Palm Beach Florida State of Delaware Limited Partnership Tax Notice is a document issued by the state of Delaware to provide important information regarding taxation for limited partnerships registered in Palm Beach, Florida. This notice is an essential requirement for all businesses operating as limited partnerships in the state and ensures compliance with Delaware's tax regulations. Keywords: Palm Beach Florida, State of Delaware, limited partnership, tax notice, taxation, Delaware's tax regulations, compliance. Different types of Palm Beach Florida State of Delaware Limited Partnership Tax Notices may include: 1. Annual Tax Notice: This notice is sent annually to limited partnerships operating in Palm Beach Florida to inform them about their tax obligations, deadlines, and any changes made to the state tax laws relevant to limited partnerships. 2. Payment Reminder Notice: When a limited partnership fails to pay their estimated taxes or misses a tax payment deadline, the state may issue a payment reminder notice. It serves as a notification to the partnership regarding the outstanding tax and provides instructions on how to rectify the issue. 3. Penalty Notice: If there are substantial delays or non-compliance with tax payments, the state may issue a penalty notice. This notice outlines the penalties or fines levied due to the partnership's failure to meet their tax obligations within the specified timeframe. 4. Dissolution Tax Notice: In the event of dissolution or termination of a limited partnership, a dissolution tax notice may be issued. This notice informs the partnership of any outstanding taxes that need to be settled before the dissolution process can be completed. 5. Tax Audit Notice: A tax audit notice is sent to a limited partnership if it has been selected for a tax audit. The state of Delaware may conduct periodic audits to verify the partnership's accuracy and compliance with tax regulations. The notice provides information on the audit process, documentation review, and the timeframe for the audit. It is important for limited partnerships operating in Palm Beach Florida to stay informed and respond promptly to any tax notices received. Failing to comply with the requirements outlined in these notices can lead to penalties, fines, and potential legal consequences. Therefore, it is advisable for limited partnerships to consult with a tax professional to ensure full compliance with Delaware's tax regulations.

Palm Beach Florida State of Delaware Limited Partnership Tax Notice

Description

How to fill out Palm Beach Florida State Of Delaware Limited Partnership Tax Notice?

Laws and regulations in every sphere differ throughout the country. If you're not a lawyer, it's easy to get lost in countless norms when it comes to drafting legal paperwork. To avoid pricey legal assistance when preparing the Palm Beach State of Delaware Limited Partnership Tax Notice, you need a verified template legitimate for your region. That's when using the US Legal Forms platform is so beneficial.

US Legal Forms is a trusted by millions web collection of more than 85,000 state-specific legal templates. It's an excellent solution for specialists and individuals searching for do-it-yourself templates for different life and business scenarios. All the documents can be used multiple times: once you purchase a sample, it remains available in your profile for further use. Thus, when you have an account with a valid subscription, you can simply log in and re-download the Palm Beach State of Delaware Limited Partnership Tax Notice from the My Forms tab.

For new users, it's necessary to make some more steps to get the Palm Beach State of Delaware Limited Partnership Tax Notice:

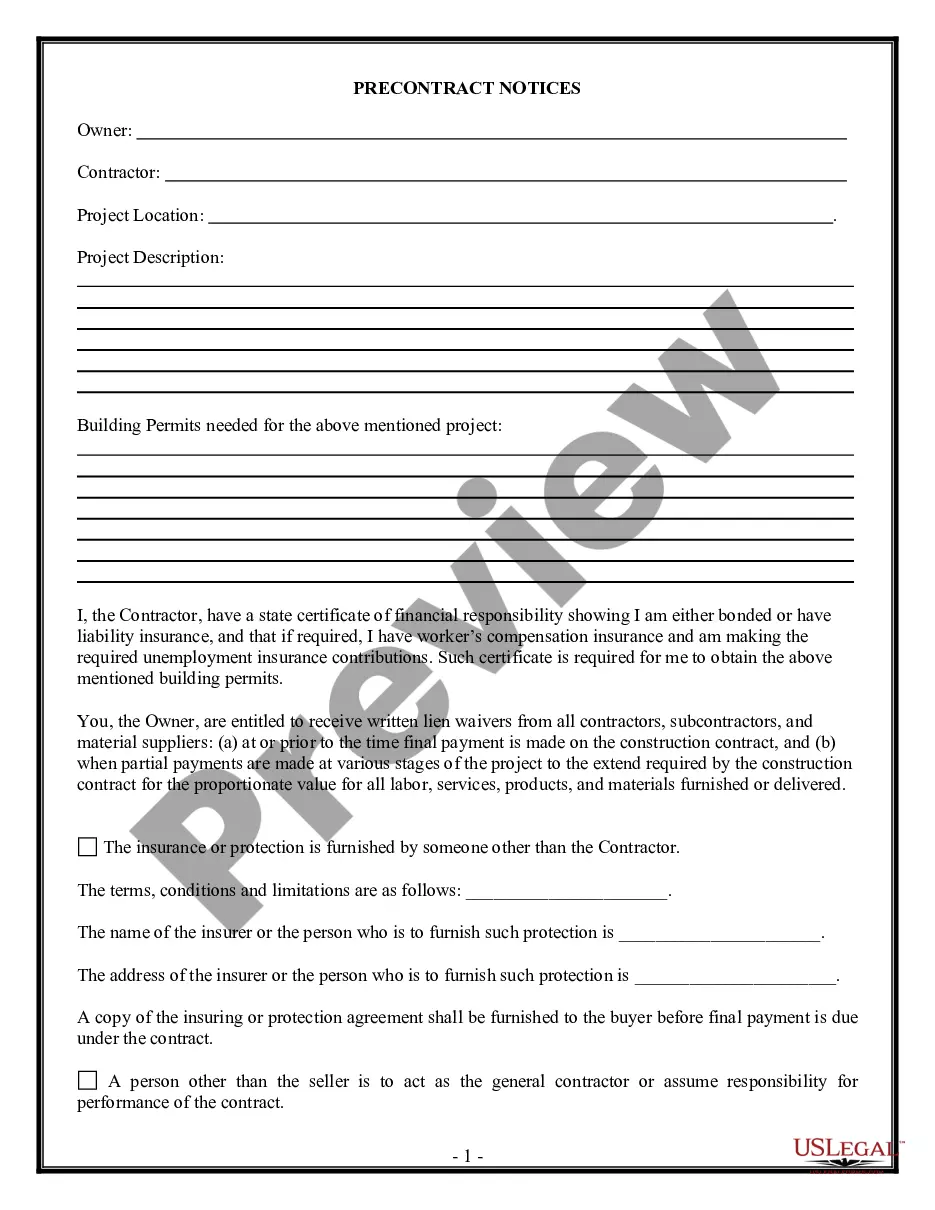

- Examine the page content to make sure you found the right sample.

- Utilize the Preview option or read the form description if available.

- Search for another doc if there are inconsistencies with any of your requirements.

- Utilize the Buy Now button to get the template when you find the proper one.

- Choose one of the subscription plans and log in or sign up for an account.

- Select how you prefer to pay for your subscription (with a credit card or PayPal).

- Select the format you want to save the document in and click Download.

- Complete and sign the template in writing after printing it or do it all electronically.

That's the simplest and most economical way to get up-to-date templates for any legal reasons. Find them all in clicks and keep your paperwork in order with the US Legal Forms!