This package is designed to assist homeowners to obtain a loan modification under the Home Affordable Modification Program (HAMP). Including in this package are the following forms:

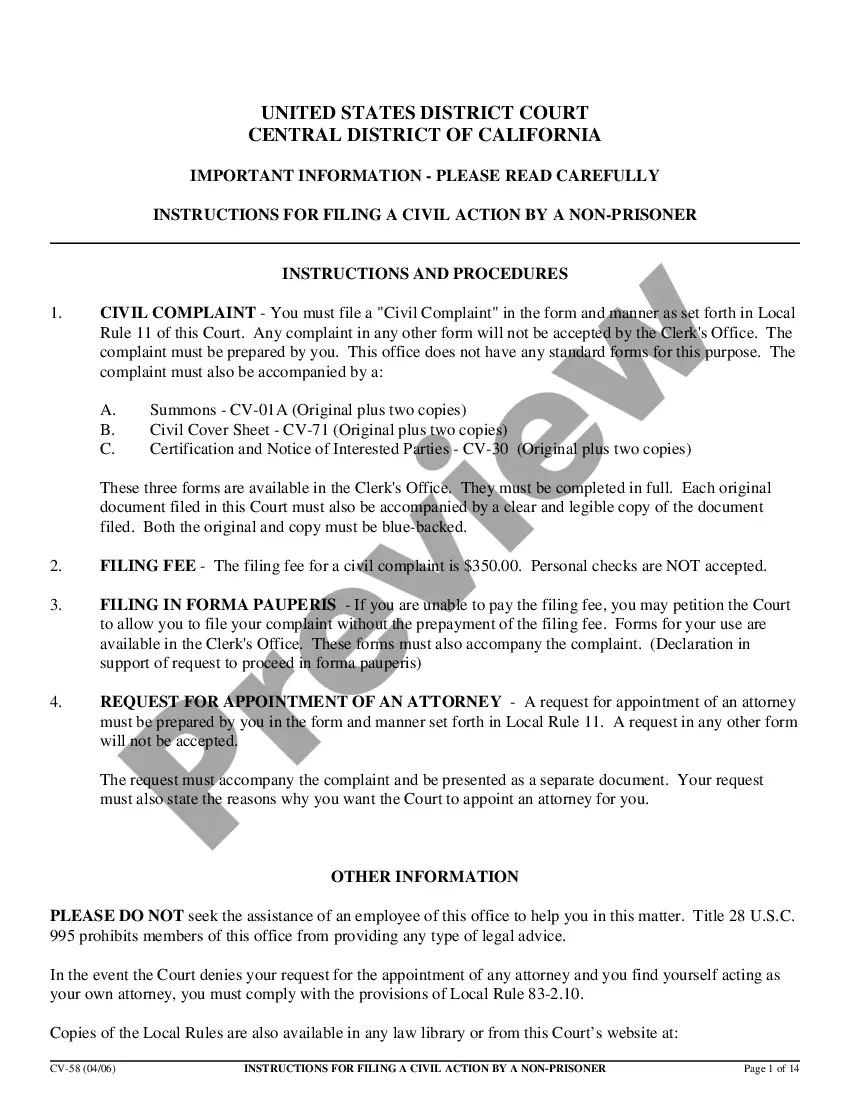

1. Request for Loan Modification and Affidavit RMA Under Home Affordable Modification Program HAMP

2. Instructions for Completing Request for Loan Modification and Affidavit RMA Form

3. IRS Form 4506-EZ Short Form Request for Individual Tax Return Transcript

4. Instructions for Completing IRS Form 4506T-EZ

5. How to Request a Home Affordable Modification Guide

Purchase of this package is a savings of nearly 30% compared to purchase of the forms individually!

The Kings New York CAMP Loan Modification Package is a comprehensive program designed to assist homeowners in Kings County, New York, who are struggling with their mortgage payments. CAMP stands for Home Affordable Modification Program, a federal initiative aimed at helping borrowers avoid foreclosure and maintain homeownership. This package offers a range of loan modification options tailored to individual circumstances, providing eligible borrowers with a path towards more affordable monthly payments. By opting for this program, homeowners can potentially lower their interest rates, extend the repayment term, or even reduce the principal owed on the mortgage. The Kings New York CAMP Loan Modification Package provides a simplified application process for homeowners, facilitating the ease of obtaining affordable loan modifications. It also includes detailed guidelines to help borrowers prepare their financial information and documentation accurately. Some key features of the Kings New York CAMP Loan Modification Package include: 1. Interest Rate Reduction: This option aims to lower the interest rate on the mortgage, reducing monthly payments and making them more affordable for struggling homeowners. 2. Loan Term Extension: Through this approach, the repayment period of the loan is extended, resulting in reduced monthly payments. This is particularly beneficial for those experiencing temporary financial hardship. 3. Principal Forbearance: In cases where homeowners owe more on their mortgage than the current market value of their property, principal forbearance allows a portion of the principal to be deferred, potentially reducing the burden of monthly payments. It's important to note that eligibility for the Kings New York CAMP Loan Modification Package is subject to certain criteria. Borrowers must demonstrate financial hardship, be delinquent or at risk of default on their mortgage payments, and have a loan originated before a specific date. Additionally, the property must be the primary residence and meet other program requirements. By offering various approaches to modifying mortgages, the Kings New York CAMP Loan Modification Package strives to provide homeowners in Kings County with viable alternatives to foreclosure. With the potential to reduce monthly payments and make them more manageable, this initiative supports struggling borrowers to regain financial stability and keep their homes.