The Suffolk New York State of Delaware Limited Partnership Tax Notice is an official document that outlines the tax obligations and regulations for limited partnerships registered in Suffolk County, New York, and the State of Delaware. This notice serves as a vital resource for limited partnerships to understand, comply with, and fulfill their tax responsibilities to avoid penalties or legal consequences. The Suffolk New York State of Delaware Limited Partnership Tax Notice provides comprehensive and detailed information on various aspects related to taxation. It covers crucial topics such as taxable income, partnership tax rates, deductible expenses, estimated tax payments, partnership tax forms, filing deadlines, and relevant contact information for further assistance. Understanding and adhering to the Suffolk New York State of Delaware Limited Partnership Tax Notice is essential for limited partnerships as non-compliance can result in hefty fines, interest charges, or even the revocation of partnership status. Therefore, it is crucial for limited partnerships to review, comprehend, and strictly follow the guidelines outlined in the tax notice. As for the different types of Suffolk New York State of Delaware Limited Partnership Tax Notice, they may include: 1. Annual Tax Notice: A notice issued annually to every limited partnership registered in Suffolk County, New York, and the State of Delaware, reminding them of their upcoming tax obligations, deadlines, and any changes in tax regulations. 2. Estimated Tax Notice: This notice informs limited partnerships about their requirement to make estimated tax payments throughout the year to avoid underpayment penalties. It provides guidance on calculating and submitting these payments. 3. Delinquency Notice: A notice sent to limited partnerships that have failed to fulfill their tax obligations promptly. It serves as a warning, informing them of possible penalties, interest charges, or legal actions if the delinquent taxes are not resolved within a specified timeframe. 4. Amendment Notice: In case of any significant changes or updates to tax regulations, the Suffolk New York State of Delaware Limited Partnership Tax Notice may issue an amendment notice, highlighting the revised tax provisions that limited partnerships must consider while filing their taxes. 5. Non-Resident Partnership Notice: For limited partnerships operating across state lines or with non-resident partners, this notice provides information on additional tax requirements, such as apportionment rules, tax credits, and reporting obligations. It is crucial for every limited partnership in Suffolk County, New York, and the State of Delaware to thoroughly review and comprehend the Suffolk New York State of Delaware Limited Partnership Tax Notice to ensure compliance, accurate tax reporting, and efficient tax management. Failure to do so may result in severe consequences, negatively impacting the business's financial health and legal standing.

Suffolk New York State of Delaware Limited Partnership Tax Notice

Description

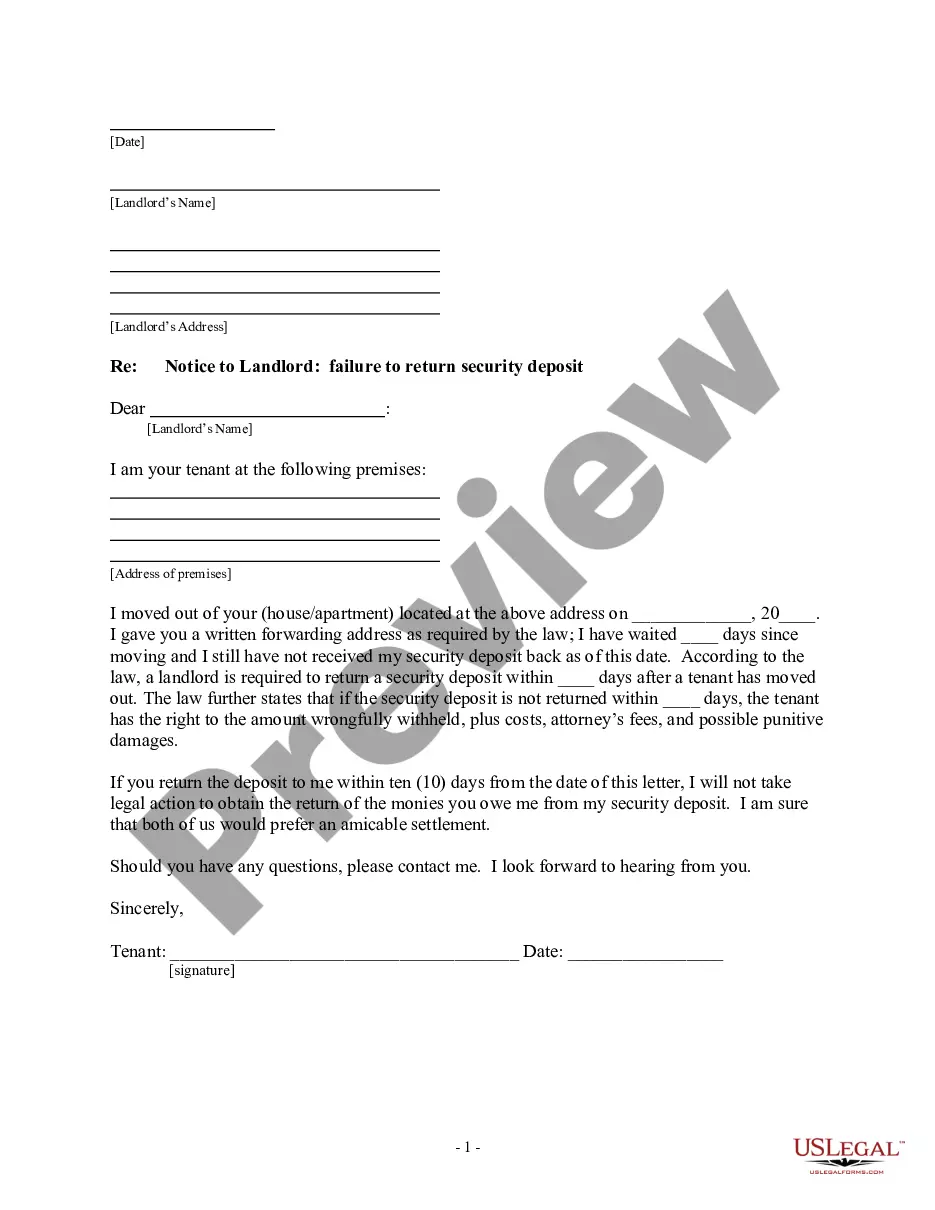

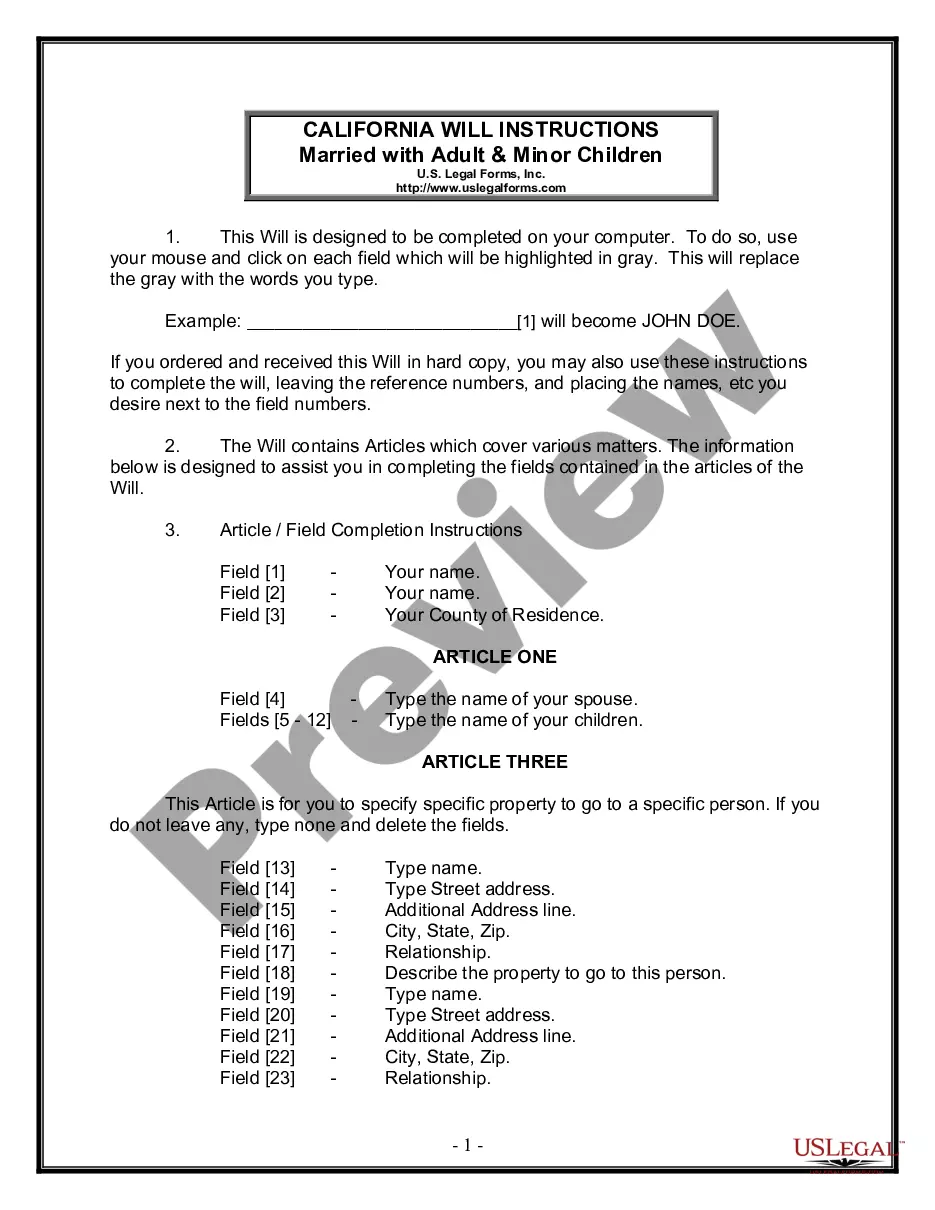

How to fill out Suffolk New York State Of Delaware Limited Partnership Tax Notice?

A document routine always accompanies any legal activity you make. Opening a business, applying or accepting a job offer, transferring ownership, and many other life scenarios demand you prepare formal paperwork that differs throughout the country. That's why having it all accumulated in one place is so valuable.

US Legal Forms is the most extensive online library of up-to-date federal and state-specific legal templates. On this platform, you can easily locate and get a document for any individual or business purpose utilized in your county, including the Suffolk State of Delaware Limited Partnership Tax Notice.

Locating forms on the platform is extremely simple. If you already have a subscription to our service, log in to your account, find the sample using the search field, and click Download to save it on your device. Following that, the Suffolk State of Delaware Limited Partnership Tax Notice will be accessible for further use in the My Forms tab of your profile.

If you are dealing with US Legal Forms for the first time, follow this simple guideline to obtain the Suffolk State of Delaware Limited Partnership Tax Notice:

- Ensure you have opened the correct page with your regional form.

- Make use of the Preview mode (if available) and browse through the template.

- Read the description (if any) to ensure the template corresponds to your requirements.

- Look for another document via the search tab in case the sample doesn't fit you.

- Click Buy Now when you locate the necessary template.

- Decide on the suitable subscription plan, then log in or create an account.

- Choose the preferred payment method (with credit card or PayPal) to proceed.

- Choose file format and save the Suffolk State of Delaware Limited Partnership Tax Notice on your device.

- Use it as needed: print it or fill it out electronically, sign it, and send where requested.

This is the simplest and most trustworthy way to obtain legal documents. All the templates available in our library are professionally drafted and checked for correspondence to local laws and regulations. Prepare your paperwork and manage your legal affairs efficiently with the US Legal Forms!