages. We offer documents for an array of life circumstances: from divorce papers to real estate documents. We've been on the market for over 25 years and got a spotless reputation among our customers. Here's how you can become one of them and obtain the necessary document without extra hassles.

- First and foremost, double-check if the Hillsborough Clauses Relating to Dividends, Distributions is tailored to your state's or county's regulations.

- If the form comes with a desciption, make sure to check what it's intended for.

- Start the search again if the template isn’t what you were looking for by utilizing the search box in the header.

- Select the plan that best suits your needs and proceed to the payment.

- Choose the file format you would like to get your form in and download it.

- Print it out, fill it out, and sign on the dotted line.

If you've already registered an account, you can simply log in to it, locate the Hillsborough Clauses Relating to Dividends, Distributions template, and download it. To re-download the form, simply head to the My Forms tab.

It's easy to buy and download legal forms if you use our services. In addition, the paperwork we offer are updated by law professionals, which gives you greater confidence when dealing with legal affairs. Try US Legal Forms now and see for yourself!