Title: Houston, Texas Clauses Relating to Transfers of Venture Interests — Exploring Rights of First Refusal and Their Types Introduction: Located in southeastern Texas, Houston is a vibrant city renowned for its thriving business and entrepreneurial culture. Within this dynamic environment, numerous ventures and partnerships are formed, each governed by sets of clauses, including those relating to the transfer of venture interests. One such critical clause is the "Rights of First Refusal." In this article, we will delve into the details of this clause, its significance, and the different types of Houston, Texas Clauses Relating to Transfers of Venture interests — including Rights of First Refusal. 1. Rights of First Refusal (ROAR): The Rights of First Refusal (ROAR) is a contractual clause that grants existing venture interest holders the priority or the first opportunity to purchase additional interests being offered for sale by another party. It ensures that current stakeholders have the chance to maintain their proportional ownership in the venture and prevents dilution of their interests by external parties. 2. Types of Rights of First Refusal Clauses (ROAR): a. Simple ROAR: A simple ROAR clause entitles the existing interest holders to match the proposed terms of a third-party offer made for additional venture interests. If they choose to do so, they can purchase the interests under the same conditions within a specified timeframe. b. Multiple Bidder ROAR: Multiple Bidder ROAR allows the existing interest holders not only to match the terms but also to compete with other potential buyers when new venture interests are offered for sale. In this case, they have the option to submit a superior proposal to acquire the interests, surpassing any competing offer. c. Shotgun ROAR: A shotgun ROAR provision provides a mechanism for resolving conflicts between existing stakeholders in a venture. It allows one party to initiate an offer to buy the venture interests of the other party at a specified price. However, the party receiving the offer also has the right to accept the offer and purchase the interests or counter the offer by providing their own terms. The clause ultimately forces a resolution since the receiving party must either exit the venture or buy out the initiating party's interests. d. Right of Last Refusal: While not technically a type of ROAR, the Right of Last Refusal clause is often mentioned alongside the ROAR provisions. It grants the existing interest holders the option to purchase the venture interests at the same price and on the same terms as a bona fide third-party offer. However, it only comes into effect after the initial offeree declines or fails to accept the third-party offer, allowing existing stakeholders to step in as the final resort. Conclusion: In the realm of venture ownership transfers, Rights of First Refusal play a crucial role in preserving the proportional ownership of existing stakeholders and controlling who can become a part of the venture. Houston, Texas, with its vibrant business landscape, recognizes the significance of such clauses and utilizes various types of ROAR provisions including Simple ROAR, Multiple Bidder ROAR, Shotgun ROAR, and Right of Last Refusal. These clauses ensure the balance of ownership within ventures and provide a framework for harmonious and mutually beneficial agreements between interested parties.

Houston Texas Clauses Relating to Transfers of Venture interests - including Rights of First Refusal

Description

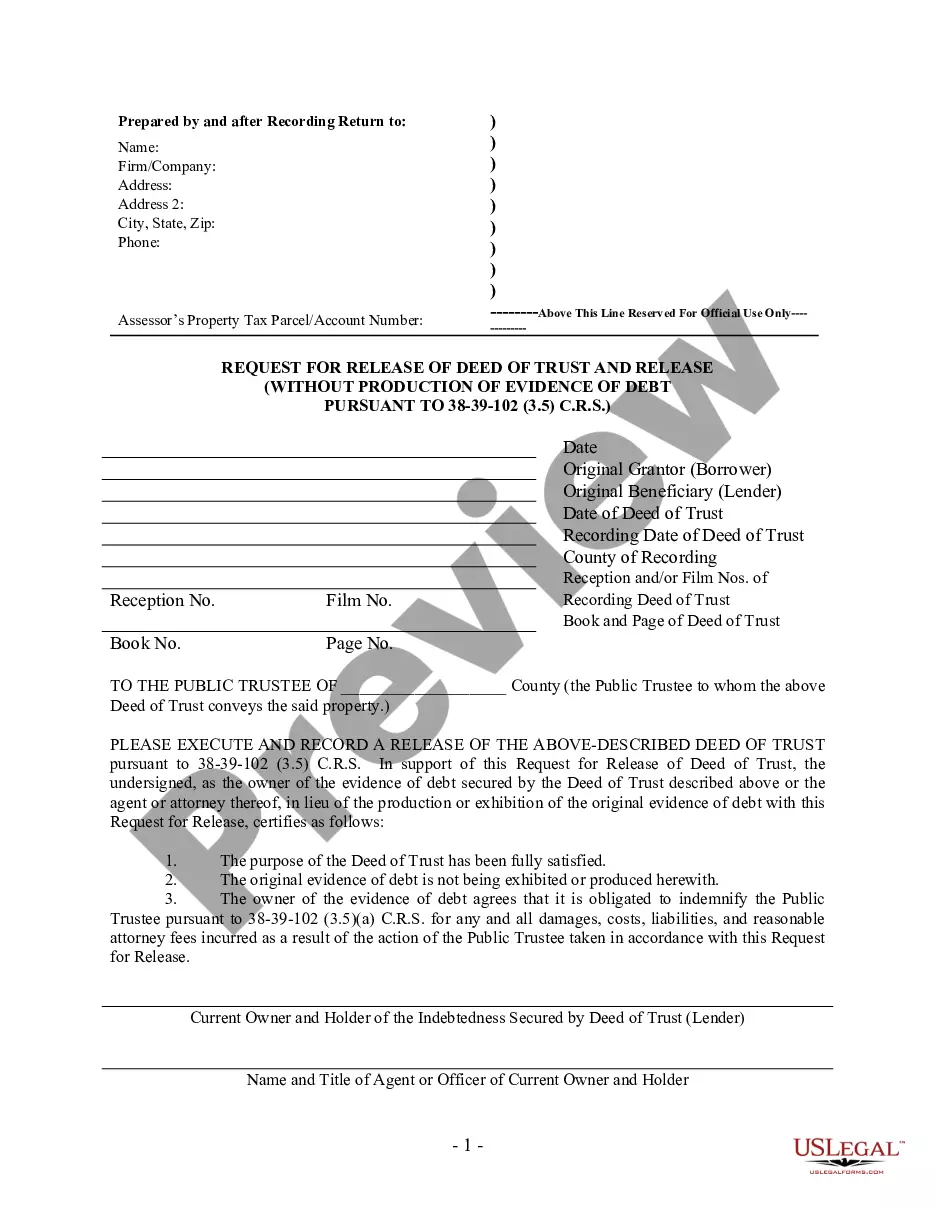

How to fill out Houston Texas Clauses Relating To Transfers Of Venture Interests - Including Rights Of First Refusal?

Whether you plan to open your business, enter into an agreement, apply for your ID renewal, or resolve family-related legal issues, you need to prepare certain paperwork meeting your local laws and regulations. Finding the right papers may take a lot of time and effort unless you use the US Legal Forms library.

The service provides users with more than 85,000 professionally drafted and checked legal templates for any personal or business occurrence. All files are collected by state and area of use, so opting for a copy like Houston Clauses Relating to Transfers of Venture interests - including Rights of First Refusal is fast and easy.

The US Legal Forms website users only need to log in to their account and click the Download button next to the required template. If you are new to the service, it will take you a few more steps to get the Houston Clauses Relating to Transfers of Venture interests - including Rights of First Refusal. Follow the guide below:

- Make certain the sample meets your individual needs and state law requirements.

- Read the form description and check the Preview if available on the page.

- Use the search tab providing your state above to find another template.

- Click Buy Now to obtain the sample once you find the right one.

- Opt for the subscription plan that suits you most to continue.

- Log in to your account and pay the service with a credit card or PayPal.

- Download the Houston Clauses Relating to Transfers of Venture interests - including Rights of First Refusal in the file format you prefer.

- Print the copy or complete it and sign it electronically via an online editor to save time.

Documents provided by our website are reusable. Having an active subscription, you are able to access all of your earlier purchased paperwork at any time in the My Forms tab of your profile. Stop wasting time on a constant search for up-to-date formal documentation. Sign up for the US Legal Forms platform and keep your paperwork in order with the most extensive online form library!