The Dallas Texas Certificate of Foreign Limited Partnership is a legal document that grants authorization to a limited partnership established in another state or country to conduct business in the state of Texas. This certificate is a prerequisite for foreign limited partnerships aiming to operate in Dallas, Texas, ensuring compliance with the state's laws and regulations. Keywords: Dallas Texas, Certificate of Foreign Limited Partnership, limited partnership, business, authorization, state of Texas, compliance, laws, regulations. There are different types of certificates of foreign limited partnerships in Dallas, Texas, based on various characteristics and requirements. Some of these variations include: 1. Domestic Limited Partnership: This refers to a partnership formed under the laws of Texas that seeks to engage in business activities solely within the state. 2. Foreign Limited Partnership: It represents a partnership legally established in a different state or country, intending to expand its operations to Dallas, Texas. 3. General Partnership: A partnership structure where all partners have joint and several liabilities for the partnership's obligations. This form does not have limited liability protection for its partners. 4. Limited Partnership (LP): This type includes at least one general partner who has unlimited liability and at least one limited partner whose liability is limited to their investment in the partnership. 5. Limited Liability Partnership (LLP): Under an LLP, all partners have limited liability and are not personally responsible for the partnership's debts or obligations caused by other partners or employees. 6. Master Limited Partnership (MLP): Typically used in the energy sector, an MLP is a publicly traded partnership that combines the tax benefits of a partnership with the liquidity of a publicly traded company. It is crucial for foreign limited partnerships aiming to operate in Dallas, Texas, to identify the appropriate type of certificate, ensuring legal compliance and a seamless process of conducting business within the state. Proper documentation and adherence to regulations will guarantee a smooth entry into Dallas's competitive business landscape.

Dallas Texas Certificate of Foreign Limited Partnership

Description

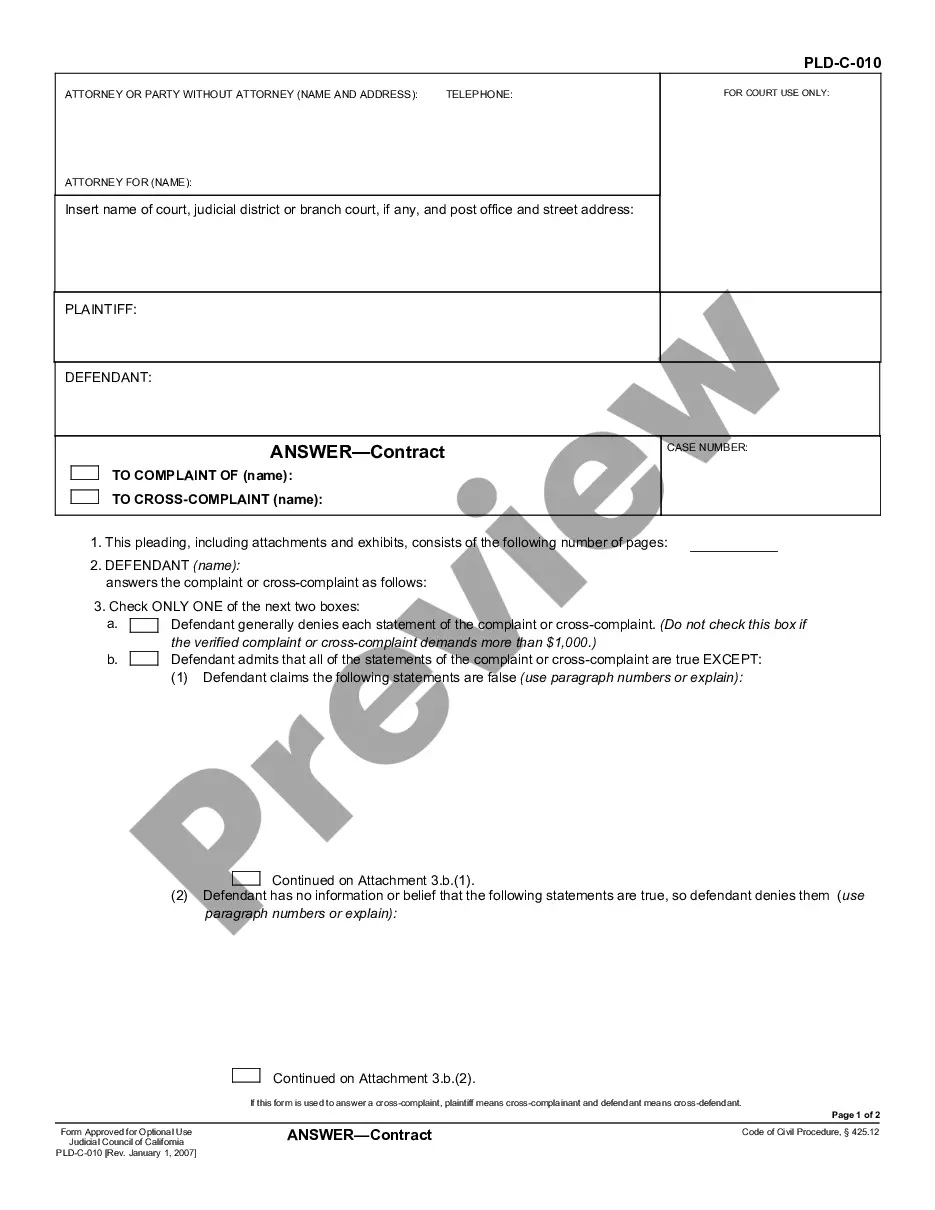

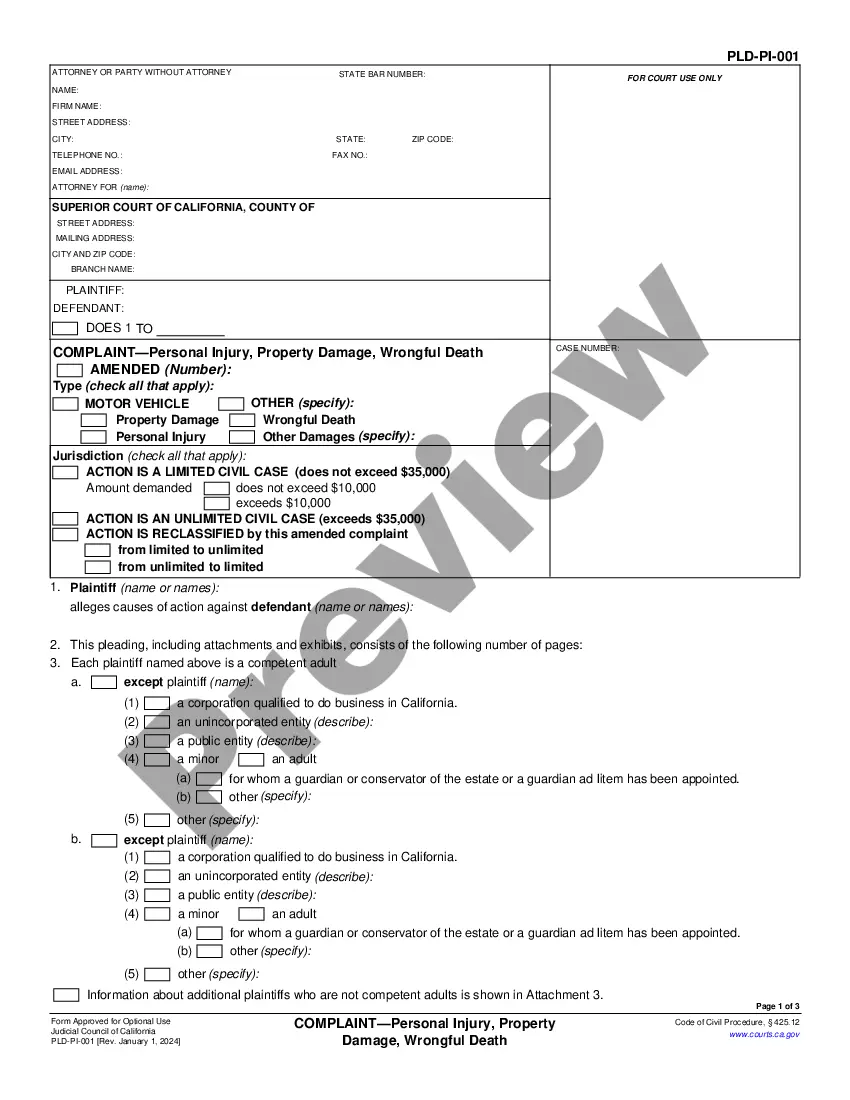

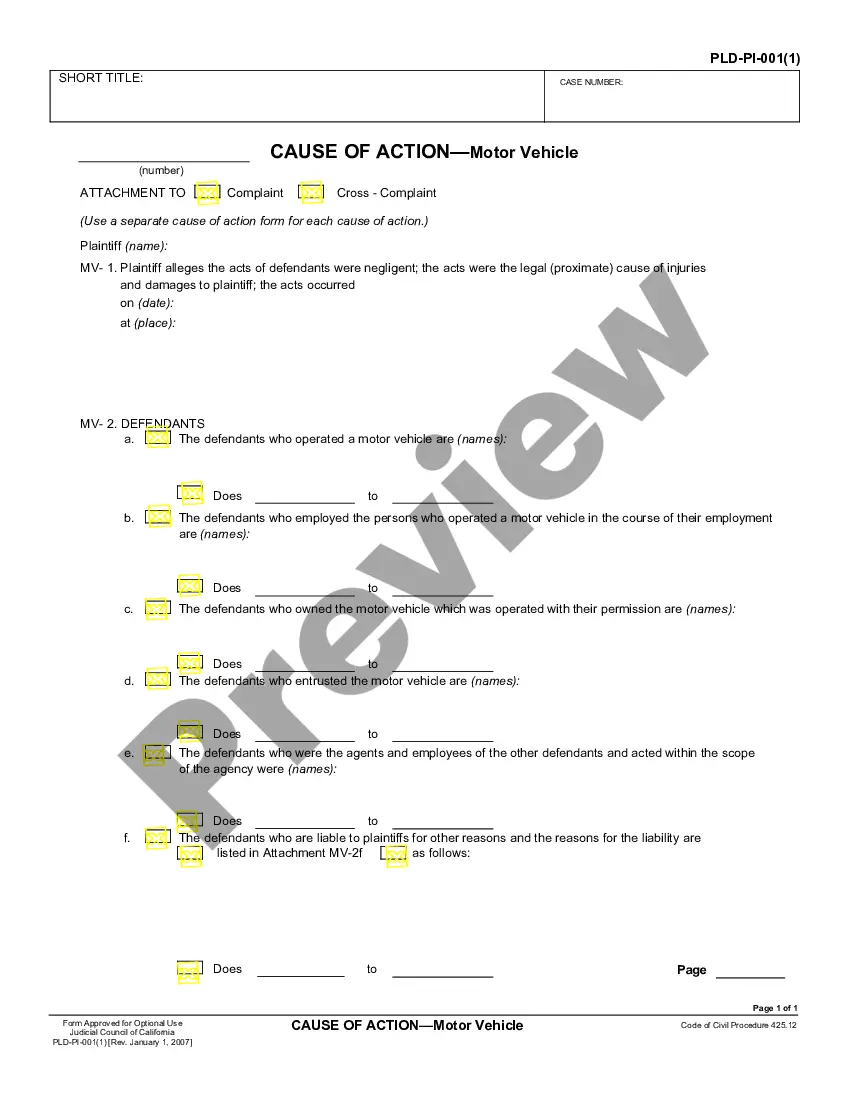

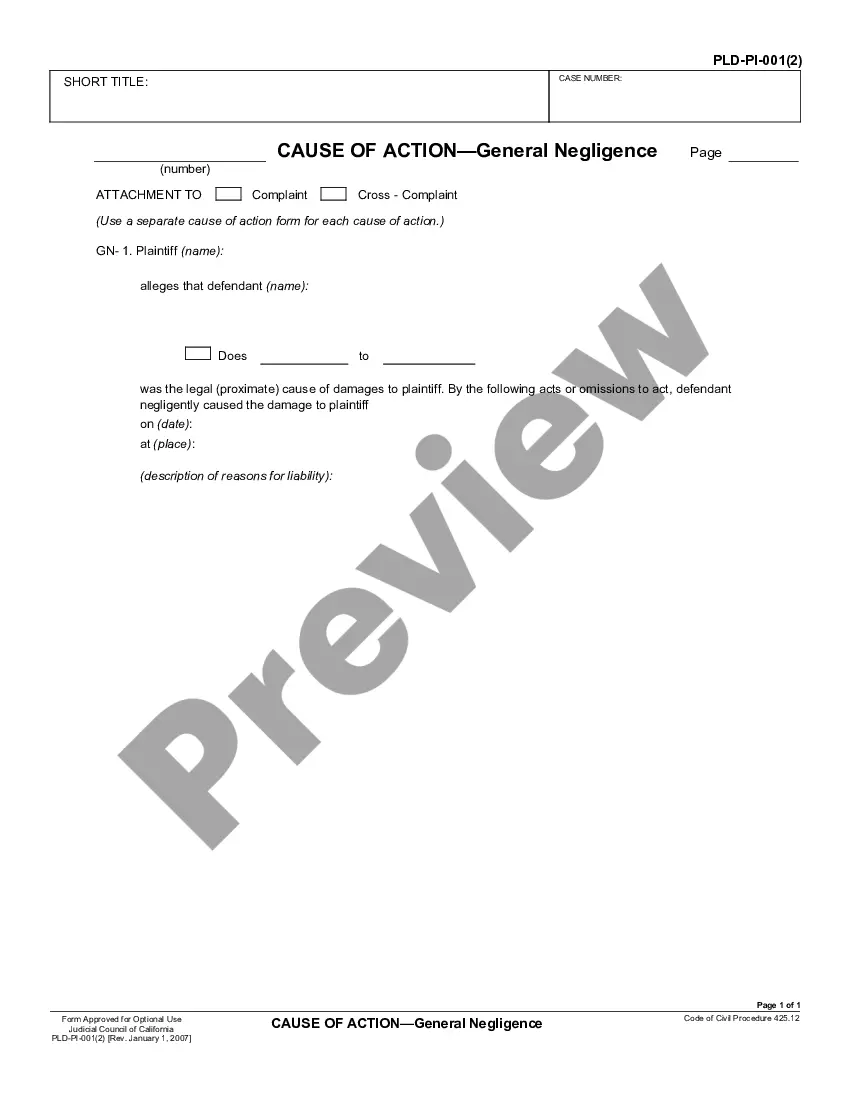

How to fill out Dallas Texas Certificate Of Foreign Limited Partnership?

Drafting papers for the business or personal demands is always a huge responsibility. When drawing up a contract, a public service request, or a power of attorney, it's essential to consider all federal and state laws of the particular area. However, small counties and even cities also have legislative provisions that you need to consider. All these aspects make it stressful and time-consuming to create Dallas Certificate of Foreign Limited Partnership without expert help.

It's possible to avoid spending money on attorneys drafting your documentation and create a legally valid Dallas Certificate of Foreign Limited Partnership by yourself, using the US Legal Forms online library. It is the greatest online collection of state-specific legal documents that are professionally cheched, so you can be certain of their validity when picking a sample for your county. Earlier subscribed users only need to log in to their accounts to save the required form.

In case you still don't have a subscription, adhere to the step-by-step instruction below to get the Dallas Certificate of Foreign Limited Partnership:

- Look through the page you've opened and verify if it has the sample you require.

- To do so, use the form description and preview if these options are available.

- To find the one that meets your requirements, use the search tab in the page header.

- Recheck that the sample complies with juridical criteria and click Buy Now.

- Pick the subscription plan, then log in or create an account with the US Legal Forms.

- Use your credit card or PayPal account to pay for your subscription.

- Download the selected document in the preferred format, print it, or complete it electronically.

The great thing about the US Legal Forms library is that all the documentation you've ever purchased never gets lost - you can get it in your profile within the My Forms tab at any moment. Join the platform and quickly get verified legal templates for any scenario with just a few clicks!

Form popularity

FAQ

A Texas limited partnership that also registers with the secretary of state as a limited liability partnership (LLP) must file an annual report with the secretary of state no later than June 1 of each year. The report is due following the calendar year in which the application for registration takes effect.

Corporations, LLCs, LPs, and LLPs must register a Texas DBA name with the Secretary of State. You can do so electronically via the state's online business services portal, SOSDirect. Sign in to your account to access the Assumed Name Certificate. Complete the form online and pay the required filing fee.

You create a Texas LLP by filing a Registration with the Texas Secretary of State (SOS) and paying the required filing fee. To complete the Registration you'll need to provide: the official name of your new LLP. the LLP's federal employer identification number (EIN) if already obtained.

The cost for registering a Texas foreign LLC is $750. You can register a foreign LLC in Texas by filing an Application for Registration of a Foreign Limited Liability (Form 304).

When and if your DBA expires, the state will allow you to renew the DBA application online for a fee, plus a small renewal form. DBA renewals should take place before they expire, so be sure to know your state's renewal frequency to ensure you DBA application filing is a smoother process for your and your business.

What is a Foreign LLC? For Texas purposes, if your LLC is formed in another state, then it is known as a foreign LLC in Texas. In other words, foreign doesn't mean from another country. Instead, it means your business was organized under the laws of another state.

You can apply online or by mail. Read our Form an LLC in Texas guide for details. Or use a professional service like ZenBusiness or to form your LLC for you. To register your Texas corporation, you'll need to file the Certificate of Incorporation with the Texas Secretary of State.

The certificate may be filed online through the Texas Secretary of State SOSDirect website or it can be filed by mail.

How to Form a Texas Limited Partnership (in 6 Steps) Step One) Choose an LP Name.Step Two) Designate a Registered Agent.Step Three) File the Certificate of Formation.Step Four) Create a Limited Partnership Agreement.Step Five) Handle Taxation Requirements.Step Six) Obtain Business Licenses and Permits.

The Assumed Name Certificate can be filed electronically via SOSDirect, by mail to the address in the Form 503 instructions, or delivered in person to the James Earl Rudder Office Building in Austin, Texas.