The Bexar Texas Employment of Independent Contractors Package is a comprehensive set of documents and resources designed to legally establish and govern the working relationship between businesses and independent contractors in Bexar County, Texas. It ensures compliance with all applicable labor laws and protects the rights and interests of both parties involved. This package includes several important documents such as an Independent Contractor Agreement, Non-Disclosure Agreement, and a Scope of Work document. Each document serves a specific purpose in clarifying the terms of the engagement, ensuring confidentiality, and outlining the project's details and objectives. The Independent Contractor Agreement is a crucial component of the package, as it outlines the specific responsibilities, payment terms, and working arrangements between the hiring party and the independent contractor. It clearly defines the contractor's status as an independent entity, rather than an employee, and establishes the expectations and obligations of both parties. Another essential document included in the package is the Non-Disclosure Agreement (NDA). This agreement ensures that any sensitive or confidential information shared between the hiring party and the independent contractor remains protected and cannot be disclosed to any third parties. These safeguards trade secrets, proprietary information, and any other confidential data critical to the business. Additionally, the Scope of Work document details the specific tasks, deliverables, timelines, and milestones of the project or assignment. It serves as a roadmap for the independent contractor, ensuring clear communication and understanding of the project's scope and objectives. This helps in avoiding misunderstandings and disputes over expectations and deliverables. While the Bexar Texas Employment of Independent Contractors Package generally includes these primary documents, there might be additional variations or customized versions available depending on the specific industry or requirements of the hiring party. For instance, in industries such as construction, there might be specific contract templates or liability waivers included. By utilizing the Bexar Texas Employment of Independent Contractors Package, businesses in Bexar County can confidently engage independent contractors knowing that they have comprehensive legal protection and clear expectations in place. This package offers peace of mind and ensures a mutually beneficial working relationship between the hiring party and the independent contractor.

Bexar Texas Employment of Independent Contractors Package

Description

How to fill out Bexar Texas Employment Of Independent Contractors Package?

How much time does it usually take you to create a legal document? Given that every state has its laws and regulations for every life situation, finding a Bexar Employment of Independent Contractors Package meeting all local requirements can be exhausting, and ordering it from a professional attorney is often expensive. Many online services offer the most common state-specific templates for download, but using the US Legal Forms library is most beneficial.

US Legal Forms is the most comprehensive online collection of templates, collected by states and areas of use. Aside from the Bexar Employment of Independent Contractors Package, here you can get any specific form to run your business or personal deeds, complying with your county requirements. Specialists check all samples for their actuality, so you can be certain to prepare your paperwork properly.

Using the service is remarkably straightforward. If you already have an account on the platform and your subscription is valid, you only need to log in, opt for the required form, and download it. You can get the document in your profile anytime later on. Otherwise, if you are new to the platform, there will be some extra steps to complete before you obtain your Bexar Employment of Independent Contractors Package:

- Examine the content of the page you’re on.

- Read the description of the template or Preview it (if available).

- Look for another form using the corresponding option in the header.

- Click Buy Now when you’re certain in the selected document.

- Decide on the subscription plan that suits you most.

- Register for an account on the platform or log in to proceed to payment options.

- Pay via PalPal or with your credit card.

- Change the file format if necessary.

- Click Download to save the Bexar Employment of Independent Contractors Package.

- Print the sample or use any preferred online editor to fill it out electronically.

No matter how many times you need to use the purchased template, you can locate all the files you’ve ever saved in your profile by opening the My Forms tab. Give it a try!

Form popularity

FAQ

Let's explore the following categories of independent contractor tax deductions. Home office. Educational expenses. Depreciation of property and equipment. Car expenses. Business travel. Cell phone. Health insurance. Business insurance.

1099 employees are generally individuals who are in an independent trade, business, or profession in which they offer their services to the general public (not just a single customer or employer), including: Doctors. Dentists.

When the company supplies those things to its workers, the workers are considered employees. Independent contractors provide their own equipment, buy their own supplies and do their own industry training.

Employers need to file Form 1099 for every independent contractor they work with, and Form W-2 for every employee. Other than these tax forms, the main differences between W-2 employees and 1099 contractors are: Work schedule: employers determine working hours for their employees, but not for independent contractors.

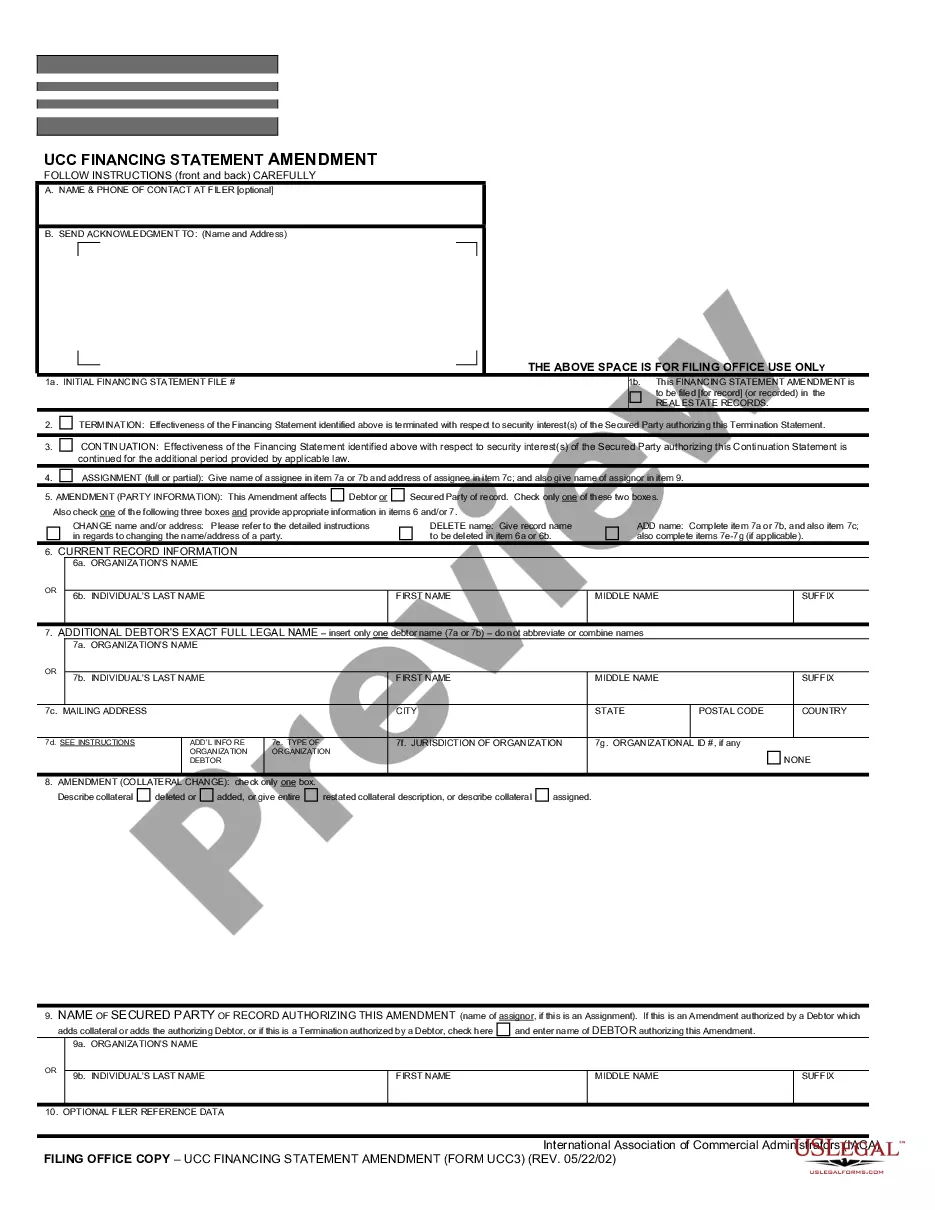

Essential Forms for Hiring Independent Contractors W-9 Form.Work Agreement or Contract.Payment Information and Documentation.Form 1099-NEC.Confidentiality Agreements.Non-Compete Agreements.Proof of Worker's Compensation.

Here is a list of steps you can follow to help you hire a 1099 employee: Correctly classify the individual.Check credentials and employment history.Create a contract.Have them fill out the proper forms.Integrate into company.

There are a number of advantages to being a contractor. Contract work provides greater independence and, for many people, a greater perceived level of job security than traditional employment. Less commuting, fewer meetings, less office politics and you can work the hours that suit you and your lifestyle best.

7 Terms you should include in an independent contractor agreement? Statement of Relationship.Project Description.Payment and Billing Terms.Responsibilities of Each Party.Project Timeline and Deadlines.Termination Conditions.Nondisclosure Terms, and Confidentiality and Non-Compete Clauses.

The current self-employment tax rate is 12.4% for Social Security and 2.9% for Medicare a total of 15.3% just in self-employment tax. The good news is that while you need to pay the entire 15.3% tax, you can take half of what you pay as a deduction from your income.

The only problem is that it is often illegal. There is no such thing as a 1099 employee. The 1099 part of the name refers to the fact that independent contractors receive a form 1099 at the end of the year, which reports to the IRS how much money was paid to the contractor.