Kings New York Clauses Relating to Accounting Matters are contractual provisions that govern financial and accounting aspects in business agreements. These clauses ensure accuracy, transparency, and compliance with accounting standards, promoting fair financial reporting and accountability. The specific types of Kings New York Clauses Relating to Accounting Matters may include: 1. Financial Reporting: This clause outlines the requirements for reporting financial information accurately and in a timely manner. It may specify the frequency and format of financial statements to be prepared, the accounting principles and standards to be followed, and the specific disclosures to be included. 2. Auditing and Inspection: This clause highlights the right of one party to inspect and audit the financial records of the other party. It may include provisions regarding the appointment of independent auditors, access to books and records, and the sharing of audit findings and reports. 3. Cost Allocation: When multiple parties are involved in a business agreement, this clause determines how costs and expenses are allocated among them. It may outline the methodology for calculating and allocating costs, highlighting key factors such as sales volume, production output, or usage of shared resources. 4. Indemnification for Accounting Errors: In case of any accounting errors or misstatements, this clause establishes the responsibility and liability of the parties involved. It may outline the procedure for identifying and rectifying errors, as well as determining the party responsible for any resulting financial losses. 5. Taxation: This clause addresses tax-related matters, including the allocation of tax liabilities, tax reporting requirements, and any applicable tax incentives or exemptions. It may also cover the sharing of tax-related information and the cooperation between parties during tax audits or investigations. 6. Dispute Resolution: If any accounting-related disputes arise between the parties, this clause sets out the procedure for resolving such disagreements. It may specify the methods of negotiation, mediation, or arbitration to be utilized and the jurisdiction for resolving such disputes, ensuring a fair and unbiased resolution process. Overall, Kings New York Clauses Relating to Accounting Matters play a crucial role in ensuring financial transparency, accuracy, and compliance within business agreements. These clauses promote good accounting practices, facilitate effective auditing, and maintain trust and accountability between the parties involved.

Kings New York Clauses Relating to Accounting Matters

Description

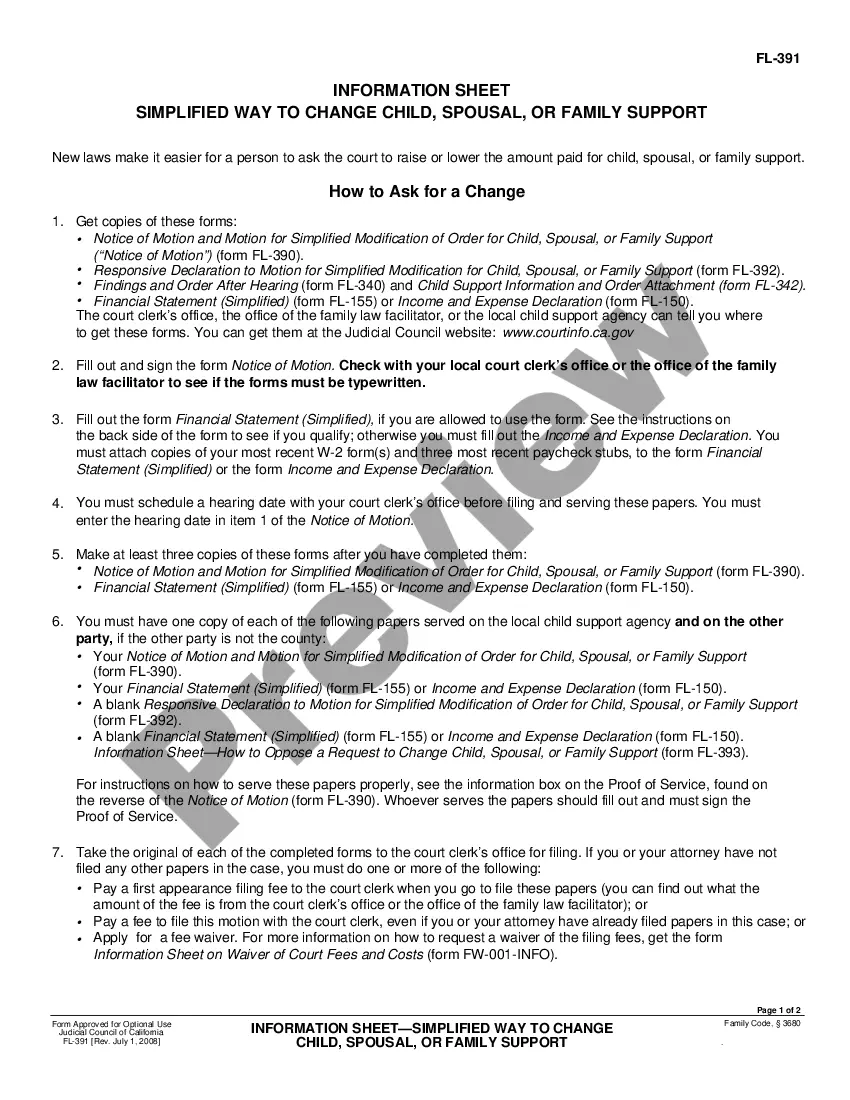

How to fill out Kings New York Clauses Relating To Accounting Matters?

Laws and regulations in every area vary around the country. If you're not an attorney, it's easy to get lost in countless norms when it comes to drafting legal documentation. To avoid pricey legal assistance when preparing the Kings Clauses Relating to Accounting Matters, you need a verified template legitimate for your county. That's when using the US Legal Forms platform is so helpful.

US Legal Forms is a trusted by millions online catalog of more than 85,000 state-specific legal forms. It's a great solution for specialists and individuals searching for do-it-yourself templates for different life and business occasions. All the forms can be used many times: once you obtain a sample, it remains accessible in your profile for future use. Thus, if you have an account with a valid subscription, you can just log in and re-download the Kings Clauses Relating to Accounting Matters from the My Forms tab.

For new users, it's necessary to make a couple of more steps to obtain the Kings Clauses Relating to Accounting Matters:

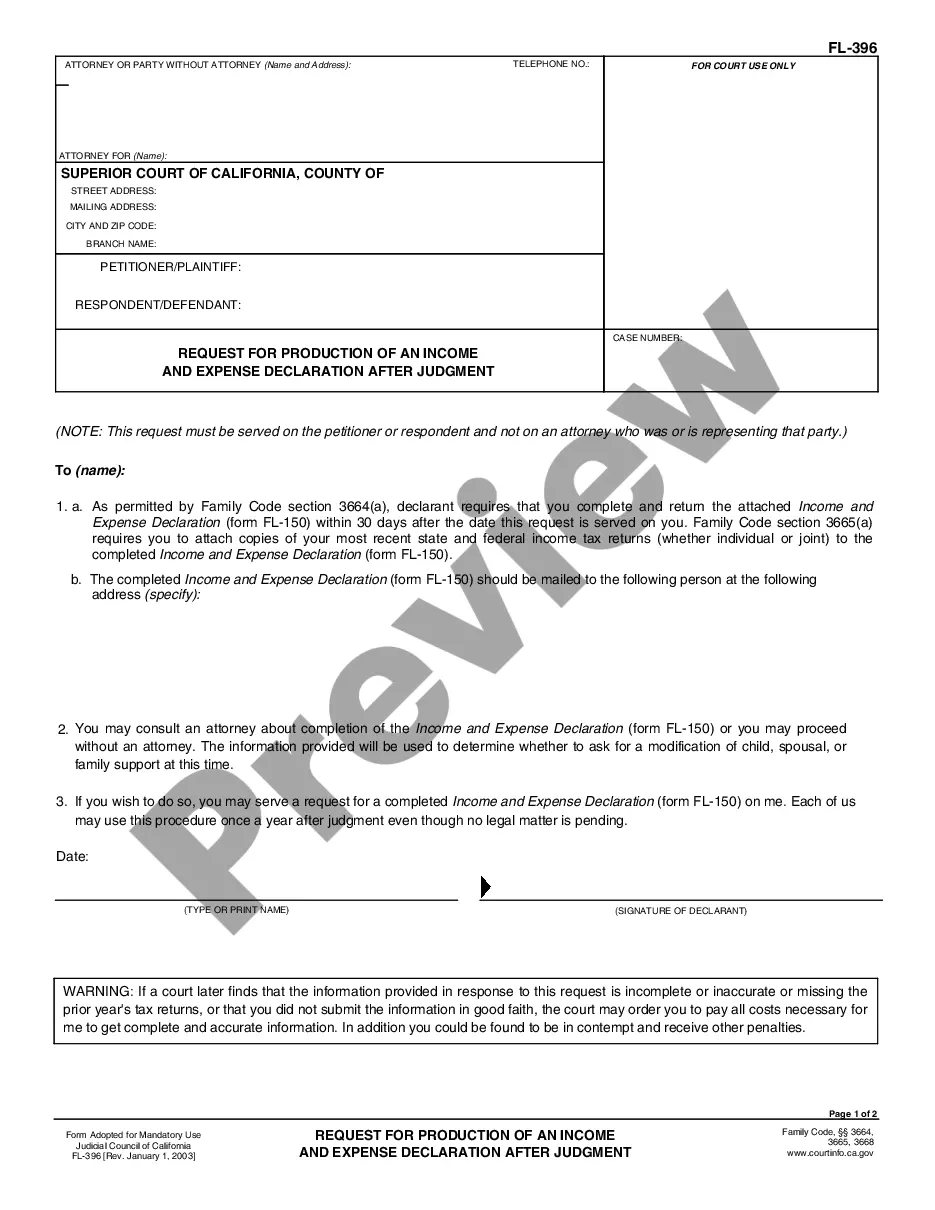

- Take a look at the page content to make sure you found the right sample.

- Use the Preview option or read the form description if available.

- Search for another doc if there are inconsistencies with any of your requirements.

- Click on the Buy Now button to obtain the document once you find the appropriate one.

- Choose one of the subscription plans and log in or sign up for an account.

- Choose how you prefer to pay for your subscription (with a credit card or PayPal).

- Select the format you want to save the document in and click Download.

- Fill out and sign the document on paper after printing it or do it all electronically.

That's the simplest and most cost-effective way to get up-to-date templates for any legal scenarios. Locate them all in clicks and keep your documentation in order with the US Legal Forms!