Wayne Michigan Limited Liability Company (LLC) Agreement for New General Partner is a legal document that outlines the rights, responsibilities, and obligations of a new general partner joining an LLC based in Wayne, Michigan. This agreement serves to govern the relationship between the LLC and the new general partner, ensuring smooth operations and defining the partnership's terms. The agreement covers various important aspects such as profit and loss sharing, management authority, decision-making processes, capital contributions, and the withdrawal or transfer of partnership interests. It also specifies the duration of the partnership and any provisions for its termination or dissolution. There are several types of Wayne Michigan Limited Liability Company LLC Agreements for New General Partner, each tailored to meet specific business requirements: 1. Single-Member LLC Agreement for New General Partner: This agreement is designed for situations where the LLC has only one member, namely the new general partner. It outlines the roles and responsibilities of the lone partner in compliance with Michigan's regulations for single-member LCS. 2. Multi-Member LLC Agreement for New General Partner: This agreement caters to LCS with multiple members, including the new general partner. It addresses the distribution of profits and losses among partners, decision-making processes, and the rights and obligations of each member. 3. Capital Contribution LLC Agreement for New General Partner: This agreement focuses primarily on the capital contributions made by the new general partner to the LLC. It specifies the amount and terms of these contributions, as well as any additional agreements related to capital investment. 4. Buyout LLC Agreement for New General Partner: This agreement comes into play when a new general partner joins the LLC by buying out an existing member's interest. It outlines the process of transferring ownership, the valuation of the member's interest, and any additional terms or conditions associated with the buyout. 5. Operating Agreement Amendment LLC Agreement for New General Partner: In cases where the new general partner's addition requires modifications to the existing LLC agreement, an operating agreement amendment is created. This agreement specifies the necessary changes, ensuring a legally binding and up-to-date document. The Wayne Michigan Limited Liability Company LLC Agreement for New General Partner, in any of its variations, provides a comprehensive framework for governing the partnership and protecting the rights and investments of all involved parties. It is essential to consult with legal professionals to draft an agreement that aligns with Michigan state laws and caters to the specific needs of the LLC and its new general partner.

Wayne Michigan Limited Liability Company LLC Agreement for New General Partner

Description

How to fill out Wayne Michigan Limited Liability Company LLC Agreement For New General Partner?

Preparing legal paperwork can be burdensome. Besides, if you decide to ask a lawyer to write a commercial contract, papers for proprietorship transfer, pre-marital agreement, divorce papers, or the Wayne Limited Liability Company LLC Agreement for New General Partner, it may cost you a fortune. So what is the most reasonable way to save time and money and draft legitimate forms in total compliance with your state and local laws? US Legal Forms is a perfect solution, whether you're looking for templates for your personal or business needs.

US Legal Forms is the most extensive online catalog of state-specific legal documents, providing users with the up-to-date and professionally checked forms for any scenario accumulated all in one place. Consequently, if you need the latest version of the Wayne Limited Liability Company LLC Agreement for New General Partner, you can easily locate it on our platform. Obtaining the papers requires a minimum of time. Those who already have an account should check their subscription to be valid, log in, and select the sample by clicking on the Download button. If you haven't subscribed yet, here's how you can get the Wayne Limited Liability Company LLC Agreement for New General Partner:

- Look through the page and verify there is a sample for your region.

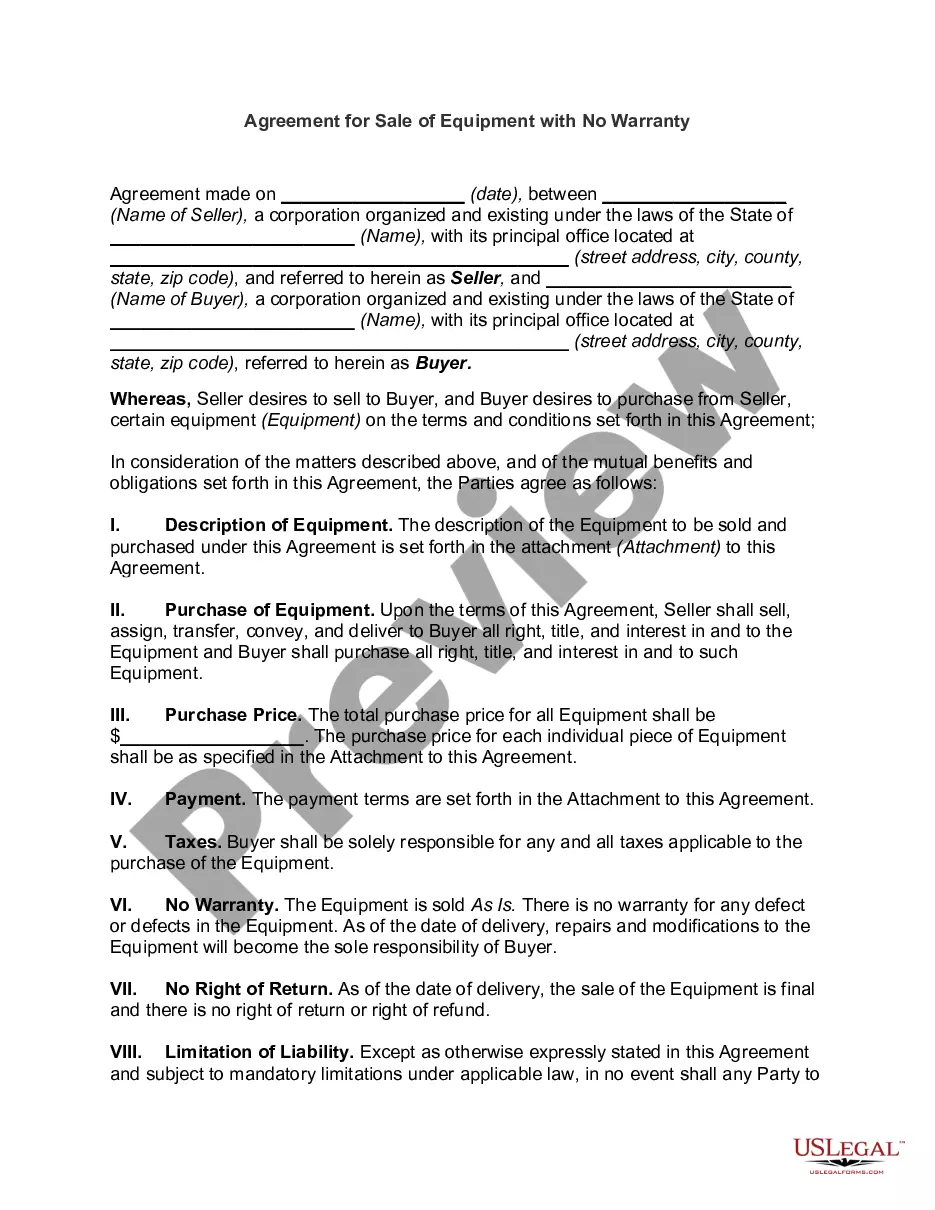

- Examine the form description and use the Preview option, if available, to make sure it's the template you need.

- Don't worry if the form doesn't satisfy your requirements - search for the correct one in the header.

- Click Buy Now once you find the required sample and choose the best suitable subscription.

- Log in or sign up for an account to purchase your subscription.

- Make a payment with a credit card or through PayPal.

- Choose the file format for your Wayne Limited Liability Company LLC Agreement for New General Partner and download it.

When finished, you can print it out and complete it on paper or import the template to an online editor for a faster and more practical fill-out. US Legal Forms allows you to use all the documents ever obtained many times - you can find your templates in the My Forms tab in your profile. Give it a try now!