Hillsborough Florida State of Delaware Limited Partnership Tax Notice is a formal document issued by the state taxing authorities in Hillsborough, Florida. This notice is specifically related to limited partnerships registered in the state of Delaware that have tax obligations in Hillsborough County. The Hillsborough Florida State of Delaware Limited Partnership Tax Notice serves as a communication from the tax department to the partnership, informing them about their tax obligations, due dates, and any outstanding liabilities. This notice is an essential tool for partnership owners to ensure compliance with tax laws and avoid penalties or legal consequences. Some types of Hillsborough Florida State of Delaware Limited Partnership Tax Notices may include: 1. Annual Tax Notice: This notice is sent out annually to remind limited partnerships operating in Hillsborough County, Florida, about their tax responsibilities. It includes information on filing requirements, tax rates, deductions, and payment deadlines. 2. Tax Assessment Notice: If the tax department identifies discrepancies or issues, they may send out a tax assessment notice to a specific limited partnership. This notice outlines the adjustments made to the partnership's tax liability, and provides an opportunity for the partnership to appeal or rectify any errors. 3. Delinquency Notice: Delinquency notices are sent when a limited partnership fails to meet its tax obligations. This notice highlights the overdue tax payments, penalties, and any further consequences, such as liens or levies, that may be imposed if the taxes remain unpaid. 4. Audit Notice: In cases where the tax department suspects non-compliance or wishes to examine a limited partnership's financial records, an audit notice may be issued. This notice informs the partnership about the impending audit, including the period under examination and any additional documentation required. Receiving a Hillsborough Florida State of Delaware Limited Partnership Tax Notice should prompt immediate attention and action from the partnership. It is important for the partnership's responsible individuals, such as general partners or tax professionals, to thoroughly review the notice, understand the implications, and address any issues promptly. Keywords: Hillsborough Florida, State of Delaware, Limited Partnership, Tax Notice, obligations, due dates, tax liabilities, compliance, penalties, legal consequences, Annual Tax Notice, Tax Assessment Notice, Delinquency Notice, Audit Notice, tax department.

Hillsborough Florida State of Delaware Limited Partnership Tax Notice

Description

How to fill out Hillsborough Florida State Of Delaware Limited Partnership Tax Notice?

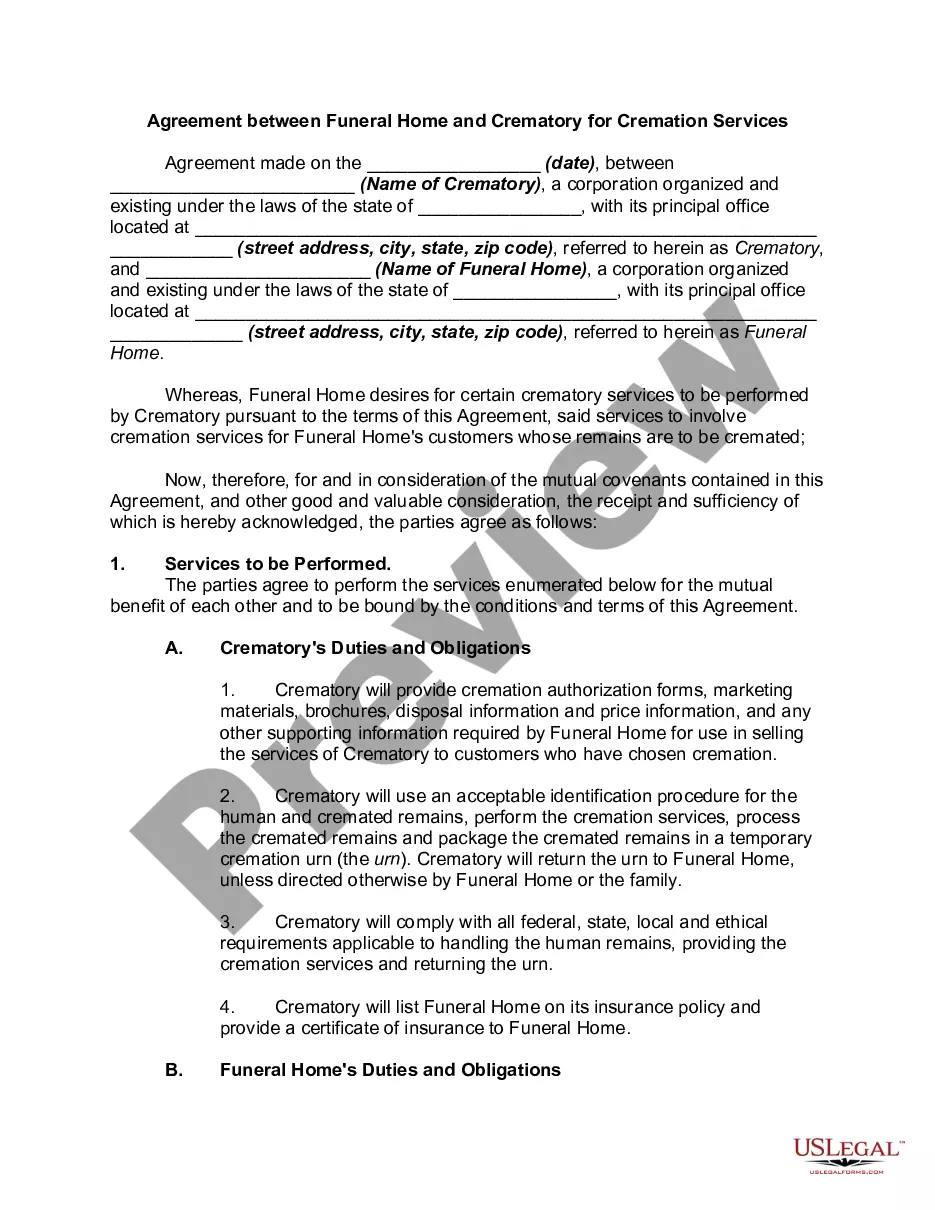

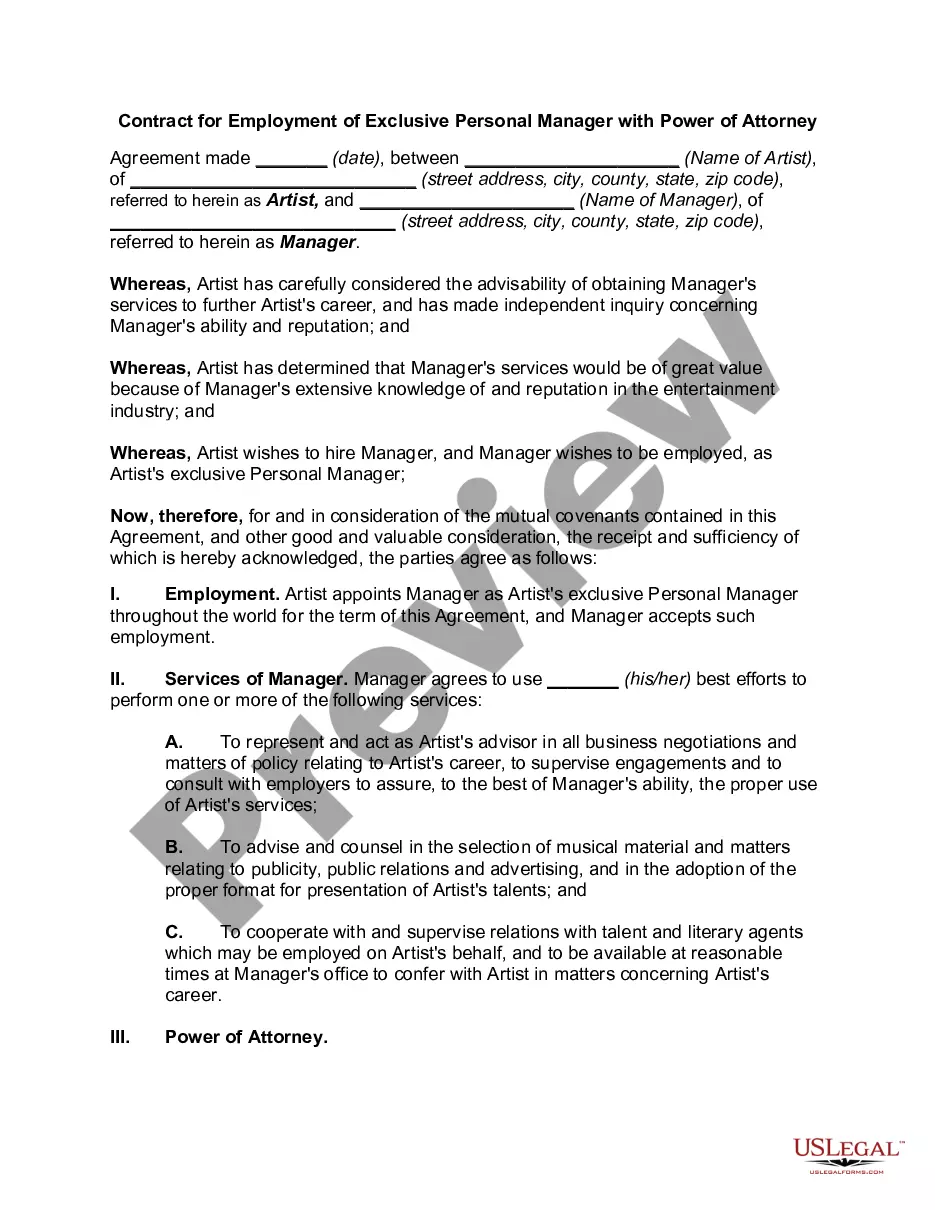

How much time does it usually take you to draw up a legal document? Given that every state has its laws and regulations for every life sphere, finding a Hillsborough State of Delaware Limited Partnership Tax Notice suiting all local requirements can be stressful, and ordering it from a professional lawyer is often pricey. Many web services offer the most common state-specific templates for download, but using the US Legal Forms library is most beneficial.

US Legal Forms is the most extensive web collection of templates, grouped by states and areas of use. Apart from the Hillsborough State of Delaware Limited Partnership Tax Notice, here you can get any specific document to run your business or personal affairs, complying with your regional requirements. Experts verify all samples for their validity, so you can be sure to prepare your paperwork correctly.

Using the service is fairly straightforward. If you already have an account on the platform and your subscription is valid, you only need to log in, pick the required sample, and download it. You can retain the file in your profile anytime in the future. Otherwise, if you are new to the website, there will be a few more actions to complete before you obtain your Hillsborough State of Delaware Limited Partnership Tax Notice:

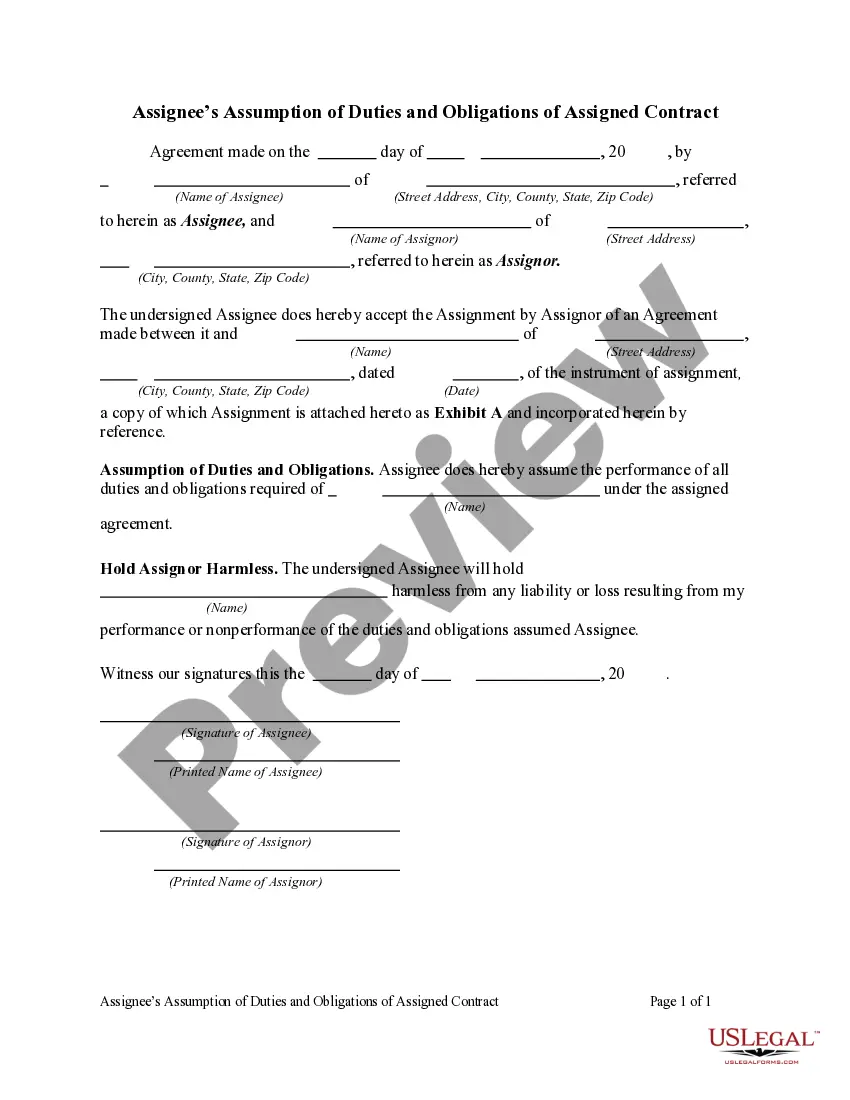

- Check the content of the page you’re on.

- Read the description of the sample or Preview it (if available).

- Look for another document utilizing the related option in the header.

- Click Buy Now once you’re certain in the selected file.

- Choose the subscription plan that suits you most.

- Register for an account on the platform or log in to proceed to payment options.

- Make a payment via PalPal or with your credit card.

- Change the file format if needed.

- Click Download to save the Hillsborough State of Delaware Limited Partnership Tax Notice.

- Print the doc or use any preferred online editor to fill it out electronically.

No matter how many times you need to use the acquired document, you can find all the files you’ve ever downloaded in your profile by opening the My Forms tab. Try it out!