The Harris Texas Investment Management Agreement refers to a legally binding contract between an investor and an investment management company based in Texas, specifically known as Harris Texas. This agreement outlines the terms and conditions under which the investment management company will handle and manage the investor's assets and investments. By entering into this agreement, investors can benefit from the expertise and professional services provided by Harris Texas to achieve their financial objectives. The Harris Texas Investment Management Agreement covers various aspects such as investment objectives, risk tolerance, investment strategy, fee structure, and duration of the agreement. This agreement ensures that both parties are aligned in their goals and expectations, ultimately aiming to enhance the investor's portfolio performance and potential returns. Key terms and keywords that are relevant to the Harris Texas Investment Management Agreement include: 1. Investment Management Company: Harris Texas, a reputable investment management firm based in Texas, offering a range of services to investors. 2. Investor: The individual or entity seeking professional investment management services from Harris Texas. 3. Assets: Refers to the various types of investments owned by the investor, including stocks, bonds, mutual funds, real estate, and other securities. 4. Investment Objectives: The specific goals an investor wants to achieve through their investments, such as growth, income, or capital preservation. 5. Risk Tolerance: The degree of comfort an investor has regarding the potential volatility and fluctuations in investment returns. 6. Investment Strategy: The approach taken by Harris Texas to manage the investor's assets, which may involve diversification, asset allocation, sector rotation, and other techniques to maximize returns and manage risk. 7. Fee Structure: The compensation structure outlined in the agreement, which may include a percentage of assets under management, performance-based fees, or flat fees. 8. Duration: The specified time period for which the agreement remains in effect, typically subject to renewal or termination clauses. Furthermore, it should be noted that there might be different types of Harris Texas Investment Management Agreements, tailored to meet specific investor needs or investment strategies. Some potential variations may include separate agreements for individual investors, institutional investors, high net worth individuals, retirement accounts, or specific investment vehicles like mutual funds or private equity funds. These variations would address unique requirements and regulatory considerations associated with each type of investment.

Harris Texas Investment Management Agreement

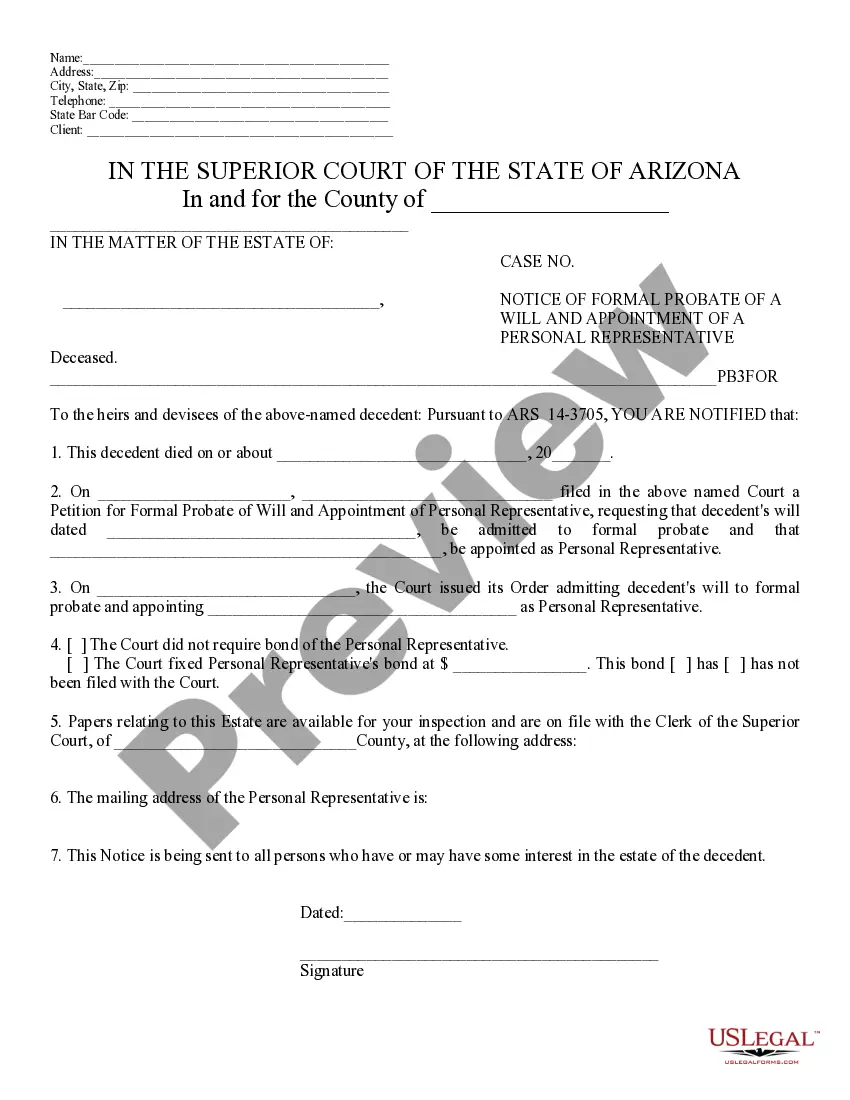

Description

How to fill out Harris Texas Investment Management Agreement?

A document routine always accompanies any legal activity you make. Creating a company, applying or accepting a job offer, transferring property, and many other life scenarios require you prepare formal documentation that differs from state to state. That's why having it all accumulated in one place is so helpful.

US Legal Forms is the biggest online library of up-to-date federal and state-specific legal templates. Here, you can easily find and download a document for any individual or business purpose utilized in your region, including the Harris Investment Management Agreement.

Locating forms on the platform is amazingly straightforward. If you already have a subscription to our service, log in to your account, find the sample using the search bar, and click Download to save it on your device. After that, the Harris Investment Management Agreement will be accessible for further use in the My Forms tab of your profile.

If you are using US Legal Forms for the first time, follow this simple guide to obtain the Harris Investment Management Agreement:

- Make sure you have opened the right page with your local form.

- Utilize the Preview mode (if available) and browse through the sample.

- Read the description (if any) to ensure the template meets your needs.

- Look for another document via the search tab if the sample doesn't fit you.

- Click Buy Now when you find the necessary template.

- Decide on the suitable subscription plan, then sign in or create an account.

- Select the preferred payment method (with credit card or PayPal) to continue.

- Choose file format and download the Harris Investment Management Agreement on your device.

- Use it as needed: print it or fill it out electronically, sign it, and file where requested.

This is the easiest and most reliable way to obtain legal documents. All the templates available in our library are professionally drafted and checked for correspondence to local laws and regulations. Prepare your paperwork and manage your legal affairs properly with the US Legal Forms!