The Harris Texas Amended Equity Fund Partnership Agreement is a legally binding document that outlines the terms and conditions governing the partnership between multiple parties involved in the formation and management of an equity fund in Harris County, Texas. This agreement is designed to establish the rights, responsibilities, and obligations of the partners, as well as the operations, management, and decision-making processes of the equity fund. Keywords: Harris Texas, Amended Equity Fund Partnership Agreement, partnership, equity fund, Harris County, Texas, rights, responsibilities, obligations, operations, management, decision-making. There are different types of Harris Texas Amended Equity Fund Partnership Agreements that may be specific to the purpose and structure of the equity fund. These variations may include: 1. Limited Partnership Agreement: This type of agreement defines the roles and responsibilities of general partners, who manage and operate the equity fund, and limited partners, who invest capital into the fund but do not participate in day-to-day operations or decision-making. 2. Private Equity Fund Partnership Agreement: This agreement focuses on the establishment and management of a private equity fund, which typically invests in privately held companies with the aim of generating capital appreciation. 3. Real Estate Equity Fund Partnership Agreement: This type of agreement is tailored to address partnerships that invest specifically in real estate properties. It outlines how the fund will acquire, manage, and sell properties to generate returns. 4. Public Equity Fund Partnership Agreement: This agreement is relevant when the equity fund invests in publicly traded securities, such as stocks and bonds, and follows regulations tailored to public market investments. 5. Renewable Energy Equity Fund Partnership Agreement: This variation is specific to partnerships that focus on investing in renewable energy projects, like solar or wind farms, and addresses the unique challenges and considerations associated with this sector. 6. Growth Equity Fund Partnership Agreement: This agreement applies to partnerships that aim to invest in companies with significant growth potential, often providing capital and expertise to support the expansion and development of these businesses. It is important to customize the Harris Texas Amended Equity Fund Partnership Agreement to suit the specific needs and objectives of the partners involved, as well as the nature of the equity fund being established. Seeking legal counsel is highly recommended ensuring compliance with relevant laws and regulations.

Harris Texas Amended Equity Fund Partnership Agreement

Description

How to fill out Harris Texas Amended Equity Fund Partnership Agreement?

Laws and regulations in every area vary around the country. If you're not a lawyer, it's easy to get lost in various norms when it comes to drafting legal documentation. To avoid high priced legal assistance when preparing the Harris Amended Equity Fund Partnership Agreement, you need a verified template legitimate for your region. That's when using the US Legal Forms platform is so helpful.

US Legal Forms is a trusted by millions web catalog of more than 85,000 state-specific legal templates. It's a perfect solution for professionals and individuals looking for do-it-yourself templates for different life and business occasions. All the forms can be used multiple times: once you pick a sample, it remains available in your profile for future use. Therefore, when you have an account with a valid subscription, you can just log in and re-download the Harris Amended Equity Fund Partnership Agreement from the My Forms tab.

For new users, it's necessary to make some more steps to obtain the Harris Amended Equity Fund Partnership Agreement:

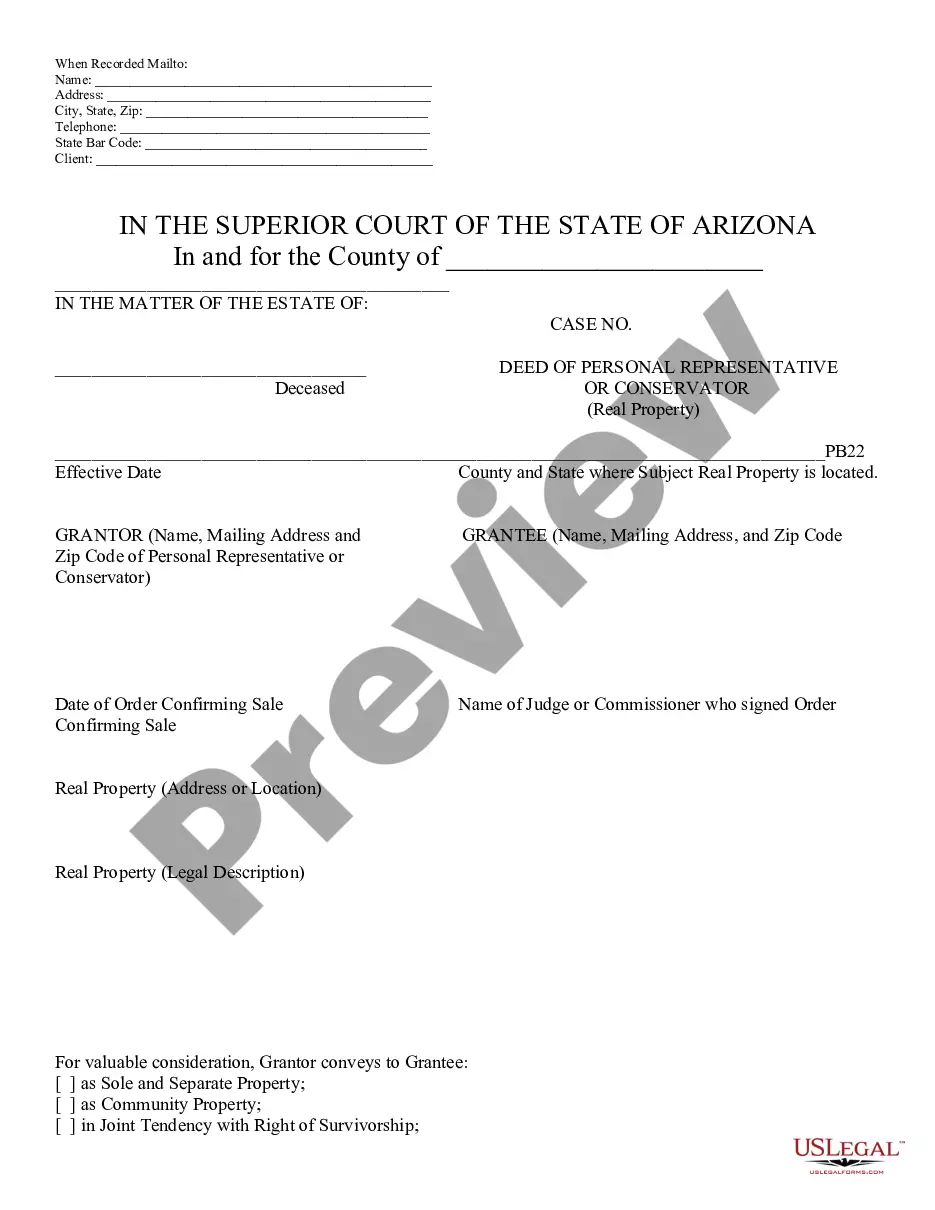

- Examine the page content to make sure you found the correct sample.

- Take advantage of the Preview option or read the form description if available.

- Search for another doc if there are inconsistencies with any of your requirements.

- Utilize the Buy Now button to obtain the template when you find the appropriate one.

- Opt for one of the subscription plans and log in or create an account.

- Decide how you prefer to pay for your subscription (with a credit card or PayPal).

- Select the format you want to save the file in and click Download.

- Fill out and sign the template in writing after printing it or do it all electronically.

That's the simplest and most economical way to get up-to-date templates for any legal scenarios. Locate them all in clicks and keep your documentation in order with the US Legal Forms!