Wayne Michigan Investment Management Agreement is a legally binding contract that outlines the terms and conditions agreed upon between an investor and an investment manager in Wayne, Michigan. This agreement is crucial for individuals or organizations seeking professional assistance in managing their investment portfolio. It establishes the responsibilities, expectations, and limitations for both parties involved, ensuring a transparent and efficacious working relationship. The Wayne Michigan Investment Management Agreement covers a wide range of investment-related activities, including but not limited to portfolio analysis, asset allocation, risk assessment, investment research, and trade execution. By signing this agreement, investors entrust their investment decisions to experienced professionals who possess the necessary expertise and knowledge of local and global financial markets. There are several types of Wayne Michigan Investment Management Agreements available, which cater to varying needs and preferences: 1. Discretionary Investment Management Agreement: This type of agreement grants the investment manager full authority to make investment decisions on behalf of the investor. The manager has the power to buy or sell assets without obtaining prior consent, within the agreed-upon investment objectives. 2. Non-Discretionary Investment Management Agreement: Under this agreement, the investment manager provides investment advice to the investor, but the final decision-making authority remains with the investor. The manager's role is to provide recommendations and execute trades based on the investor's instructions. 3. Performance-Based Fee Investment Management Agreement: In such agreements, the investment manager's compensation is directly linked to the performance of the investment portfolio. The manager receives a predetermined percentage of the investment gains, incentivizing them to strive for superior investment returns. 4. Fee-Only Investment Management Agreement: This type of agreement ensures that the investment manager's compensation is solely based on a fixed fee or an hourly rate. It eliminates any potential conflicts of interest associated with commissions received from financial products or services, ultimately focusing on the investor's best interests. Wayne Michigan Investment Management Agreements typically include essential provisions regarding fees, performance benchmarks, reporting obligations, termination clauses, and confidentiality requirements. It is essential for prospective investors to thoroughly review and understand the terms of the agreement before signing, seeking legal advice if necessary. By engaging in an Investment Management Agreement, investors in Wayne, Michigan can instill confidence and peace of mind in the process of managing their financial assets.

Wayne Michigan Investment Management Agreement

Description

How to fill out Wayne Michigan Investment Management Agreement?

Whether you plan to start your company, enter into an agreement, apply for your ID renewal, or resolve family-related legal issues, you must prepare certain documentation meeting your local laws and regulations. Locating the correct papers may take a lot of time and effort unless you use the US Legal Forms library.

The service provides users with more than 85,000 expertly drafted and verified legal documents for any individual or business occasion. All files are grouped by state and area of use, so opting for a copy like Wayne Investment Management Agreement is quick and simple.

The US Legal Forms library users only need to log in to their account and click the Download button next to the required form. If you are new to the service, it will take you several additional steps to get the Wayne Investment Management Agreement. Adhere to the guidelines below:

- Make certain the sample meets your individual needs and state law regulations.

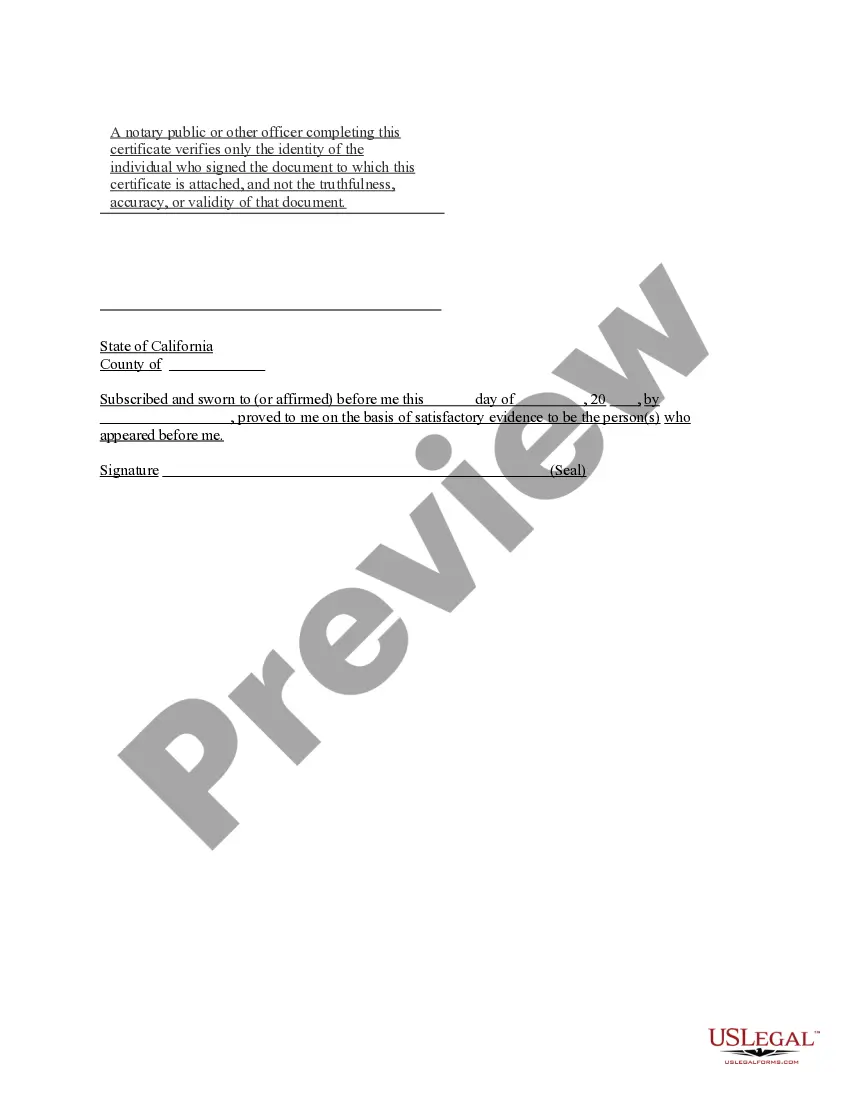

- Read the form description and check the Preview if there’s one on the page.

- Make use of the search tab providing your state above to locate another template.

- Click Buy Now to obtain the file when you find the proper one.

- Select the subscription plan that suits you most to proceed.

- Sign in to your account and pay the service with a credit card or PayPal.

- Download the Wayne Investment Management Agreement in the file format you prefer.

- Print the copy or complete it and sign it electronically via an online editor to save time.

Forms provided by our library are multi-usable. Having an active subscription, you are able to access all of your previously acquired paperwork whenever you need in the My Forms tab of your profile. Stop wasting time on a endless search for up-to-date official documentation. Join the US Legal Forms platform and keep your paperwork in order with the most comprehensive online form library!

Form popularity

FAQ

Portfolio Management Agreement means an agreement to be entered into by the Issuer, the Trustee and the Portfolio Manager on the Issue Date pursuant to which the Portfolio Manager will perform certain management functions with respect to the Reference Portfolio.

Investment management agreements (IMAs) are legal documents that give investment managers the authority to manage capital on behalf of investors. They detail the terms and conditions under which a client will invest in a shared vehicle while agreeing to pay investment management service fees and direct expenses.

Investment Management Account (IMA) refers to the management of financial assets or investments of an individual or a corporate client in which LANDBANK Trust Banking Group (TBG) acts as a portfolio manager.

Investment mandates set out the Government's broad expectations of how we will invest the assets of each fund. They set the benchmark return for each fund and the timeframe in which it should be achieved. We balance the risk aspects of each investment mandate to maximise returns.

Investment advisory contracts are legal documents that outline the relationship between the client and the investment advisor. They provide clear guidelines of what is expected of each party in order for your needs to be met.

A special memorandum account (SMA) is a dedicated investment account where excess margin generated from a client's margin account is deposited, thereby increasing the buying power for the client. The SMA essentially represents a line of credit and may also be known as a "special miscellaneous account."

Investment management agreements (IMAs) are legal documents that give investment managers the authority to manage capital on behalf of investors. They detail the terms and conditions under which a client will invest in a shared vehicle while agreeing to pay investment management service fees and direct expenses.

Portfolio management is the selection, prioritisation and control of an organisation's programmes and projects, in line with its strategic objectives and capacity to deliver. The goal is to balance the implementation of change initiatives and the maintenance of business-as-usual, while optimising return on investment.

The particular structure of the SMA is the reason why, in our view, an IMA or MDA is often a better option. In an IMA or MDA, unlike an SMA, an operator can time or stagger investment decisions in response to market conditions.

An Individually Managed Account or IMA is a discretionary management agreement whereby clients delegate the day to day investment decisions and implementation of their chosen investment strategy to PPM while retaining the full beneficial ownership of their investments.