Nassau, New York is a county located on Long Island and is well-known for its vibrant business community. It attracts numerous businesses and entrepreneurs due to its favorable economic conditions. When engaging in business transactions in Nassau, it is crucial to understand certain legal aspects, such as the Nassau New York clauses relating to accounting matters. These clauses help regulate financial practices and ensure transparency in business operations. One type of Nassau New York clause relating to accounting matters is the "Financial Reporting Clause." This clause stipulates that parties involved in a business agreement must provide accurate and timely financial statements. It ensures that financial information is presented according to recognized accounting principles, such as Generally Accepted Accounting Principles (GAAP). Adhering to this clause promotes transparency and facilitates informed business decisions. Another important clause is the "Auditing Clause." This clause requires businesses to undergo periodic audits by independent, certified public accountants. The purpose is to verify the accuracy and reliability of financial statements and assess compliance with accounting regulations. By enforcing this clause, businesses in Nassau maintain accountability and credibility in financial reporting. Furthermore, there are "Tax Compliance Clauses" that pertain to accounting matters in Nassau, New York. These clauses ensure businesses meet all tax obligations imposed by federal, state, and local authorities. They require businesses to maintain accurate records, file tax returns on time, and adhere to relevant tax laws. Upholding these clauses helps businesses avoid penalties and legal complications, fostering a fair and compliant business environment. Additionally, the "Confidentiality Clause" is crucial when it comes to accounting matters in Nassau, New York. This clause states that any financial information shared during business transactions should be treated with utmost confidentiality. It prohibits the unauthorized disclosure or use of financial data, protecting businesses from potential fraud or information breaches. In conclusion, Nassau, New York, has several types of clauses related to accounting matters that businesses must consider when entering into agreements. These clauses include the Financial Reporting Clause, Auditing Clause, Tax Compliance Clauses, and Confidentiality Clause. Understanding and abiding by these clauses ensures financial transparency, compliance with accounting regulations, and the overall progress and success of businesses operating in Nassau, New York.

Nassau New York Clauses Relating to Accounting Matters

Description

How to fill out Nassau New York Clauses Relating To Accounting Matters?

Whether you plan to start your company, enter into a contract, apply for your ID renewal, or resolve family-related legal issues, you need to prepare certain documentation meeting your local laws and regulations. Locating the correct papers may take a lot of time and effort unless you use the US Legal Forms library.

The service provides users with more than 85,000 professionally drafted and verified legal documents for any individual or business case. All files are grouped by state and area of use, so opting for a copy like Nassau Clauses Relating to Accounting Matters is quick and simple.

The US Legal Forms website users only need to log in to their account and click the Download key next to the required form. If you are new to the service, it will take you several more steps to get the Nassau Clauses Relating to Accounting Matters. Follow the instructions below:

- Make sure the sample meets your personal needs and state law regulations.

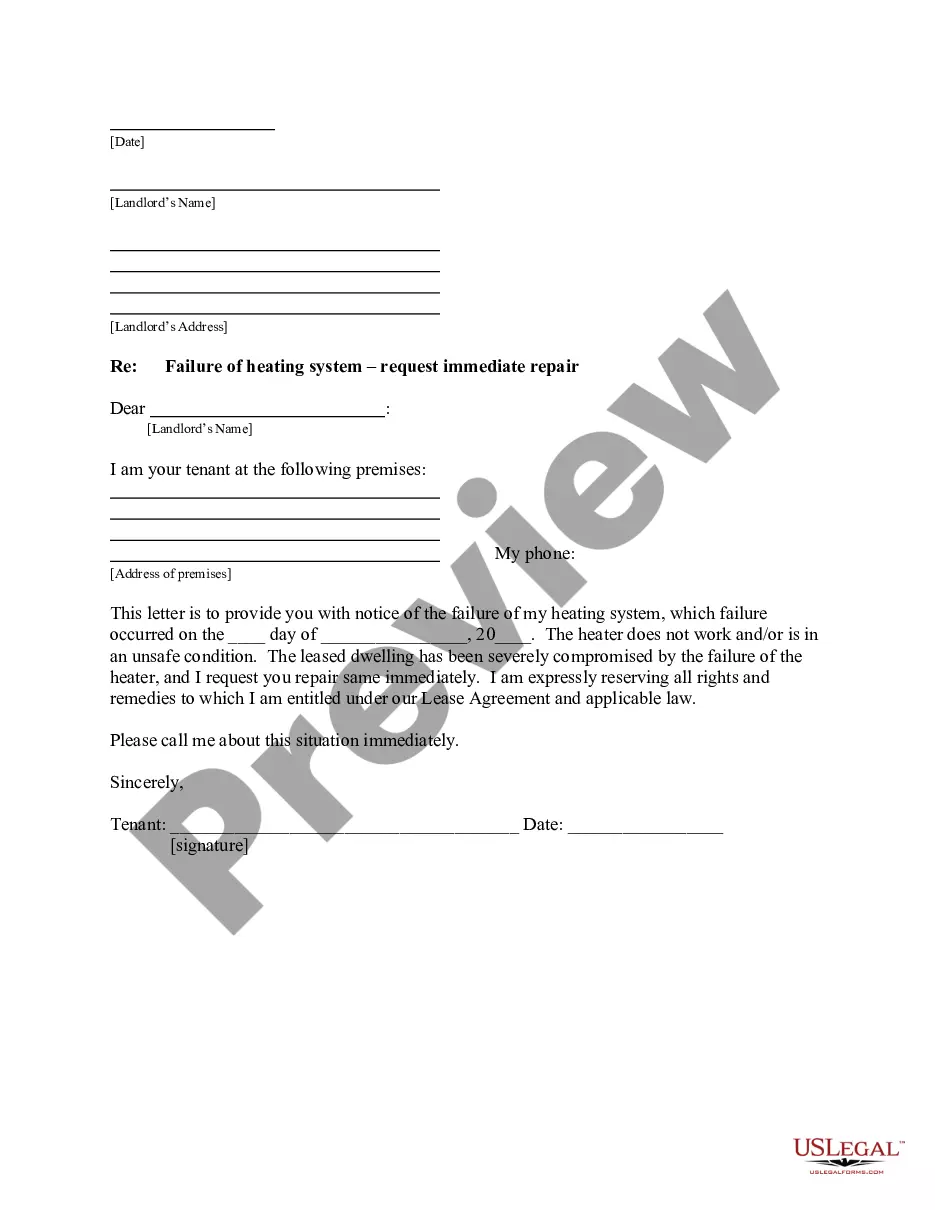

- Look through the form description and check the Preview if available on the page.

- Make use of the search tab providing your state above to locate another template.

- Click Buy Now to obtain the sample when you find the correct one.

- Choose the subscription plan that suits you most to proceed.

- Log in to your account and pay the service with a credit card or PayPal.

- Download the Nassau Clauses Relating to Accounting Matters in the file format you require.

- Print the copy or fill it out and sign it electronically via an online editor to save time.

Forms provided by our website are reusable. Having an active subscription, you can access all of your earlier purchased paperwork at any moment in the My Forms tab of your profile. Stop wasting time on a endless search for up-to-date official documentation. Sign up for the US Legal Forms platform and keep your paperwork in order with the most comprehensive online form library!