Fairfax Virginia Form — Term Sheet for Series C Preferred Stock is a legal document that outlines the terms and conditions associated with Series C Preferred Stock investments in Fairfax, Virginia. This term sheet serves as a preliminary agreement between the company issuing the stock and the investor, outlining the key terms of the investment. Keywords: Fairfax Virginia, Form, Term Sheet, Series C Preferred Stock, investment, investor, agreement, terms, conditions. 1. Overview: The Fairfax Virginia Form — Term Sheet for Series C Preferred Stock provides a concise overview of the investment opportunity, highlighting the essential details, terms, and expectations. 2. Parties: This term sheet clearly identifies the parties involved in the agreement, including the company issuing the stock and the investor(s) participating in the Series C Preferred Stock round. 3. Investment Structure: The term sheet discusses the structure of the investment, including the number of shares offered, the price per share, and the total investment amount. 4. Dividends: It outlines the dividend rights associated with Series C Preferred Stock. This section may include information related to dividend rates, timing of payments, and whether dividends are cumulative or noncumulative. 5. Liquidation Rights: This section specifies the rights of Series C Preferred Stockholders in case of liquidation or sale of the company. It may include information about preferences, participation, and conversion rights. 6. Voting Rights: The term sheet explains the voting rights of Series C Preferred Stockholders, including matters that require their consent or the threshold for voting on certain corporate actions. 7. Anti-Dilution Provisions: It describes any anti-dilution provisions in place to protect Series C Preferred Stockholders from potential dilution resulting from future stock issuance or other capital events. 8. Redemption Rights: This section discusses the conditions and terms under which the company may have the ability to redeem Series C Preferred Stock, either at the option of the company or the investor. 9. Conversion Rights: If applicable, the term sheet outlines the conversion rights of Series C Preferred Stockholders into common shares, including any conversion ratios or events triggering conversion. 10. Conditions Precedent: This section lists the conditions that must be met before the investment can be completed, such as regulatory approvals or completion of due diligence. Different types of Fairfax Virginia Form — Term Sheet for Series C Preferred Stock can be named based on the specific characteristics or variations of the investment. Examples include: 1. Fairfax Virginia Form — Term Sheet for Series C-1 Preferred Stock 2. Fairfax Virginia Form — Term Sheet for Series C-2 Preferred Stock 3. Fairfax Virginia Form — Term Sheet for Series C-3 Preferred Stock Each type represents a different round of funding or variation in the terms offered to investors within the Series C Preferred Stock class.

Fairfax Virginia Form - Term Sheet for Series C Preferred Stock

Description

How to fill out Fairfax Virginia Form - Term Sheet For Series C Preferred Stock?

Laws and regulations in every area differ throughout the country. If you're not an attorney, it's easy to get lost in various norms when it comes to drafting legal documents. To avoid costly legal assistance when preparing the Fairfax Form - Term Sheet for Series C Preferred Stock, you need a verified template valid for your county. That's when using the US Legal Forms platform is so advantageous.

US Legal Forms is a trusted by millions web catalog of more than 85,000 state-specific legal forms. It's a perfect solution for specialists and individuals looking for do-it-yourself templates for various life and business occasions. All the forms can be used multiple times: once you obtain a sample, it remains available in your profile for subsequent use. Thus, if you have an account with a valid subscription, you can just log in and re-download the Fairfax Form - Term Sheet for Series C Preferred Stock from the My Forms tab.

For new users, it's necessary to make a couple of more steps to obtain the Fairfax Form - Term Sheet for Series C Preferred Stock:

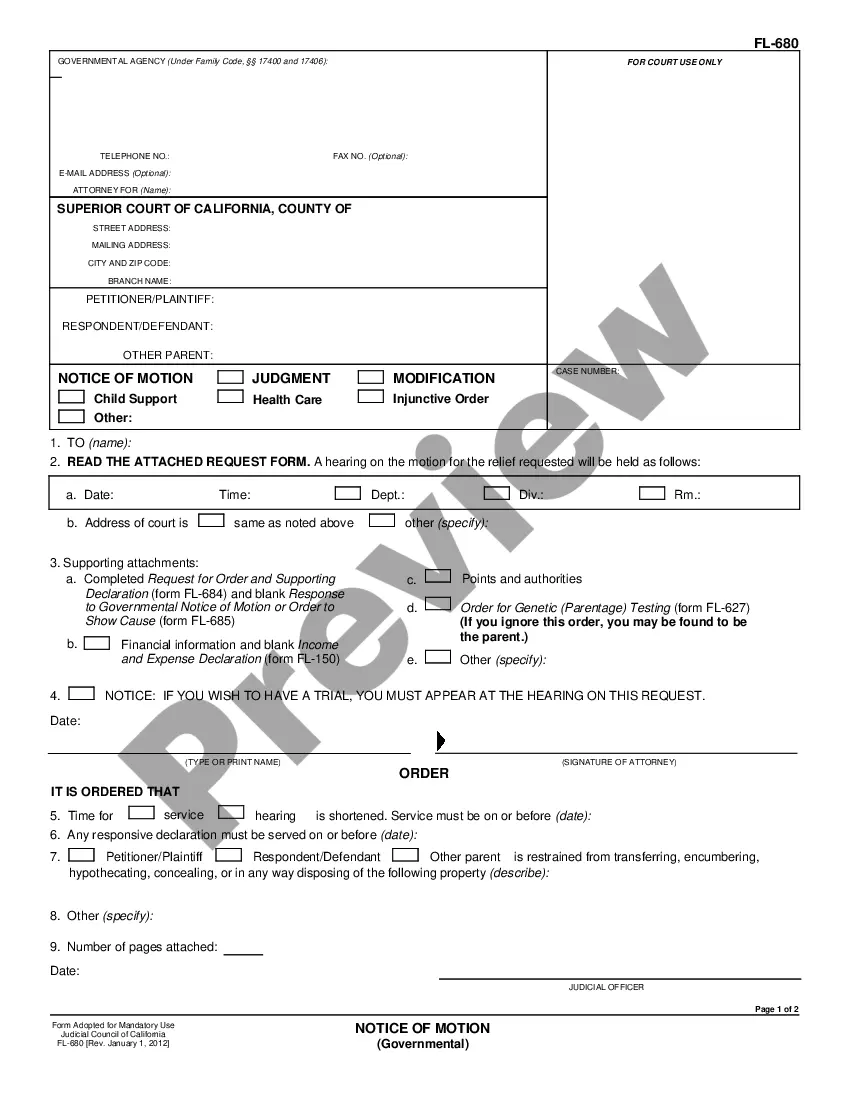

- Analyze the page content to ensure you found the right sample.

- Use the Preview option or read the form description if available.

- Look for another doc if there are inconsistencies with any of your requirements.

- Use the Buy Now button to get the document once you find the correct one.

- Choose one of the subscription plans and log in or create an account.

- Decide how you prefer to pay for your subscription (with a credit card or PayPal).

- Select the format you want to save the file in and click Download.

- Complete and sign the document on paper after printing it or do it all electronically.

That's the simplest and most cost-effective way to get up-to-date templates for any legal purposes. Find them all in clicks and keep your paperwork in order with the US Legal Forms!