Harris Texas Clauses Relating to Venture IPO — Understanding the Key Provisions Introduction: In the realm of venture capital and IPOs, the Harris Texas Clauses play a crucial role in defining the rights and responsibilities of stakeholders involved. These clauses, specific to the state of Texas, outline terms and conditions that govern the process of taking a venture-backed company public. This article provides an in-depth analysis of the Harris Texas Clauses relating to venture IPOs, highlighting their significance and different types. 1. Preemptive Rights Clause: One key provision, commonly found in Harris Texas Clauses, is the Preemptive Rights Clause. This clause grants existing shareholders the right to maintain their ownership percentage by enabling them to purchase additional shares before external investors. It safeguards early-stage investors from dilution and ensures their involvement in subsequent financing rounds. 2. Tag-Along Rights Clause: The Tag-Along Rights Clause is another important provision observed in Harris Texas Clauses. This clause protects minority shareholders by allowing them to "tag along" and sell their shares on the same terms and conditions as majority shareholders when a significant stake is sold to a third party. It ensures equal treatment, preventing any discrimination in the event of a large-scale transaction. 3. Drag-Along Rights Clause: The Harris Texas Clauses also encompass the Drag-Along Rights Clause, which aids majority shareholders. This provision enables majority shareholders to force minority shareholders to sell their shares along with theirs, facilitating larger transactions, such as mergers or acquisitions. It ensures that no minority shareholder obstructs a deal that the majority wishes to pursue. 4. Conversion Rights Clause: The Conversion Rights Clause is vital in Harris Texas Clauses, particularly during the IPO process. This clause allows venture investors to convert their preferred shares into common shares, which are more favorable to public market investors. It ensures that different classes of shares do not hinder the company's ability to go public smoothly. 5. Board Representation Clause: In some instances, Harris Texas Clauses relating to venture IPOs may include the Board Representation Clause. This clause grants venture investors the right to appoint board members and maintain a level of control proportional to their investment. It helps safeguard the interests of venture investors during critical decision-making processes. 6. Anti-Dilution Clause: An integral part of Harris Texas Clauses, the Anti-Dilution Clause protects early-stage investors from experiencing significant dilution in the event of a subsequent financing round at a lower valuation. It ensures that investors are compensated in terms of additional shares or adjustments to the conversion price of their preferred stock, safeguarding their initial investment value. Conclusion: The Harris Texas Clauses Relating to Venture IPOs extensively cover various provisions that establish the rights, protection, and obligations of investors and shareholders. By understanding these clauses, stakeholders can effectively navigate the venture capital landscape, ensuring equitable treatment and minimizing risks associated with going public. Familiarity with clauses such as Preemptive Rights, Tag-Along Rights, Drag-Along Rights, Conversion Rights, Board Representation, and Anti-Dilution empowers investors to make informed decisions and foster successful ventures.

Harris Texas Clauses Relating to Venture IPO

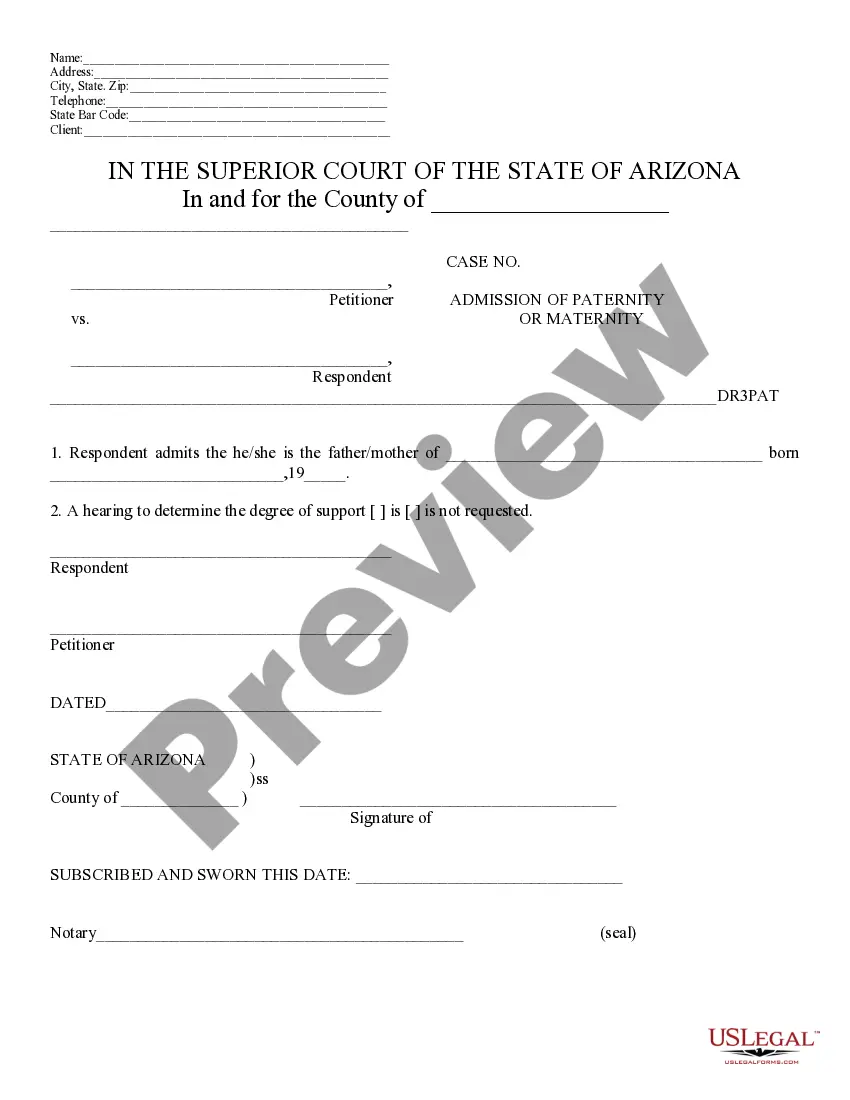

Description

How to fill out Harris Texas Clauses Relating To Venture IPO?

A document routine always goes along with any legal activity you make. Staring a company, applying or accepting a job offer, transferring property, and lots of other life scenarios require you prepare formal paperwork that varies from state to state. That's why having it all collected in one place is so beneficial.

US Legal Forms is the largest online library of up-to-date federal and state-specific legal templates. Here, you can easily find and get a document for any individual or business objective utilized in your region, including the Harris Clauses Relating to Venture IPO.

Locating samples on the platform is extremely simple. If you already have a subscription to our library, log in to your account, find the sample through the search bar, and click Download to save it on your device. Afterward, the Harris Clauses Relating to Venture IPO will be available for further use in the My Forms tab of your profile.

If you are dealing with US Legal Forms for the first time, follow this simple guide to get the Harris Clauses Relating to Venture IPO:

- Ensure you have opened the proper page with your local form.

- Use the Preview mode (if available) and scroll through the template.

- Read the description (if any) to ensure the template corresponds to your needs.

- Look for another document using the search tab if the sample doesn't fit you.

- Click Buy Now when you find the required template.

- Select the appropriate subscription plan, then log in or create an account.

- Choose the preferred payment method (with credit card or PayPal) to continue.

- Opt for file format and save the Harris Clauses Relating to Venture IPO on your device.

- Use it as needed: print it or fill it out electronically, sign it, and file where requested.

This is the easiest and most trustworthy way to obtain legal paperwork. All the templates available in our library are professionally drafted and checked for correspondence to local laws and regulations. Prepare your paperwork and manage your legal affairs effectively with the US Legal Forms!