Suffolk New York Clauses Relating to Accounting Matters play a crucial role in ensuring accurate financial reporting and transparency among businesses operating in Suffolk County, New York. These clauses are typically included in contracts, agreements, or business transactions that involve accounting processes, financial statements, audits, and related matters. They aim to establish clear guidelines, requirements, and standards to safeguard the integrity of financial information within the county. Here are several types of Suffolk New York Clauses Relating to Accounting Matters that businesses may encounter: 1. Financial Reporting Clause: This type of clause specifies the obligations and standards for financial reporting, including the frequency, format, and content of financial statements. It may outline the need for adherence to Generally Accepted Accounting Principles (GAAP) or specific accounting frameworks applicable in Suffolk County. 2. Audit Clause: An audit clause establishes the rights and obligations of parties involved in an audit process. It may detail the requirement for an annual financial audit conducted by an independent certified public accountant (CPA) to ensure compliance and accuracy. 3. Accounting Standards Clause: This clause outlines the obligation to follow specific accounting principles and standards recognized in Suffolk County, such as those set forth by the Financial Accounting Standards Board (FAST) or the Governmental Accounting Standards Board (GAS), depending on the nature of the business. 4. Disclosure and Transparency Clause: Highlighting the importance of transparency, this clause mandates the timely and accurate disclosure of financial information, such as significant transactions, contingent liabilities, related-party transactions, or any potential conflicts of interest. 5. Compliance with Laws and Regulations Clause: This type of clause ensures that businesses adhere to relevant local, state, and federal laws and regulations related to accounting matters. These may include tax laws, securities regulations, or specific accounting rules imposed by Suffolk County. 6. Dispute Resolution Clause: In the event of an accounting dispute, this clause lays out the procedures, processes, and methods for resolving disagreements, which may involve mediation, arbitration, or litigation. 7. Non-Disclosure Clause: To protect sensitive financial or proprietary information, this clause establishes confidentiality obligations for parties involved in the accounting processes, such as contractors, employees, or business partners. It is essential for businesses operating in Suffolk County, New York, to carefully consider and understand the specific clauses relating to accounting matters included in their contracts or agreements. These clauses not only promote financial accuracy and transparency but also help maintain compliance with local regulations and standards, ensuring a trustworthy business environment.

Suffolk New York Clauses Relating to Accounting Matters

Description

How to fill out Suffolk New York Clauses Relating To Accounting Matters?

Dealing with legal forms is a must in today's world. Nevertheless, you don't always need to seek professional help to draft some of them from scratch, including Suffolk Clauses Relating to Accounting Matters, with a platform like US Legal Forms.

US Legal Forms has more than 85,000 templates to pick from in different types ranging from living wills to real estate paperwork to divorce documents. All forms are organized according to their valid state, making the searching experience less overwhelming. You can also find information materials and tutorials on the website to make any activities related to paperwork completion simple.

Here's how you can locate and download Suffolk Clauses Relating to Accounting Matters.

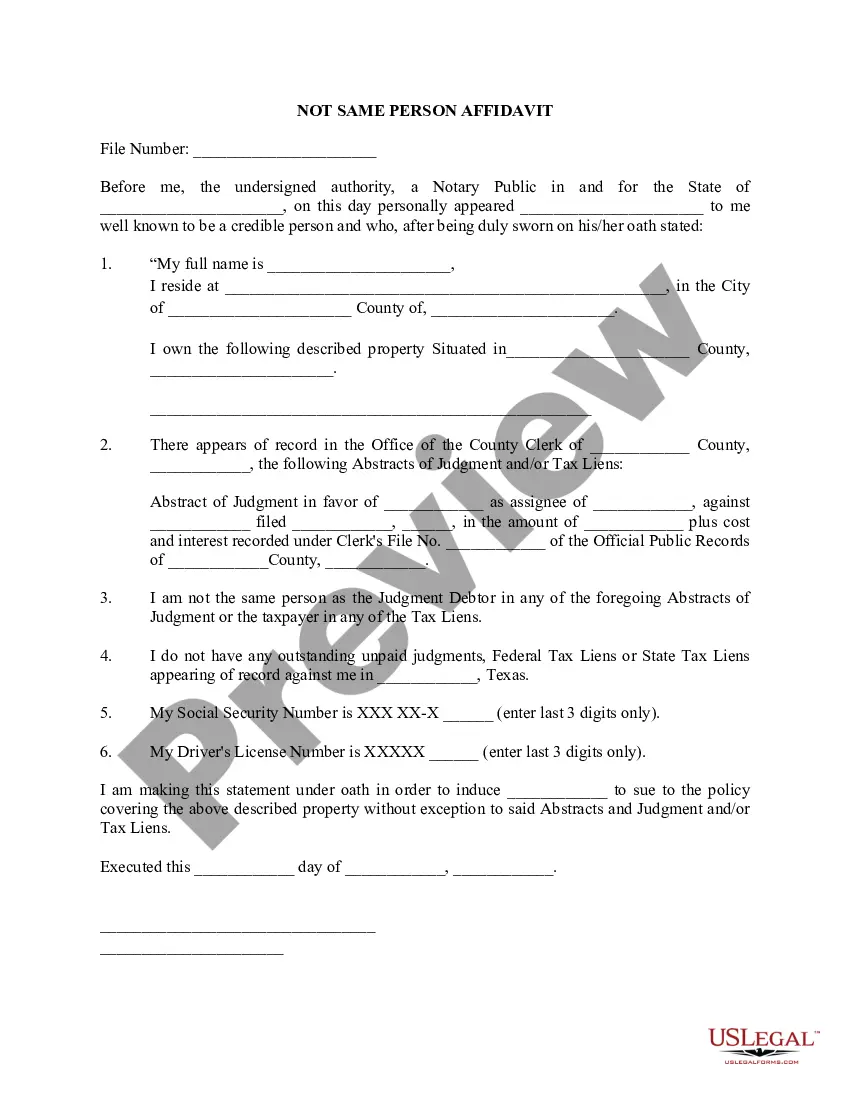

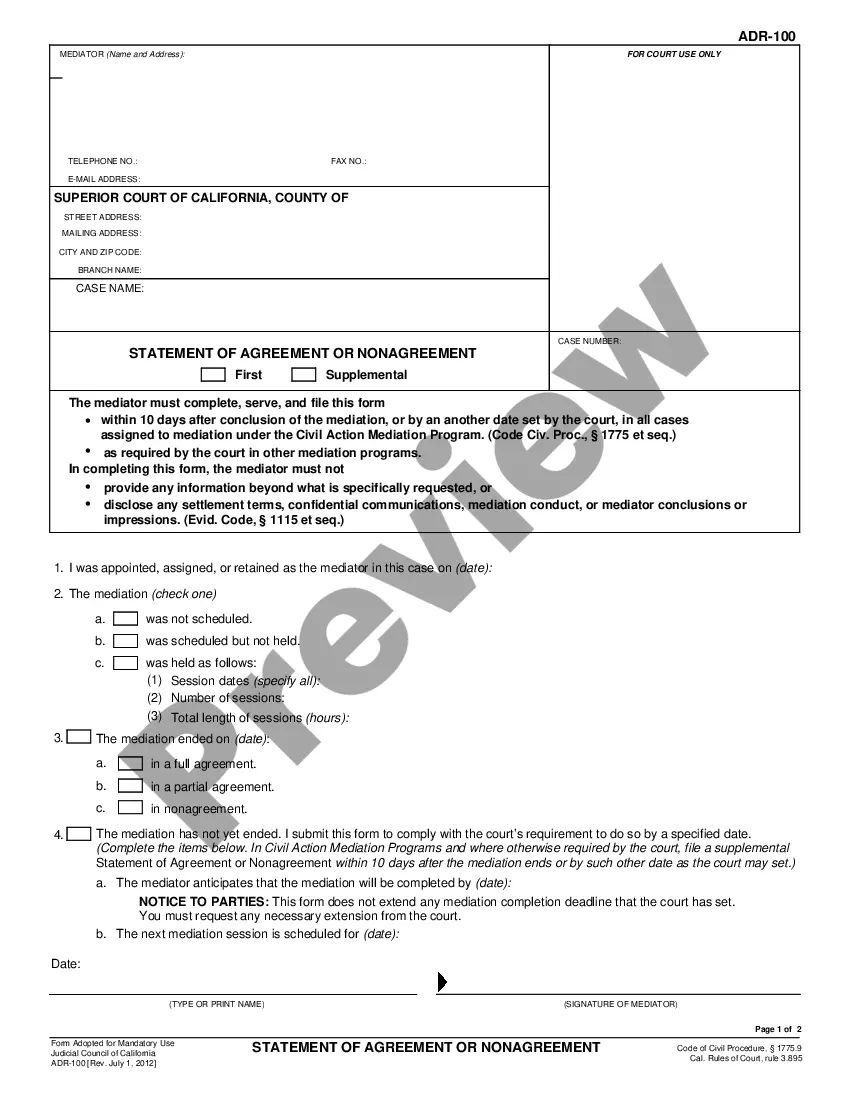

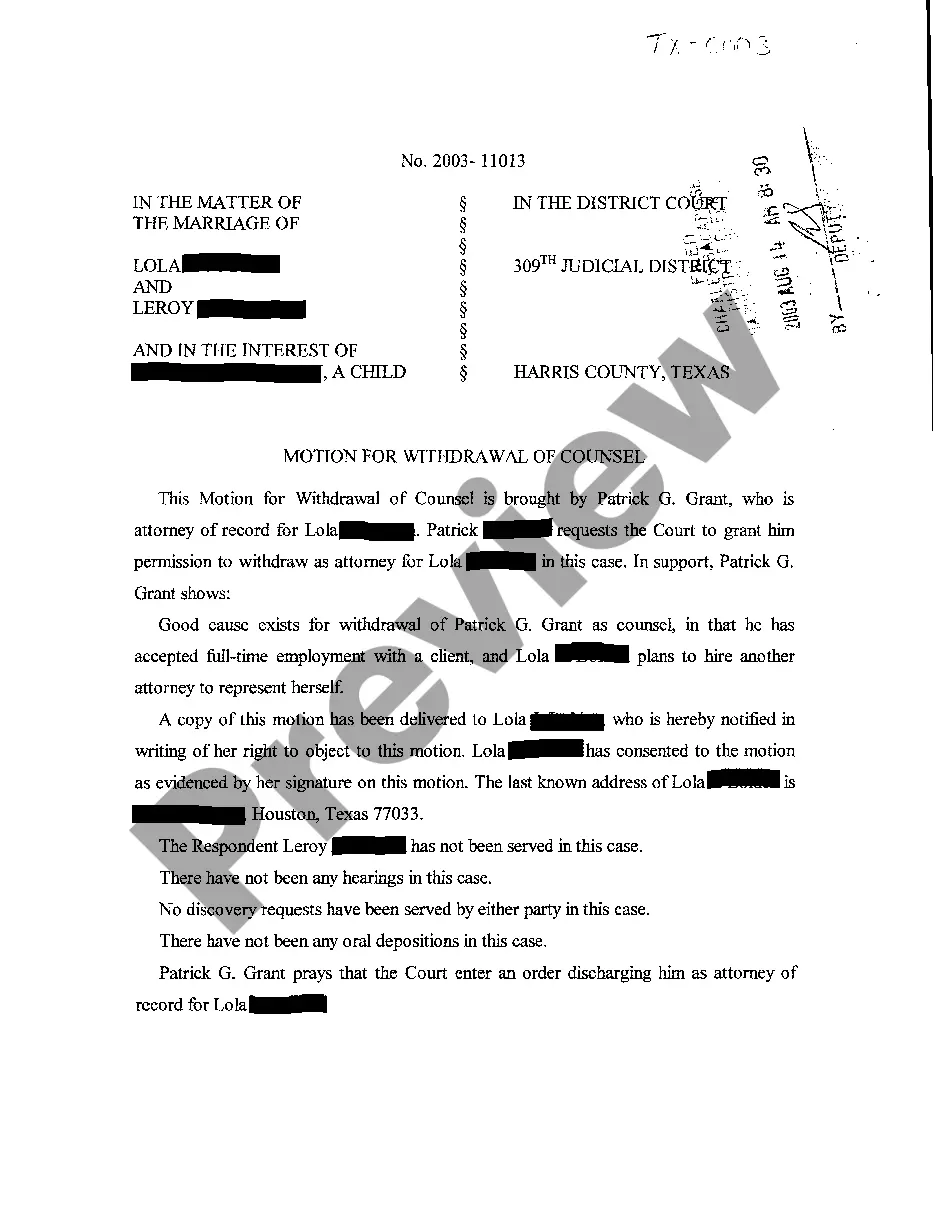

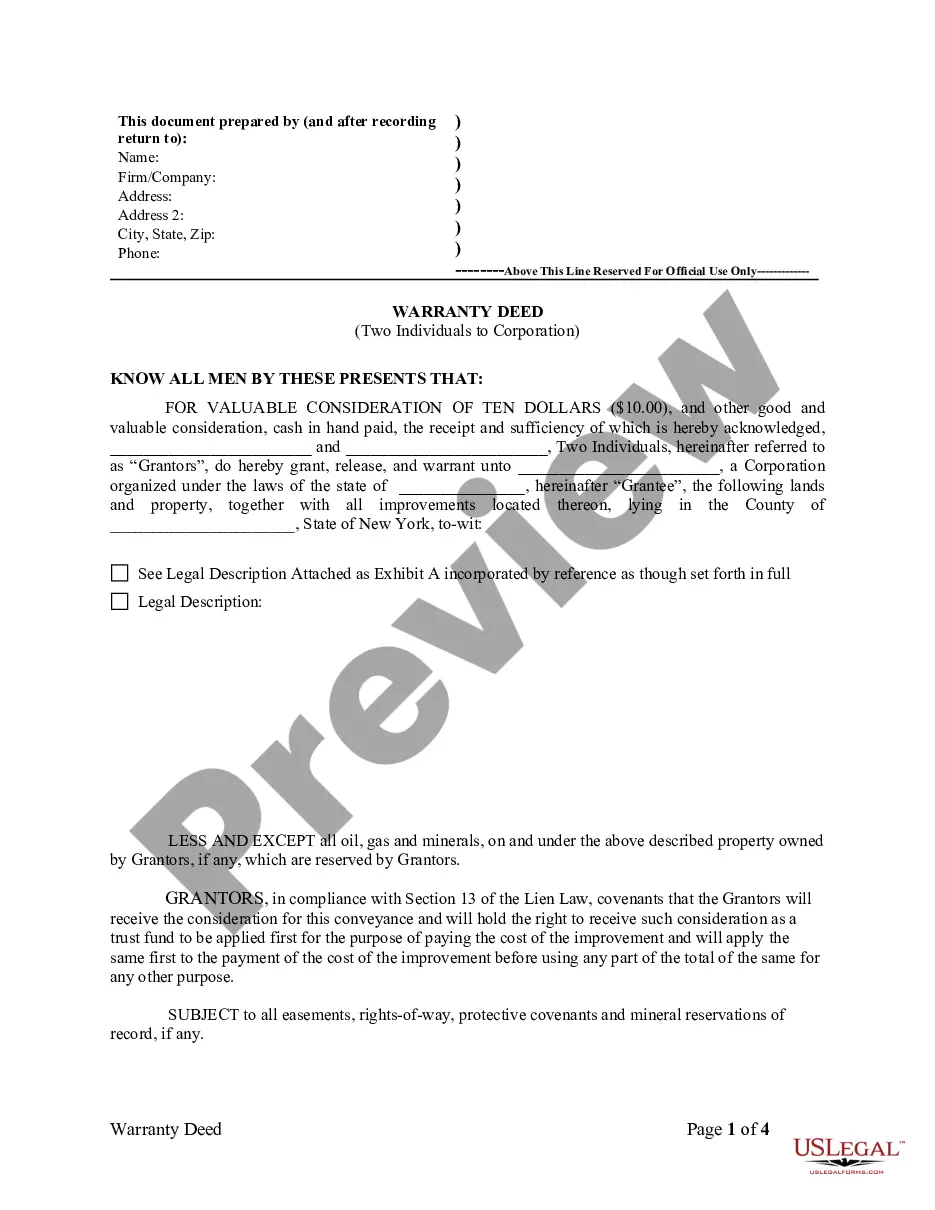

- Go over the document's preview and outline (if provided) to get a general idea of what you’ll get after downloading the document.

- Ensure that the document of your choice is specific to your state/county/area since state laws can impact the legality of some records.

- Check the related document templates or start the search over to locate the appropriate document.

- Hit Buy now and register your account. If you already have an existing one, choose to log in.

- Pick the option, then a suitable payment gateway, and buy Suffolk Clauses Relating to Accounting Matters.

- Choose to save the form template in any offered format.

- Go to the My Forms tab to re-download the document.

If you're already subscribed to US Legal Forms, you can locate the needed Suffolk Clauses Relating to Accounting Matters, log in to your account, and download it. Of course, our platform can’t replace a legal professional completely. If you have to cope with an extremely complicated case, we recommend getting an attorney to review your document before signing and filing it.

With over 25 years on the market, US Legal Forms became a go-to platform for various legal forms for millions of users. Join them today and purchase your state-specific documents effortlessly!