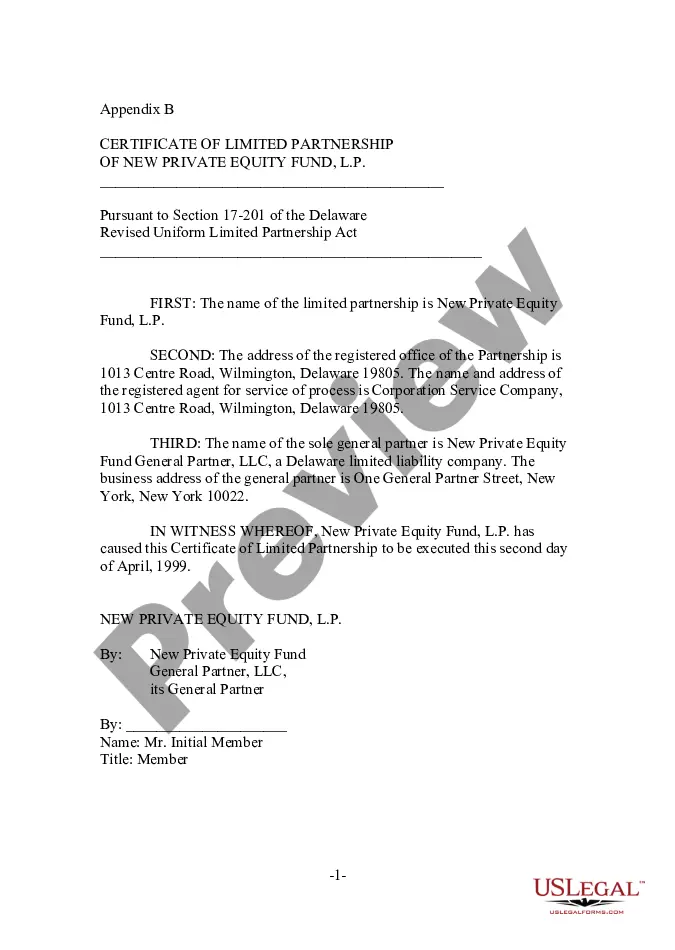

The Fairfax Virginia Certificate of Limited Partnership of a New Private Equity Fund is a legal document that establishes the formation and structure of a new private equity fund in Fairfax, Virginia. This certificate is an essential requirement for any private equity fund that wishes to operate in this region. Private equity funds are investment vehicles that pool capital from a variety of investors, such as institutional investors, pension funds, and high-net-worth individuals. These funds are managed by professional investment managers who utilize the pooled capital to invest in potentially high-growth companies or distressed assets with the aim of generating substantial returns for their investors. The Certificate of Limited Partnership is a formal agreement that outlines the terms and conditions under which the private equity fund will operate. It defines the roles and responsibilities of the general partners, who manage the fund, and the limited partners, who provide the capital. This document also outlines the distribution of profits, the duration of the partnership, and the procedures for adding or withdrawing partners. In Fairfax, Virginia, multiple types of Certificates of Limited Partnership may be established, depending on the specific nature of the private equity fund. Some examples include: 1. Traditional Private Equity Fund: This type of private equity fund typically focuses on acquiring controlling stakes in established companies with growth potential. The fund's managers work closely with the company's management team to improve operations and generate higher shareholder value. 2. Venture Capital Fund: Venture capital funds primarily invest in startups or early-stage companies with significant growth prospects. These funds often provide not only financial support but also mentorship and guidance to the invested companies. 3. Mezzanine Debt Fund: Mezzanine debt funds provide a hybrid form of financing by offering junior debt to companies, usually with a combination of both debt and equity features. These funds fill the gap between traditional bank debt and equity financing options. 4. Distressed Asset Fund: Distressed asset funds specialize in investing in financially distressed companies or distressed assets. They acquire these assets at discounted prices with the goal of turning them around or liquidating them for a profit. 5. Real Estate Private Equity Fund: Real estate private equity funds focus on investing in commercial or residential real estate properties, development projects, or real estate-backed companies. These funds generate returns through rental income, capital appreciation, or property sales. In conclusion, the Fairfax Virginia Certificate of Limited Partnership is a crucial legal document that establishes the formation and structure of a private equity fund in Fairfax, Virginia. It ensures that the fund operates within the legal framework and outlines the rights and obligations of the partners involved. The different types of private equity funds in Fairfax, Virginia cater to varying investment strategies, such as traditional equity investments, venture capital, mezzanine debt, distressed asset investing, and real estate investments.

Fairfax Virginia Certificate of Limited Partnership of New Private Equity Fund

Description

How to fill out Fairfax Virginia Certificate Of Limited Partnership Of New Private Equity Fund?

A document routine always goes along with any legal activity you make. Creating a company, applying or accepting a job offer, transferring property, and many other life situations require you prepare formal paperwork that differs from state to state. That's why having it all collected in one place is so helpful.

US Legal Forms is the biggest online collection of up-to-date federal and state-specific legal templates. Here, you can easily find and download a document for any individual or business purpose utilized in your county, including the Fairfax Certificate of Limited Partnership of New Private Equity Fund.

Locating templates on the platform is extremely simple. If you already have a subscription to our service, log in to your account, find the sample through the search field, and click Download to save it on your device. Following that, the Fairfax Certificate of Limited Partnership of New Private Equity Fund will be available for further use in the My Forms tab of your profile.

If you are using US Legal Forms for the first time, follow this quick guideline to obtain the Fairfax Certificate of Limited Partnership of New Private Equity Fund:

- Ensure you have opened the correct page with your localised form.

- Make use of the Preview mode (if available) and browse through the template.

- Read the description (if any) to ensure the template corresponds to your needs.

- Search for another document using the search option in case the sample doesn't fit you.

- Click Buy Now when you locate the required template.

- Select the suitable subscription plan, then log in or create an account.

- Select the preferred payment method (with credit card or PayPal) to continue.

- Opt for file format and download the Fairfax Certificate of Limited Partnership of New Private Equity Fund on your device.

- Use it as needed: print it or fill it out electronically, sign it, and send where requested.

This is the easiest and most trustworthy way to obtain legal documents. All the samples provided by our library are professionally drafted and checked for correspondence to local laws and regulations. Prepare your paperwork and manage your legal affairs efficiently with the US Legal Forms!