Keywords: Suffolk New York, stock purchase agreement, strategic investment, initial public offering Description: The Suffolk New York Form — Stock Purchase Agreement for Strategic Investment Made at Time of Initial Public Offering is a legal document that outlines the terms and conditions of a stock purchase agreement between a company and an investor. This agreement is specific to the Suffolk County region in New York, and it is designed to facilitate strategic investments in company stocks during the time of their initial public offerings (IPOs). The primary purpose of this form is to establish a clear understanding between the company issuing the stocks and the investor regarding the purchase and sale of shares. It sets forth the terms and conditions, including the number of shares being sold, the purchase price, the rights and obligations of both parties, and any additional provisions specific to the strategic investment. In the context of an IPO, this stock purchase agreement serves as a crucial tool for potential investors, enabling them to participate in the initial offering. The agreement ensures transparency and protection for both parties involved, outlining the rights and responsibilities that come with owning the shares. Different types of Suffolk New York Forms — Stock Purchase Agreement for Strategic Investment Made at Time of Initial Public Offering can be categorized based on the nature of the strategic investment. These variations may include: 1. Equity Investment Agreement: This type of agreement focuses on the purchase of equity shares, allowing the investor to hold ownership in the company. It commonly specifies voting rights and dividend entitlements. 2. Debt Investment Agreement: In contrast to equity investment, this agreement revolves around debt securities, such as convertible bonds or debentures. It outlines the terms of loaned capital, including interest rates and repayment schedules. 3. Preferred Stock Purchase Agreement: This agreement is specific to the acquisition of preferred stock, typically offering investors certain privileges over common stockholders, such as priority in dividends or liquidation proceeds. 4. Convertible Stock Purchase Agreement: Designed for investors seeking a potential future conversion of their stocks into another class of securities, such as common shares or debt instruments. This agreement states the terms of conversion, including conversion ratios and conditions. Regardless of the specific type, these agreements aim to bring clarity and security to both the issuing company and the investor, providing a solid foundation for their strategic investment during the IPO.

Suffolk New York Form - Stock Purchase Agreement for Strategic Investment Made at Time of Initial Public Offering

Description

How to fill out Suffolk New York Form - Stock Purchase Agreement For Strategic Investment Made At Time Of Initial Public Offering?

A document routine always goes along with any legal activity you make. Creating a company, applying or accepting a job offer, transferring property, and lots of other life scenarios demand you prepare formal paperwork that differs throughout the country. That's why having it all accumulated in one place is so helpful.

US Legal Forms is the most extensive online collection of up-to-date federal and state-specific legal templates. On this platform, you can easily locate and download a document for any personal or business objective utilized in your region, including the Suffolk Form - Stock Purchase Agreement for Strategic Investment Made at Time of Initial Public Offering.

Locating forms on the platform is amazingly simple. If you already have a subscription to our library, log in to your account, find the sample through the search field, and click Download to save it on your device. After that, the Suffolk Form - Stock Purchase Agreement for Strategic Investment Made at Time of Initial Public Offering will be accessible for further use in the My Forms tab of your profile.

If you are using US Legal Forms for the first time, adhere to this quick guideline to get the Suffolk Form - Stock Purchase Agreement for Strategic Investment Made at Time of Initial Public Offering:

- Ensure you have opened the right page with your local form.

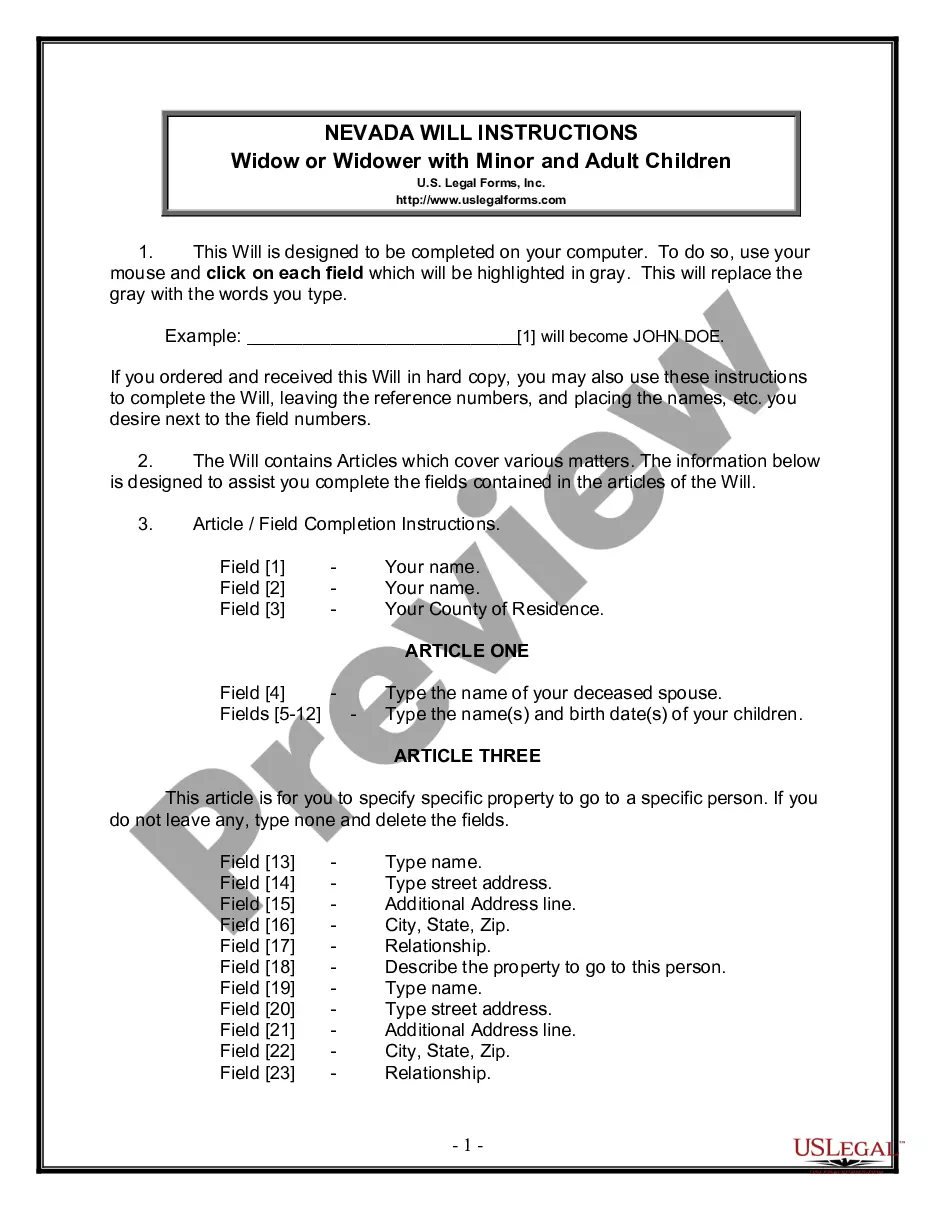

- Use the Preview mode (if available) and scroll through the sample.

- Read the description (if any) to ensure the template satisfies your needs.

- Search for another document via the search option if the sample doesn't fit you.

- Click Buy Now when you locate the necessary template.

- Select the appropriate subscription plan, then sign in or create an account.

- Select the preferred payment method (with credit card or PayPal) to continue.

- Opt for file format and save the Suffolk Form - Stock Purchase Agreement for Strategic Investment Made at Time of Initial Public Offering on your device.

- Use it as needed: print it or fill it out electronically, sign it, and send where requested.

This is the simplest and most reliable way to obtain legal paperwork. All the samples provided by our library are professionally drafted and verified for correspondence to local laws and regulations. Prepare your paperwork and run your legal affairs properly with the US Legal Forms!