Los Angeles, California is a vibrant and bustling city located on the western coast of the United States. Known for its beautiful beaches, diverse culture, and thriving entertainment industry, Los Angeles is often referred to as the "City of Angels." This city is not only a popular tourist destination, but it also offers a thriving business environment for many industries, including technology and finance. One specific area of interest for entrepreneurs and investors in Los Angeles is venture IPO (Initial Public Offering) and the clauses that govern this process. Venture IPO is an exciting strategic move for startups and emerging companies, as it allows them to raise capital by offering shares of their company to the public for the first time. Los Angeles boasts a number of renowned venture capital firms and investment banks that specialize in supporting and facilitating IPOs for companies in various sectors. When it comes to the different types of Clauses Relating to Venture IPO in Los Angeles, there are several key considerations that both companies and investors should be familiar with. These clauses can vary based on the specific needs and negotiations of each party involved. Some common clauses seen in Los Angeles California include: 1. Lock-Up Period Clause: This clause stipulates that certain shareholders, typically founders and key executives, are restricted from selling their shares for a specified period following the IPO. The lock-up period can last from 90 days to several years, ensuring stability in the company's stock price and preventing significant fluctuations. 2. Green shoe Clause: Also known as an over allotment option, this clause allows underwriters to issue additional shares beyond the initial offering if there is high demand. It provides flexibility to increase the number of shares available during the IPO process, based on market appetite. 3. Escrow Account Clause: This clause ensures that the funds generated from the IPO are held in a secure account by a third-party custodian until specific conditions are met, such as regulatory approvals or the completion of certain milestones. It provides assurance to investors that their investment will be handled appropriately. 4. Registration Rights Clause: This clause details the rights of shareholders to have their shares registered with the Securities and Exchange Commission (SEC) and enables them to sell their shares on the public market in the future. It ensures transparency and fairness in the IPO process. 5. Anti-Dilution Clause: This protective clause is designed to safeguard the equity interest of investors in the event of future stock issuance sat a lower price than the IPO. It allows investors to retain their ownership percentage by adjusting the conversion price of their shares. 6. Non-Compete Clause: This clause restricts company founders and key executives from engaging in competing businesses or activities during and after the IPO process. It aims to protect the company's value and prevent conflicts of interest. These are just a few examples of the various Clauses Relating to Venture IPO in Los Angeles, California. It is important for companies and investors to carefully review and negotiate these clauses to ensure a successful and mutually beneficial IPO process. The specific clauses chosen will depend on the unique circumstances of each company and the preferences of both the company and its investors.

Los Angeles California Clauses Relating to Venture IPO

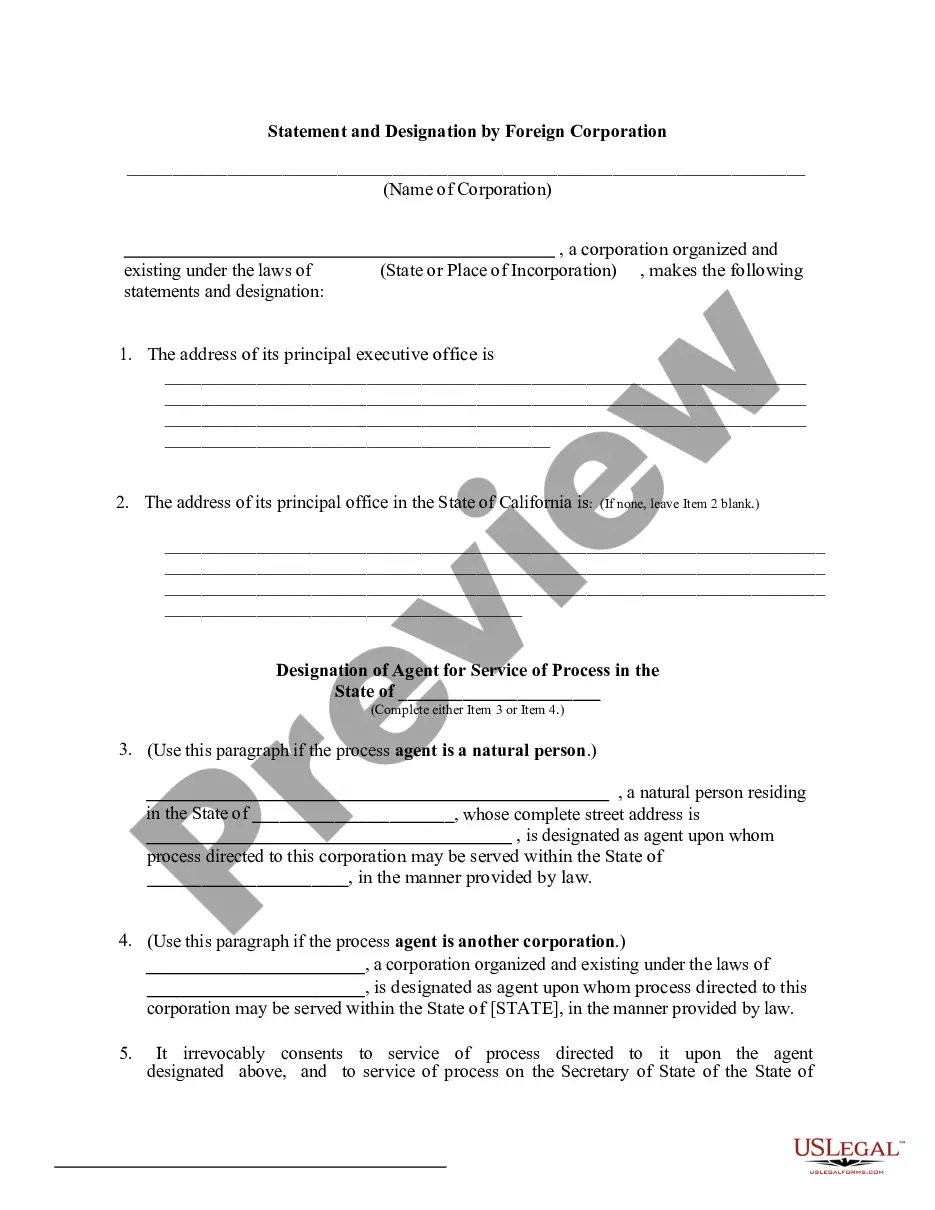

Description

How to fill out Los Angeles California Clauses Relating To Venture IPO?

Draftwing forms, like Los Angeles Clauses Relating to Venture IPO, to take care of your legal affairs is a challenging and time-consumming task. Many cases require an attorney’s involvement, which also makes this task expensive. Nevertheless, you can acquire your legal matters into your own hands and handle them yourself. US Legal Forms is here to save the day. Our website features over 85,000 legal documents intended for various cases and life situations. We make sure each form is in adherence with the laws of each state, so you don’t have to worry about potential legal problems associated with compliance.

If you're already aware of our services and have a subscription with US, you know how straightforward it is to get the Los Angeles Clauses Relating to Venture IPO form. Go ahead and log in to your account, download the form, and personalize it to your needs. Have you lost your form? No worries. You can get it in the My Forms folder in your account - on desktop or mobile.

The onboarding process of new customers is fairly simple! Here’s what you need to do before downloading Los Angeles Clauses Relating to Venture IPO:

- Make sure that your template is compliant with your state/county since the rules for writing legal paperwork may vary from one state another.

- Discover more information about the form by previewing it or reading a quick description. If the Los Angeles Clauses Relating to Venture IPO isn’t something you were looking for, then take advantage of the search bar in the header to find another one.

- Log in or register an account to begin using our service and download the form.

- Everything looks great on your end? Click the Buy now button and select the subscription plan.

- Pick the payment gateway and type in your payment details.

- Your form is all set. You can go ahead and download it.

It’s easy to find and buy the appropriate document with US Legal Forms. Thousands of businesses and individuals are already taking advantage of our extensive collection. Subscribe to it now if you want to check what other benefits you can get with US Legal Forms!