Suffolk New York Short Form Limited Liability Company LLC Agreement is a legal document that outlines the terms and conditions of the formation and operation of a limited liability company (LLC) in Suffolk County, New York. This agreement serves as the foundation for the LLC and governs the relationships among its members, known as the managing members and non-managing members, as well as the internal affairs of the company. The Suffolk New York Short Form Limited Liability Company LLC Agreement includes various key provisions that define the roles, responsibilities, rights, and obligations of the LLC and its members. Some essential elements covered in this agreement may include: 1. Formation: This section outlines the process of forming the LLC, including its name, purpose, principal place of business, and duration. 2. Members: It specifies the identities of managing and non-managing members, their ownership interests, contribution amounts, and voting rights. 3. Management: This part discusses how the LLC will be managed, whether by the members collectively, a designated managing member, or an appointed manager. 4. Capital Contributions: It stipulates the initial contributions made by members to the LLC, as well as the procedure for additional contributions in the future. 5. Distributions: This provision outlines how profits will be distributed among members and whether there will be any preferred allocations or special distribution rights. 6. Meetings and Voting: It describes the frequency and protocol of LLC meetings, the quorum required for decision-making, and the voting power of each member. 7. Transferability of Interests: This section governs the transferability of membership interests and outlines any restrictions or preemption rights that may apply. 8. Dissolution: It specifies the circumstances under which the LLC may be dissolved, as well as the procedures for winding up its affairs and distributing assets upon dissolution. The Suffolk New York Short Form Limited Liability Company LLC Agreement may have variations depending on the specific needs and preferences of the LLC members. Some different types of agreements that may exist within this category include Single-Member LLC Agreement, Multi-Member LLC Agreement, Operating Agreement for Professional LCS, and Manager-Managed LLC Agreement. Overall, the Suffolk New York Short Form Limited Liability Company LLC Agreement is a crucial legal document that provides a comprehensive framework for managing an LLC's affairs and ensuring clarity and protection for all involved parties. It is always advisable to consult with an attorney or legal professional when drafting or reviewing such agreements to ensure compliance with applicable laws and regulations.

Suffolk New York Short Form Limited Liability Company LLC Agreement

Description

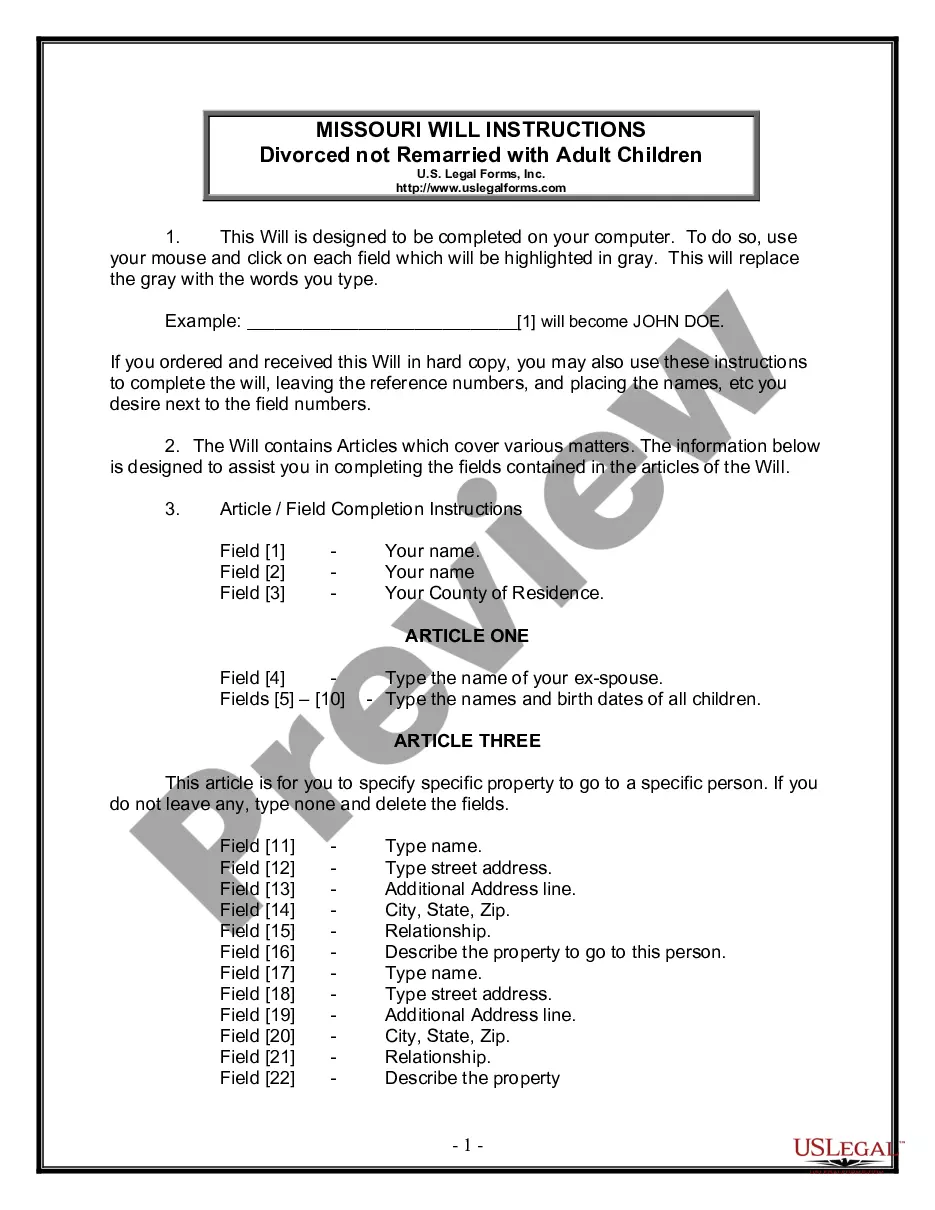

How to fill out Suffolk New York Short Form Limited Liability Company LLC Agreement?

Drafting documents for the business or individual needs is always a huge responsibility. When creating an agreement, a public service request, or a power of attorney, it's crucial to take into account all federal and state regulations of the specific region. Nevertheless, small counties and even cities also have legislative procedures that you need to consider. All these aspects make it tense and time-consuming to draft Suffolk Short Form Limited Liability Company LLC Agreement without expert help.

It's possible to avoid wasting money on lawyers drafting your paperwork and create a legally valid Suffolk Short Form Limited Liability Company LLC Agreement by yourself, using the US Legal Forms online library. It is the greatest online collection of state-specific legal documents that are professionally verified, so you can be certain of their validity when picking a sample for your county. Previously subscribed users only need to log in to their accounts to save the required document.

If you still don't have a subscription, adhere to the step-by-step instruction below to obtain the Suffolk Short Form Limited Liability Company LLC Agreement:

- Examine the page you've opened and check if it has the sample you require.

- To achieve this, use the form description and preview if these options are available.

- To find the one that fits your requirements, utilize the search tab in the page header.

- Recheck that the sample complies with juridical criteria and click Buy Now.

- Select the subscription plan, then log in or create an account with the US Legal Forms.

- Use your credit card or PayPal account to pay for your subscription.

- Download the chosen document in the preferred format, print it, or fill it out electronically.

The great thing about the US Legal Forms library is that all the paperwork you've ever acquired never gets lost - you can get it in your profile within the My Forms tab at any time. Join the platform and easily obtain verified legal templates for any situation with just a couple of clicks!