Collin Texas Limited Liability Company LLC Agreement for New General Partner is a legal document that outlines the rights, responsibilities, and obligations of a new general partner in a limited liability company (LLC) based in Collin County, Texas. This agreement is crucial for defining the relationship between the new general partner and the existing members or managing partners of the LLC. In this partnership agreement, the new general partner agrees to assume certain duties and responsibilities in managing the operations, finances, and decision-making processes of the LLC. The agreement typically covers important aspects such as profit sharing, capital contributions, voting rights, management authority, and the process for admitting or removing partners. The agreement also addresses the potential risks and liabilities that the new general partner may face, ensuring there is limited personal liability for the company's debts and obligations. It defines the limited liability aspect of an LLC, shielding the new general partner's personal assets from being held accountable in case of legal claims or debts incurred by the company. Generally, there are no specific variations of Collin Texas Limited Liability Company LLC Agreement for New General Partner. However, variations may arise based on the specific requirements or preferences of the parties involved. For instance, the agreement may include clauses on restrictions or allowances regarding the transfer of ownership interests, buyout provisions, non-compete agreements, or dispute resolution mechanisms. The Collin Texas Limited Liability Company LLC Agreement for New General Partner serves as a vital foundation for the LLC's structure, operations, and governance. It ensures that all parties are aware of their rights and obligations, protecting the interests of both the new general partner and the existing members or managing partners. This legally binding document provides clarity and guidance throughout the partnership, preventing potential misunderstandings and disputes. Keywords: Collin Texas, limited liability company, LLC agreement, new general partner, partnership agreement, managing partners, duties and responsibilities, profit sharing, capital contributions, voting rights, management authority, admitting partner, removing partner, risks and liabilities, limited personal liability, legal claims, debts, specific requirements, transfer of ownership interests, buyout provisions, non-compete agreements, dispute resolution mechanisms, structure, operations, governance, clarity, misunderstandings, disputes.

Collin Texas Limited Liability Company LLC Agreement for New General Partner

Description

How to fill out Collin Texas Limited Liability Company LLC Agreement For New General Partner?

Preparing documents for the business or individual demands is always a huge responsibility. When creating a contract, a public service request, or a power of attorney, it's crucial to consider all federal and state regulations of the particular region. However, small counties and even cities also have legislative provisions that you need to consider. All these aspects make it tense and time-consuming to draft Collin Limited Liability Company LLC Agreement for New General Partner without expert help.

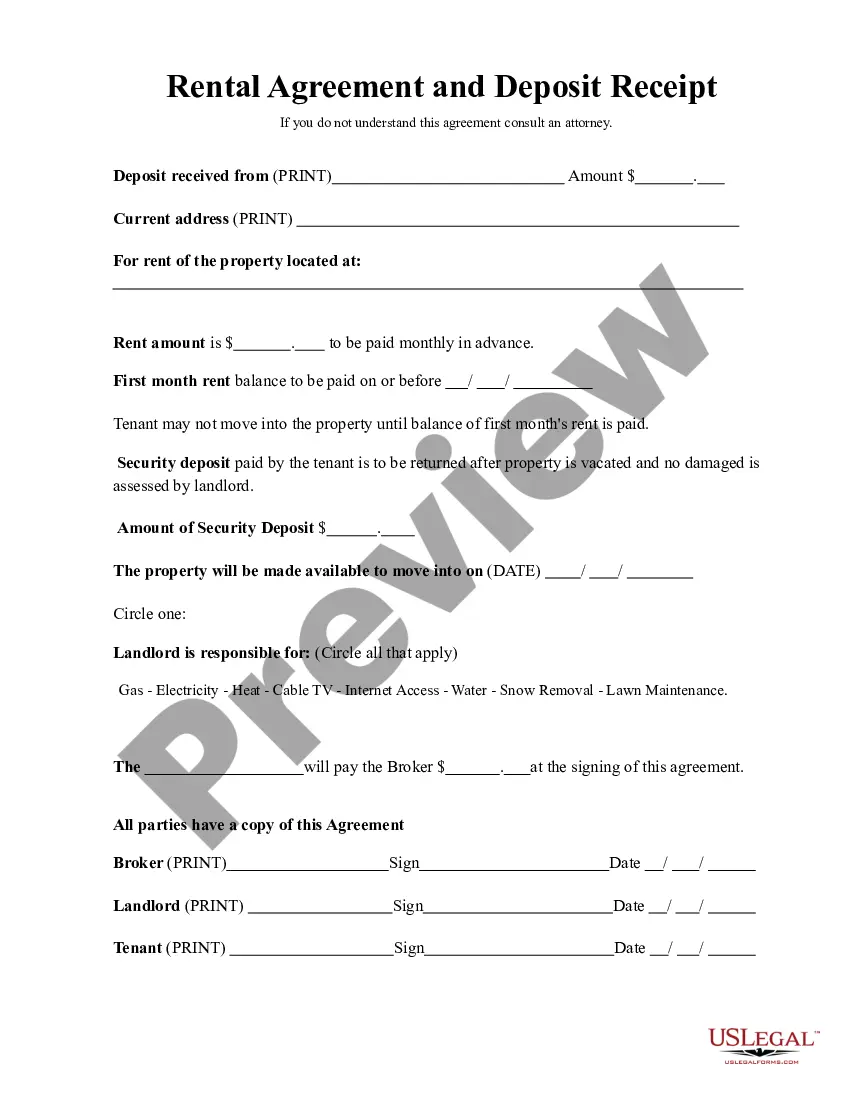

It's easy to avoid wasting money on lawyers drafting your documentation and create a legally valid Collin Limited Liability Company LLC Agreement for New General Partner by yourself, using the US Legal Forms web library. It is the greatest online catalog of state-specific legal templates that are professionally verified, so you can be sure of their validity when selecting a sample for your county. Previously subscribed users only need to log in to their accounts to download the needed document.

If you still don't have a subscription, adhere to the step-by-step instruction below to get the Collin Limited Liability Company LLC Agreement for New General Partner:

- Look through the page you've opened and verify if it has the sample you need.

- To accomplish this, use the form description and preview if these options are available.

- To find the one that meets your requirements, use the search tab in the page header.

- Double-check that the sample complies with juridical criteria and click Buy Now.

- Opt for the subscription plan, then log in or create an account with the US Legal Forms.

- Utilize your credit card or PayPal account to pay for your subscription.

- Download the chosen document in the preferred format, print it, or complete it electronically.

The exceptional thing about the US Legal Forms library is that all the documentation you've ever purchased never gets lost - you can access it in your profile within the My Forms tab at any time. Join the platform and easily get verified legal forms for any scenario with just a few clicks!

Form popularity

FAQ

Generally speaking, the process for how to add an LLC member involves amending the LLC's operating agreement that brings in the new member. Current LLC members must then vote on the amendment for it to passand most states, as well as many LLC operating agreements, require unanimous approval.

A general partner LLC, one of the most common types of partnerships, is arranged by two partners that have sole ownership of and liability for the business. This means they control all aspects of the business and are held financially responsible for its obligations and debts.

Most states do not require LLCs to have this document, so many LLCs choose not to draft one. While it may not be a requirement to have an operating agreement, it's actually in the best interest of an LLC to draft one. And by drafting it, I'm referring to creating a written operating agreement.

An LLC partnership can have two or more owners, called members. Limited liability companies with multiple members are referred to as multi-member LLCs or LLC partnerships. Under an LLC partnership, members' personal assets are protected. In most cases, members can't be sued for the business's actions or debts.

General partnerships have no restrictions on who can be owners. Owners can range from individuals to corporations to LLCs. In addition, states do not place restrictions on the types of businesses in which LLCs can participate. Therefore, LLCs can serve as general partners in a partnership.

What Type of Liability Protection Do You Get With an LLC? The main reason people form LLCs is to avoid personal liability for the debts of a business they own or are involved in. By forming an LLC, only the LLC is liable for the debts and liabilities incurred by the businessnot the owners or managers.

Limited liability companies (LLCs) are common ways for real estate owners and developers to hold title to property. Their popularity is due, in part, to the fact that LLCs limit members' personal liability. In other words, only an LLC member's equity investment is usually at risk, not his or her personal assets.

A managing partner of an LLC is the partner who runs the company. Other partners may be general partners or even nominal partners who have less of an active role in day-to-day operations and may be silent or public representatives of the company. The managing member has a significant role to play.

Aside from formation requirements, the main difference between a partnership and an LLC is that partners are personally liable for any business debts of the partnership -- meaning that creditors of the partnership can go after the partners' personal assets -- while members (owners) of an LLC are not personally liable

A domestic LLC with at least two members is classified as a partnership for federal income tax purposes unless it files Form 8832 and elects to be treated as a corporation.