This package contains essential forms to assist covered entities in complying with the requirements of the Fair and Accurate Credit Transactions Act, which is part of the federal Fair Credit Reporting Act. The forms included are designed to allow covered entities to meet their legal obligations and protect the rights of the parties involved.

Included in your package are the following forms:

1. How-To Guide for Fighting Fraud and Identity Theft With the FCRA sand FACTA Red Flags Rule

2. Guide to Complying with the Red Flags Rule under FCRA and FACTA

3. Sample Identity Theft Policy for FCRA and FACTA Compliance

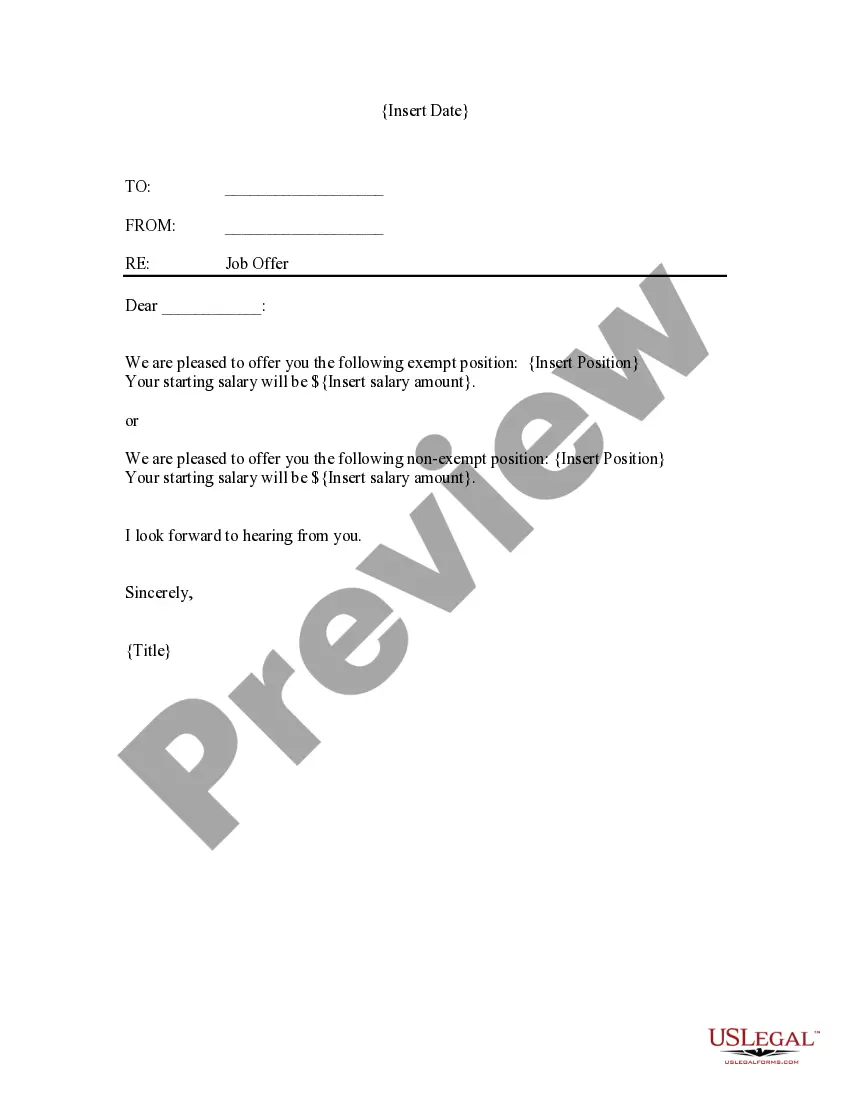

4. Sample Pre-Adverse Action Letter Regarding Application for Employment

5. Sample Post-Adverse Action Letter Regarding Application for Employment

6. Notice To Users Of Consumer Reports - Obligations Of Users Under The FCRA

7. A Summary of Your Rights Under the Fair Credit Reporting Act

8. The FACTA Red Flags Rule: A Primer

9. Background Check Acknowledgment

The Chicago, Illinois Fair Credit Reporting Act (FCRA) and Fair and Accurate Credit Transactions (FACT) Package refer to a set of laws and regulations designed to protect consumers' rights and ensure the accuracy and fairness of their credit reports. These legislations establish guidelines and impose obligations on credit reporting agencies, businesses, and consumers alike. Under the FCRA, credit reporting agencies are responsible for maintaining accurate and up-to-date credit information. They must also respond to consumer disputes and provide individuals with a free copy of their credit report annually upon request. The FCRA also outlines procedures that must be followed when conducting background checks for employment purposes, including obtaining the applicant's consent. The FACT, a part of the FCRA, aims to combat identity theft and prevent unauthorized access to sensitive personal information. It requires businesses that possess consumer information to take certain measures to safeguard that data. These measures include proper disposal methods for sensitive documents and notification requirements in the event of a security breach. In Chicago, Illinois, the FCRA and FACT Package apply to all residents and businesses operating within the city limits. However, it should be noted that these laws are Federal in nature and therefore apply nationwide. While there may not be different types of FCRA and FACT Packages specific to Chicago, Illinois, the laws and regulations outlined by the FCRA and FACT collectively form the package that governs credit reporting and consumer rights throughout the country.

The Chicago, Illinois Fair Credit Reporting Act (FCRA) and Fair and Accurate Credit Transactions (FACT) Package refer to a set of laws and regulations designed to protect consumers' rights and ensure the accuracy and fairness of their credit reports. These legislations establish guidelines and impose obligations on credit reporting agencies, businesses, and consumers alike. Under the FCRA, credit reporting agencies are responsible for maintaining accurate and up-to-date credit information. They must also respond to consumer disputes and provide individuals with a free copy of their credit report annually upon request. The FCRA also outlines procedures that must be followed when conducting background checks for employment purposes, including obtaining the applicant's consent. The FACT, a part of the FCRA, aims to combat identity theft and prevent unauthorized access to sensitive personal information. It requires businesses that possess consumer information to take certain measures to safeguard that data. These measures include proper disposal methods for sensitive documents and notification requirements in the event of a security breach. In Chicago, Illinois, the FCRA and FACT Package apply to all residents and businesses operating within the city limits. However, it should be noted that these laws are Federal in nature and therefore apply nationwide. While there may not be different types of FCRA and FACT Packages specific to Chicago, Illinois, the laws and regulations outlined by the FCRA and FACT collectively form the package that governs credit reporting and consumer rights throughout the country.