Hillsborough Florida Certificate of Foreign Limited Partnership

Description

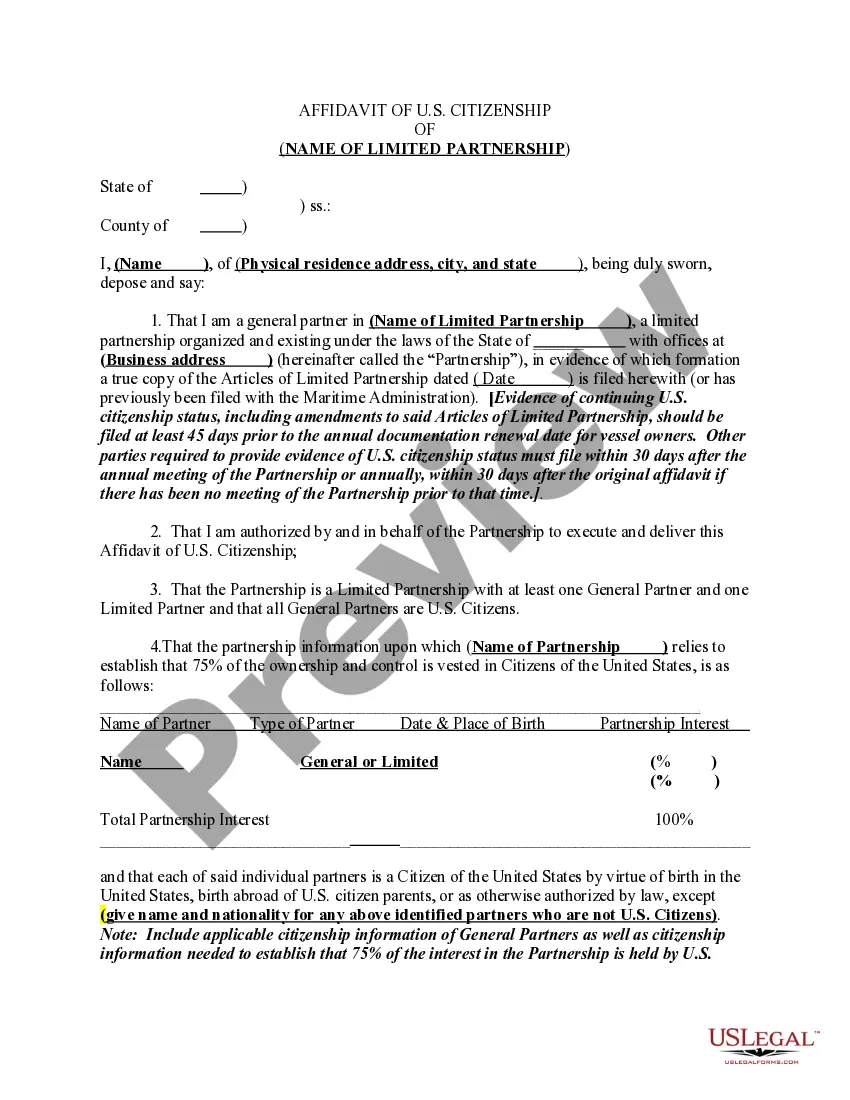

How to fill out Certificate Of Foreign Limited Partnership?

How long does it typically take for you to draft a legal document.

Since each state has its own laws and regulations for various life circumstances, locating a Hillsborough Certificate of Foreign Limited Partnership that meets all local criteria can be exhausting, and acquiring it from a qualified attorney is frequently expensive.

Many online platforms provide the most sought-after state-specific documents for download, but utilizing the US Legal Forms library is the most beneficial.

Create an account on the platform or Log In to access payment methods. Pay using PayPal or with your credit card. Alter the file format if needed. Press Download to save the Hillsborough Certificate of Foreign Limited Partnership. Print the document or use any preferred online editor to complete it electronically. Regardless of how many times you require the document, you can find all the templates you’ve previously saved in your profile by selecting the My documents tab. Give it a shot!

- US Legal Forms is the largest online collection of templates, categorized by states and fields of use.

- Besides the Hillsborough Certificate of Foreign Limited Partnership, you can find any particular form to operate your business or personal affairs that aligns with your county regulations.

- Experts verify all samples for their relevance, ensuring you can prepare your documents accurately.

- Accessing the service is incredibly easy.

- If you already hold an account on the site and your subscription is active, you just need to Log In, choose the required form, and download it.

- You can retrieve the document in your account at any time later.

- If you are a newcomer to the platform, there will be some additional steps to complete before you secure your Hillsborough Certificate of Foreign Limited Partnership.

- Review the content of the page you are visiting.

- Examine the description of the template or Preview it (if it's available).

- Search for another form using the related option in the header.

- Press Buy Now once you are confident in the chosen document.

- Choose the subscription plan that best fits your needs.

Form popularity

FAQ

The Florida Department of Revenue administers over 30 taxes and fees. In most cases, you must register with the Department as a dealer before you begin conducting business activities subject to Florida's taxes and fees.

620.1201, F.S., and cover the minimum requirements for filing a Certificate of Limited Partnership. Your Certificate of Limited Partnership may need to include additional items that specifically apply to your situation.

To form a limited partnership, the partners must enter into a partnership agreement and file a certificate of formation with the secretary of state. In a limited partnership, there will be one or more general partners and one or more limited partners.

Florida requires the foreign LLC to file a Certificate of Existence. A Certificate of Existence is a document issued by your home state that shows your LLC is in good standing. Good standing means that you've met state requirements and paid the necessary fees.

Florida Limited Partnership (Florida LP) In a Florida LP, there must be at least one limited partner and at least one general partner. A limited partner is one who has limited personal liability for the debts and actions of the business and its other partners beyond their own personal investment in the LP.

Transacting Business in Florida According to Florida's LLC Act, you are required to register your foreign company with the state of Florida if you are "transacting business" in Florida.

Florida requires the foreign LLC to file a Certificate of Existence. A Certificate of Existence is a document issued by your home state that shows your LLC is in good standing. Good standing means that you've met state requirements and paid the necessary fees.

How to Form a Florida Limited Partnership (in 6 Steps) Step One) Choose an LP Name.Step Two) Designate a Registered Agent.Step Three) File the Certificate of Limited Partnership.Step Four) Create a Limited Partnership Agreement.Step Five) Handle Taxation Requirements.Step Six) Obtain Business Licenses and Permits.

How to Form a Florida Limited Partnership (in 6 Steps) Step One) Choose an LP Name.Step Two) Designate a Registered Agent.Step Three) File the Certificate of Limited Partnership.Step Four) Create a Limited Partnership Agreement.Step Five) Handle Taxation Requirements.Step Six) Obtain Business Licenses and Permits.

They are the same thing. Think of this as the Birth Certificate of your company. Articles of Limited Partnership Contained within the Certificate of Limited Partnership, and filed with the Secretary of State's office, the articles serve as the agreement between two or more partners to operate their company.