Middlesex Massachusetts Form — Stock Purchase Agreement for Strategic Investment Made at Time of Initial Public Offering is a legal document used in the state of Massachusetts for securing strategic investments during the initial public offering (IPO) process. This agreement lays out the terms and conditions under which a potential investor agrees to purchase stocks from a company going public. Keywords: Middlesex Massachusetts, Form, Stock Purchase Agreement, Strategic Investment, Initial Public Offering, IPO, legal document, terms and conditions, potential investor, purchase stocks, company going public. Types of Middlesex Massachusetts Form — Stock Purchase Agreement for Strategic Investment Made at Time of Initial Public Offering: 1. Common Stock Purchase Agreement: This type of agreement is the most common and straightforward form used during an IPO. It specifies the terms for purchasing common stocks in the company at the time of the IPO. 2. Preferred Stock Purchase Agreement: This agreement type is specific to situations where investors want to purchase preferred stocks rather than common stocks during the IPO. Preferred stocks usually come with various additional rights and preferences compared to common stocks, such as priority in dividend payments or liquidation. 3. Convertible Preferred Stock Purchase Agreement: This agreement caters to investors who wish to purchase convertible preferred stocks during the IPO. Convertible preferred stocks have the option to be converted into common stocks at a later time, providing flexibility for the investor. 4. Warrant Stock Purchase Agreement: This agreement involves the purchase of warrant stocks during the IPO. Warrants are financial instruments that grant the holder the right to purchase underlying stock at a predetermined price within a specific period. In conclusion, the Middlesex Massachusetts Form — Stock Purchase Agreement for Strategic Investment Made at Time of Initial Public Offering is a crucial legal document used to secure investments during the IPO process in Massachusetts. It comes in various types, including common stock, preferred stock, convertible preferred stock, and warrant stock purchase agreements, catering to different investor preferences and objectives.

Middlesex Massachusetts Form - Stock Purchase Agreement for Strategic Investment Made at Time of Initial Public Offering

Description

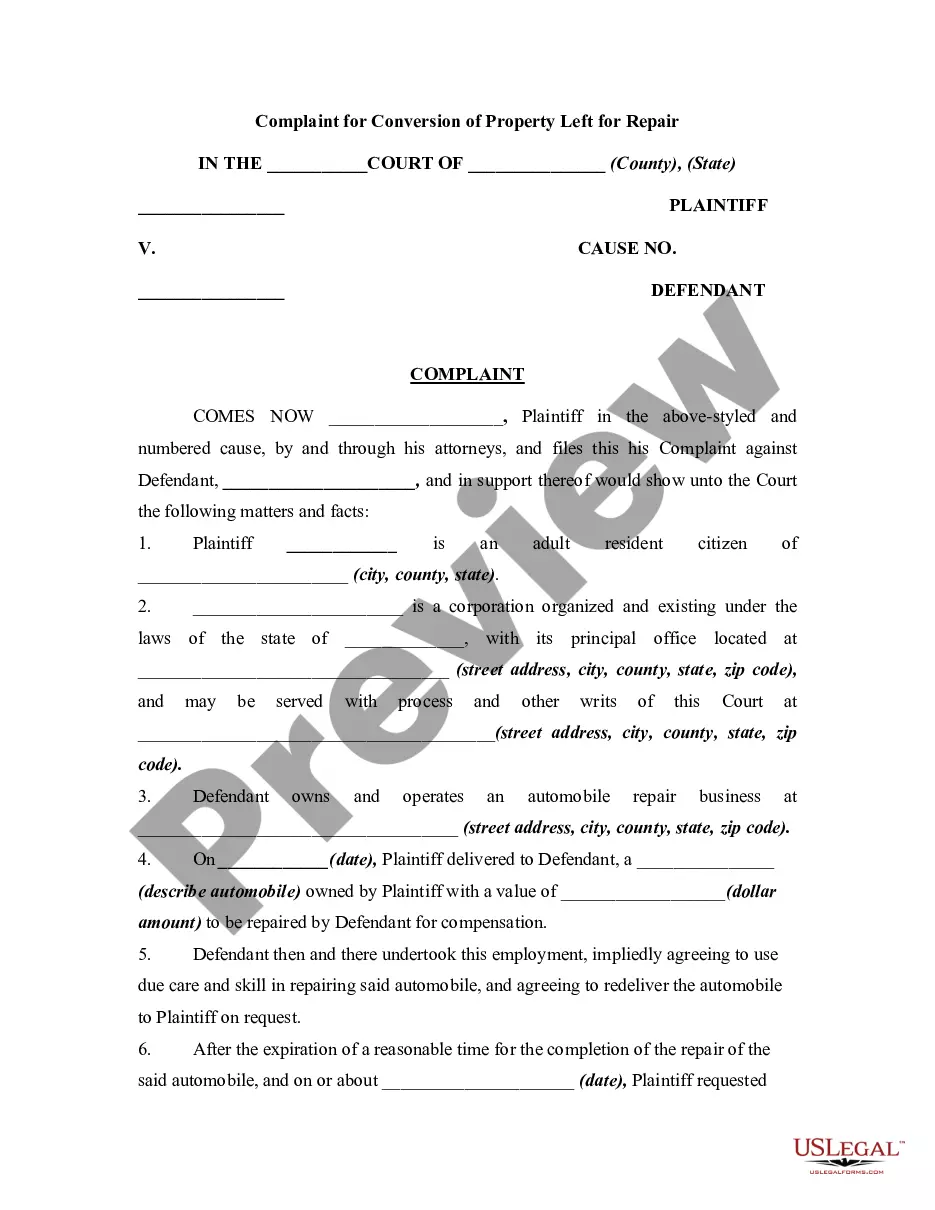

How to fill out Middlesex Massachusetts Form - Stock Purchase Agreement For Strategic Investment Made At Time Of Initial Public Offering?

How much time does it normally take you to draft a legal document? Considering that every state has its laws and regulations for every life sphere, locating a Middlesex Form - Stock Purchase Agreement for Strategic Investment Made at Time of Initial Public Offering meeting all local requirements can be exhausting, and ordering it from a professional attorney is often costly. Numerous web services offer the most common state-specific templates for download, but using the US Legal Forms library is most beneficial.

US Legal Forms is the most extensive web catalog of templates, grouped by states and areas of use. Apart from the Middlesex Form - Stock Purchase Agreement for Strategic Investment Made at Time of Initial Public Offering, here you can find any specific form to run your business or personal deeds, complying with your county requirements. Experts check all samples for their actuality, so you can be sure to prepare your paperwork properly.

Using the service is fairly simple. If you already have an account on the platform and your subscription is valid, you only need to log in, pick the needed form, and download it. You can get the document in your profile anytime later on. Otherwise, if you are new to the platform, there will be some extra actions to complete before you get your Middlesex Form - Stock Purchase Agreement for Strategic Investment Made at Time of Initial Public Offering:

- Check the content of the page you’re on.

- Read the description of the template or Preview it (if available).

- Look for another form utilizing the corresponding option in the header.

- Click Buy Now when you’re certain in the selected document.

- Decide on the subscription plan that suits you most.

- Sign up for an account on the platform or log in to proceed to payment options.

- Make a payment via PalPal or with your credit card.

- Change the file format if necessary.

- Click Download to save the Middlesex Form - Stock Purchase Agreement for Strategic Investment Made at Time of Initial Public Offering.

- Print the doc or use any preferred online editor to fill it out electronically.

No matter how many times you need to use the purchased document, you can locate all the files you’ve ever saved in your profile by opening the My Forms tab. Give it a try!

Form popularity

FAQ

The key provisions detail the terms of the transaction: the number and type of stock sold (i.e. common, preferred) the purchase price.

A stock purchase agreement is a contract to transfer ownership of stocks from the seller to the purchaser. The key provisions of a stock purchase agreement have to do with the transaction itself, such as the date of the transaction, the number of stock certificates, and the price per share.

A stock and asset purchase agreement is a contract between the buyer and seller of a business. It outlines the terms, conditions, and details regarding the sale of shares or ownership interest in an existing company.

Business Asset Purchase Agreement (APA): What You MUST Know! Preamble and Recitals. Identifying the Parties Involved. Purchase Price and Payment Terms. Representations and Warranties of the Buyer and Seller. Conditions to Closing and other Obligations of the Parties. Termination Provisions. Miscellaneous Terms.

Stock Purchase Agreement: Everything You Need to Know Name of company. Purchaser's name. Par value of shares. Number of shares being sold. When/where the transaction takes place. Representations and warranties made by purchaser and seller. Potential employee issues, such as bonuses and benefits.

An Investor Rights Agreement (IRA) is an agreement between an investor and a company that contractually guarantees the investor certain rights including, but not limited to, voting rights, inspection rights, rights of first refusal, and observer rights.

Stock purchase agreements (SPAs) are legally binding contracts between shareholders and companies. Also known as share purchase agreements, these contracts establish all of the terms and conditions related to the sale of a company's stocks.

Any purchase agreement should include at least the following information: The identity of the buyer and seller. A description of the property being purchased. The purchase price. The terms as to how and when payment is to be made. The terms as to how, when, and where the goods will be delivered to the purchaser.

Share Purchase Agreement Signing Requirements The Share Purchase Agreement needs to be signed by both the purchaser and seller of the shares. Before you put pen on paper, you want to review all the details and provisions for accuracy and your comfort level. It is not necessary to get the agreement notarized.

Stock Purchase Agreement: Everything You Need to Know Name of company. Purchaser's name. Par value of shares. Number of shares being sold. When/where the transaction takes place. Representations and warranties made by purchaser and seller. Potential employee issues, such as bonuses and benefits.