Cuyahoga Ohio Form of Parent Guaranty is a legally binding document that provides financial security to a creditor by a parent company for the obligations or debts of its subsidiary located in Cuyahoga, Ohio. This guaranty ensures that the parent company will be responsible for the repayment of the debt if the subsidiary is unable to fulfill its financial obligations. The Cuyahoga Ohio Form of Parent Guaranty is essential in cases where the subsidiary may not have sufficient assets or creditworthiness to secure a loan or fulfill its financial obligations independently. By having the parent company guarantee the subsidiary's debts, the creditor has an additional layer of protection and assurance. Highlighted keywords: Cuyahoga Ohio, Form of Parent Guaranty, legally binding, financial security, creditor, obligations, debts, subsidiary, parent company, repayment, guarantee, assets, creditworthiness, loan, protection, assurance. Different types of Cuyahoga Ohio Form of Parent Guaranty may include: 1. Full Guaranty: This type of guaranty holds the parent company fully responsible for all the debts and obligations of the subsidiary. It covers the entire amount owed by the subsidiary, including principal, interest, and any associated fees. 2. Limited Guaranty: In this form of guaranty, the parent company guarantees only a portion of the debt or specific obligations of the subsidiary. The limitation can be in terms of a capped amount or specific obligations explicitly mentioned in the agreement. 3. Conditional Guaranty: A conditional guaranty is imposed when certain conditions or criteria are met, outlining the circumstances under which the parent company becomes liable. For example, the guaranty may become effective if the subsidiary fails to make a payment within a specified time period. 4. Continuing Guaranty: With a continuing guaranty, the parent company's obligation persists even if the subsidiary has already incurred some debts. It covers not only current debts but also any future debts or obligations that may arise during a specific period or until termination. 5. Joint and Several guaranties: In cases where there are multiple parent companies, a joint and several guaranty makes each parent company individually and collectively liable for the subsidiary's debts. The creditor has the flexibility to pursue any or all of the parent companies for the full amount owed. It is important to note that the specific terms and conditions of a Cuyahoga Ohio Form of Parent Guaranty can vary based on the negotiations between the creditor and the parent company.

Cuyahoga Ohio Form of Parent Guaranty

Description

How to fill out Cuyahoga Ohio Form Of Parent Guaranty?

How much time does it typically take you to create a legal document? Considering that every state has its laws and regulations for every life scenario, finding a Cuyahoga Form of Parent Guaranty meeting all local requirements can be tiring, and ordering it from a professional attorney is often expensive. Numerous online services offer the most popular state-specific documents for download, but using the US Legal Forms library is most advantegeous.

US Legal Forms is the most comprehensive online catalog of templates, gathered by states and areas of use. Aside from the Cuyahoga Form of Parent Guaranty, here you can find any specific form to run your business or personal deeds, complying with your county requirements. Specialists verify all samples for their actuality, so you can be sure to prepare your paperwork properly.

Using the service is remarkably simple. If you already have an account on the platform and your subscription is valid, you only need to log in, pick the required form, and download it. You can retain the document in your profile at any moment in the future. Otherwise, if you are new to the platform, there will be a few more actions to complete before you get your Cuyahoga Form of Parent Guaranty:

- Examine the content of the page you’re on.

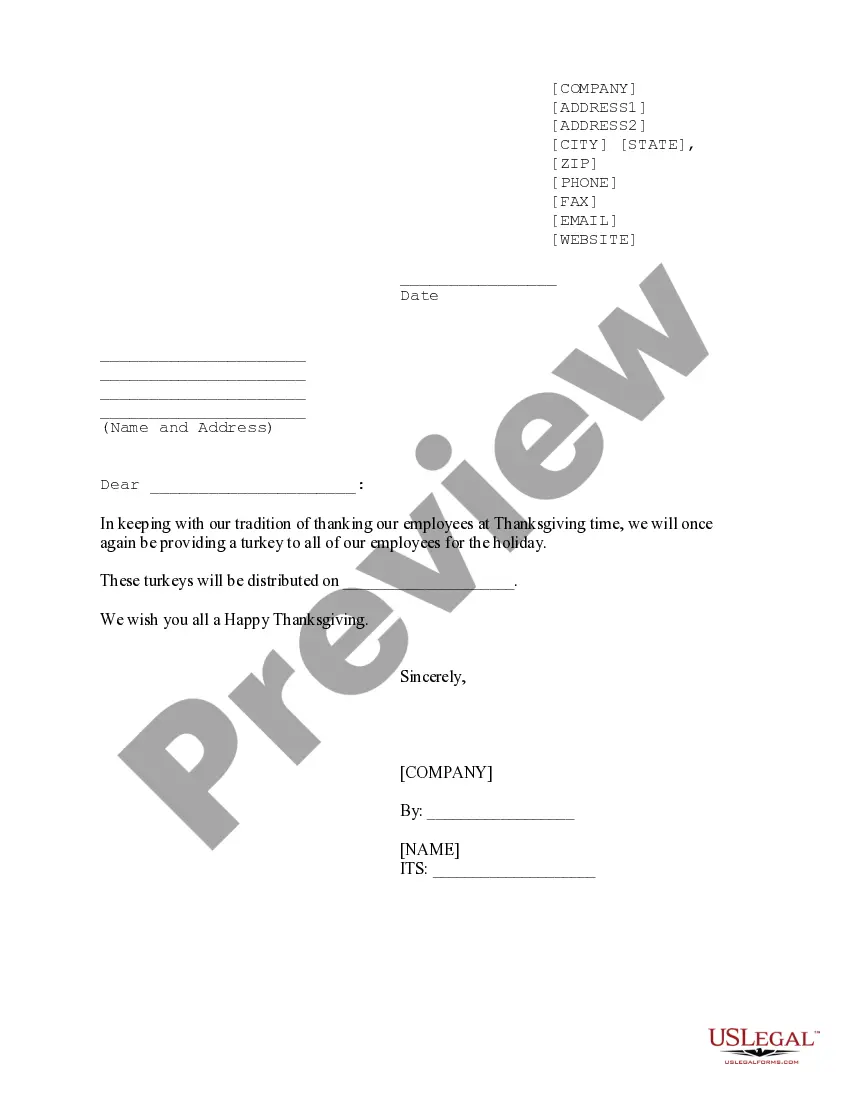

- Read the description of the sample or Preview it (if available).

- Search for another form using the related option in the header.

- Click Buy Now once you’re certain in the selected document.

- Select the subscription plan that suits you most.

- Register for an account on the platform or log in to proceed to payment options.

- Pay via PalPal or with your credit card.

- Switch the file format if necessary.

- Click Download to save the Cuyahoga Form of Parent Guaranty.

- Print the doc or use any preferred online editor to complete it electronically.

No matter how many times you need to use the acquired template, you can locate all the samples you’ve ever downloaded in your profile by opening the My Forms tab. Give it a try!