Houston Texas Form — Stock Purchase Agreement for Strategic Investment Made at Time of Initial Public Offering is a legally binding document that outlines the terms and conditions for purchasing company stocks during the initial public offering (IPO) process. This agreement serves as a vital tool for both the company issuing the stocks and potential investors looking to make strategic investments. Keywords: Houston Texas, Form, Stock Purchase Agreement, Strategic Investment, Initial Public Offering. 1. Purpose: The Houston Texas Form — Stock Purchase Agreement for Strategic Investment Made at Time of Initial Public Offering serves as a formal contract between the company offering stocks and investors seeking to purchase stocks during the IPO. This agreement solidifies the terms and conditions under which stocks are purchased and provides legal protection to both parties involved. 2. Parties Involved: This agreement identifies the key parties involved, including the issuing company and the investors making strategic investments. The company, referred to as the "Issuer," provides detailed information about its legal status, contact details, and other relevant particulars. The investor, referred to as the "Purchaser," provides their personal information, such as name, address, and contact details. 3. Stock Purchase Terms: The form outlines the terms and specifics of the stock purchase. It includes the total number of stocks available for purchase, the purchase price per stock, any discounts or premium applied, and the total investment amount. This section may also include provisions for additional investment rounds, if applicable. 4. Representations and Warranties: The agreement includes a section where the issuing company provides certain representations and warranties about its financial status, operations, and legal compliance. These assurances help the investor gain confidence in the investment decision and mitigate potential risks. 5. Conditions Precedent: This section outlines the conditions that must be met before the stock purchase can occur. Common conditions include the successful completion of the IPO process, regulatory approvals, and any necessary due diligence by the purchaser. It is crucial to clearly define these conditions to protect the interests of both parties. 6. Governing Law and Dispute Resolution: The agreement includes provisions specifying the governing law for the agreement and the jurisdiction for dispute resolution. This assures both parties that any potential conflicts will be resolved in a fair and unbiased manner. 7. Termination Rights: In some cases, circumstances may arise that require the termination of the agreement. This section outlines the rights of both parties to terminate the agreement and any associated consequences, such as refunding the purchase amount or penalties. Types of Houston Texas Form — Stock Purchase Agreement for Strategic Investment Made at Time of Initial Public Offering: 1. Basic Houston Texas Form — Stock Purchase Agreement for Strategic Investment Made at Time of Initial Public Offering: This form includes the essential terms and conditions required for a stock purchase agreement during an IPO. 2. Customized Houston Texas Form — Stock Purchase Agreement for Strategic Investment Made at Time of Initial Public Offering: This form allows parties to include additional terms and conditions tailored to their specific needs, such as additional warranties, exit strategies, or limitations on stock transferability. 3. Preferred Stock Purchase Agreement at Time of Initial Public Offering: This form specifically caters to investors looking to purchase preferred stocks during an IPO. Preferred stocks often carry additional rights and privileges compared to common stocks, and this agreement reflects those distinctions. 4. Secondary Stock Purchase Agreement for Strategic Investment Made at Time of Initial Public Offering: This agreement is used when an existing shareholder intends to sell their stocks to a new investor during the IPO process. It establishes the terms and conditions under which the transfer of ownership occurs. Remember, it is essential to consult with legal professionals specializing in corporate law and IPOs to ensure compliance with all relevant regulations and create a comprehensive Houston Texas Form — Stock Purchase Agreement for Strategic Investment Made at Time of Initial Public Offering.

Houston Texas Form - Stock Purchase Agreement for Strategic Investment Made at Time of Initial Public Offering

Description

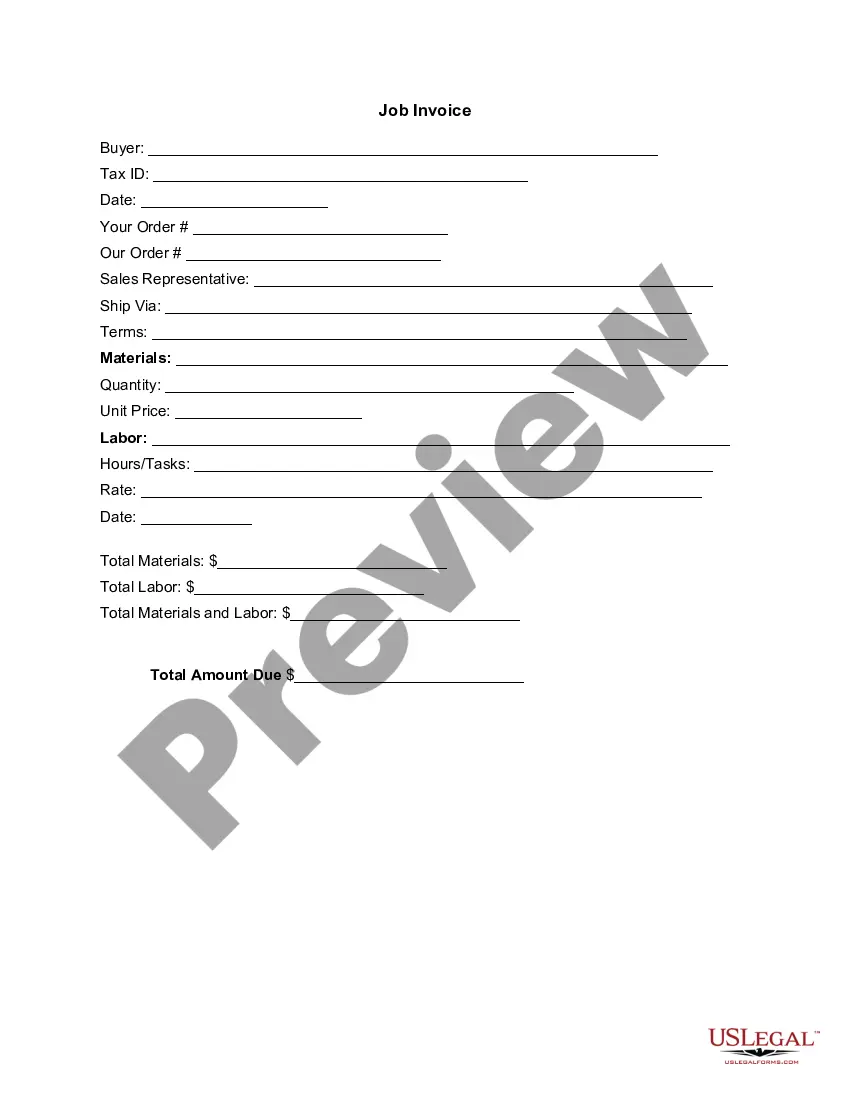

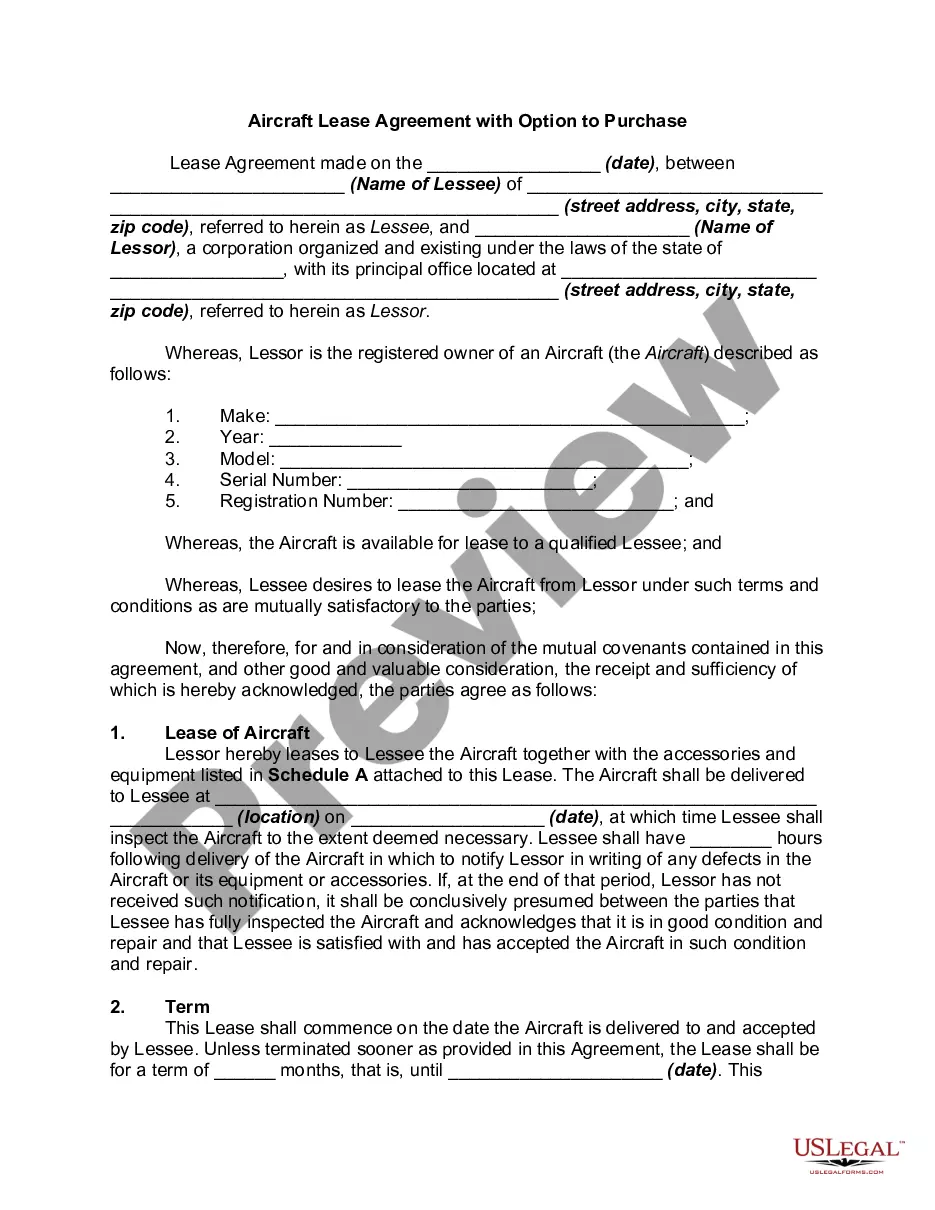

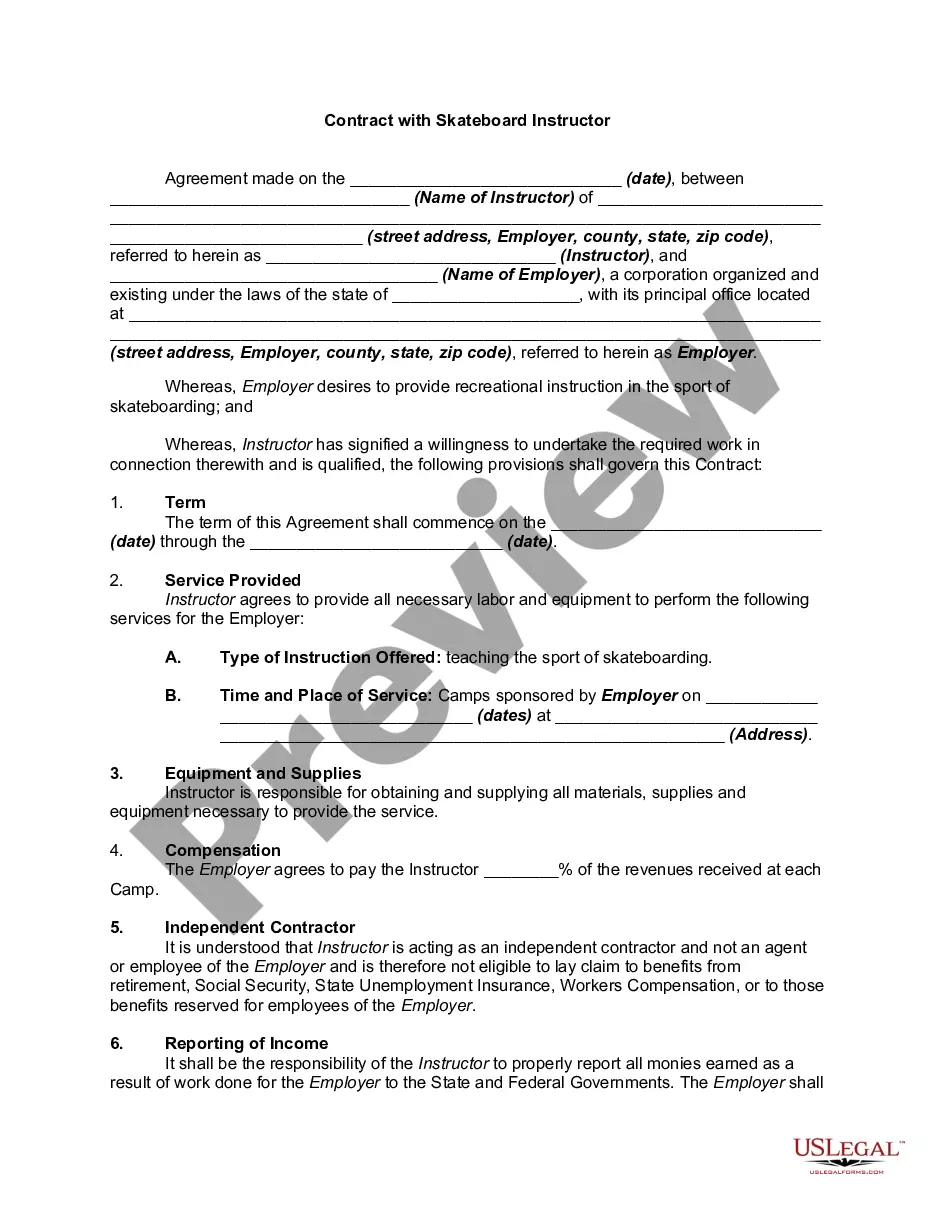

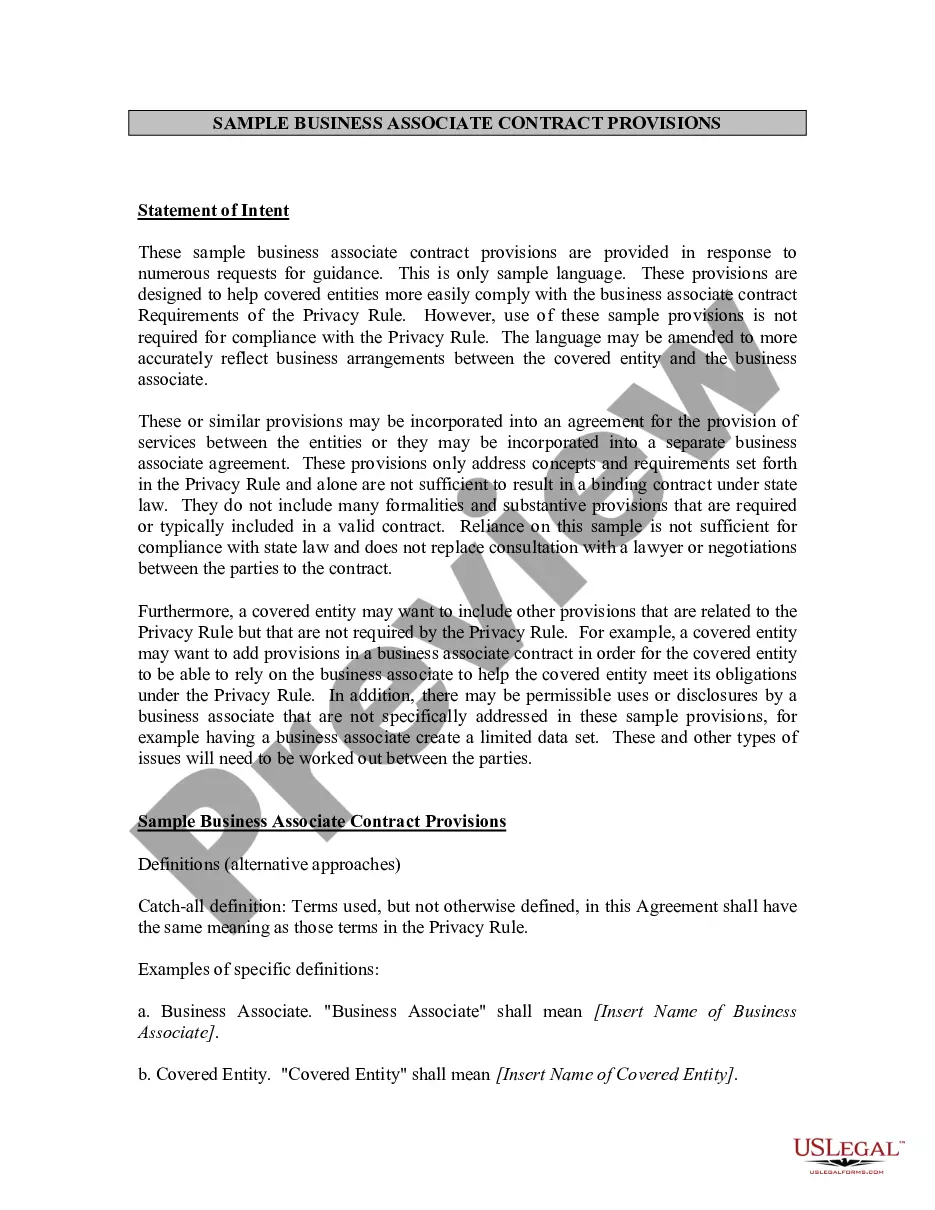

How to fill out Houston Texas Form - Stock Purchase Agreement For Strategic Investment Made At Time Of Initial Public Offering?

Preparing legal paperwork can be cumbersome. In addition, if you decide to ask an attorney to write a commercial contract, papers for proprietorship transfer, pre-marital agreement, divorce paperwork, or the Houston Form - Stock Purchase Agreement for Strategic Investment Made at Time of Initial Public Offering, it may cost you a lot of money. So what is the best way to save time and money and draft legitimate forms in total compliance with your state and local regulations? US Legal Forms is an excellent solution, whether you're looking for templates for your individual or business needs.

US Legal Forms is the most extensive online library of state-specific legal documents, providing users with the up-to-date and professionally checked forms for any scenario collected all in one place. Therefore, if you need the current version of the Houston Form - Stock Purchase Agreement for Strategic Investment Made at Time of Initial Public Offering, you can easily find it on our platform. Obtaining the papers requires a minimum of time. Those who already have an account should check their subscription to be valid, log in, and pick the sample by clicking on the Download button. If you haven't subscribed yet, here's how you can get the Houston Form - Stock Purchase Agreement for Strategic Investment Made at Time of Initial Public Offering:

- Look through the page and verify there is a sample for your region.

- Examine the form description and use the Preview option, if available, to ensure it's the sample you need.

- Don't worry if the form doesn't suit your requirements - look for the right one in the header.

- Click Buy Now when you find the needed sample and select the best suitable subscription.

- Log in or sign up for an account to purchase your subscription.

- Make a payment with a credit card or through PayPal.

- Opt for the document format for your Houston Form - Stock Purchase Agreement for Strategic Investment Made at Time of Initial Public Offering and save it.

Once done, you can print it out and complete it on paper or upload the template to an online editor for a faster and more practical fill-out. US Legal Forms enables you to use all the documents ever obtained many times - you can find your templates in the My Forms tab in your profile. Try it out now!