Cook Illinois Clauses Relating to Venture IPO are a series of provisions often included in venture capital agreements to protect the interests of investors in the event of an initial public offering (IPO). These clauses outline the specific conditions and requirements that need to be met before the venture capital firm can go public and sell its shares on a stock exchange. Here are the different types of Cook Illinois Clauses Relating to Venture IPO: 1. Lock-up Period: This clause imposes restrictions on the venture capital firm and its shareholders from selling their shares in the public market for a specified period after the IPO. The lock-up period is usually set to prevent sudden volatility or drop in share price and allows market stabilization. 2. Underwriting Agreement: This clause states that the venture capital firm must enter into an underwriting agreement with an investment bank to facilitate the IPO. The underwriters assist in valuing the company, determining the IPO price, and managing the entire process. 3. Minimum Offering Size: This clause outlines the minimum amount of funds that must be raised through the IPO. It ensures that there is enough investor demand and that the offering is not under subscribed, which could negatively impact the company's valuation and future prospects. 4. Green shoe Option: This clause grants the underwriters the option to purchase additional shares from the venture capital firm if there is high demand during the IPO. The additional shares, typically around 15% of the original offering size, can help the underwriters stabilize the share price and manage any short-term market fluctuations. 5. Post-IPO Support: This clause defines the responsibilities of the venture capital firm after the IPO. It may include providing ongoing guidance to management, participating in strategic decisions, and maintaining a certain level of ownership in the company to align interests between the venture capital firm and the newly public company. 6. IPO Expenses: This clause specifies the allocation of expenses associated with the IPO process, such as legal fees, filing fees, accounting fees, and marketing expenses. It ensures that these costs are covered appropriately and prevents any undue burden on either party. 7. Investor Rights: This clause safeguards the rights of venture capital investors during and after the IPO. It may include provisions such as tag-along rights, registration rights, and information rights to protect their investment and maintain transparency. By incorporating Cook Illinois Clauses Relating to Venture IPO, venture capital firms can navigate the complexities of the IPO process while safeguarding the interests of their investors. These provisions provide a framework to ensure a successful transition from a private to a public company, while balancing the interests of all stakeholders involved.

Cook Illinois Clauses Relating to Venture IPO

Description

How to fill out Cook Illinois Clauses Relating To Venture IPO?

Dealing with legal forms is a necessity in today's world. However, you don't always need to seek professional help to create some of them from scratch, including Cook Clauses Relating to Venture IPO, with a platform like US Legal Forms.

US Legal Forms has over 85,000 templates to choose from in different categories ranging from living wills to real estate papers to divorce documents. All forms are arranged based on their valid state, making the searching experience less challenging. You can also find detailed materials and tutorials on the website to make any tasks related to document execution straightforward.

Here's how to purchase and download Cook Clauses Relating to Venture IPO.

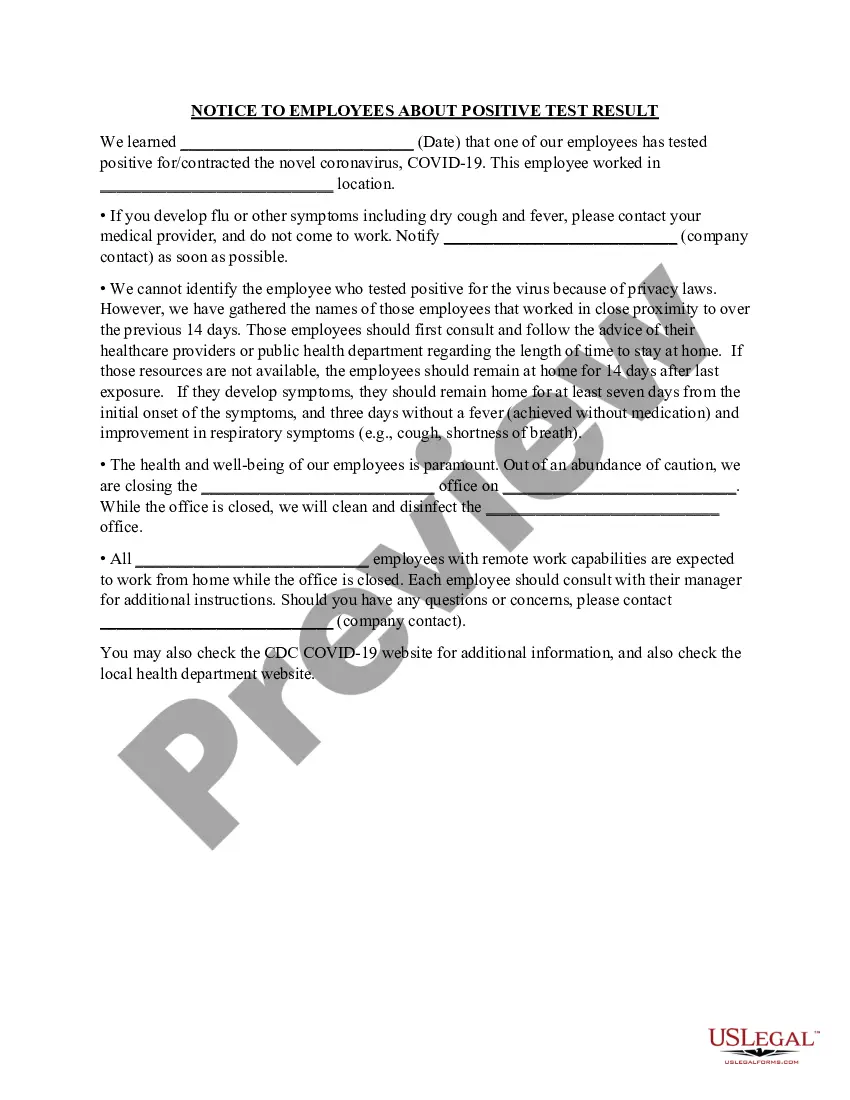

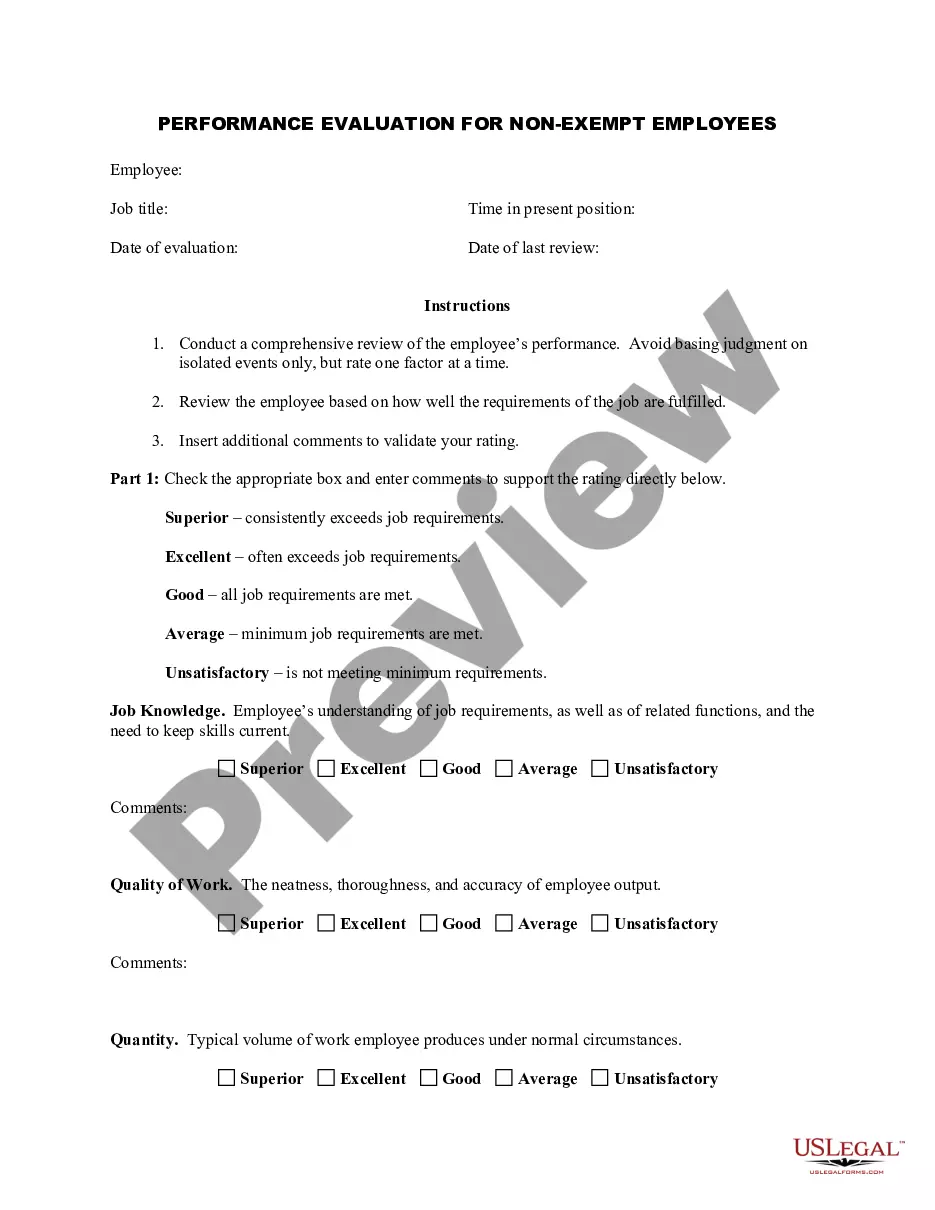

- Go over the document's preview and outline (if available) to get a general information on what you’ll get after downloading the form.

- Ensure that the template of your choice is adapted to your state/county/area since state laws can affect the legality of some records.

- Check the related document templates or start the search over to locate the appropriate file.

- Click Buy now and register your account. If you already have an existing one, choose to log in.

- Pick the pricing {plan, then a suitable payment gateway, and buy Cook Clauses Relating to Venture IPO.

- Select to save the form template in any available format.

- Visit the My Forms tab to re-download the file.

If you're already subscribed to US Legal Forms, you can locate the needed Cook Clauses Relating to Venture IPO, log in to your account, and download it. Of course, our website can’t take the place of a lawyer completely. If you need to cope with an exceptionally challenging case, we advise using the services of a lawyer to check your document before executing and filing it.

With over 25 years on the market, US Legal Forms became a go-to provider for many different legal forms for millions of users. Become one of them today and purchase your state-compliant documents with ease!