The San Antonio Texas Certificate of Limited Partnership of a New Private Equity Fund is a legal document that establishes the formation and existence of a limited partnership in the private equity sector in San Antonio, Texas. This certificate is specifically designed for entities seeking to establish a private equity fund in the San Antonio region. Private equity funds are investment vehicles that pool capital from investors and deploy it into various businesses with the goal of generating substantial returns. These funds often invest in companies at different stages of their growth, such as startups, early-stage companies, or even established businesses looking for expansion or restructuring. The San Antonio Texas Certificate of Limited Partnership outlines the structure, governance, and rights and responsibilities of the partners involved in the private equity fund. It serves as a legally binding agreement between the general partner(s) and limited partner(s), defining their roles and contribution limits within the fund. The certificate typically includes important details such as the fund's name, principal place of business (which would be San Antonio, Texas in this case), duration of the partnership, capital contributions required from each limited partner, profit and loss allocation mechanisms, management responsibilities, and other provisions necessary for the smooth operation and administration of the fund. It is important to note that various types of private equity funds can be established using the San Antonio Texas Certificate of Limited Partnership, depending on the investment strategy and focus of the fund. Some common types include: 1. Venture Capital Funds: These funds primarily invest in high-potential startups and early-stage companies, usually in technology-driven industries, with the aim of achieving significant capital appreciation. 2. Growth Equity Funds: These funds focus on investing in established companies that are seeking capital to expand their operations or enter new markets. They typically provide funding in exchange for minority ownership stakes. 3. Buyout Funds: These funds primarily target mature companies, often with a proven track record, and acquire a controlling stake through a leveraged buyout or similar strategies. The aim is to improve operational efficiencies, drive growth, and eventually sell the company for a substantial profit. 4. Distressed Debt Funds: These funds invest in the debt of troubled companies or distressed assets, seeking to generate returns by restructuring the debt, taking control of the company, or selling off the assets for a profit. The San Antonio Texas Certificate of Limited Partnership provides the necessary legal foundation and framework for the successful establishment and operation of these private equity fund types in the San Antonio region. It ensures that all parties involved are aware of their rights, obligations, and the governance structure of the fund, promoting transparency and accountability within the partnership.

San Antonio Texas Certificate of Limited Partnership of New Private Equity Fund

Description

How to fill out San Antonio Texas Certificate Of Limited Partnership Of New Private Equity Fund?

Whether you intend to open your company, enter into a deal, apply for your ID update, or resolve family-related legal issues, you must prepare certain documentation meeting your local laws and regulations. Locating the right papers may take a lot of time and effort unless you use the US Legal Forms library.

The platform provides users with more than 85,000 expertly drafted and checked legal documents for any personal or business occurrence. All files are grouped by state and area of use, so opting for a copy like San Antonio Certificate of Limited Partnership of New Private Equity Fund is fast and easy.

The US Legal Forms library users only need to log in to their account and click the Download button next to the required form. If you are new to the service, it will take you a few more steps to get the San Antonio Certificate of Limited Partnership of New Private Equity Fund. Adhere to the guide below:

- Make certain the sample fulfills your individual needs and state law regulations.

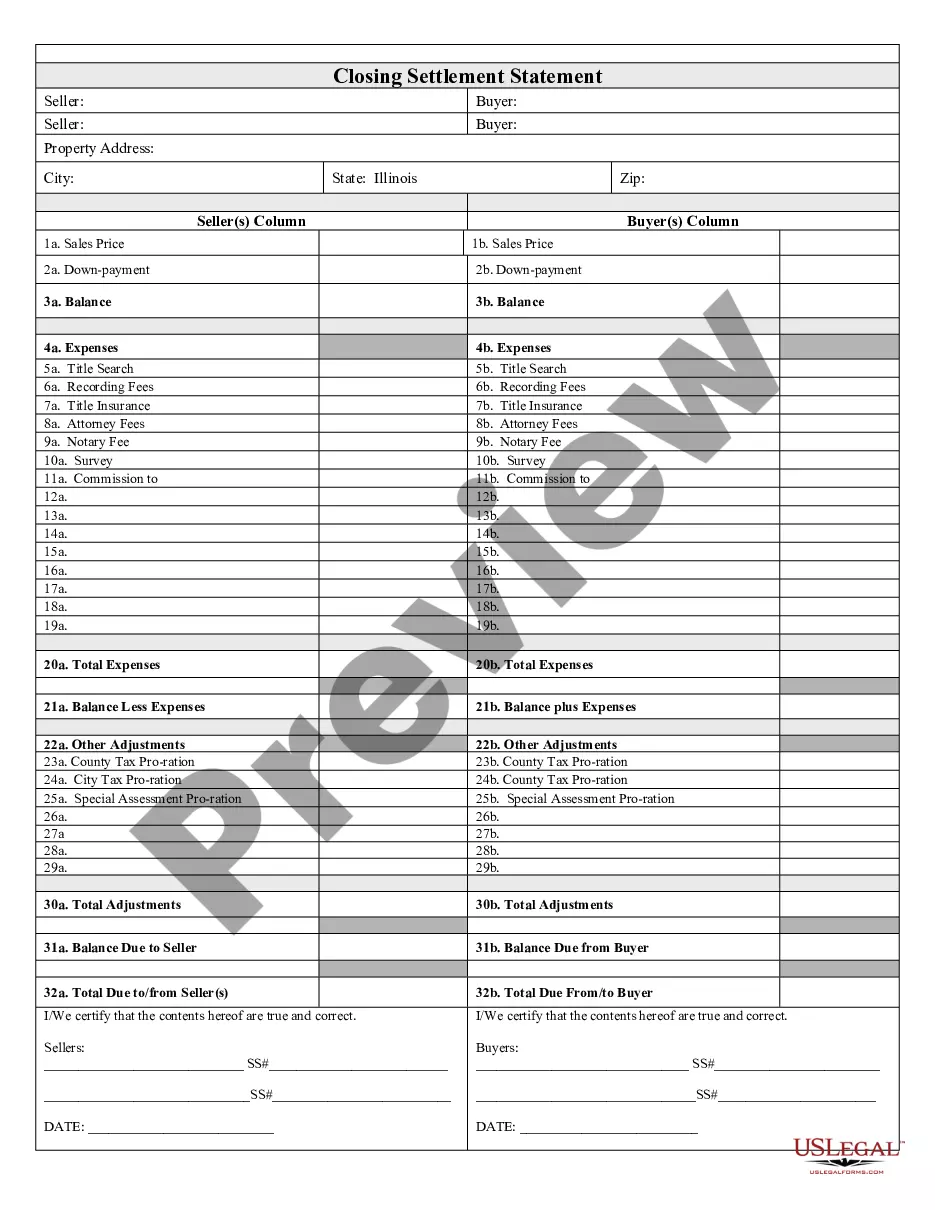

- Read the form description and check the Preview if available on the page.

- Make use of the search tab providing your state above to find another template.

- Click Buy Now to obtain the sample once you find the right one.

- Select the subscription plan that suits you most to continue.

- Log in to your account and pay the service with a credit card or PayPal.

- Download the San Antonio Certificate of Limited Partnership of New Private Equity Fund in the file format you need.

- Print the copy or fill it out and sign it electronically via an online editor to save time.

Forms provided by our library are multi-usable. Having an active subscription, you can access all of your previously acquired paperwork whenever you need in the My Forms tab of your profile. Stop wasting time on a endless search for up-to-date official documents. Sign up for the US Legal Forms platform and keep your paperwork in order with the most comprehensive online form library!