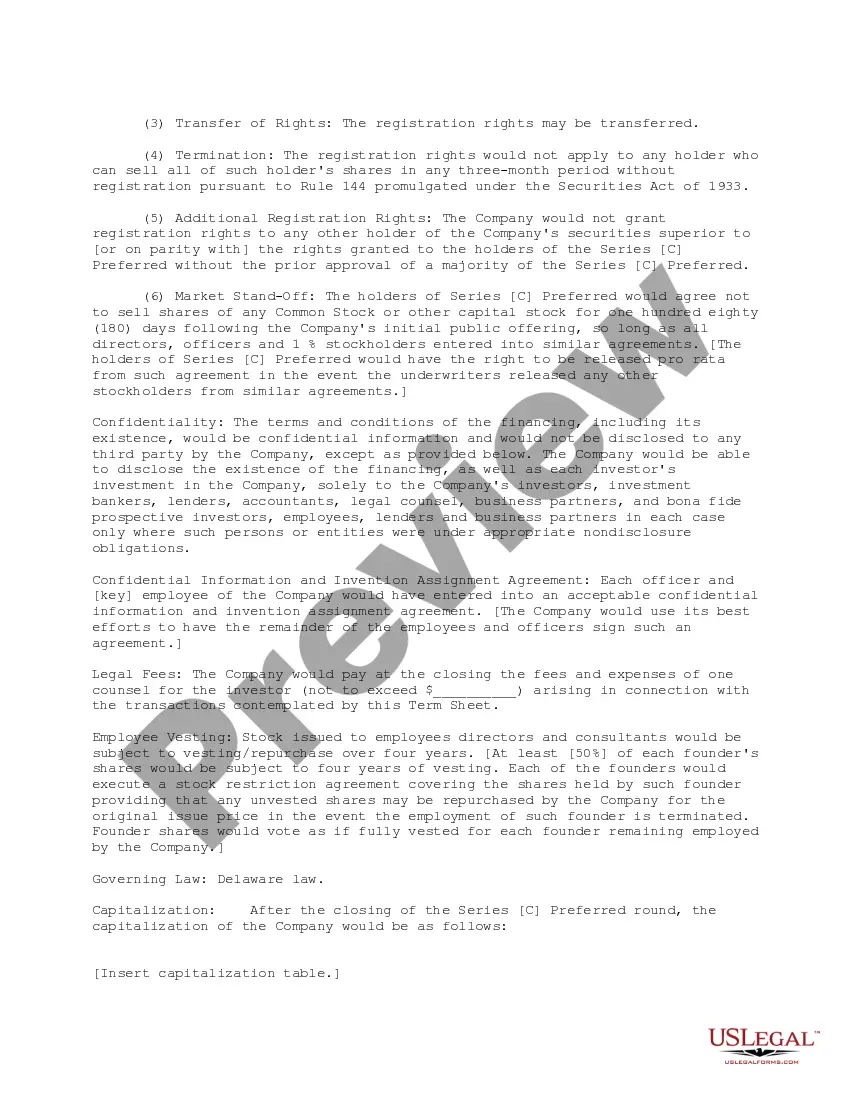

Houston Texas Form — Term Sheet for Series C Preferred Stock is a legal document that outlines the terms and conditions for the issuance of Series C Preferred Stock by a company based in Houston, Texas. This term sheet serves as a framework for negotiations and lays the foundation for creating a binding agreement between the company and potential investors. The Houston Texas Form — Term Sheet for Series C Preferred Stock typically includes various sections, such as: 1. Capitalization: This section provides an overview of the company's authorized capital stock, including the number of authorized shares, classes of stock, and any outstanding convertible securities. 2. Series C Preferred Stock: It describes the specific rights and preferences granted to the Series C Preferred Stockholders. This may include dividend preferences, liquidation preferences, conversion rights, voting rights, anti-dilution protections, and redemption rights. 3. Purchase Price: The term sheet determines the purchase price per share for the Series C Preferred Stock. It may include provisions such as minimum investment amounts and any discounts or bonuses applied. 4. Closing Conditions: This section outlines the conditions that must be satisfied before the issuance and purchase of the Series C Preferred Stock can occur. This can include legal and regulatory requirements, board approval, and any other closing conditions. 5. Representations and Warranties: Both the company and the investor make certain representations and warranties to each other regarding their respective legal and financial standings. These serve as assurances that both parties have the legal authority and capacity to engage in the transaction. 6. Governing Law and Dispute Resolution: The term sheet specifies the jurisdiction and governing law that will govern the interpretation and enforcement of the agreement. It also lays out the mechanism for resolving any disputes that may arise. Different types of Houston Texas Form — Term Sheet for Series C Preferred Stock may vary based on specific provisions and terms negotiated between the company and investors. For example, one term sheet may grant additional investor rights like board representation, while another may provide stricter limitations on transferability of shares. Overall, the Houston Texas Form — Term Sheet for Series C Preferred Stock serves as a crucial document in the fundraising process for companies in Houston, Texas. It outlines the terms and conditions of the investment opportunity, protecting the interests of both the company and the investors.

Houston Texas Form - Term Sheet for Series C Preferred Stock

Description

How to fill out Houston Texas Form - Term Sheet For Series C Preferred Stock?

Whether you plan to open your business, enter into a contract, apply for your ID update, or resolve family-related legal concerns, you must prepare specific paperwork meeting your local laws and regulations. Locating the right papers may take a lot of time and effort unless you use the US Legal Forms library.

The platform provides users with more than 85,000 professionally drafted and verified legal templates for any personal or business occasion. All files are collected by state and area of use, so picking a copy like Houston Form - Term Sheet for Series C Preferred Stock is fast and easy.

The US Legal Forms website users only need to log in to their account and click the Download button next to the required template. If you are new to the service, it will take you a couple of additional steps to get the Houston Form - Term Sheet for Series C Preferred Stock. Adhere to the guidelines below:

- Make sure the sample fulfills your personal needs and state law regulations.

- Look through the form description and check the Preview if available on the page.

- Utilize the search tab providing your state above to find another template.

- Click Buy Now to obtain the file when you find the correct one.

- Select the subscription plan that suits you most to proceed.

- Sign in to your account and pay the service with a credit card or PayPal.

- Download the Houston Form - Term Sheet for Series C Preferred Stock in the file format you need.

- Print the copy or complete it and sign it electronically via an online editor to save time.

Documents provided by our website are multi-usable. Having an active subscription, you can access all of your earlier purchased paperwork at any moment in the My Forms tab of your profile. Stop wasting time on a endless search for up-to-date formal documents. Sign up for the US Legal Forms platform and keep your paperwork in order with the most comprehensive online form library!