Travis Texas Clauses Relating to Venture IPO: A Detailed Description In the realm of Venture IPOs, the Travis Texas Clauses play a significant role in protecting the interests of both investors and companies. These clauses are a legal mechanism that governs the initial public offering (IPO) process of venture-backed companies based in Travis County, Texas, but are also often used as a reference in various jurisdictions. 1. Escrow Account Clause: One of the essential Travis Texas Clauses is the provision of an escrow account. Under this clause, a certain percentage of the shares offered during the IPO are placed in an escrow account. This allocation is designed to safeguard the interests of investors by mitigating risks related to overvaluation, misrepresentation, or any material adverse events that may arise post-IPO. 2. Lock-Up Period Clause: Another notable Travis Texas Clause related to Venture IPOs is the Lock-Up Period provision. This clause restricts early investors, founders, and key employees from selling their shares for a specific period after the IPO, typically around 180 days. This safeguards the market by preventing sudden flooding of shares, which can adversely impact stock price stability. 3. Anti-Dilution Protection Clause: In the context of Venture IPOs, the Anti-Dilution Protection Clause is included to safeguard the interests of early-stage investors. This provision ensures that, in the event of a subsequent equity financing round at a lower valuation than the IPO, these investors are offered additional shares or a price adjustment to compensate for the dilution of their stake. 4. Prorate Participation Rights Clause: The Prorate Participation Rights Clause is an essential aspect of Venture IPOs, designed to maintain the balance of ownership between existing investors and new investors. This clause gives existing investors the option to invest in subsequent financing rounds on a pro rata basis, ensuring they can maintain their ownership percentage and capitalize on the future value of the company. 5. Preferred Stock Conversion Clause: Venture-backed companies often have different classes of stock, including preferred and common stock. The Preferred Stock Conversion Clause establishes the terms under which preferred stock converts into common stock, typically at the time of an IPO. This conversion helps ensure all shareholders have a more equal footing and are treated equitably during the public listing process. It is important to note that while the Travis Texas Clauses Relating to Venture IPOs provide a comprehensive framework, these clauses can vary depending on the specific terms agreed upon by the parties involved. Negotiations and legal counsel are essential to tailor the clauses to the unique circumstances of each venture-backed company seeking an IPO in Travis County, Texas, or other jurisdictions that reference these clauses for guidance.

Travis Texas Clauses Relating to Venture IPO

Description

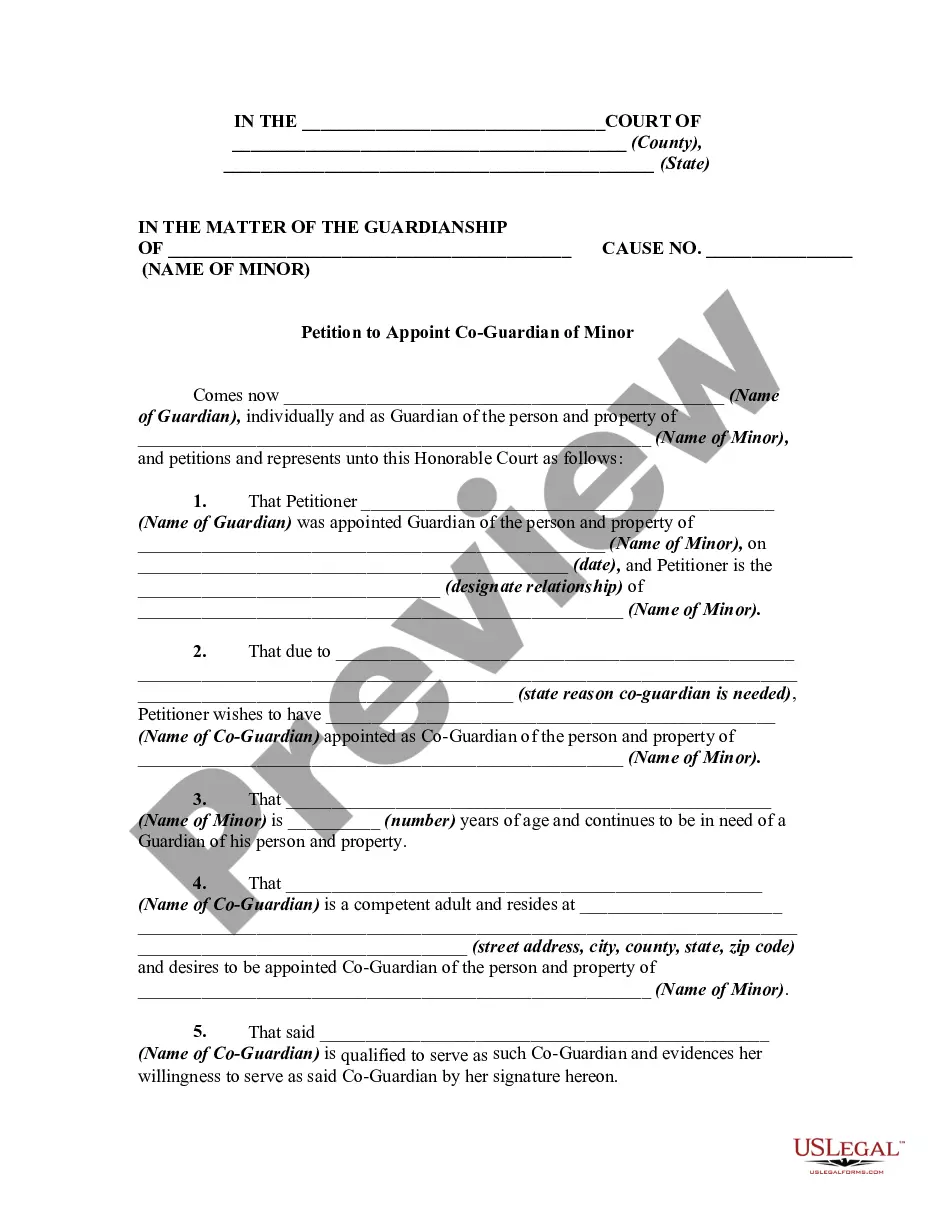

How to fill out Travis Texas Clauses Relating To Venture IPO?

If you need to get a trustworthy legal document provider to obtain the Travis Clauses Relating to Venture IPO, consider US Legal Forms. No matter if you need to start your LLC business or manage your belongings distribution, we got you covered. You don't need to be well-versed in in law to find and download the needed template.

- You can select from more than 85,000 forms categorized by state/county and situation.

- The intuitive interface, number of supporting materials, and dedicated support team make it easy to locate and execute different paperwork.

- US Legal Forms is a reliable service offering legal forms to millions of users since 1997.

Simply type to search or browse Travis Clauses Relating to Venture IPO, either by a keyword or by the state/county the form is intended for. After finding the needed template, you can log in and download it or save it in the My Forms tab.

Don't have an account? It's easy to get started! Simply locate the Travis Clauses Relating to Venture IPO template and take a look at the form's preview and short introductory information (if available). If you're confident about the template’s language, go ahead and hit Buy now. Create an account and choose a subscription option. The template will be immediately ready for download once the payment is processed. Now you can execute the form.

Handling your law-related matters doesn’t have to be expensive or time-consuming. US Legal Forms is here to demonstrate it. Our rich collection of legal forms makes this experience less expensive and more affordable. Set up your first business, organize your advance care planning, draft a real estate contract, or execute the Travis Clauses Relating to Venture IPO - all from the convenience of your sofa.

Join US Legal Forms now!