Phoenix, Arizona is a vibrant city located in the southwestern region of the United States. Known for its warm weather, stunning landscapes, and growing economy, Phoenix has become a popular destination for individuals and businesses alike. This bustling metropolis offers countless opportunities, including clauses relating to venture initial public offerings (IPOs) that attract entrepreneurs and investors from across the globe. When it comes to Phoenix Arizona Clauses Relating to Venture IPOs, there are several essential elements to consider. The primary focus of these clauses is to provide protection and benefits for both the venture and the potential investors involved in the IPO process. Some different types of Phoenix Arizona Clauses Relating to Venture IPOs include: 1. Disclosure Clauses: These clauses require the venture to provide comprehensive and accurate information about their financial status, operations, and potential risks involved in the IPO. Transparent disclosures are vital in ensuring that investors have all the necessary information to make informed decisions. 2. Registration Clauses: Registration clauses require the venture to comply with all the legal requirements established by federal, state, and local authorities for conducting an IPO. These clauses ensure that the venture fulfills its obligations and provides the necessary documentation to regulators and investors. 3. Lock-Up Period Clauses: A lock-up period clause restricts venture owners, founders, and key stakeholders from selling their shares for a specified period after the IPO. This provision ensures that the market is stable, prevents sudden stock value fluctuations, and maintains investor confidence. 4. Escrow Agreements: These agreements involve holding portions of the IPO proceeds in escrow, typically to cover any potential liabilities or legal obligations. Escrow agreements provide security for investors, as well as protection for the venture, in case unforeseen circumstances arise post-IPO. 5. Indemnification Clauses: These clauses protect the venture, its officers, directors, and stakeholders from any financial loss, liability, or damages resulting from third-party claims related to the IPO. Indemnification provisions help mitigate potential risks and provide a level of confidence to the investors involved. 6. Anti-Dilution Clauses: Anti-dilution clauses protect investors from suffering substantial ownership reductions due to subsequent rounds of financing or issuance of additional shares. These clauses ensure that investors' ownership percentages remain consistent and fair throughout the venture's growth. In conclusion, Phoenix Arizona Clauses Relating to Venture IPOs are designed to safeguard the interests of both ventures and investors during the initial public offering process. The mentioned clauses, including disclosure, registration, lock-up periods, escrow agreements, indemnification, and anti-dilution provisions, offer a comprehensive framework for ensuring transparency, stability, and fairness in the IPO market.

Phoenix Arizona Clauses Relating to Venture IPO

Description

How to fill out Phoenix Arizona Clauses Relating To Venture IPO?

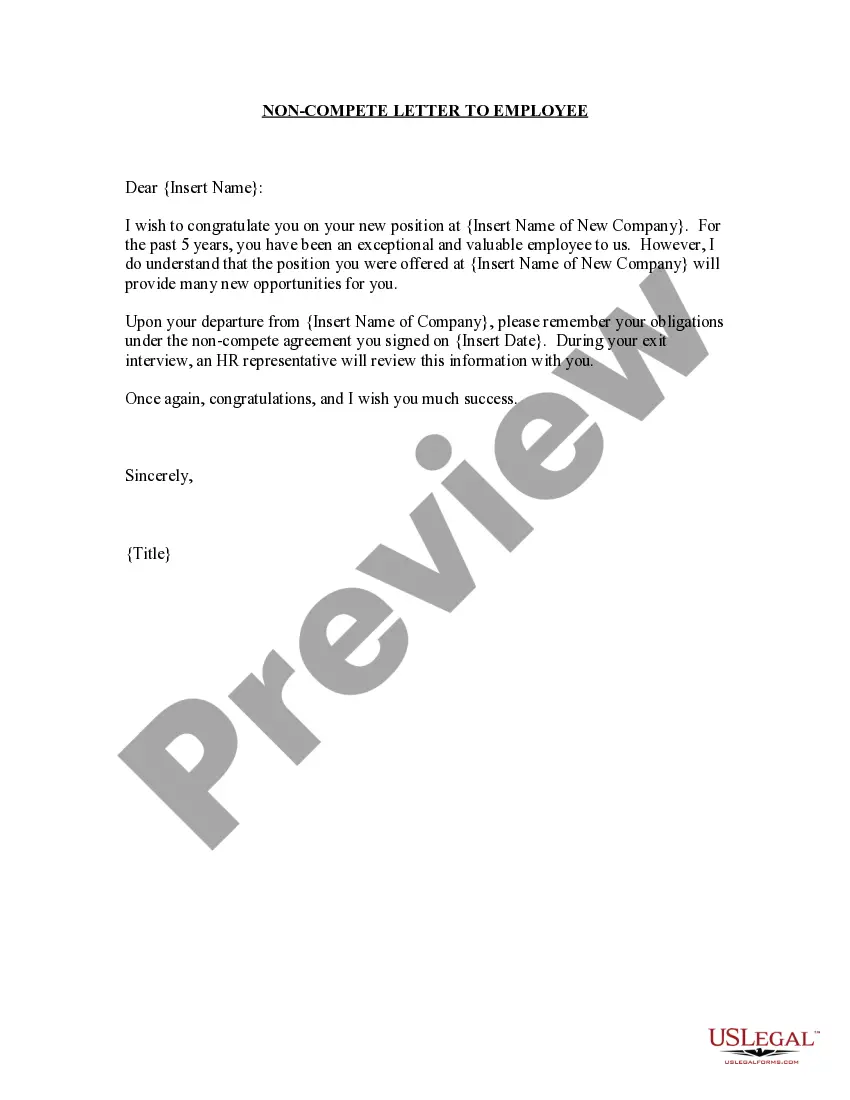

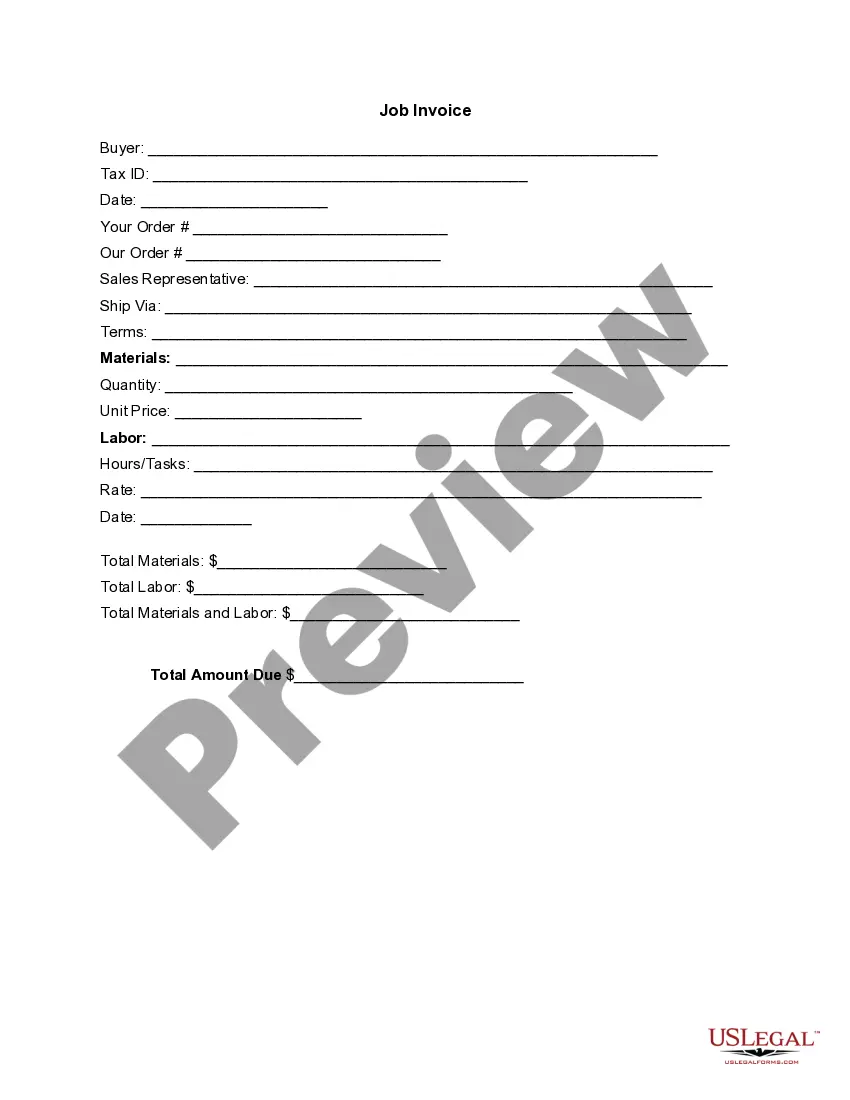

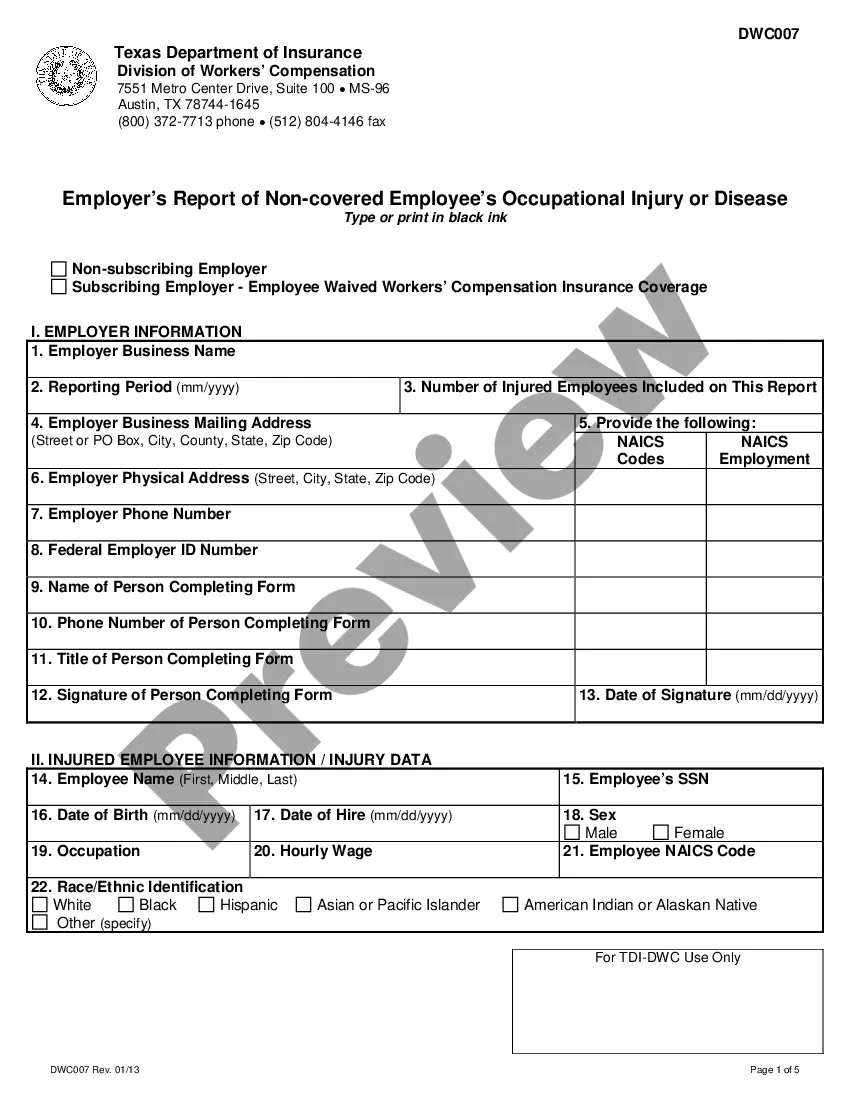

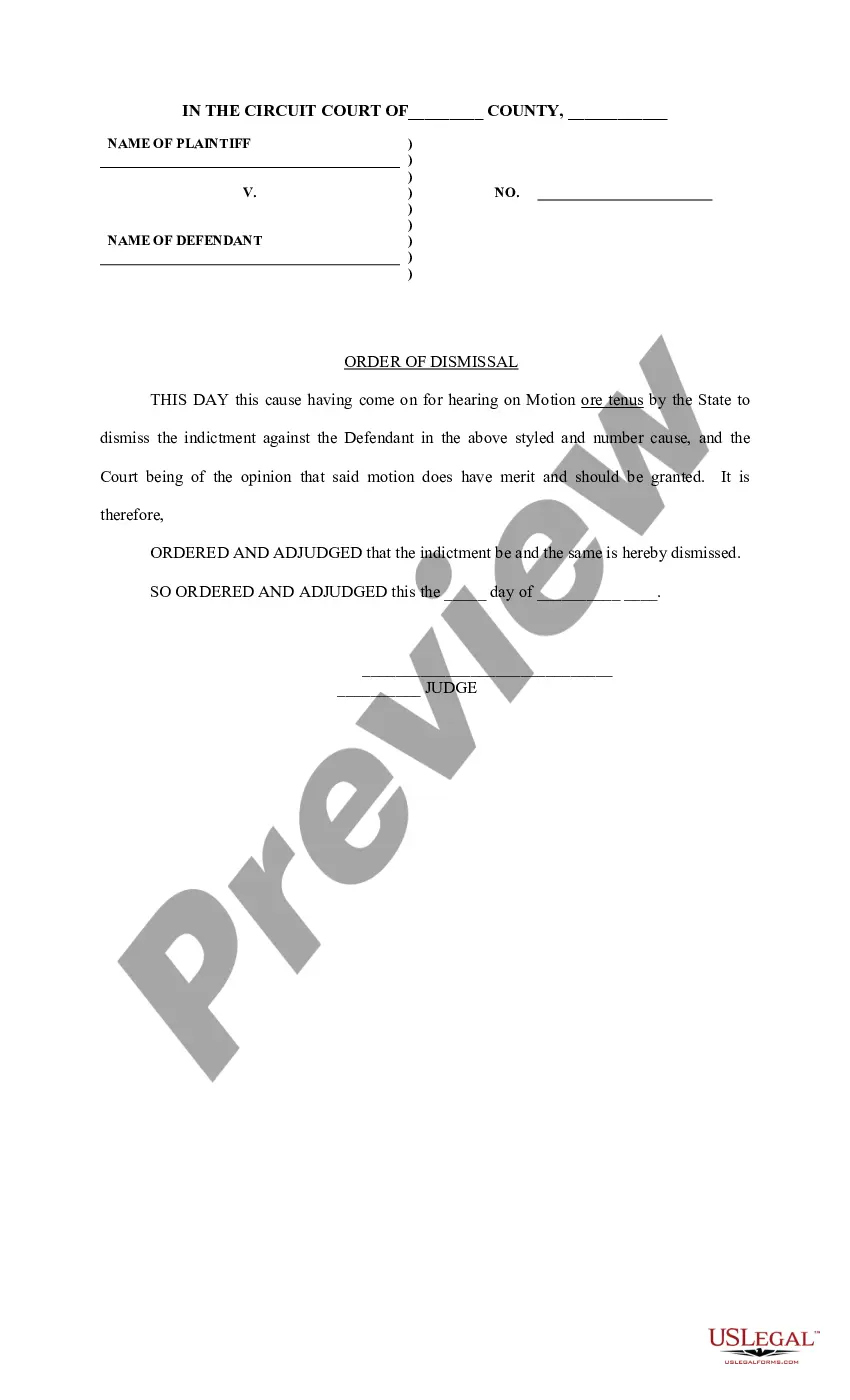

Do you need to quickly draft a legally-binding Phoenix Clauses Relating to Venture IPO or maybe any other document to handle your personal or business matters? You can go with two options: contact a legal advisor to write a valid paper for you or draft it completely on your own. Luckily, there's another option - US Legal Forms. It will help you receive neatly written legal documents without paying sky-high fees for legal services.

US Legal Forms provides a rich collection of over 85,000 state-specific document templates, including Phoenix Clauses Relating to Venture IPO and form packages. We provide templates for an array of life circumstances: from divorce papers to real estate document templates. We've been on the market for more than 25 years and gained a spotless reputation among our customers. Here's how you can become one of them and get the needed document without extra hassles.

- To start with, carefully verify if the Phoenix Clauses Relating to Venture IPO is adapted to your state's or county's laws.

- If the document includes a desciption, make sure to check what it's suitable for.

- Start the search over if the template isn’t what you were seeking by using the search box in the header.

- Select the subscription that best fits your needs and move forward to the payment.

- Choose the format you would like to get your document in and download it.

- Print it out, fill it out, and sign on the dotted line.

If you've already registered an account, you can easily log in to it, locate the Phoenix Clauses Relating to Venture IPO template, and download it. To re-download the form, simply head to the My Forms tab.

It's easy to buy and download legal forms if you use our catalog. In addition, the paperwork we offer are updated by law professionals, which gives you greater confidence when dealing with legal matters. Try US Legal Forms now and see for yourself!

Form popularity

FAQ

Companies typically issue an IPO to raise capital to pay off debts, fund growth initiatives, raise their public profile, or to allow company insiders to diversify their holdings or create liquidity by selling all or a portion of their private shares as part of the IPO.

There are two ways SEBI and the companies make sure the IPO prospectus is readily available. Firstly, they make it available on the company website. SEBI requires companies planning to undergo an IPO to have a website on their own. This enables investors to know more about the company.

A DRHP is a preliminary version of a RHP. It is created before finalizing the full prospectus. A Red Herring Prospectus is an offer document that is finalized and filed by a company with SEBI (Securities and Exchange Board of India) at the time of making a public offer for sale of its shares for the first time.

Who prepares the prospectus? A company offering its security to the public typically creates the prospectus for the offering. It can have its legal and accounting department create it. Or the underwriter (an investment bank that helps a company launch its IPO) it hires for the offering process may do it.

What Are the Benefits of IPO to Investors? Greater Liquidity. Once a company goes public, investors can sell the company's stock on the open market.Diversification.Greater Capital Markets Access.Raise Money.Increase Brand Equity.Discipline Management.Outsiders Perspective.

A Diversified Approach to IPO Investing. If you're interested in the exciting potential IPOs but would prefer a more diversified, lower risk approach, consider funds that offer exposure to IPOs and diversify their holdings by investing in hundreds of IPO companies.

Restrictions to sell: IPO shares come in within a mandatory lock-in period for six months from the day of allotment. The lock-in period is set to avoid dumping of shares which can cause the market value of the share to fall and create a situation of stock instability.

A red herring is a preliminary prospectus filed with the SEC, usually in connection with an IPO?excludes key details of the issue, such as price and number of shares offered. The document states that a registration statement has been filed with the SEC but is not yet effective.

?A common perception in everyone's mind is that IPO's are meant for short-term gains and that they do not generate investor returns over a longer term,? said Mathur. However, equities are meant for long-term investments and the quest to earn short-term gains on IPOs may backfire, in case of overvaluation of an IPO.

Can you sell an IPO immediately? IPO trading starts when the market opens on the listing day. You cannot sell the share prior to it. They can only be sold at or after the market hours begin.