The Contra Costa California Certificate of Limited Partnership of New Private Equity Fund is a legal document that establishes the formation of a private equity investment vehicle within Contra Costa County, California. This certificate serves as proof of the partnership's existence and outlines crucial details regarding its operations, management, and investment strategies. Private equity funds are investment vehicles that pool capital from various investors to acquire stakes in privately held companies or participate in specific projects. These funds are typically managed by professional investment firms or general partners who oversee the entire investment process, from sourcing deals to providing returns to investors. In Contra Costa County, California, there may be different types of Certificates of Limited Partnership for various private equity funds, including but not limited to: 1. Contra Costa Growth Equity Fund — This type of private equity fund focuses on investing in companies or projects with high growth potential. The fund actively seeks opportunities that can provide significant capital appreciation over the long term. 2. Contra Costa Venture Capital Fund — Venture capital funds primarily target early-stage startups and companies with highly innovative products or business models. These funds provide capital, mentorship, and strategic support to help these companies grow and succeed. 3. Contra Costa Real Estate Private Equity Fund — Real estate private equity funds specialize in financing and investing in real estate projects, such as residential developments, commercial properties, or infrastructure. These funds seek capital appreciation and current income from rental or lease payments. 4. Contra Costa Distressed Asset Fund — Distressed asset funds focus on investing in distressed companies that may be experiencing financial difficulties, bankruptcy, or restructuring. These funds aim to acquire these assets at a discount and turn them around for a profit. When establishing a new private equity fund within Contra Costa County, California, the Certificate of Limited Partnership provides critical information about the partnership's name, its general partner(s), limited partner(s), and their respective rights and obligations. The certificate may also outline the fund's investment objectives, its duration, and the process for admitting new investors or withdrawing from the partnership. Overall, the Contra Costa California Certificate of Limited Partnership of New Private Equity Fund serves as a legally binding document that formalizes the creation of a private equity fund in Contra Costa County, California, and defines its structure and operation.

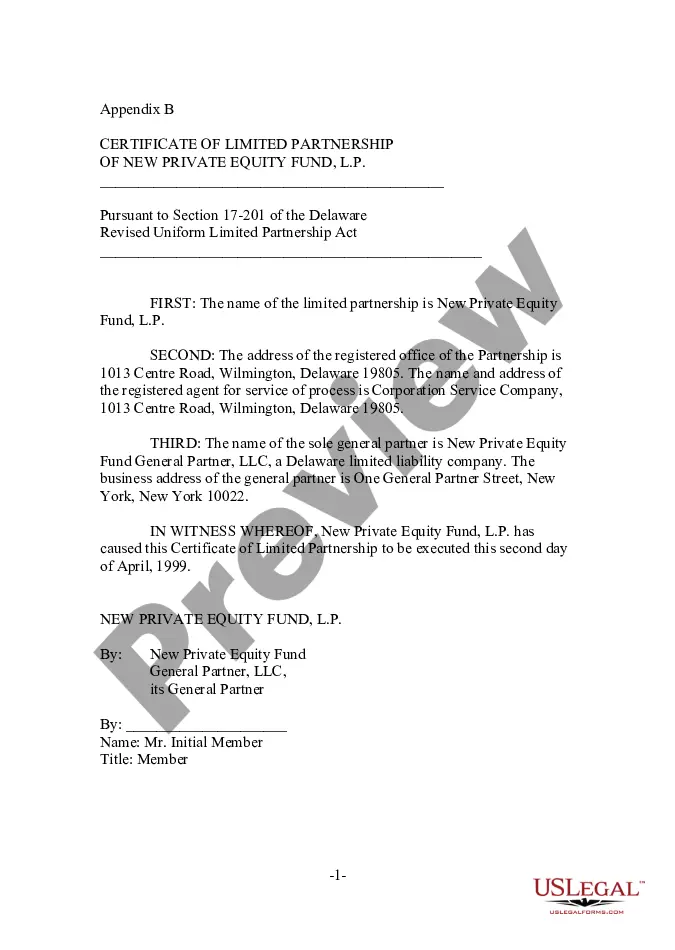

Contra Costa California Certificate of Limited Partnership of New Private Equity Fund

Description

How to fill out Contra Costa California Certificate Of Limited Partnership Of New Private Equity Fund?

Dealing with legal forms is a necessity in today's world. Nevertheless, you don't always need to look for qualified assistance to create some of them from scratch, including Contra Costa Certificate of Limited Partnership of New Private Equity Fund, with a platform like US Legal Forms.

US Legal Forms has over 85,000 forms to pick from in various categories ranging from living wills to real estate papers to divorce documents. All forms are organized based on their valid state, making the searching experience less frustrating. You can also find detailed materials and tutorials on the website to make any tasks related to document execution simple.

Here's how to purchase and download Contra Costa Certificate of Limited Partnership of New Private Equity Fund.

- Take a look at the document's preview and outline (if provided) to get a basic information on what you’ll get after downloading the form.

- Ensure that the template of your choosing is adapted to your state/county/area since state regulations can affect the legality of some documents.

- Check the similar forms or start the search over to find the appropriate file.

- Click Buy now and create your account. If you already have an existing one, choose to log in.

- Choose the pricing {plan, then a needed payment method, and buy Contra Costa Certificate of Limited Partnership of New Private Equity Fund.

- Choose to save the form template in any offered file format.

- Visit the My Forms tab to re-download the file.

If you're already subscribed to US Legal Forms, you can find the needed Contra Costa Certificate of Limited Partnership of New Private Equity Fund, log in to your account, and download it. Of course, our website can’t replace an attorney completely. If you need to cope with an exceptionally challenging case, we advise getting an attorney to review your form before executing and submitting it.

With over 25 years on the market, US Legal Forms proved to be a go-to provider for many different legal forms for millions of customers. Become one of them today and get your state-specific paperwork with ease!