Harris Texas Clauses Relating to Accounting Matters are specific terms and conditions included in business contracts that pertain to accounting practices and financial matters. These clauses ensure transparency, accuracy, and reliability in financial reporting and account management within the bounds of Harris County, Texas laws and regulations. Such clauses aim to safeguard the interests of both parties involved in the contract and to maintain a fair and trustworthy business environment. Some different types of Harris Texas Clauses Relating to Accounting Matters are: 1. Financial Reporting Clause: This clause outlines the requirements for financial reporting, including the frequency, format, and content of financial statements. It may specify that the Generally Accepted Accounting Principles (GAAP) should be followed for accurate reporting. 2. Audit Clause: This clause stipulates that one party has the right to conduct regular audits of the other party's financial records and accounts. It ensures that financial information is accurate, complete, and in accordance with the agreed-upon practices. 3. Accounting Standards Clause: This clause mandates compliance with specific accounting standards or guidelines, such as the International Financial Reporting Standards (IFRS) or the Generally Accepted Accounting Principles (GAAP). It ensures uniformity and consistency in financial reporting. 4. Materiality Clause: This clause sets a threshold for determining when an accounting issue or error becomes material enough to require disclosure or rectification in financial statements. It defines what constitutes a significant impact on the financial statements or decision-making process. 5. Non-Disclosure of Financial Information Clause: This clause ensures that confidential financial information shared between the parties remains private and does not get disclosed to third parties, protecting sensitive data and trade secrets. 6. Dispute Resolution Clause: Though not directly related to accounting matters, this clause can be included in contracts with implications for accounting. It outlines the agreed-upon methods for resolving accounting disputes, such as utilizing arbitration or mediation services. 7. Indemnification and Liability Clause: This clause specifies the responsibilities and liabilities of each party concerning accounting errors, fraud, or misrepresentations. It determines whether one party can seek indemnification from the other for financial losses incurred due to accounting irregularities. Harris Texas Clauses Relating to Accounting Matters play a crucial role in ensuring accurate financial reporting and accountability. It is essential for businesses to carefully draft and review these clauses to protect their financial interests and maintain compliance with regulatory requirements in Harris County, Texas.

Harris Texas Clauses Relating to Accounting Matters

Description

How to fill out Harris Texas Clauses Relating To Accounting Matters?

Laws and regulations in every sphere vary around the country. If you're not a lawyer, it's easy to get lost in various norms when it comes to drafting legal documentation. To avoid pricey legal assistance when preparing the Harris Clauses Relating to Accounting Matters, you need a verified template legitimate for your county. That's when using the US Legal Forms platform is so advantageous.

US Legal Forms is a trusted by millions web collection of more than 85,000 state-specific legal templates. It's a perfect solution for specialists and individuals searching for do-it-yourself templates for different life and business situations. All the documents can be used multiple times: once you purchase a sample, it remains available in your profile for further use. Therefore, if you have an account with a valid subscription, you can simply log in and re-download the Harris Clauses Relating to Accounting Matters from the My Forms tab.

For new users, it's necessary to make several more steps to obtain the Harris Clauses Relating to Accounting Matters:

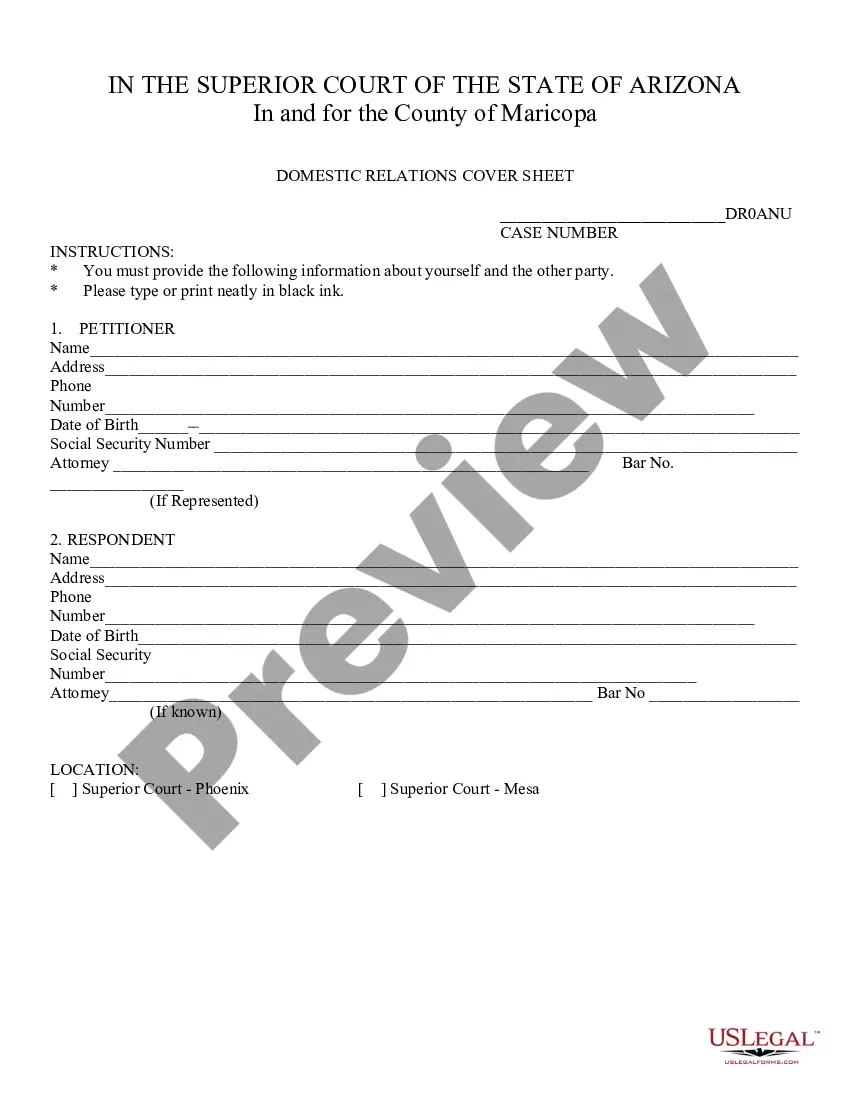

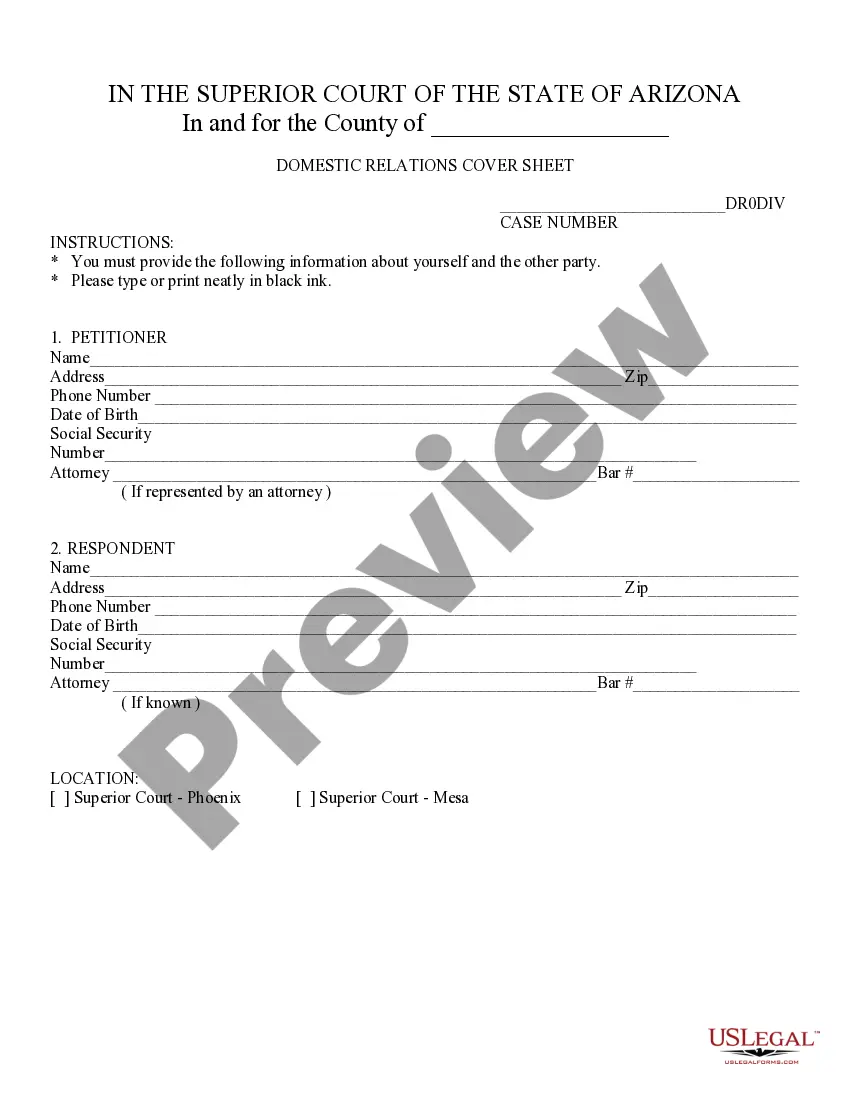

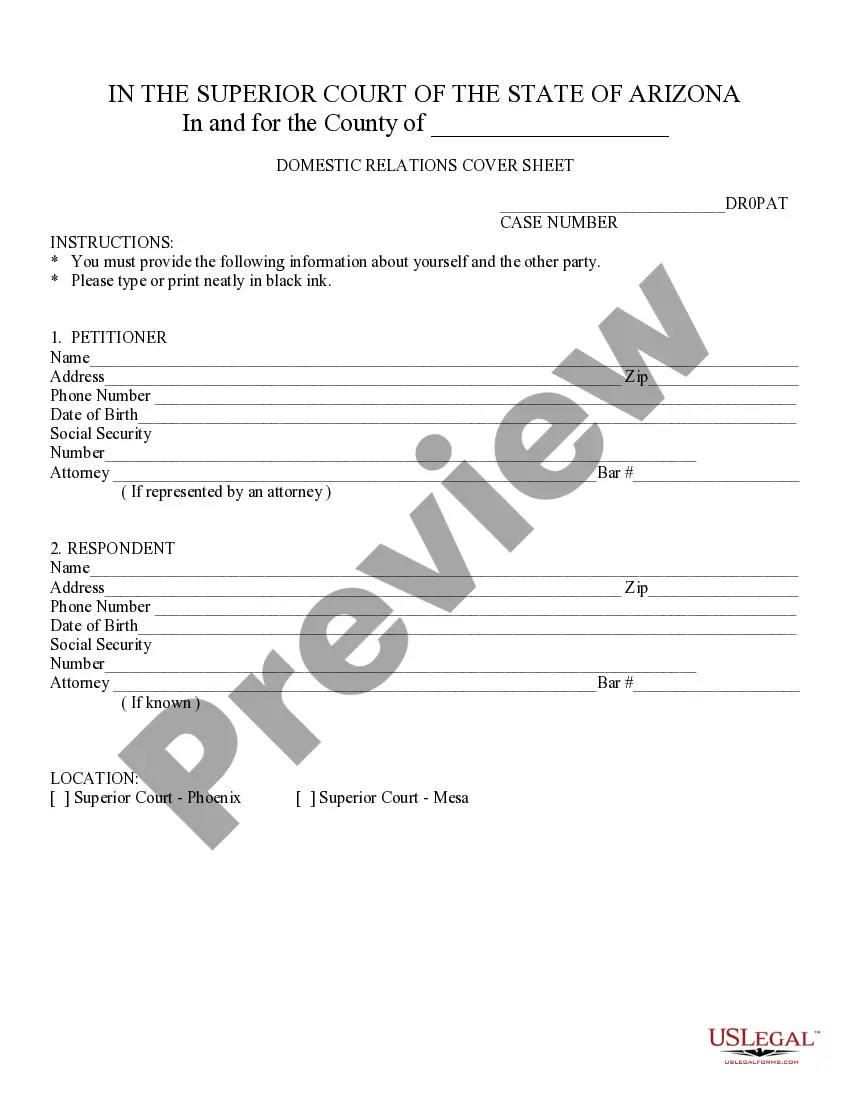

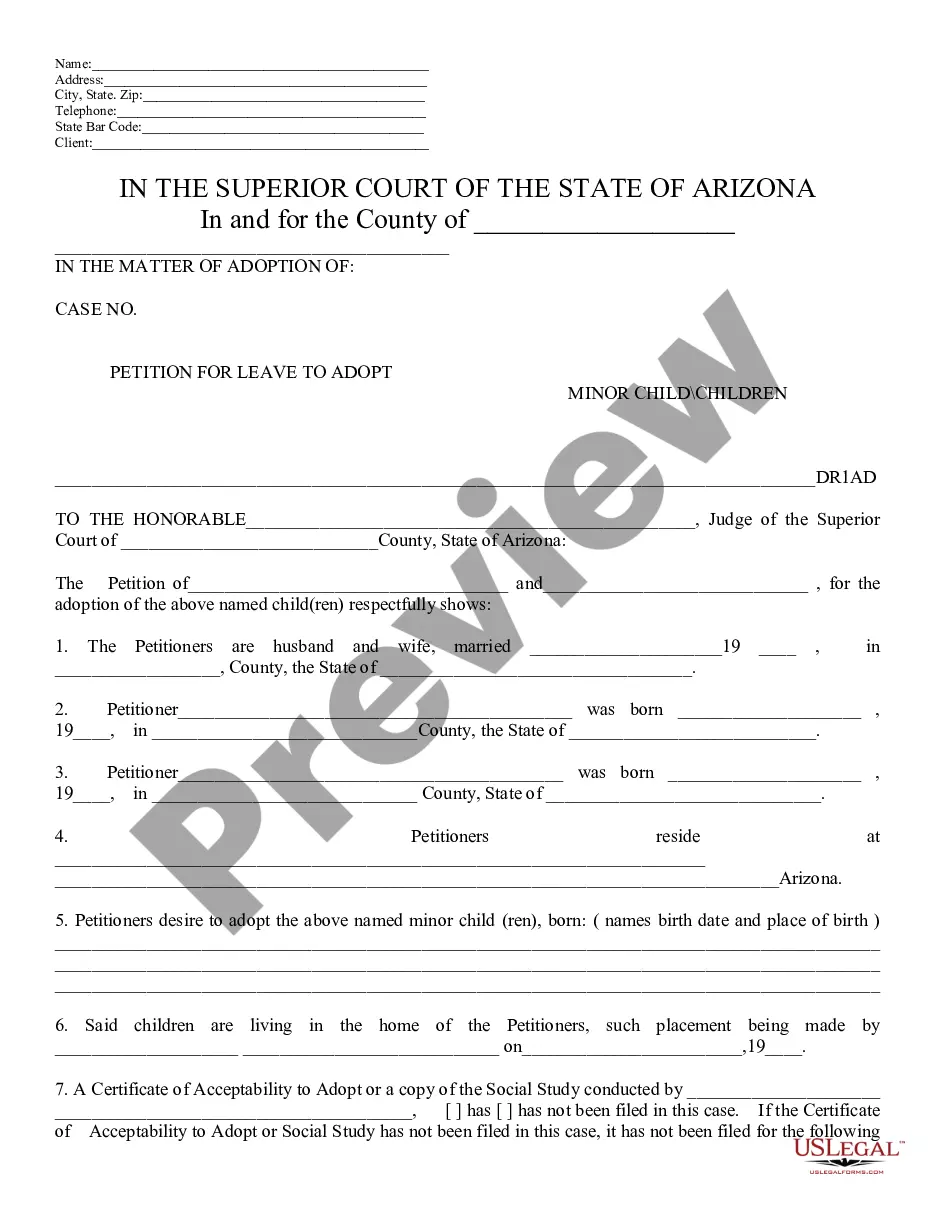

- Analyze the page content to make sure you found the appropriate sample.

- Use the Preview option or read the form description if available.

- Look for another doc if there are inconsistencies with any of your criteria.

- Utilize the Buy Now button to obtain the template once you find the right one.

- Choose one of the subscription plans and log in or create an account.

- Select how you prefer to pay for your subscription (with a credit card or PayPal).

- Pick the format you want to save the document in and click Download.

- Fill out and sign the template in writing after printing it or do it all electronically.

That's the easiest and most affordable way to get up-to-date templates for any legal purposes. Locate them all in clicks and keep your paperwork in order with the US Legal Forms!