Tarrant Texas Form - Stock Purchase Agreement for Strategic Investment Made at Time of Initial Public Offering

Description

How to fill out Tarrant Texas Form - Stock Purchase Agreement For Strategic Investment Made At Time Of Initial Public Offering?

Whether you plan to start your company, enter into an agreement, apply for your ID renewal, or resolve family-related legal issues, you must prepare certain paperwork meeting your local laws and regulations. Finding the correct papers may take a lot of time and effort unless you use the US Legal Forms library.

The platform provides users with more than 85,000 professionally drafted and verified legal documents for any personal or business occurrence. All files are grouped by state and area of use, so opting for a copy like Tarrant Form - Stock Purchase Agreement for Strategic Investment Made at Time of Initial Public Offering is quick and easy.

The US Legal Forms library users only need to log in to their account and click the Download key next to the required template. If you are new to the service, it will take you several more steps to get the Tarrant Form - Stock Purchase Agreement for Strategic Investment Made at Time of Initial Public Offering. Adhere to the guide below:

- Make sure the sample meets your individual needs and state law regulations.

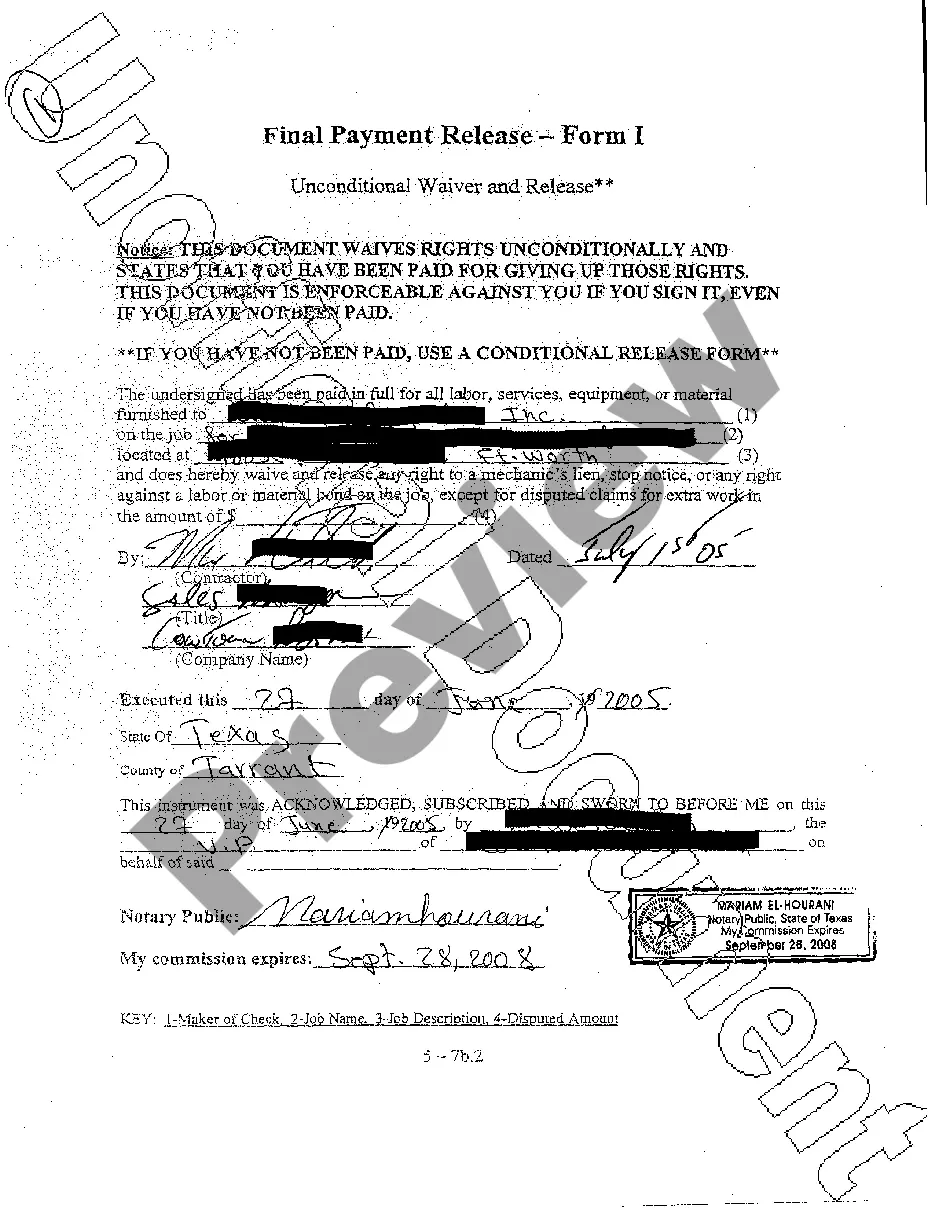

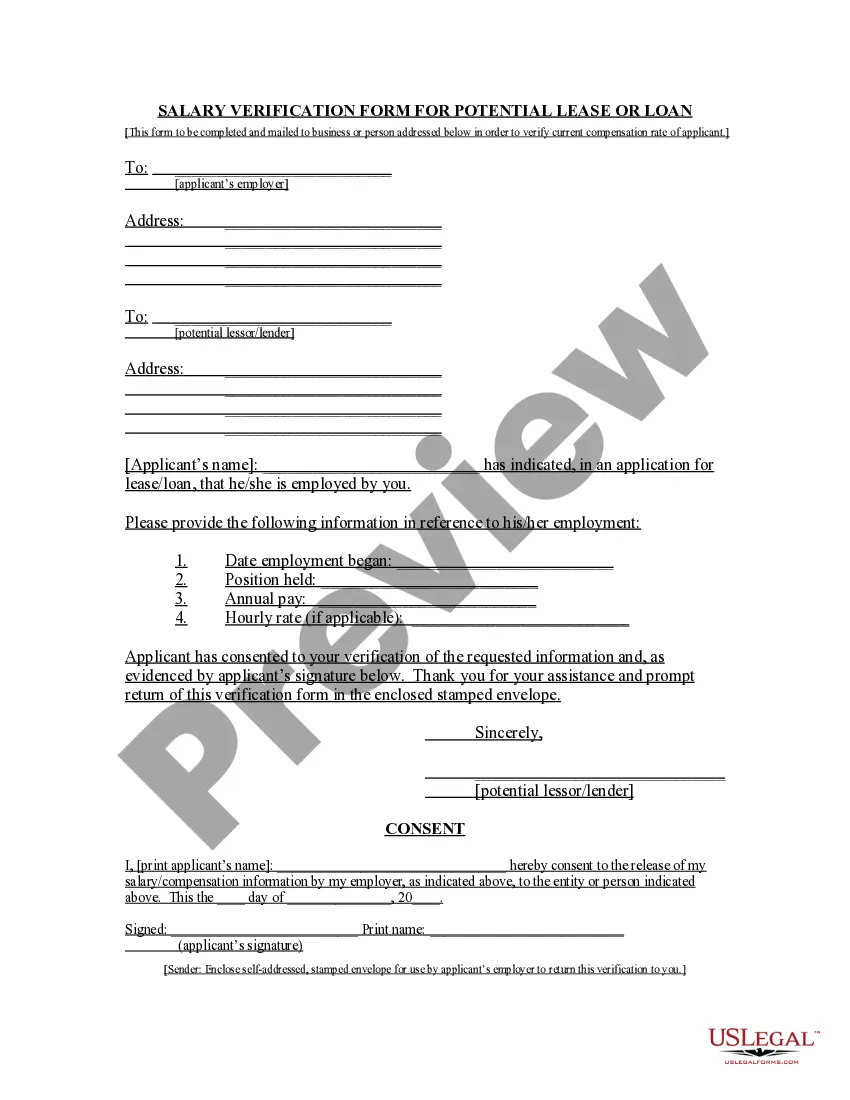

- Read the form description and check the Preview if there’s one on the page.

- Make use of the search tab providing your state above to locate another template.

- Click Buy Now to obtain the file when you find the proper one.

- Select the subscription plan that suits you most to proceed.

- Sign in to your account and pay the service with a credit card or PayPal.

- Download the Tarrant Form - Stock Purchase Agreement for Strategic Investment Made at Time of Initial Public Offering in the file format you require.

- Print the copy or fill it out and sign it electronically via an online editor to save time.

Forms provided by our library are reusable. Having an active subscription, you can access all of your earlier acquired paperwork at any moment in the My Forms tab of your profile. Stop wasting time on a endless search for up-to-date formal documentation. Sign up for the US Legal Forms platform and keep your paperwork in order with the most extensive online form collection!

Form popularity

FAQ

Stock purchase agreements or SPAs are transaction contracts for stock sale and acquisition. Their primary purpose is to establish the price of the stock being sold. SPAs achieve this by: Listing out the prices of the stock being sold.

Buying a Stock Investment: Stock purchases are when investors buy ownership of the shares of a company. The investor's purchase price is called the cost basis. The goal is to sell the stock at a higher price and realize a profit. A buy order is an instruction to a stockbroker to buy a security.

A stock and asset purchase agreement is a contract between the buyer and seller of a business. It outlines the terms, conditions, and details regarding the sale of shares or ownership interest in an existing company.

Stock Purchase Agreement: Everything You Need to Know Name of company. Purchaser's name. Par value of shares. Number of shares being sold. When/where the transaction takes place. Representations and warranties made by purchaser and seller. Potential employee issues, such as bonuses and benefits.

The key provisions detail the terms of the transaction: the number and type of stock sold (i.e. common, preferred) the purchase price.

What Is a Sales and Purchase Agreement (SPA)? A sales and purchase agreement (SPA) is a binding legal contract between two parties that obligates a transaction to occur between a buyer and seller. SPAs are typically used for real estate transactions, but they are found in other areas of business.

Business Asset Purchase Agreement (APA): What You MUST Know! Preamble and Recitals. Identifying the Parties Involved. Purchase Price and Payment Terms. Representations and Warranties of the Buyer and Seller. Conditions to Closing and other Obligations of the Parties. Termination Provisions. Miscellaneous Terms.

A stock purchase agreement, also known as an SPA, is a contract between buyers and sellers of company shares. This legal document transfers the ownership of stock and detail the terms of shares bought and sold by both parties. Other names for stock purchase agreements include: Stock transfer agreements.