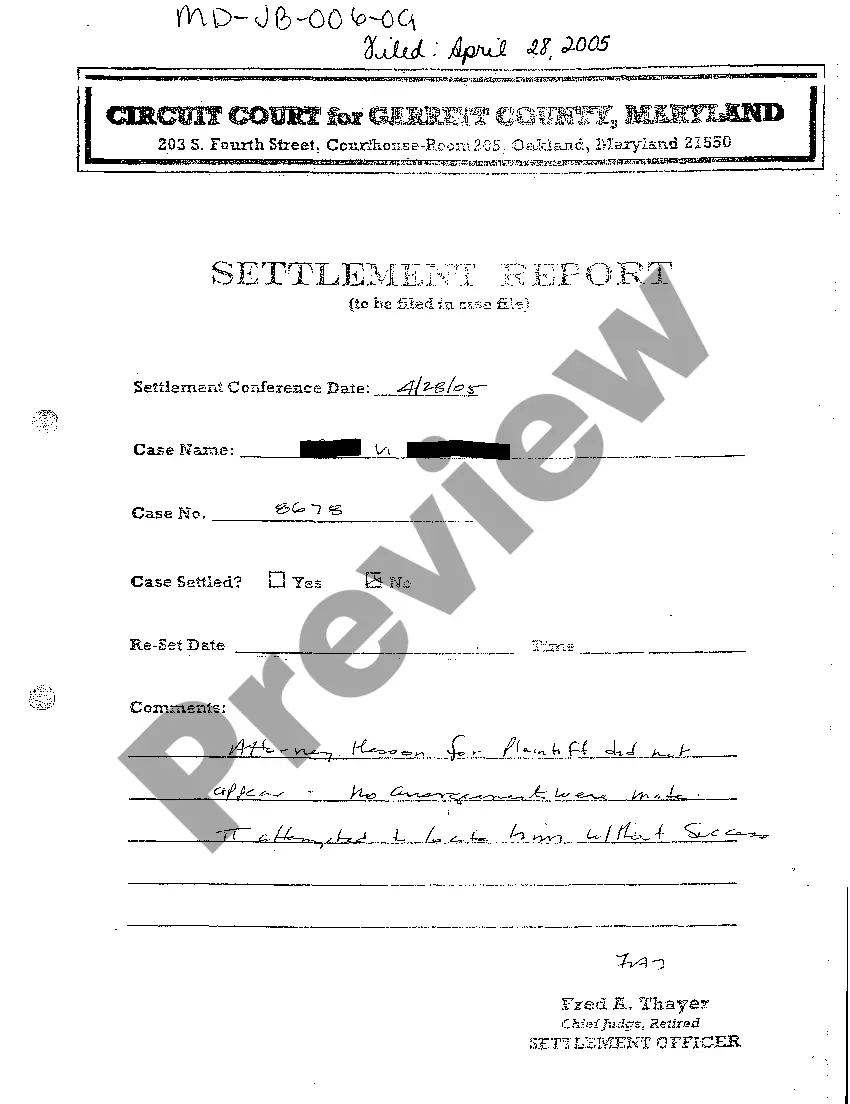

The Wake North Carolina State of Delaware Limited Partnership Tax Notice is a document issued by the state of Delaware to notify limited partnerships operating in Wake County, North Carolina about their tax obligations. It serves as an official reminder to ensure compliance with the state's tax laws and regulations. The notice provides detailed information regarding the required tax forms, deadlines, and instructions for reporting partnership income, expenses, and other financial activities for taxation purposes. It outlines the partnership tax filing requirements and any specific guidelines pertaining to Wake County. There may be different types of Wake North Carolina State of Delaware Limited Partnership Tax Notices based on various factors, such as the nature and size of the partnership, the eligible tax deductions, or specific tax incentives available. For example, there could be separate notices for general partnerships, limited partnerships, or limited liability partnerships. Partnerships receiving the Wake North Carolina State of Delaware Limited Partnership Tax Notice are advised to review it thoroughly and consult with a tax professional to accurately complete their tax returns. Failure to file the necessary forms or pay the required taxes on time may result in penalties or legal consequences. To ensure compliance and avoid any potential issues, partnerships should keep a record of all financial transactions, maintain organized financial statements, and stay updated with any changes in the relevant tax laws and regulations. It is crucial to respond promptly to the notice and submit all required documents accurately and within the specified deadline. In summary, the Wake North Carolina State of Delaware Limited Partnership Tax Notice is an important communication tool used by the state of Delaware to inform limited partnerships operating in Wake County, North Carolina, about their tax obligations. Complying with this notice is essential for maintaining good standing with the state and avoiding penalties or legal repercussions.

Wake North Carolina State of Delaware Limited Partnership Tax Notice

Description

How to fill out Wake North Carolina State Of Delaware Limited Partnership Tax Notice?

Draftwing forms, like Wake State of Delaware Limited Partnership Tax Notice, to take care of your legal matters is a tough and time-consumming process. Many situations require an attorney’s participation, which also makes this task expensive. However, you can get your legal issues into your own hands and deal with them yourself. US Legal Forms is here to save the day. Our website features over 85,000 legal forms created for a variety of cases and life circumstances. We make sure each form is in adherence with the laws of each state, so you don’t have to be concerned about potential legal issues associated with compliance.

If you're already familiar with our website and have a subscription with US, you know how easy it is to get the Wake State of Delaware Limited Partnership Tax Notice form. Go ahead and log in to your account, download the form, and customize it to your needs. Have you lost your form? No worries. You can get it in the My Forms tab in your account - on desktop or mobile.

The onboarding flow of new users is fairly straightforward! Here’s what you need to do before downloading Wake State of Delaware Limited Partnership Tax Notice:

- Make sure that your template is specific to your state/county since the rules for writing legal papers may differ from one state another.

- Find out more about the form by previewing it or going through a quick description. If the Wake State of Delaware Limited Partnership Tax Notice isn’t something you were looking for, then take advantage of the search bar in the header to find another one.

- Sign in or register an account to start using our website and get the form.

- Everything looks good on your end? Hit the Buy now button and select the subscription option.

- Select the payment gateway and type in your payment information.

- Your form is good to go. You can try and download it.

It’s easy to locate and buy the needed template with US Legal Forms. Thousands of businesses and individuals are already benefiting from our rich library. Sign up for it now if you want to check what other advantages you can get with US Legal Forms!