Contra Costa California Clauses Relating to Venture IPO In Contra Costa County, California, there are various clauses that play a crucial role in the process of Venture Initial Public Offerings (IPOs) for businesses seeking investment opportunities. These clauses set specific terms, conditions, and provisions that protect both venture capitalists (VCs) and companies involved in the IPO process. Here are some key types of Contra Costa California Clauses Relating to Venture IPO: 1. Non-Disclosure Agreement (NDA) Clause: This clause ensures that all parties involved in the Venture IPO maintain strict confidentiality regarding sensitive information shared during the investment process. It prohibits the disclosure of any confidential information to third parties without prior written consent. 2. Right of First Refusal (ROAR) Clause: ROAR clauses grant existing shareholders or VCs the first opportunity to purchase additional shares if the company decides to issue more shares or offers the chance to buy back shares from shareholders who wish to sell them. 3. Information Rights Clause: This clause grants VCs the right to access certain financial, operational, and strategic information of the company. VCs can review quarterly financial statements, business plans, management reports, and other crucial documents to assess the company's progress and make informed decisions. 4. Anti-Dilution Clause: The anti-dilution clause protects the VCs' investments from being substantially diluted by subsequent fundraising rounds or share issuance sat lower valuations. It ensures that if the company issues shares at a lower price, the VCs will receive additional shares or a price adjustment to maintain their ownership percentage. 5. Voting Rights Clause: This clause defines the VCs' voting rights and their ability to influence major decisions affecting the company's operations, such as the election of directors, mergers, acquisitions, or significant changes in the company's capital structure. 6. Drag-Along Rights Clause: In the event that a majority of VCs wish to sell their shares to an acquirer or take the company public, the drag-along rights clause allows them to compel minority shareholders to sell their shares on the same terms and conditions. 7. Redemption Rights Clause: Some Contra Costa California IPO clauses include redemption rights, which allow the VCs to force the company to repurchase their shares after a specified period. This can provide an opportunity for VCs to exit their investment at a predetermined price. 8. Board Composition Clause: This clause determines the representation of VCs on the company's board of directors and outlines the appointment process, the number of seats, and the voting rights of the VC-appointed directors. These are just a few examples of the Contra Costa California Clauses Relating to Venture IPO. Each IPO agreement may have variations and additional clauses based on the specific needs and negotiations of the parties involved. It is important for both entrepreneurs and VCs to carefully understand and negotiate these clauses to protect their interests and ensure a successful IPO process.

Contra Costa California Clauses Relating to Venture IPO

Description

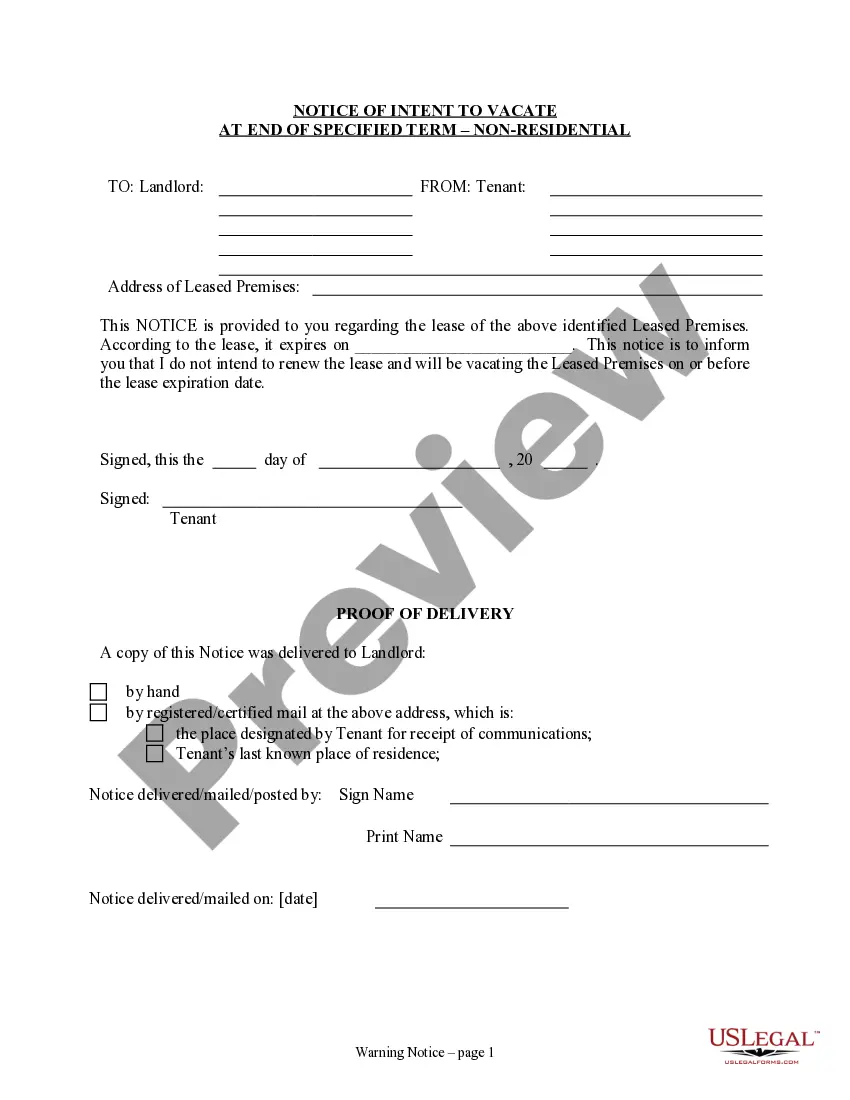

How to fill out Contra Costa California Clauses Relating To Venture IPO?

How much time does it normally take you to draft a legal document? Because every state has its laws and regulations for every life sphere, locating a Contra Costa Clauses Relating to Venture IPO meeting all local requirements can be stressful, and ordering it from a professional lawyer is often expensive. Many web services offer the most common state-specific templates for download, but using the US Legal Forms library is most advantegeous.

US Legal Forms is the most comprehensive web catalog of templates, collected by states and areas of use. Apart from the Contra Costa Clauses Relating to Venture IPO, here you can get any specific document to run your business or individual deeds, complying with your county requirements. Specialists verify all samples for their validity, so you can be sure to prepare your documentation correctly.

Using the service is pretty straightforward. If you already have an account on the platform and your subscription is valid, you only need to log in, select the required form, and download it. You can get the document in your profile at any time in the future. Otherwise, if you are new to the website, there will be a few more steps to complete before you get your Contra Costa Clauses Relating to Venture IPO:

- Check the content of the page you’re on.

- Read the description of the sample or Preview it (if available).

- Search for another document using the related option in the header.

- Click Buy Now once you’re certain in the chosen document.

- Select the subscription plan that suits you most.

- Create an account on the platform or log in to proceed to payment options.

- Pay via PalPal or with your credit card.

- Switch the file format if necessary.

- Click Download to save the Contra Costa Clauses Relating to Venture IPO.

- Print the doc or use any preferred online editor to fill it out electronically.

No matter how many times you need to use the acquired document, you can find all the files you’ve ever downloaded in your profile by opening the My Forms tab. Give it a try!

Form popularity

FAQ

Orders (form FL-306) (b) Either party may request a continuance of the hearing, which the court shall grant on a showing of good cause. The request may be made in writing before or at the hearing or orally at the hearing. The court may also grant a continuance on its own motion.

Going to Court First class mail to DCSS, 50 Douglas Drive, Suite 100, Martinez, CA 94553. Put them in the document drop box in front of the building at 50 Douglas Drive, Martinez, California. Scan and email them to DCSS.Service@dcss.cccounty.us. Fax to 925-335-3630.

Contra Costa County is located within the First District Court of Appeal. The people of Contra Costa County are served by a Superior Court. The United States District Court for the Northern District of California has jurisdiction in Contra Costa County.

You can submit an Contra Costa county process service request immediately! If you'd like to speak with a licensed Contra Costa county process server about your case, call us today at (855) 545-1303, or click on the live chat link located in the lower right-hand corner.

If a case hasn t been settled, many courts set a time for an issue conference. The lawyers usually appear at this hearing before a judge without their clients and try to agree on undisputed facts or points of law. Such agreements are called stipulations .

If the parties are able to find a solution, then a settlement agreement can be written (a court reporter is always handy to have ready) and signed by both parties, then submitted to the judge who can enter it as an order. If the parties do not reach an agreement, the case will proceed to a trial.

(c) Settlement conference statement (4) A statement identifying and discussing in detail all facts and law pertinent to the issues of liability and damages involved in the case as to that party. The settlement conference statement must comply with any additional requirement imposed by local rule.

Contra Costa mandates eFiling in its cases that are deemed complex, but not before an Order Authorizing Electronic Service is issued by the Judge. That Order is generally not issued before the first Case Management Conference.

Contra Costa mandates eFiling in its cases that are deemed complex, but not before an Order Authorizing Electronic Service is issued by the Judge. That Order is generally not issued before the first Case Management Conference.

There are 7 Courthouse Locations.