Mecklenburg County, located in the state of North Carolina, has several relevant clauses relating to venture IPOs. These clauses govern the conduct and regulations surrounding initial public offerings (IPOs) of ventures within the county. Here is a detailed description of Mecklenburg North Carolina Clauses Relating to Venture IPO, including different types that may exist: 1. Mecklenburg County Venture IPO Registration Clause: — This clause outlines the mandatory registration process that ventures must undergo before conducting an IPO within Mecklenburg County. — It specifies the required documentation, such as financial statements, business plans, and offering prospectuses, which must be submitted to the relevant regulatory authorities within the county. — The clause may define specific disclosure requirements and timelines for submission. 2. Mecklenburg County Investor Protection Clause: — This clause focuses on safeguarding the interests of investors participating in venture IPOs within Mecklenburg County. — It may stipulate disclosure requirements to ensure accurate and transparent information is provided to potential investors. — The clause may also address issues such as insider trading, fraud prevention, and penalties for non-compliance with applicable regulations. 3. Mecklenburg County Disclosure Requirements Clause: — This clause sets forth the information that ventures must disclose to the regulatory authorities, potential investors, and the public. — It may include details about the company's financial positions, risk factors, business operations, major shareholders, and any other material information necessary for making informed investment decisions. — The clause might also establish guidelines for periodic updates and reporting requirements post-IPO. 4. Mecklenburg County Offering Process Clause: — This clause governs the process of offering venture IPOs in Mecklenburg County. — It may include provisions regarding the issuance and sale of securities, underwriting arrangements, pricing mechanisms, and allocation criteria for shares. — The clause might also address specific requirements related to roadshows, prospectus distribution, and investor conferences. 5. Mecklenburg County Secondary Market Trading Clause: — While not directly related to IPOs, this clause may address the trading of shares of ventures that have already undergone IPOs. — It may include regulations on stock exchanges, trading platforms, listing requirements, and shareholder rights within Mecklenburg County. — The clause might also cover topics like insider trading restrictions, reporting obligations, and manipulation prevention measures. It's important to note that the specific clauses relating to venture IPOs in Mecklenburg County may vary, as they are subject to local laws, regulations, and ordinances. Therefore, it is advisable to consult legal counsel or refer to the relevant county authorities for the most accurate and up-to-date information on Mecklenburg North Carolina Clauses Relating to Venture IPO.

Mecklenburg North Carolina Clauses Relating to Venture IPO

Description

How to fill out Mecklenburg North Carolina Clauses Relating To Venture IPO?

Laws and regulations in every sphere differ from state to state. If you're not an attorney, it's easy to get lost in various norms when it comes to drafting legal paperwork. To avoid costly legal assistance when preparing the Mecklenburg Clauses Relating to Venture IPO, you need a verified template valid for your region. That's when using the US Legal Forms platform is so helpful.

US Legal Forms is a trusted by millions web collection of more than 85,000 state-specific legal forms. It's a perfect solution for specialists and individuals looking for do-it-yourself templates for various life and business occasions. All the forms can be used multiple times: once you purchase a sample, it remains accessible in your profile for further use. Therefore, when you have an account with a valid subscription, you can simply log in and re-download the Mecklenburg Clauses Relating to Venture IPO from the My Forms tab.

For new users, it's necessary to make several more steps to get the Mecklenburg Clauses Relating to Venture IPO:

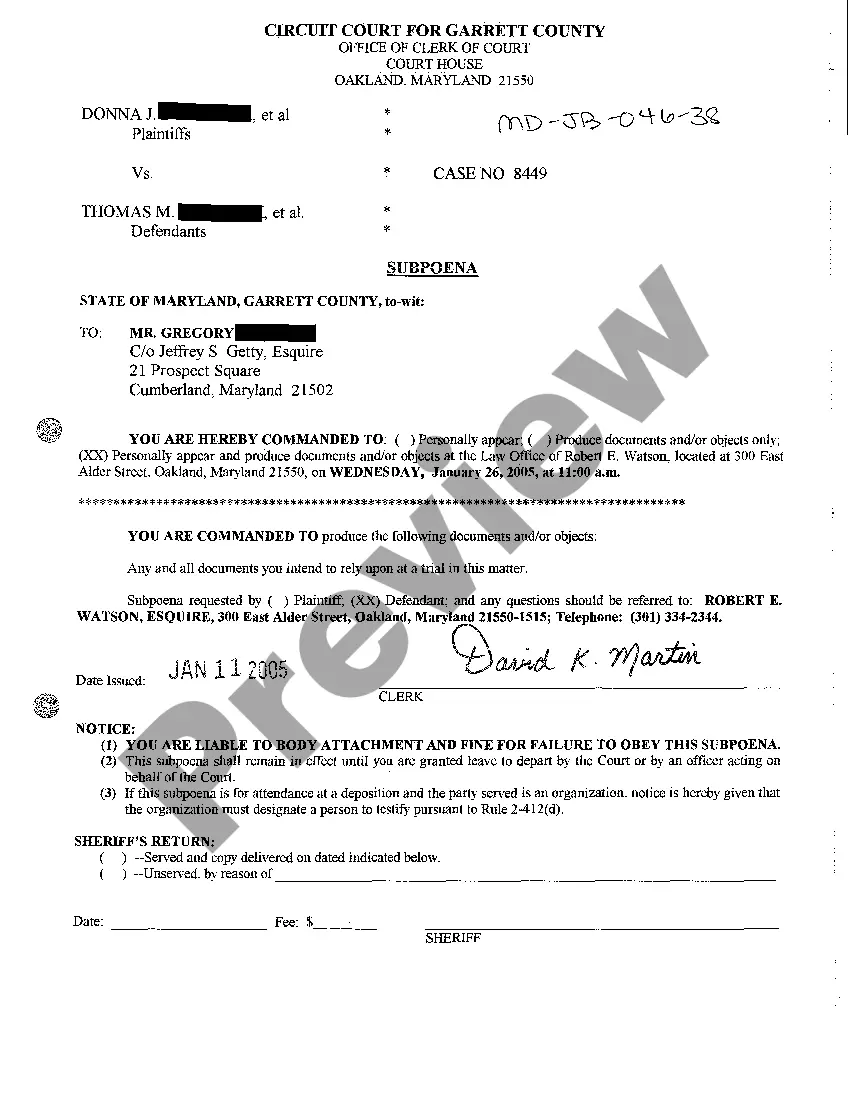

- Analyze the page content to ensure you found the correct sample.

- Take advantage of the Preview option or read the form description if available.

- Search for another doc if there are inconsistencies with any of your criteria.

- Click on the Buy Now button to get the template when you find the proper one.

- Opt for one of the subscription plans and log in or create an account.

- Select how you prefer to pay for your subscription (with a credit card or PayPal).

- Pick the format you want to save the file in and click Download.

- Fill out and sign the template in writing after printing it or do it all electronically.

That's the simplest and most cost-effective way to get up-to-date templates for any legal scenarios. Locate them all in clicks and keep your documentation in order with the US Legal Forms!