Oakland Michigan, located in the state of Michigan, is a county full of vibrant communities and a thriving economy. When it comes to business contracts and agreements, there are several clauses related to dividends and distributions that are commonly incorporated. These clauses provide guidelines and provisions for how dividends and distributions are handled within the agreement. One type of Oakland Michigan clause relating to dividends and distributions is the Dividend Payment Clause. This clause outlines the terms and conditions regarding the payment of dividends to shareholders. It may specify the frequency with which dividends will be paid, the method of payment, and the calculation of dividend amounts. The clause may also address any restrictions or limitations on dividend payments, such as minimum retained earnings requirements or the approval of a majority of shareholders. Another type of clause relevant to Oakland Michigan is the Distribution of Profits Clause. This clause pertains to the distribution of profits among different parties involved in the agreement. It may allocate a certain percentage or amount of profits to be distributed to specific individuals or entities. The clause may also address the timing and method of profit distribution, as well as any qualifications or restrictions on such distributions. In addition, the clause may also outline the process for allocating losses or negative results, should they occur. This ensures fairness and transparency in distributing both profits and losses among the parties involved. Furthermore, it is essential to note that the specific language and details of these clauses may vary depending on the nature of the agreement and the parties involved. Legal professionals in Oakland Michigan can assist in drafting and customizing these clauses to meet the unique needs and requirements of a particular business transaction or contract. Implementing well-drafted Oakland Michigan clauses on dividends and distributions in business contracts can help ensure clear communication, prevent disputes, and protect the rights and interests of all parties involved. By clearly defining the terms and conditions related to dividends and distributions, businesses can operate smoothly and confidently in Oakland Michigan's dynamic business landscape.

Oakland Michigan Clauses Relating to Dividends, Distributions

Description

How to fill out Oakland Michigan Clauses Relating To Dividends, Distributions?

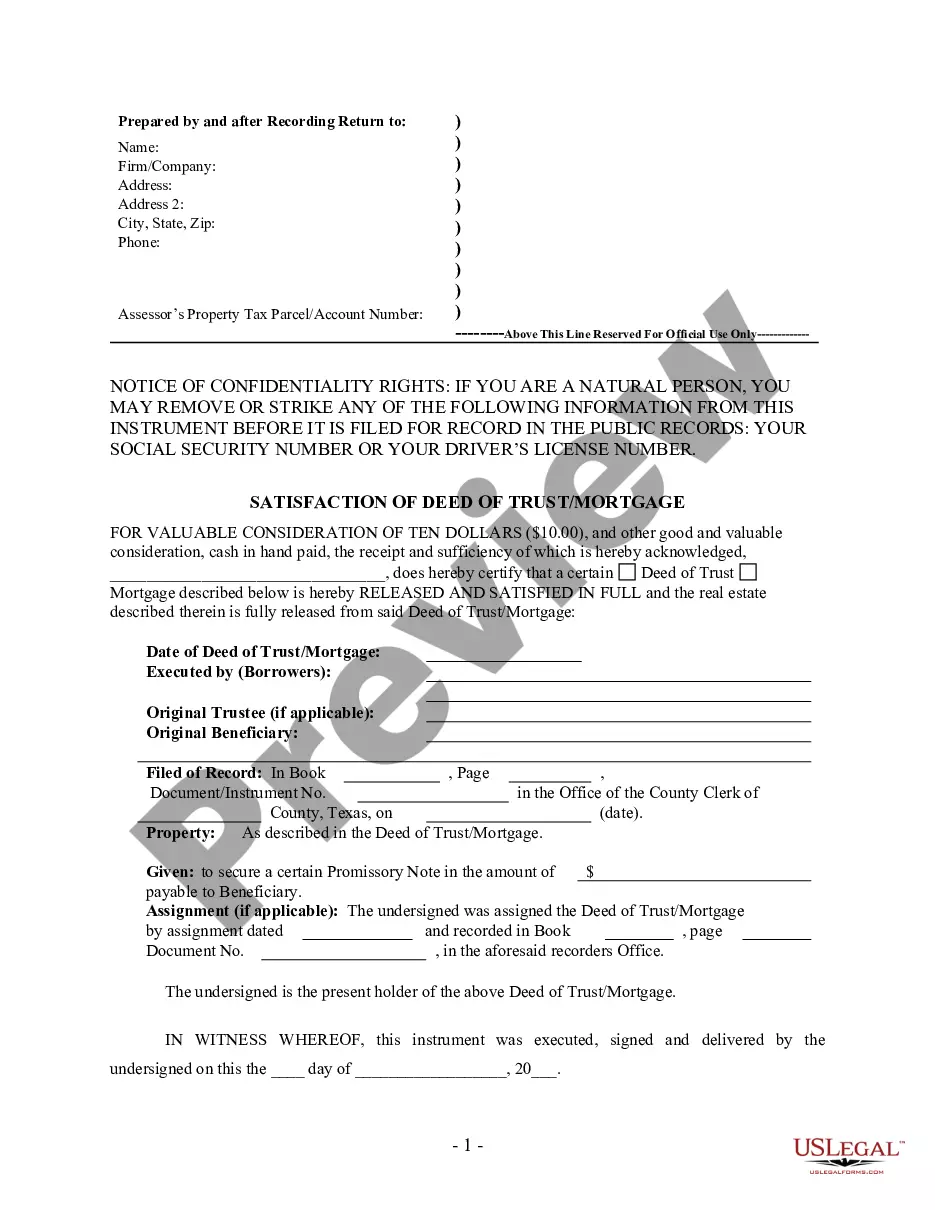

Preparing legal documentation can be burdensome. Besides, if you decide to ask a legal professional to write a commercial agreement, documents for proprietorship transfer, pre-marital agreement, divorce paperwork, or the Oakland Clauses Relating to Dividends, Distributions, it may cost you a fortune. So what is the most reasonable way to save time and money and create legitimate documents in total compliance with your state and local laws and regulations? US Legal Forms is an excellent solution, whether you're looking for templates for your personal or business needs.

US Legal Forms is biggest online library of state-specific legal documents, providing users with the up-to-date and professionally checked templates for any scenario collected all in one place. Therefore, if you need the recent version of the Oakland Clauses Relating to Dividends, Distributions, you can easily find it on our platform. Obtaining the papers requires a minimum of time. Those who already have an account should check their subscription to be valid, log in, and select the sample with the Download button. If you haven't subscribed yet, here's how you can get the Oakland Clauses Relating to Dividends, Distributions:

- Glance through the page and verify there is a sample for your area.

- Examine the form description and use the Preview option, if available, to make sure it's the template you need.

- Don't worry if the form doesn't satisfy your requirements - look for the correct one in the header.

- Click Buy Now once you find the needed sample and choose the best suitable subscription.

- Log in or register for an account to purchase your subscription.

- Make a transaction with a credit card or through PayPal.

- Opt for the file format for your Oakland Clauses Relating to Dividends, Distributions and download it.

Once finished, you can print it out and complete it on paper or upload the template to an online editor for a faster and more convenient fill-out. US Legal Forms enables you to use all the paperwork ever acquired multiple times - you can find your templates in the My Forms tab in your profile. Try it out now!

Form popularity

FAQ

The provisions under the Companies Act, 2013 provides that no dividend shall be paid except through cash and where the dividend is payable in cash, it can be paid by way of cheque, warrant or by any electronic mode to the shareholder who is eligible to receive the dividend.

If dividends are paid, a company will declare the amount of the dividend, and all holders of the stock (by the ex-date) will be paid accordingly on the subsequent payment date. Investors who receive dividends may decide to keep them as cash or reinvest them in order to accumulate more shares.

A company must not pay dividend otherwise than out of profit. Directors recommend dividend in board meeting. Dividend is declared members in general meeting ordinary resolution. Directors may from time to time pay to members such interim dividend as may be justified the profits of the company.

The short answer is yes. But to pay unequal dividends, your shareholders must hold different classes of shares. The different classes of shares that limited companies can issue are called 'alphabet shares'.

As per Rule 3, the conditions for declaration of dividend in the event of inadequacy or absence of profits in any year are as follows: (1) The rate of dividend declared shall not exceed the average of the rates at which dividend was declared by it in the three years immediately preceding that year.

If a company pays stock dividends, the dividends reduce the company's retained earnings and increase the common stock account. Stock dividends do not result in asset changes to the balance sheet but rather affect only the equity side by reallocating part of the retained earnings to the common stock account.

Corporate Law and Dividends Public corporations have no legal obligation to pay dividends to common shareholders, no matter how profitable they are or how much cash they have.

A dividend is paid per share of stock if you own 30 shares in a company and that company pays $2 in annual cash dividends, you will receive $60 per year.

A company must not pay a dividend unless: the company's assets are greater than its liabilities when it declares the dividend, and the difference is enough to pay the dividend; the payment of the dividend is fair and reasonable to the shareholders as a whole; and.

A company will be unable to pay different rates of dividend to its shareholders unless it is clearly provided for. Failure to do so can result in the dividend being unlawful, resulting in the company's directors being in breach of their legal duties.