Salt Lake Utah Certificate of Limited Partnership of New Private Equity Fund is a legal document that establishes a new private equity fund in the state of Utah. It provides a detailed outline of the partnership agreement, governing the relationship between the general and limited partners involved in the fund. This certificate serves as an important regulatory requirement and is filed with the appropriate authorities to validate the existence of the fund. Keywords: Salt Lake Utah, Certificate of Limited Partnership, New Private Equity Fund, legal document, partnership agreement, general partner, limited partner, regulatory requirement, filing, validation. Different Types of Salt Lake Utah Certificate of Limited Partnership of New Private Equity Fund: 1. Growth Equity Fund: This type of private equity fund focuses on investing in companies with significant growth potential. It aims to provide capital and strategic support to facilitate the expansion and development of these businesses. 2. Venture Capital Fund: A venture capital fund primarily targets early-stage or high-growth startups with immense potential. It provides financing, mentorship, and expertise to these companies in exchange for an equity stake. This fund aims to generate substantial returns through successful exits. 3. Buyout Fund: A buyout fund is designed to acquire controlling stakes in established companies with the goal of improving their operations, enhancing their value, and eventually selling them for a profit. It typically invests in mature businesses or divisions that require restructuring or turnaround strategies. 4. Mezzanine Fund: Mezzanine funds provide a combination of debt and equity financing to companies. They function as a hybrid between private equity and debt financing, offering subordinate loans or convertible debt instruments. Mezzanine funds often invest in established companies with stable cash flows and solid growth potential. 5. Distressed Debt Fund: Distressed debt funds specialize in purchasing the debt of financially troubled companies at a significant discount. They aim to capitalize on distressed situations by acquiring troubled debt with potential for recovery. The fund managers then work towards restructuring the company's operations and financials to turn it around and generate profitable returns. 6. Secondary Private Equity Fund: Secondary funds invest in pre-existing private equity investments by purchasing limited partner interests from other investors. These funds offer liquidity options to limited partners seeking to exit their investments before the expiration of the fund's life cycle. 7. Real Estate Private Equity Fund: This type of fund focuses on investing in various real estate properties, including residential, commercial, or industrial projects. Real estate private equity funds typically aim to generate returns through rental income, property appreciation, or development projects. Keywords: Growth Equity Fund, Venture Capital Fund, Buyout Fund, Mezzanine Fund, Distressed Debt Fund, Secondary Private Equity Fund, Real Estate Private Equity Fund.

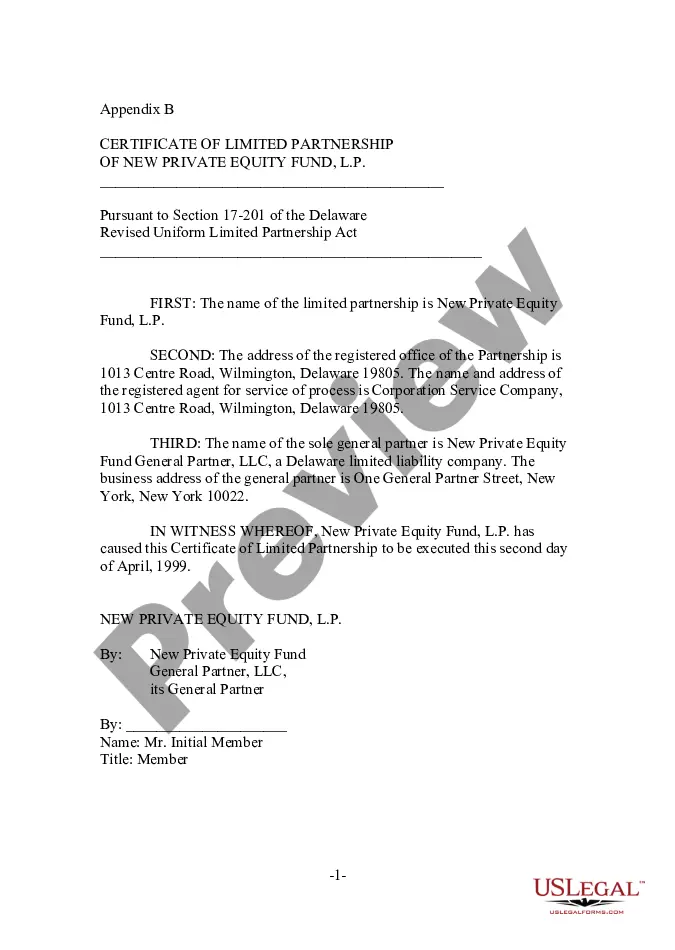

Salt Lake Utah Certificate of Limited Partnership of New Private Equity Fund

Description

How to fill out Salt Lake Utah Certificate Of Limited Partnership Of New Private Equity Fund?

Whether you intend to open your company, enter into a contract, apply for your ID update, or resolve family-related legal concerns, you must prepare certain documentation meeting your local laws and regulations. Finding the correct papers may take a lot of time and effort unless you use the US Legal Forms library.

The platform provides users with more than 85,000 professionally drafted and checked legal documents for any individual or business occurrence. All files are collected by state and area of use, so picking a copy like Salt Lake Certificate of Limited Partnership of New Private Equity Fund is fast and simple.

The US Legal Forms website users only need to log in to their account and click the Download button next to the required template. If you are new to the service, it will take you a couple of more steps to get the Salt Lake Certificate of Limited Partnership of New Private Equity Fund. Follow the instructions below:

- Make sure the sample fulfills your personal needs and state law requirements.

- Look through the form description and check the Preview if available on the page.

- Make use of the search tab providing your state above to locate another template.

- Click Buy Now to get the sample when you find the correct one.

- Select the subscription plan that suits you most to continue.

- Log in to your account and pay the service with a credit card or PayPal.

- Download the Salt Lake Certificate of Limited Partnership of New Private Equity Fund in the file format you need.

- Print the copy or fill it out and sign it electronically via an online editor to save time.

Forms provided by our website are multi-usable. Having an active subscription, you can access all of your previously acquired paperwork at any time in the My Forms tab of your profile. Stop wasting time on a endless search for up-to-date formal documents. Sign up for the US Legal Forms platform and keep your paperwork in order with the most comprehensive online form library!