The Oakland Michigan Clauses Relating to Venture IPO are a set of regulations and provisions that govern the process of taking a venture capital-backed company public in Oakland, Michigan. These clauses are specifically designed to protect the interests of both investors and the company during the initial public offering (IPO) process. One of the main types of Oakland Michigan Clauses Relating to Venture IPO is the valuation clause. This clause determines the value of the venture-backed company's shares at the time of IPO. It may include provisions for determining the fair market value of the company's assets, revenue, growth potential, and other relevant factors. The valuation clause plays a crucial role in determining the offering price of the IPO shares and ensuring a fair and transparent process. Another important clause is the dilution protection clause. This provision aims to protect the existing investors from having their ownership stakes in the company significantly diluted after the IPO. The clause may stipulate that the venture capital investors are entitled to receive additional shares or compensation if their ownership percentage drops below a certain threshold due to new shares being issued during the IPO. In addition to these clauses, the Oakland Michigan regulations may include a lock-up period clause. This clause restricts the ability of insiders, such as company founders, executives, and pre-IPO investors, to sell their shares immediately after the IPO. The lock-up period generally lasts for a specific period, such as six months to one year, and aims to prevent excessive selling pressure and maintain price stability in the market. Moreover, the Oakland Michigan regulations may include reporting and disclosure requirements. These clauses require the venture-backed company to provide timely and accurate information about its financial performance, operations, risks, and other material information to potential investors during the IPO process. This ensures transparency and helps investors make informed decisions before investing in the company. Overall, the Oakland Michigan Clauses Relating to Venture IPO are designed to ensure a fair and transparent process for venture capital-backed companies going public. These clauses aim to protect the interests of both investors and the company, providing guidelines for valuation, dilution protection, lock-up periods, and reporting requirements. Complying with these clauses is crucial for companies seeking to go public in Oakland, Michigan, as it fosters investor confidence and contributes to the overall stability and growth of the local venture capital ecosystem.

Oakland Michigan Clauses Relating to Venture IPO

Description

How to fill out Oakland Michigan Clauses Relating To Venture IPO?

How much time does it normally take you to draw up a legal document? Given that every state has its laws and regulations for every life situation, locating a Oakland Clauses Relating to Venture IPO meeting all regional requirements can be exhausting, and ordering it from a professional attorney is often pricey. Numerous online services offer the most popular state-specific documents for download, but using the US Legal Forms library is most beneficial.

US Legal Forms is the most comprehensive online collection of templates, gathered by states and areas of use. In addition to the Oakland Clauses Relating to Venture IPO, here you can find any specific document to run your business or individual affairs, complying with your county requirements. Specialists verify all samples for their actuality, so you can be sure to prepare your paperwork properly.

Using the service is pretty straightforward. If you already have an account on the platform and your subscription is valid, you only need to log in, choose the needed sample, and download it. You can get the document in your profile at any moment in the future. Otherwise, if you are new to the platform, there will be a few more steps to complete before you obtain your Oakland Clauses Relating to Venture IPO:

- Examine the content of the page you’re on.

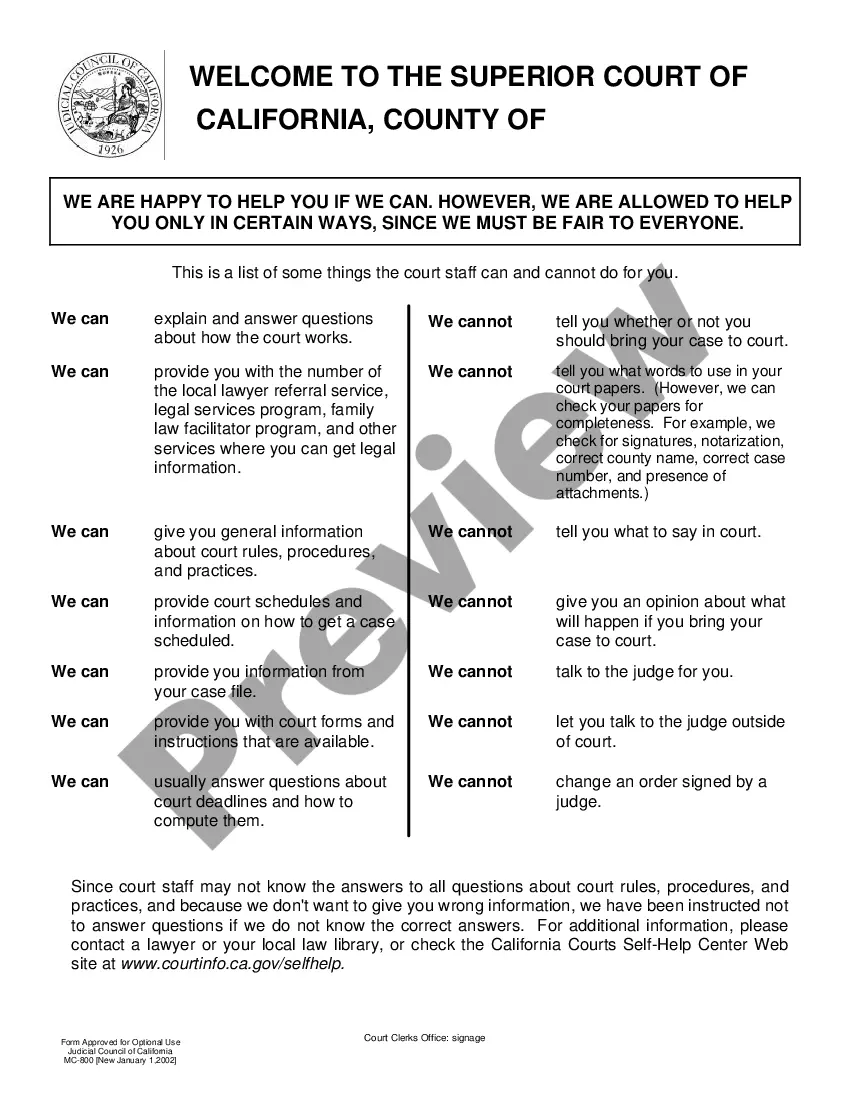

- Read the description of the sample or Preview it (if available).

- Search for another document utilizing the related option in the header.

- Click Buy Now when you’re certain in the selected document.

- Select the subscription plan that suits you most.

- Create an account on the platform or log in to proceed to payment options.

- Pay via PalPal or with your credit card.

- Change the file format if necessary.

- Click Download to save the Oakland Clauses Relating to Venture IPO.

- Print the sample or use any preferred online editor to complete it electronically.

No matter how many times you need to use the acquired template, you can locate all the files you’ve ever downloaded in your profile by opening the My Forms tab. Try it out!