Sacramento California State of Delaware Limited Partnership Tax Notice is a legal document that provides crucial information regarding the tax obligations and requirements for limited partnerships registered in the state of Delaware that conduct business or have income derived from activities in Sacramento, California. This notice serves as a reminder and guide for limited partnerships to comply with the applicable tax laws and regulations in both jurisdictions. Keywords: Sacramento California, State of Delaware, Limited Partnership, Tax Notice, tax obligations, tax requirements, business activities, income, tax laws, tax regulations, compliance. Different types of Sacramento California State of Delaware Limited Partnership Tax Notice may include: 1. Annual Tax Notice: This notice is issued annually to inform limited partnerships registered in Delaware about their tax obligations and requirements specific to conducting business or generating income in Sacramento, California. 2. Quarterly Tax Notice: Some limited partnerships may receive a quarterly tax notice that details the relevant tax obligations and requirements for the corresponding reporting period in Sacramento, California. This notice helps ensure compliance throughout the year. 3. Compliance Reminder Notice: This type of notice serves as a reminder to limited partnerships to fulfill their tax obligations promptly and accurately in both Sacramento, California, and the state of Delaware. It may contain important deadlines, filing requirements, and penalties for non-compliance. 4. New Business Tax Notice: Limited partnerships that have recently established operations in Sacramento, California, may receive a specific tax notice that outlines the steps they need to take to comply with the state's tax laws and regulations. This notice may highlight the registration process, obtaining necessary permits, and applicable taxes. 5. Tax Law Update Notice: As tax laws and regulations evolve, limited partnerships may receive periodic notices informing them of any relevant changes affecting their tax obligations in Sacramento, California. These notices provide guidance on how to adapt to the updated requirements and avoid potential penalties. By adhering to Sacramento California State of Delaware Limited Partnership Tax Notice guidelines and fulfilling their tax obligations, limited partnerships can maintain compliance, avoid penalties, and ensure smooth operations in both jurisdictions.

Sacramento California State of Delaware Limited Partnership Tax Notice

Description

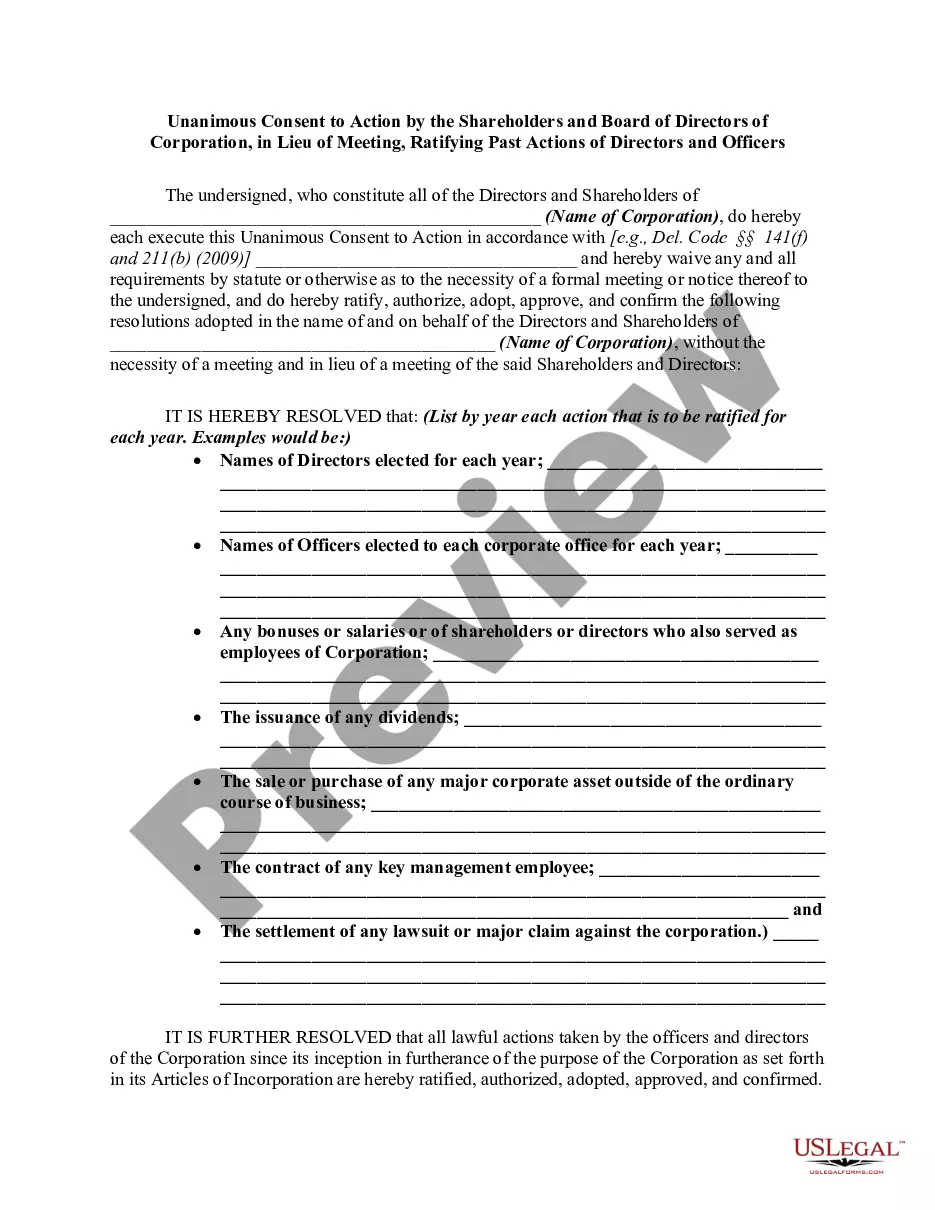

How to fill out Sacramento California State Of Delaware Limited Partnership Tax Notice?

Dealing with legal forms is a necessity in today's world. Nevertheless, you don't always need to seek professional help to draft some of them from scratch, including Sacramento State of Delaware Limited Partnership Tax Notice, with a platform like US Legal Forms.

US Legal Forms has more than 85,000 forms to choose from in various types ranging from living wills to real estate papers to divorce documents. All forms are arranged according to their valid state, making the searching experience less challenging. You can also find detailed materials and guides on the website to make any activities related to document completion straightforward.

Here's how you can find and download Sacramento State of Delaware Limited Partnership Tax Notice.

- Go over the document's preview and description (if available) to get a general information on what you’ll get after getting the form.

- Ensure that the template of your choosing is adapted to your state/county/area since state regulations can impact the validity of some documents.

- Check the related document templates or start the search over to find the appropriate document.

- Click Buy now and register your account. If you already have an existing one, choose to log in.

- Pick the pricing {plan, then a suitable payment gateway, and buy Sacramento State of Delaware Limited Partnership Tax Notice.

- Select to save the form template in any available format.

- Go to the My Forms tab to re-download the document.

If you're already subscribed to US Legal Forms, you can find the needed Sacramento State of Delaware Limited Partnership Tax Notice, log in to your account, and download it. Of course, our platform can’t replace an attorney completely. If you have to cope with an exceptionally complicated case, we advise getting a lawyer to examine your form before executing and submitting it.

With more than 25 years on the market, US Legal Forms proved to be a go-to platform for many different legal forms for millions of customers. Become one of them today and get your state-compliant documents effortlessly!