Houston Texas State of Delaware Limited Partnership Tax Notice refers to a formal notification issued by the state of Delaware to Houston-based limited partnerships regarding their tax obligations. This notice serves to inform and remind limited partnership entities of their legal requirements and responsibilities for complying with the state's taxation laws. The Houston Texas State of Delaware Limited Partnership Tax Notice outlines important details related to the filing of taxes, payment deadlines, applicable forms, and reporting guidelines. By providing this information, the state of Delaware aims to ensure that all limited partnerships operating in Houston meet their tax obligations accurately and in a timely manner. Key topics covered in the notice may include: 1. Filing Requirements: The notice specifies the criteria for determining whether a limited partnership is required to file state tax returns to Delaware. It may highlight factors such as the partnership's annual income, presence of Delaware-sourced income, or physical location within the state as determining factors. 2. Payment Deadlines: The notice will clearly state the due dates for submitting tax payments. It may include separate deadlines for estimated tax payments, annual tax returns, and any applicable penalties for late or non-payment. 3. Forms and Documentation: The notice will provide a list of necessary forms, schedules, and supporting documentation that must be submitted with the partnership's tax return. Examples may include Schedule K-1s, financial statements, and relevant federal tax information. 4. Tax Rates and Calculations: The notice will outline the applicable tax rates for different income brackets and provide instructions on how to calculate the partnership's tax liability accurately. 5. Reporting Guidelines: The notice will present detailed instructions on how to accurately report different types of income, deductions, credits, and exemptions specific to limited partnerships operating in Houston. Types of Houston Texas State of Delaware Limited Partnership Tax Notices may include: 1. Annual Tax Notice: This notice is sent annually to inform limited partnerships about their upcoming tax obligations, payment deadlines, and any changes to tax laws or regulations that may affect them. 2. Estimated Tax Notice: Limited partnerships with significant income may receive this notice, outlining their obligation to submit estimated tax payments throughout the year to avoid underpayment penalties. 3. Non-Compliance Notice: In cases where a limited partnership has failed to meet their tax obligations, the state may issue a notice highlighting the consequences, penalties, and necessary corrective actions to rectify the non-compliance. In conclusion, the Houston Texas State of Delaware Limited Partnership Tax Notice is a crucial communication tool ensuring that limited partnerships in Houston understand and fulfill their tax obligations to the state of Delaware accurately and on time.

Houston Texas State of Delaware Limited Partnership Tax Notice

Description

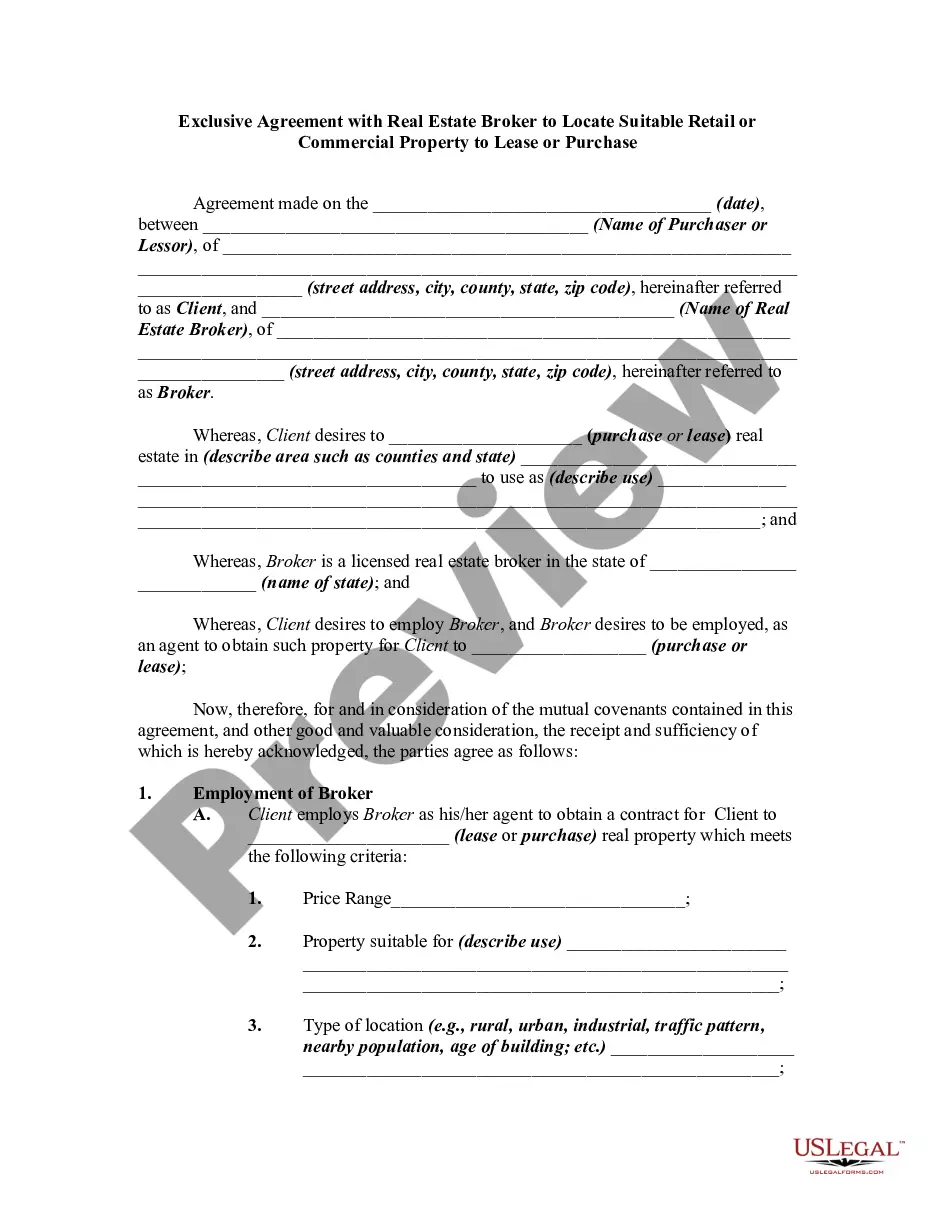

How to fill out Houston Texas State Of Delaware Limited Partnership Tax Notice?

Whether you intend to start your business, enter into a contract, apply for your ID renewal, or resolve family-related legal concerns, you need to prepare certain paperwork meeting your local laws and regulations. Finding the correct papers may take a lot of time and effort unless you use the US Legal Forms library.

The platform provides users with more than 85,000 expertly drafted and checked legal documents for any personal or business occasion. All files are grouped by state and area of use, so picking a copy like Houston State of Delaware Limited Partnership Tax Notice is fast and simple.

The US Legal Forms website users only need to log in to their account and click the Download key next to the required template. If you are new to the service, it will take you a few more steps to obtain the Houston State of Delaware Limited Partnership Tax Notice. Adhere to the instructions below:

- Make certain the sample fulfills your personal needs and state law requirements.

- Read the form description and check the Preview if available on the page.

- Make use of the search tab specifying your state above to find another template.

- Click Buy Now to obtain the sample when you find the right one.

- Opt for the subscription plan that suits you most to proceed.

- Sign in to your account and pay the service with a credit card or PayPal.

- Download the Houston State of Delaware Limited Partnership Tax Notice in the file format you prefer.

- Print the copy or fill it out and sign it electronically via an online editor to save time.

Documents provided by our website are reusable. Having an active subscription, you are able to access all of your earlier purchased paperwork at any moment in the My Forms tab of your profile. Stop wasting time on a constant search for up-to-date formal documentation. Join the US Legal Forms platform and keep your paperwork in order with the most comprehensive online form collection!

Form popularity

FAQ

A resident partner must file Form 200-01 (Delaware Resident Income Tax Return) and must report their share of partnership income or loss. Partnerships must file by the 15th day of the third month following the expiration of the taxable period (March 15 for calendar year taxpayers).

There are ways to reduce your Delaware franchise costs in certain circumstances. To reduce the taxes paid by a startup, use the Assumed Par Value method. This method calculates the taxes by total assets. As long as your issued shares constitute a third to half of your authorized shares, this method will save you money.

State Business Taxes By default, LLCs themselves do not pay federal income taxes, only their members do. Delaware, however, imposes an annual tax on LLCs. The tax, which recently increased, is a flat $300 and is payable to the DOS. The tax is due on or before June 1.

Every domestic or foreign corporation doing business in Delaware, not specifically exempt under Section 1902(b), Title 30, Delaware Code, is required to file a corporate income tax return (Form 1100 or Form 1100EZ) and pay a tax of 8.7% on its federal taxable income allocated and apportioned to Delaware.

Although Limited Partnerships, Limited Liability Companies and General Partnerships formed in the State of Delaware do not file an Annual Report, they are required to pay an annual tax of $300.00. Taxes for these entities are due on or before June 1st of each year. Penalty for non-payment or late payment is $200.00.

LLC/Partnership Tax Information All Domestic and Foreign Limited Liability Companies, Limited Partnerships, and General Partnerships formed or registered in Delaware are required to pay an annual tax of $300.00. There is no requirement to file an Annual Report.

If you do not legally and officially cancel your LLC or dissolve your corporation, your company will continue to be held responsible for the annual Delaware Franchise Tax Fee as well as your annual Registered Agent Fee until either the Registered Agent resigns or until the State of Delaware voids the company.

A PARTNERSHIP RETURN MUST BE COMPLETED BY ANY BUSINESS TREATED AS A PARTNERSHIP FOR FEDERAL PURPOSES WHICH HAS ANY INCOME OR LOSS, REGARDLESS OF AMOUNT, DERIVED FROM OR CONNECTED WITH A DELAWARE SOURCE. IF THE PARTNERSHIP HAS NO DELAWARE SOURCED INCOME OR LOSS, NO RETURN IS REQUIRED TO BE FILED.

Although Limited Partnerships, Limited Liability Companies and General Partnerships formed in the State of Delaware do not file an Annual Report, they are required to pay an annual tax of $300.00. Taxes for these entities are due on or before June 1st of each year. Penalty for non-payment or late payment is $200.00.

A. Delaware treats a single-member ?disregarded entity? as a sole proprietorship for tax purposes. This means that the LLC itself does not pay taxes and does not have to file a return with the State of Delaware.